Altcoin

PancakeSwap Price Rallies As Trading Volume Tops $2.5B; What’s Happening?

PancakeSwap price has led the broader market gains this Saturday, soaring nearly 10% amid renewed market interest. The protocol’s trading volume in the past 24 hours topped $2.5 billion, overtaking Uniswap and securing the pole position in terms of trading volume on DEXs. Notably, this market upswing is fueled by the recent BSC meme frenzy, per DeFiLlama statistics.

PancakeSwap Price Soars As Trading Volume Tops $2.5B; Here’s Everything

According to DeFiLlama data on March 22, PancakeSwap was the top DEX in terms of intraday trading volume, boasting $2.542 billion. This massive volume is more than double the second-largest DEX Uniswap, per on-chain statistics.

The weekly trading volume for the same came in at $15.46 billion, up 73% in the last seven days. Overall, the massive boost in volumes is attributed to the BSC meme frenzy, according to Wu Blockchain on X.

In the interim, CoinGape found that DeFiLlama’s intraday data also underscored rising volumes due to BNB Chain projects. Currently, PancakeSwap is the only DEX with a weekly trading volume of more than 10 billion, underlining a milestone feat. As an upshot, the DEX’s native coin also witnessed an upswing of nearly 10%.

PancakeSwap Price Overview

The native coin CAKE price witnessed gains worth 10% intraday and exchanged hands at $2.62. The crypto bottomed and peaked at $2.36 and $2.83 in the past 24 hours.

Market participants also appear to be optimistic about price movements, as indicated by the native coin’s intraday trading volume surge of 86% to $483.18 million. As mentioned above, this bullish action reflects rising market interest in the asset, escorted by burgeoning volumes.

Derivatives Market Adds Market Optimism

On the other hand, the derivatives market also saw a substantial money influx, offering market support to the DEX project. CAKE futures OI gained nearly 15% over the day, reaching $85.36 million. Also, the derivatives volume rose by 146% to $867 million today. This data signaled heightened market interest in PancakeSwap price actions.

Altogether, on-chain and market data collectively indicate a highly bullish sentiment for the token prevailing among traders and investors. This optimism is primarily dominated by BSC meme frenzy, potentially corresponding to the recent rise of meme coins like MUBARAK and BabyDoge Coin, among others.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Has XRP Price Already Bottomed? Analyst On How Ripple Coin Can Hit $15

XRP price has recorded marginal gains today and held its $2.15 support as the broader crypto market stayed in the green. Amid this, a top analyst revealed that Ripple’s coin may have already hit its bottom. However, he also highlighted some key conditions that the crypto must attain to confirm the bottom.

Meanwhile, another expert has also shared key insights and mathematical calculations, which showed how Ripple’s native crypto might hit the $15 ahead.

XRP Price Holds $2.15 Support: Has It Already Bottomed Out?

XRP price has added around 0.23% during writing and exchanged hands at $2.15, while its one-day volume fell 25% to $2.99 billion. Notably, the crypto’s current market cap stood at $125.33 billion and the token has touched a 24-hour high of $2.18.

Besides, CoinGlass data showed that XRP Futures Open Interest also rose 0.5%, reflecting renewed market confidence. Amid this, renowned analyst EGRAG CRYPTO suggests that XRP might have already hit its bottom on April 7. However, the analyst outlines some key conditions to confirm this trend reversal.

XRP Really Bottomed?

According to the pundit, Ripple’s coin must close a weekly full-body candle above $2.10, the 21-week EMA, and notably above $2.25. If these conditions are met, it would strongly confirm the bottoming out of XRP price. However, failure to achieve these conditions may lead to other market narratives emerging, the expert noted.

Meanwhile, despite the soaring discussions, another expert recently hinted that the crypto might hit $15, citing XRP ETF inflow as the key factor.

Ripple’s Coin To Hit $15? ETF Inflow Calculation Shows

In a recent analysis, market expert Zach Rector made a bold prediction that XRP price could reach $15 and beyond, driven by anticipated inflows from Exchange-Traded Funds (ETFs). According to Rector, JPMorgan’s estimate of $4 to $8 billion inflows into XRP ETFs in the first year could trigger a significant price surge.

A Closer Look Into The Calculation

Using his market cap multiplier model, Rector calculated that a conservative $4 billion inflow could lead to a 200x multiplier, resulting in an $800 billion increase in XRP’s market cap. Adding this to the current market cap of $125 billion would take the total market cap to $925 billion. With a circulating supply of 60 billion XRP tokens, this would translate to a price of $15.42 per token.

Rector’s analysis is based on the market cap multiplier theory, which measures how inflows can amplify an asset’s valuation. He cited a recent example where XRP’s market cap grew by $7.74 billion in just eight hours, fueled by a mere $12.87 million in inflows, resulting in a 601x multiplier.

While Rector’s prediction seems ambitious, industry leaders are growing more confident about the prospect of an XRP ETF. Ripple CEO has predicted that at least one XRP ETF could launch in the second half of 2025. If Rector’s analysis is correct, the anticipated ETF inflows could trigger a significant rally for XRP price, making $15 a realistic target.

Meanwhile, this also comes as Ripple’s coin continues to witness an influx, outshining BTC, ETH, SOL, and others. A recent report showed that XRP defied the broader market trend last week when the broader digital assets space noted an outflux of over $790 million.

Additionally, a recent Ripple price analysis also showed that the XRP ETF launch, among other factors, could trigger a short-term surge to $5.5 for the crypto. However, investors should exercise caution and conduct their own research before making any investment decisions.

But, this prediction seems to have sparked interest in the crypto community, with many eagerly awaiting the potential launch of XRP ETFs in 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Delists This Crypto Causing 40% Price Crash, Here’s All

Crypto exchange Binance has recently revealed plans to delist a specific spot trading pair for the VIDT crypto, causing its price to plunge nearly 40% in just a day. The exchange revealed in an official announcement this Tuesday that it will delist the VIDT/BTC trading pair shortly, pushing investors to take a cautious approach while trading the asset.

Binance To Delist VIDT/BTC: Here’s The Timeline

According to an official Binance announcement dated April 15, the VIDT/BTC trading pair will be delisted at 08:30 UTC. The decision to delist this trading pair comes as the crypto exchange looks to protect its users from emerging market risks while also ensuring a high-quality trading experience.

Per the announcement, the spot trading pair mentioned above is being delisted after a thorough periodic review by the exchange. The VIDT/BTC trading pair reflects concerning factors, such as poor liquidity and trading volume, among other reasons that pose a risk to users.

In turn, usual market sentiments remain highly bearish in light of such delistings on one of the top crypto exchanges. Besides, it’s noteworthy that this delisting was initially scheduled to take place on April 16. However, Binance pre-poned the delisting, which caused a sudden shock to traders as the coin’s price promptly crashed severely.

As of press time, VIDT price saw a steep fall of roughly 38%, closing in at $0.001838. The DAO-based token fell from a high of $0.003024 in the past 24 hours. This price drop reflects market uncertainty in the wake of one of the top crypto exchanges delisting the crypto.

Meanwhile, it’s also worth pointing out that Binance offered clarity on OM price crash by revaling a statement recently. CoinGape reported that the crypto exchange titan blamed massive cross-chain liquidations as the primary reason for Mantra’s 90% price crash on Monday. The price crash in turn caused massive liquidations and OM selling, whilst the project also faced rug pull allegations.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Shiba Inu Burn Rate Blows Up 2000%; Is SHIB Price Gearing Up For A Pump?

The Shiba Inu burn rate once again shot up by a staggering 2000% on Tuesday, reverberating market optimism surrounding its future price movements. Recent burn metrics revealed that over 20 million SHIB tokens were removed from the asset’s circulating supply in just a day. Now, crypto market traders and investors speculate if price gains loom, whilst a renowned SHIB community member further revealed that a “new pump wave is loading.”

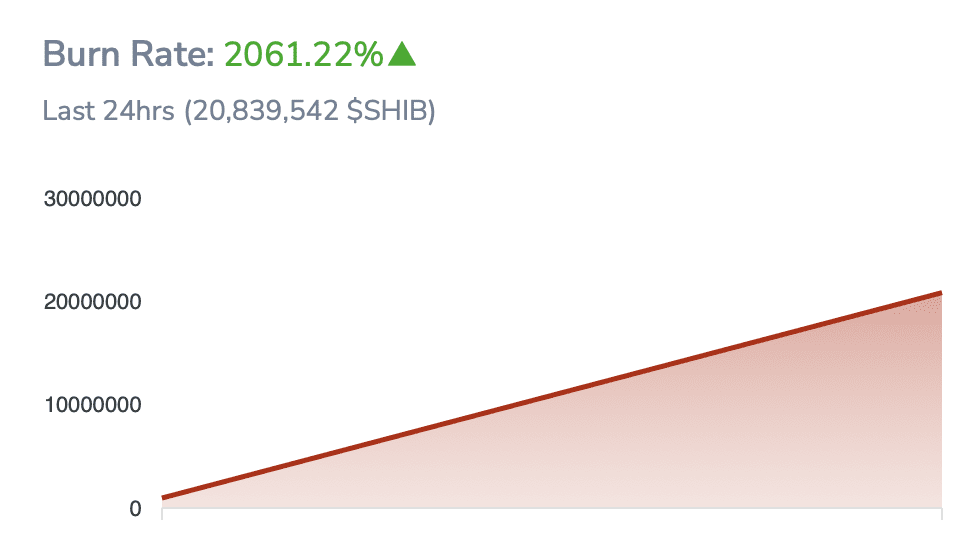

Shiba Inu Burn Rate Soars 2000% As 20M Tokens Burnt

According to Shibburn’s data on April 15, the Shiba Inu burn rate exploded by 2061.22% at the time of reporting. This surge in the meme token’s burn rate is in sync with 20.83 million coins removed from the asset’s supply intraday.

For context, the SHIB burn mechanism transfers tokens to a null address and makes their recovery impossible. This saga drastically reduces the dog-themed meme coin‘s circulating supply, a reason that many believe is driving SHIB’s relatively sluggish performance over the years.

Besides, a renowned Wall Street expert going by the name “wallstreetbets” on X has stated that “Despite burns, SHIB supply remains unchanged.” This statement has ushered an apprehensive sentiment among market participants who are anticipating price gains ahead in light of the constant burns. Intriguingly, CoinGape found that the total circulating supply rested at 584.37 trillion tokens at the time of reporting.

Can SHIB Price Pump Ahead?

CoinMarketCap’s data showed that SHIB token’s price rested at $0.00001193, down nearly 3% over the day despite the Shiba Inu burn rate surge. The meme coin fell from an intraday high of $0.00001239, even hitting a bottom of $0.00001182. Crypto market participants are currently uncertain about the coin’s future price movements, given broader market trends and a volatile price trajectory.

Nevertheless, renowned Shiba Inu community member SHIB Knight posted on X that a “new pump wave is loading.” Notably, a sustained break above $0.00001238 paves the way for a bull run, per the community member. Traders and investors continue to monitor the coin for further price action shifts ahead.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoMENAKI Leads Cat Themed Tokens

-

Market20 hours ago

Market20 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market19 hours ago

Market19 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market16 hours ago

Market16 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market24 hours ago

Market24 hours agoSolana Futures Traders Eye $147 as SOL Recovers

-

Market18 hours ago

Market18 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum

-

Market17 hours ago

Market17 hours agoXRP Jumps 22% in 7 Days as Bullish Momentum Builds

✓ Share: