Altcoin

Shiba Inu Burns Slow To A Crawl With Only 2 Transactions In 24 Hours, What’s Happening?

After a slow start to the week, Shiba Inu’s burn activity has sprung back to life with a 33% spike in the last 24 hours, according to data from Shibburn.com. The jump comes amid a noticeable dip in the number of SHIB burn transactions, which raises the question of whether these burns can have any effect on Shiba Inu’s struggle to transition away from selling pressure.

Small But Noteworthy SHIB Burn Amid Sluggish Market Conditions

The Shiba Inu burn metric is one of the most essential factors in determining the sentiment surrounding the meme coin. The latest burn activity has seen a total of 18,684,231 SHIB permanently removed from circulation in the past 24 hours, translating to a 33% increase from the previous 24-hour period. These burns were delivered through four separate transactions, the most significant of which involved 16,035,545 tokens sent to a burn address. This was followed by three smaller burns of 1,070,154, 788,643, and 789,889 SHIB, respectively.

Although these figures are modest compared to past high-volume burn sessions, they are notable, considering how subdued SHIB burns have been in recent days. Notably, SHIB’s burn rate remained unusually stagnant throughout this week. Current crypto market sentiment played a considerable role in this slow down in burns, with the Shiba Inu price essentially declining for the majority of the week. Therefore, the sudden 33% jump raises questions of whether this is a one-off spike.

Burn Rate Falls Short Of Meaningful Tokenomic Impact – Bullish Technical Signs?

Even with the 33% boost, the current SHIB burn rate is far too small to have a transformative effect on the token’s supply dynamics. Shiba Inu currently has a supply of over 500 trillions tokens, making these burn volumes a drop in the ocean. As such, the Shiba Inu tokenomics will likely remain unchanged at the current rate without sustained and exponential increases in daily burns.

In terms of price action, the Shiba Inu price has been tethered to the $0.0000125 and $0.000013 range. Despite this, some analysts remain optimistic.

One analyst pointed to a bullish ascending triangle forming on SHIB’s chart and predicted that the meme coin is ready to bounce off the lower trendline of this triangle and push to new highs. This outlook is most likely in reaction to Shiba Inu’s recent double bounce on support at $0.0000125.

If it holds this level and successfully pushes through the resistance at $0.000013, momentum could begin to shift back in favor of the bulls. A healthy and continuous burn rate, while not a miracle solution, could contribute to this recovery by creating positive sentiment.

At the time of writing, Shiba Inu is trading at $0.00001272, down by 1% in the past 24 hours. Shiba Inu’s trading volume is also down by 14.5% in the same timeframe, according to data from Coinmarketcap.

Featured image from DALL-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

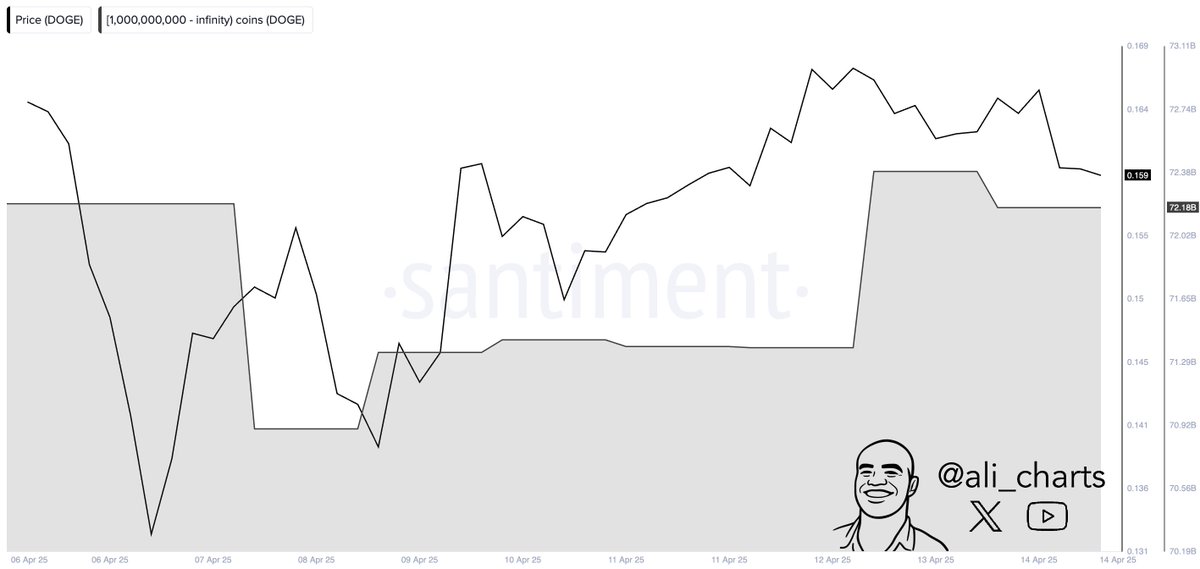

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The Solana Price Can Still Drop To $65

Solana price could be heading toward a major drop, according to crypto analyst Ali. In a recent analysis, Ali suggested that SOL might be retesting the breakout zone from a right-angled ascending broadening pattern.

Analysis Points to Downside Potential For Solana Price

Ali’s SOL analysis expects the price to drop to $65. This bearishness comes after a period of price weakness for Solana. SOL’s price fell by 1.2% in the last 24 hours, according to recent figures.

For all we know, #Solana $SOL might be retesting the breakout zone from a right-angled ascending broadening pattern, with the $65 target still in play. pic.twitter.com/vujFJQWurz

— Ali (@ali_charts) April 16, 2025

The prediction arrives at a time for the Solana network when Canada will launch Solana ETFs today after regulatory approval by the Ontario Securities Commission (OSC).

Ali’s technical analysis focuses on a right-angled broadening ascending pattern that has appeared on Solana’s price chart. SOL, according to the analyst, is re-testing the breakout pattern area, and this could be an indication of more downside action if the level fails to act as support.

This bearish outlook is shared by some other analysts in the crypto space. SatoshiOwl noted that Solana is not looking good and that it is breaking down from trendline on 1h. However, the analyst cautioned that confirmation was still needed from 1-hour and 4-hour candle closings. The analyst suggested that Solana might retest $120 first before possibly moving higher.

Not all analysts share this bearish view, however. Trader David identified what he described as bullish signs for SOL as this channel continues to move upward. He pointed out that after a 33% correction, Solana is now on a strong support level. He expressed hope that the token will reach new heights again.

Bullish signs for $SOL as this channel continues to move upward.

Hopefully we will see Solana on heights again. After 33% correction it is now on a strong support level.#Crypto #CryptoEducation pic.twitter.com/Pvj6RAC0WS

— David (@David_W_Watt) April 16, 2025

Canadian ETF Launch Could Provide Institutional Access

Despite the bearish technical outlook from some analysts, Solana is experiencing a potentially positive development on the institutional front. The Ontario Securities Commission (OSC) has approved multiple ETF issuers to list Solana-based products in Canada, including Purpose, Evolve, CI, and 3iQ.

This regulatory clearance sets the stage for Solana ETFs to come to market. This may make the cryptocurrency available to a new generation of institutional investors who would rather have regulated investment products rather than direct exposure to cryptocurrency. The timing of this news is interesting, as it is happening during technical uncertainty in the price action of Solana.

Bloomberg ETF analyst Eric Balchunas provided some background on the upcoming launches. He clarified that Canada is preparing spot Solana ETFs to launch this week after the regulator waved the green flag to multiple issuers. He added that the ETFs will also offer staking through TD.

But the initial market reaction to this news has been muted, with the Solana price showing little positive momentum in response to the much-awaited launch of the ETF. CoinGape has also released an extensive Solana prediction for April 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Mantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

The Mantra (OM) token price has surged after founder JP Mullin announced plans for a massive token burn. Mullin clarified that he intends to burn his personal team token allocation and implement a “comprehensive burn program for other parts of the OM supply.”

OM Pumps After Founder’s Burn Announcement

The OM token, which had experienced a major price drop over recent weeks, jumped from a low of $0.5115 to as high as $0.8706 following Mullin’s statement on X.

This announcement comes as OM has seen price drops of 87.0% over the past week. CoinGape has released a Mantra OM price prediction for April 2025, which could give you an idea of how the token can perform this month.

Mantra has initially shelved 300 million OM tokens for its team and core contributors. This accounts for 16.88% of the token’s nearly 1.78 billion total supply. These tokens are currently locked and were scheduled for a phased release between April 2027 and October 2029.

To be 100% clear, I am stating that I am burning MY team tokens, and we will create a comprehensive burn program for other parts of the OM supply. https://t.co/Yy6GzRBbM8

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 16, 2025

The planned burn could possibly take out a huge quantity of these tokens from the market for good. A decentralized vote could decide if all 300 million team token issuance needs to be burnt, as proposed by Mullin.

The announcement has been followed by various reactions from the Mantra community. Some members of the community believed that Mullin’s commitment was a positive development for token valuation, while others were concerned about having long-term issues.

Crypto Banter founder Ran Neuner warned against the move: “Burning the incentive may seem like a good gesture but it will hurt the team motivation long term.”

Mantra Refutes Allegations Following Price Collapse

Mullin’s token burn announcement comes at a difficult time for the project. The company has vehemently denied reports that it holds 90% of OM token supply. It has also rejected allegations of market manipulation and insider trading submitted by some community members.

Mantra explained that the latest price drop of OM occurred due to “reckless liquidations” and not due to anything the team had done. The recent history of the token indicates the size of this drop, with the charts reflecting a nearly 90% decline in value over the past month.

Major cryptocurrency exchanges OKX and Binance both experienced major OM trading activity immediately before the token’s collapse. However, both platforms have denied any wrongdoing in relation to the price crash. Binance mentioned that the crash was mainly due to cross-exchange liquidations.

They attributed the collapse to tokenomics adjustments that were made during October 2024 and abnormal market volatility that ultimately led to high-volume cross-exchange liquidations on April 13.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market20 hours ago

Market20 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Market19 hours ago

Market19 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1

-

Market18 hours ago

Market18 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market17 hours ago

Market17 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market16 hours ago

Market16 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market14 hours ago

Market14 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

✓ Share: