Altcoin

Sen. Lummis to Launch Bitcoin Reserve? This New Crypto Could Surge 100X

The strategic Bitcoin reserve is taking shape now as Senator Cynthia Lummis shared her vision.

Lummis proposed the US buy 200K $BTC (worth roughly $20B at current prices) annually until 2030.She then suggests holding it for 20 years to, hopefully, halve the US national debt.

How realistic is this idea?

Let’s unpack the benefits – and pitfalls – of Lummis’ proposal.

Bear with me as I present you with a calculation-heavy, highly speculative – and still oversimplified – outlook for the future of the Bitcoin strategic reserve.

When Ambition Meets Mathematical Reality

Not every day does a Senator say on national TV the government plans to exchange billions worth of its official currency for crypto.

At current prices, the Bitcoin reserve would be worth $100B. The US national debt is over $36T. Lummis expects the reserve to cover 50% of the debt in 20 years, or approximately $18T (assuming the debt doesn’t increase – which it likely would).

To achieve this, $BTC would either have to hit $18M per token, or the government would have to find creative ways to generate profit from it.

The first scenario means a 17,900% increase from the current level. That’s modest compared to $BTC’s actual 166,025,905% surge since its launch, but it would bring $BTC’s market cap to over $356T.

The total value of all money globally in USD is just $80T.

The math doesn’t add up.

20-Year Outlook: Could Crypto Replace National Currencies?

A more viable solution would be for the government to issue investment instruments like T-bills (BTC-bills?), options, or indexed bonds linked to $BTC. Then, generate revenue from selling these to investors globally.

Either way, the value and role of $BTC in the US economy would be massive. And this would likely lead to further depreciation of the dollar.

Could all governments ditch fiat and adopt crypto as their national currencies in 20 years? Ten years ago, people would call you crazy for even asking this, but now, it’s pretty plausible.

No country would proclaim the highly volatile $PEPE as their national currency, but $BTC, with its reputation of digital gold, or stablecoins, could be viable alternatives to fiat.

It’s early to judge if Lummis’ proposal is absurd or genius.

But it surely is a major step toward mainstream crypto adoption by institutions and governments and could drive $BTC to unprecedented heights.

Best Wallet – The World’s First Presale Wallet to Secure Your Share of $BTC’s $18T Future

While $356T is a stretch, Coinbase CEO predicts $BTC market cap to soon hit that of gold – $18T, which means one $BTC would cost $908K.

If you hold even a fraction of a $BTC (or any other crypto, for that matter), you need a reliable wallet to store all that wealth.

Best Wallet is a non-custodial hot wallet, so only you hold your private keys. On top of that, it’s mobile-first, so you can sell, buy, swap, and stake crypto anytime from one intuitive interface.

Beyond $BTC, Best Wallet supports hundreds of assets across all popular networks. This includes presale tokens, which you can buy directly through Best Wallet’s Token Launchpad.

In fact, it’s the first and only presale wallet in the world. This unique advantage could help Best Wallet achieve its goal of capturing 60% of the sector by 2026.

The ecosystem’s native token, $BEST, gives its holders early access to new projects, higher staking yields, lower fees, and governance rights.

You can still buy $BEST at $0.023775 on presale, after which it would list on exchanges and likely surge in value.

Final Remarks

While Lummis’s Bitcoin reserve idea might not slash the national debt in half, the very fact that government officials are taking crypto this seriously is huge.

Now is the perfect time to prepare for the crypto revolution with a wallet that matches your ambition. To join the Best Wallet ecosystem, visit the official presale website and buy $BEST using $USDT, $ETH, or a card.

Meanwhile, we remind you to DYOR before investing in any asset, whether it’s $BTC or a hot presale crypto.

Altcoin

Expert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

Crypto analyst CasiTrades has provided a roadmap for the XRP price, revealing what could happen before the altcoin reaches a new all-time high (ATH). Based on her analysis, XRP could still witness a price decline before it potentially rallies past its current ATH of $3.4.

XRP Price Could Drop To $1.9 Before Rally To New Highs

In an X post, CasiTrades stated that in the event of a deeper flush, the XRP price could wick down to $1.90, suggesting that the altcoin could visit this low before it rallies to new highs. She believes XRP will ideally hold above this $1.90 and avoid dropping to new lows.

The crypto expert noted that the next move is critical. She claimed that if XRP gets that flush with bullish RSI divergence, it could mark the bottom before the altcoin rockets into Wave 3. However, CasiTrades warned that a break below $1.90 could force a reset of the entire new trend count.

Meanwhile, there is still the possibility that the XRP price might not drop to as low as $1.90. CasiTrades stated that $1.95 is the prime target, with subwaves heavily aligning there and a drop to $1.90 only likely to occur in the event of a deeper flush.

It is worth mentioning that US President Donald Trump recently announced reciprocal tariffs on all countries, a move which is set to ignite a global trade war and is bearish for XRP and the broader crypto market. As such, this development could be what sparks the deeper flush and send the altcoin to as low as $1.90.

A Drop To $1.4 Is Also The Cards

In an X post, crypto analyst Brandon asserted that the XRP price is about to have a massive breakout, to the downside. His accompanying chart showed that XRP could drop to as low as $1.4.

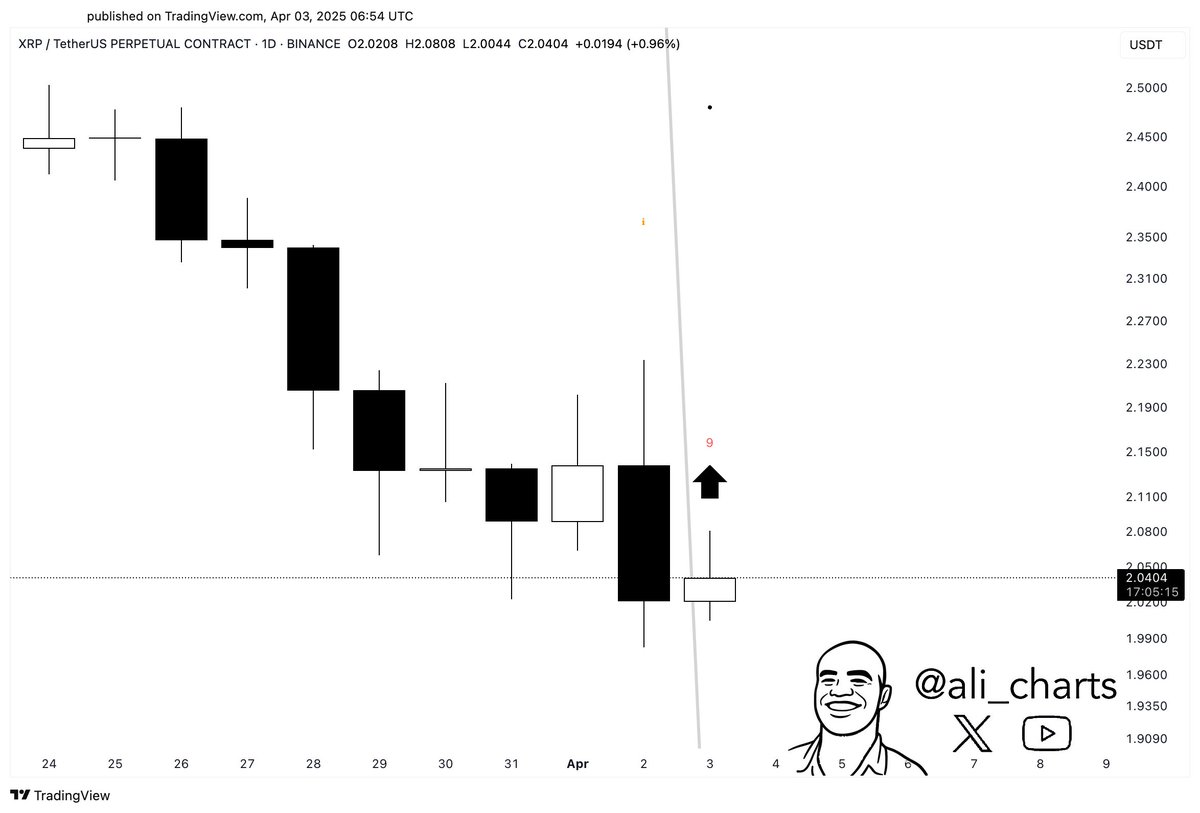

On the other hand, crypto analysts such as Ali Martinez have provided a bullish outlook for the XRP price. In an X post, he stated that XRP could be setting up for a rebound. The analyst further remarked that the altcoin is holding above $2 while the TD Sequential flashes a buy signal.

Crypto analyst Javon Marks also recently predicted that Ripple’s coin could surge 44x and reach as high as $99. He alluded to the 2017 bull run as the reason why he is confident that the altcoin could record such a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here’s Why Is Shiba Inu Price Crashing Daily?

Shiba Inu price is on a strong bearish trend, with price indicators recording losses in all time frames. The highly popular meme token now threatens to add an additional zero to its value if the current bear run continues for much longer. Even with Shibarium, SHIB’s layer-2, reaching the milestone of 1 billion transactions recently, the token’s price has not responded positively to this milestone.

Falling Shiba Inu Price Affects Holder Profitability

According to current data, SHIB is down 4.6% in the past 24 hours, 14.7% over seven days and a substantial 54.9% over the past year.

The current context for the SHIB price appears tough for the majority of investors. Based on on-chain analytics, 62% of SHIB investors are at the moment in a loss, while merely 34% are in profit and 4% are breaking even as per IntoTheBlock data.

SHIB has fallen 85.9% from its all-time high of $0.00008616 on October 28, 2021, over three years ago. This extended period of decline has made many of the investors who bought during the bull run in 2021 underwater on their holdings.

The token reflects a high ownership concentration with 74% of SHIB owned by major holders. The concentration may be behind price volatility. This is due to the fact that the moves by the large holders tend to have disproportionate impacts on the market. Major volume trading in the last week has hit $184.02 million which indicates sustained activity even as the price goes down.

Shibarium Milestone Fails To Reverse Trend

Despite Shiba Inu’s layer-2 scaling solution, Shibarium recently achieved a major milestone of 1 billion transactions. However, this accomplishment has not translated into positive price action for SHIB. This disconnect between ecosystem development and token price shows the current market’s focus on overall trends rather than project-specific achievements.

Shibarium is a key component of the Shiba Inu ecosystem that focuses on reducing transaction fees, increasing processing speed, and enabling more advanced applications within the SHIB ecosystem.

The continued negative price action despite reaching such a substantial transaction milestone raises questions about what catalysts might eventually reverse SHIB’s downward trend.

Will Shiba Inu Token Burns Aid In Price Pump?

The Shiba Inu community has historically highlighted token burns as one possible method of driving scarcity and price support. Recent burn behavior has been spotty and inadequate to have any real effect on the enormous Shiba Inu token supply.

After a recent spike in burn rate of more than 12,000%, the last 24 hours have seen the burn rate decline by 60%. During this period, only 37.6 million SHIB tokens were removed from circulation as per Shibburn data.

Token burns continue to be a mainstay narrative among the SHIB community. However, the volume of burning has to rise in order to have an effect on the token’s supply that can be measured. The 17.88% hike in trading volume in the last 24 hours to $311.14 million gives some indications of market action. This potentially could be being driven by the larger holders stockpiling at lower prices.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Altcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

Over time, Ethereum, the second-largest crypto asset and largest altcoin, has often spearheaded an Altcoin Season due to its significant performance after the market shifts from a Bitcoin season to an altcoin season in each bull market cycle. In spite of this waning performance of the king of alts, an altcoin season is still likely to occur in the near term.

Is An Altcoin Season On The Horizon?

With the heightened volatility and BTC’s robust market dominance, the possibility of an Altcoin Season happening in this cycle is looking slim. However, an on-chain expert and the CEO of Alphractal Joao Wedson believes that this sustained Bitcoin’s dominance could be laying the groundwork for a huge altseason in the foreseeable future. Historically, altcoin seasons have followed periods of Bitcoin dominance.

Joao Wedson highlighted that Ethereum’s waning performance has strangled other alts in the ongoing market cycle, but an altcoin season “is just a matter of time.” With the alt market struggling to gain dominance and ETH facing headwinds, traders hope for a shift that might spur renewed gains across the altcoin sector.

In the X post, Wedson delved into altcoin market dominance with Ethereum, revealing an interesting trend. According to the expert, altcoin dominance is declining, while altcoin dominance excluding Ethereum and Stablecoins has remained sideways and in a neutral zone since late 2022.

This development implies that Bitcoin has drained most of Ethereum’s market capitalization. Presently, Bitcoin’s dominance has increased to 62%, and BTC and Stablecoin’s dominance has risen to nearly 71%. Meanwhile, Ethereum and all other alts dominate only 29% of the general market.

Bitcoin and Stablecoin‘s market dominance may seem like a threat to the upcoming altcoin season. However, the interesting part is that the higher the BTC and Stablecoin dominance rise, the more robust the next altcoin season will be, which Wedson claims is only a matter of time away.

BTC And Stablecoins Stealing The Spotlight

Daan Crypto Trades, a technical expert and trader, has also shared insights on the subject, highlighting that the altcoin market cap has declined sharply, leading to a drop in altcoins’ dominance. Although it was on track for a while, the steady growth of Bitcoin and Stablecoins has put the alt dominance under serious pressure within the crypto market.

Given the dilution amongst them, individual alts have performed horribly. Thus, for altcoins to regain dominance over Bitcoin, Stablecoins, and other major assets, the ETH/BTC pair needs to gather some momentum first.

Daan Crypto Trades claims Ethereum often plays a massive role in getting a wider altcoin performance. This is because many liquidity pools are denominated in ETH, and most coins are developed on it. Therefore, for altcoins to run, this wealth effect for ETH and majors is essential.

Until this is the case, the analyst urges investors not to get into the market. Even though alt rallies are usually brief, there is frequently a high timeframe retest. Once it is evident that the trend is changing, Daan Crypto Trades believes this is the ideal time to get involved in the action.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Market20 hours ago

Market20 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market14 hours ago

Market14 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market19 hours ago

Market19 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market23 hours ago

Market23 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Regulation9 hours ago

Regulation9 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Ethereum14 hours ago

Ethereum14 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

✓ Share: