Altcoin

Why Is Bitcoin, Ethereum, Solana & XRP Price Dropping?

Another crypto market crash is occurring, with the Bitcoin price dropping below the crucial $95,000 support level, dragging altcoins like Ethereum, Solana, and the XRP price along with it. This price crash has occurred mainly due to the bearish sentiment in the market, thanks to several factors.

Crypto Market Crash: Why BTC, ETH, SOL & XRP Are Down

CoinMarketCap data shows that a crypto market crash is occurring again, with the Bitcoin price dropping below the psychological $95,000 level. Altcoins like Ethereum, Solana, Dogecoin, and the XRP price have also significantly declined.

This price crash has occurred due to several factors, including global economic uncertainty. For one, US President Donald Trump continues to threaten to impose tariffs on other countries. Yesterday, the president announced that he has decided that for the purposes of fairness, he will charge reciprocal tariffs on countries that charge the US.

This continues to raise concerns about trade wars, which is bearish for the crypto market. Meanwhile, the bearish sentiment in the market is also due to the US Federal Reserve’s quantitative tightening policy, with no hopes of monetary easing policies anytime soon. Traders predict that there will be only one Fed rate cut this year, which is unlikely to come until the second half of the year.

These developments sparked a bearish sentiment among investors, ultimately leading to this crypto market crash. The Bitcoin price has struggled to reclaim $100,000 for a while now and now even looks more likely to touch $90,000.

Bearish Factors In The Market

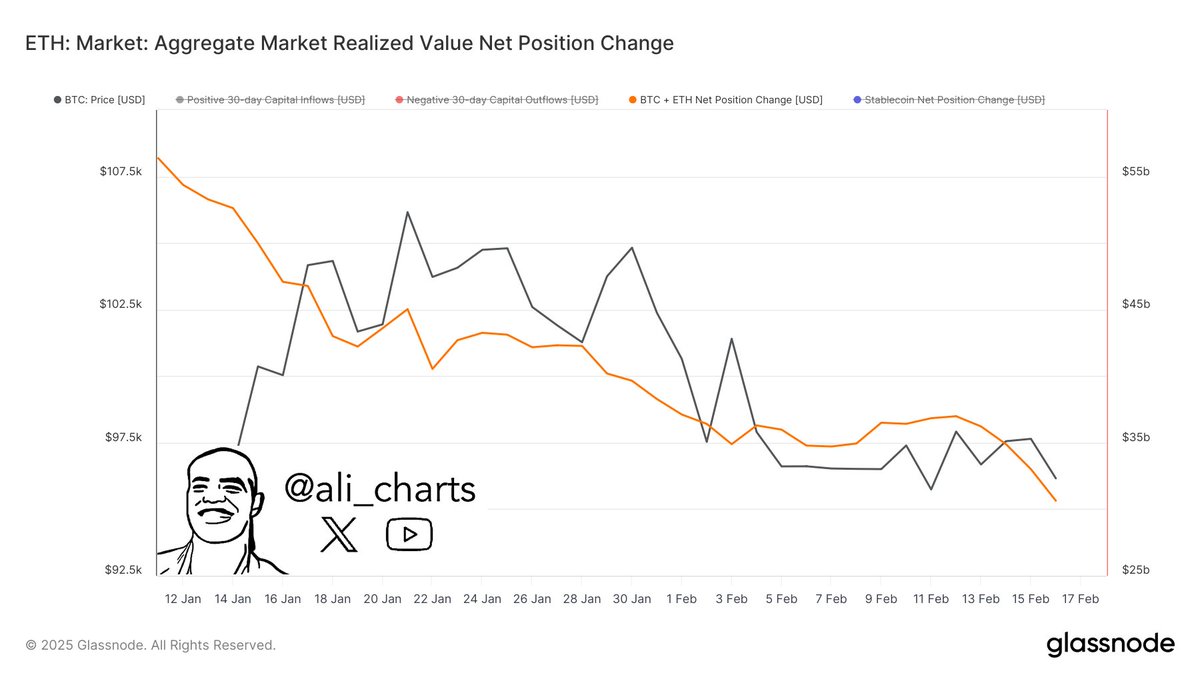

Besides the uncertainty on the macro side, other developments have led to the crypto market crash. Crypto analyst Ali Martinez recently revealed that the capital inflows into Bitcoin and Ethereum have declined by over 30% in the past month, dropping from $45 billion to $30 billion.

This indicates that there is a lack of liquidity in the market to sustain higher prices. Investors look to be holding off on allocating more capital to the market due to the bearish sentiment. Instead, more investors look to offloading their coins as the market likely priced in to Donald Trump’s administration even before he took office.

Moreover, some community members believe that Trump’s administration has fallen short of its promises to the crypto industry, considering that the Strategic Bitcoin Reserve initiative hasn’t yet happened.

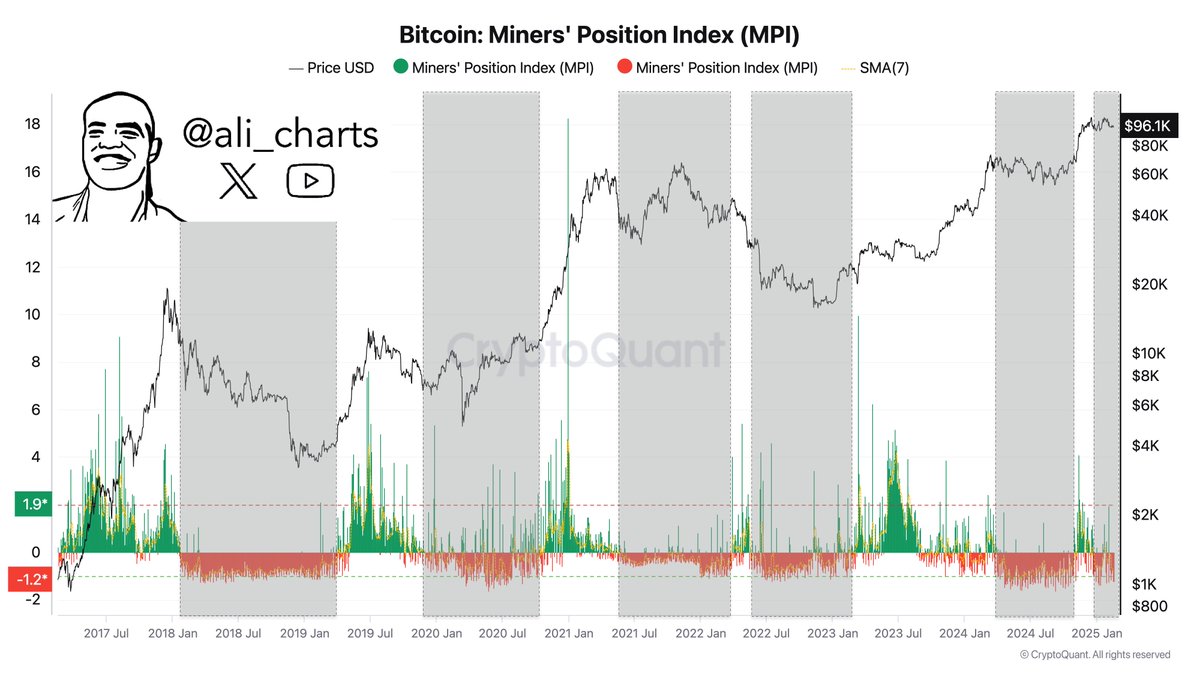

Amid this crypto market crash, Martinez has also suggested that the market could witness lower prices, as he revealed that prolonged price corrections have historically followed a decline in Bitcoin mining activity.

Away from the Bitcoin ecosystem, the bearish sentiment in the Solana sentiment also looks to be at an all-time high (ATH) following the LIBRA meme coin rug pull. Traders allegedly lost over $286 million to the rug pull, which has further sucked liquidity out of the crypto market.

This development has further dampened investors’ confidence, especially considering Argentina’s President Javier Milei promoted this meme coin on his X account. This saga has raised the ghosts of the TRUMP and Melania meme coins, which sucked liquidity from the market just before Donald Trump took office.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

TRUMP Crypto Whale Incurs Massive $15M Loss Amid Price Slump, Here’s How

A TRUMP crypto whale extended its overall losses to over $15 million as the PolitiFi token crashed roughly 10% this Friday. On-chain metrics indicated that the whale recently sold 743,947 tokens, worth almost $8 million, amid an ongoing price slump. This trade maneuver is what slammed the whale’s total losses to over $15 million with the token.

TRUMP Crypto Whale Dumps Heavily Amid Sluggish Price Action

According to an X post by Lookonchain on March 28, a TRUMP crypto whale sold $7.92 million worth of coins in the past 24 hours. This trade maneuver presented the trader with a severe $3.3 million loss. Meanwhile, it’s noteworthy that the selloff occurred at an average price of $10.66.

Further, data suggested that this whale only profited on his first trade with the PolitiFi token. All other trades made subsequently brought losses to a total of $15.7 million.

TRUMP Coin: A Fall From Grace

The U.S. President-themed token gained significant traction across the market promptly after its inception. The PolitiFi token saw its price rise from $8 level to $74 within a week of its launch, securing a prominent spot on crypto traders’ radars.

However, the buzz was short-lived as the TRUMP crypto’s price crashed to a $10 level to date. As of press time, TRUMP price cracked 9% intraday and exchanged hands at $10.35. The PolitiFi token slammed nearly 20% over the past month.

Overall, the broader waning action appears to have prompted the whale’s selloff. Meanwhile, market watchers reflect a cautious approach as the dumps signal a loss of confidence in the asset’s future potential.

Can TRUMP Price Recover?

It’s worth mentioning that a recovery to previous highs remains highly questionable, given the current market scenario. Nevertheless, a renowned market analyst has recently conveyed a highly bullish outlook for the coin’s future price action.

Analyst Crypto Gems on X revealed that the crypto’s price chart shows a double bottom pattern, whilst the potential for a bullish reversal also persists. The next price target for TRUMP crypto remains at $13, per the analyst. A sustained break above this level could fuel a rally to $18 or even $25.

Nevertheless, a trading session above $50 and near previous highs remains out of the question as the token even slipped from one of the top cryptos by market cap to 45th.

Additionally, a recent TRUMP price prediction by CoinGape revealed that the 3-month bias indicator remains 61% in favor of bears. This stat added to market concerns surrounding the coin’s future price prospects.

Nevertheless, as Donald Trump continues to usher pro-crypto movers in the U.S., market watchers anticipate some relief in price movements ahead. Notably, TRUMP price previously rallied 10% in just a day, CoinGape reported last week. However, the token failed to sustain this bullish movement, only adding to investor concerns.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Dogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

Crypto analyst Investing Scope has predicted that the Dogecoin price is set to reach the much-anticipated $1 level. The analyst also suggested that now is a great time to accumulate the foremost meme coin as a once-in-a-year buy opportunity returns.

Dogecoin Coin Eyes Rally To $1 As Buy Opportunity Returns

The Dogecoin price is eyeing a rally to $1 as a buy opportunity returns. In a TradingView post, Investing Scope mentioned this $1 target while revealing that this once-in-a-year buy opportunity is aiming for the 1.618 Fibonacci extension on the higher high trendline. His accompanying chart showed that the projected rally for DOGE is already in play and that a deeper correction is unlikely.

Commenting on the current Dogecoin price action, the analyst stated that DOGE is neutral on its 1-day technical outlook. He added that the foremost meme coin is recovering from its prior oversold state and testing the 1-week MA50 for the first time in three weeks.

This current rebound is said to have been made after the Dogecoin price touched the 1-week MA200, which the analyst claimed is the new long-term bottom, similar to August 5th, 2024, and October 9th, 2023.

Crypto analyst Master Kenobi also recently predicted that the Dogecoin price could reach $1 by June later this year. The analyst revealed that DOGE is mirroring a bullish pattern from the 2017 bull run, which is why he believes that the foremost meme coin could reach this price target. This projected rally to $1 will represent the second phase of Dogecoin’s bull run, just the same way there were two equal pumps in the 2017 market cycle.

Key Levels To Watch For DOGE

In an X post, crypto analyst Ali Martinez revealed the key levels to watch for the Dogecoin price. He highlighted $0.177 and $0.207 as the major support and resistance levels for the foremost meme coin. He added that these levels are crucial for determining the next price movement.

In an earlier post, Martinez stated that the SuperTrend indicator suggests that the Dogecoin price could enter a bullish phase upon breaking the $0.21 resistance level. Market participants are betting on a bullish reversal for DOGE as Martinez revealed that 76.65% of traders on Binance futures are long on the meme coin.

Crypto analyst Trader Tardigrade is also predicting massive moves for the Dogecoin price. In one post, he stated that the meme coin’s macro chart follows the DOGE cycle. His accompanying chart showed that the foremost meme coin could rally to as high as $8 in this market cycle.

At the time of writing, the Dogecoin price is trading at around $0.18, down over 6% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Why the US SEC Is Delaying the Ripple Case?

The Securities and Exchange Commission’s (SEC) decision to drop lawsuits against several major crypto players has left the Ripple case as a notable exception. Recently, the US SEC dismissed litigations against Kraken, Cumberland, and Consensys, sparking curiosity about the status of the XRP lawsuit. Fox Business journalist Eleanor Terrett took to X to share insights on the possible reasons behind the SEC’s delay in the Ripple case.

Let’s take a closer look at the Ripple case and the SEC’s decision to exclude the platform while dropping lawsuits against other crypto companies.

Is US SEC Further Delaying the XRP Lawsuit?

In her recent X post, Fox Business reporter Eleanor Terrett shared insights on the possible reasons for the SEC’s delay in the XRP lawsuit. While the SEC intentionally missed Ripple while dismissing cases against other major firms, Terret stated that the move wasn’t surprising.

Emphasizing the unique circumstances of the Ripple case, Terrett stated, “No Ripple here but I’m not entirely surprised because, again, it is slightly different to these other cases.” The journalist pinpointed the complexities surrounding the XRP lawsuit unlike other crypto lawsuits.

The SEC’s approach to resolving the XRP lawsuit differs from other crypto cases due to an existing injunction. To move forward, the SEC must request Judge Torres to lift this injunction, allowing them to proceed with voting on the withdrawal of the appeal and other related matters.

SEC Dismisses Kraken, Cumberland, Consensys Cases

In a recent development, the US SEC officially announced the dismissal of the crypto lawsuits involving Kraken, Cumberland, and Consensys. This decision comes after the SEC filed a joint stipulation with each company. The filing agrees to dismiss the cases with prejudice, meaning they cannot be refiled.

It is noteworthy that the dismissal comes without any financial implications for the crypto firms. Dropping the lawsuits, the Commission underscored the irrelevance of the cases. However, the regulator clarified that its decision does not imply a change in its position on the underlying issues of the lawsuits.

As highlighted by Terrett, these dismissals do not impact or influence the ongoing XRP lawsuit. Meanwhile, the Ripple lawsuit is expected to follow specific procedures, which may lead to a delay in its conclusion. The settlement process for the Ripple lawsuit involves several steps. This includes the SEC’s request to lift the existing injunction and the subsequent voting on the withdrawal of the appeal.

Recently, attorney Fred Rispoli shared a possible timeline for the Ripple case settlement. He stated that the lawsuit will end within the next 60 days.

How This Delay in the Ripple Lawsuit Settlement Impact XRP Price?

Amidst the complexities and uncertain timeline surrounding the Ripple case settlement, the XRP price faces major corrections. As of press time, XRP is trading at $2.21, with a 5.38% dip in a single day. Over the past week and month, XRP has plummeted by 6.7% and 2.2%, respectively.

Despite this negative trend, a positive sentiment persists among investors, as indicated by a 17.6% surge in trading volume, currently at $3.85 billion. This sparks a bullish prediction for XRP, with analysts foreseeing its ascendance to $11.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market19 hours ago

Market19 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin19 hours ago

Altcoin19 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Market23 hours ago

Market23 hours agoWill Bitcoin Hit $90,000 in April? Analysts Weigh In

-

Market20 hours ago

Market20 hours agoCan Cardano (ADA) Reach Back to $1 in April?

-

Market18 hours ago

Market18 hours agoBinance To List MUBARAK, BROCCOLI, BANANAS31, and Tutorial

-

Market16 hours ago

Market16 hours agoHyperLiquid Responds to JELLY Crisis Amid Community Backlash

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Reveals Three Key Developments That Will Boost Ripple And XRP This Year

-

Market15 hours ago

Market15 hours agoBinance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

✓ Share: