Altcoin

Over 18000 Bitcoin Options to Expire, Real Panic Selloff Isn’t Even Here Yet

Bitcoin bears took control over bulls as investors panicked to sell BTC holdings amid Mt. Gox, US government and German government moves Bitcoin. BTC price has hit a low of $53,400, a fall to February levels. Bitcoin and Ethereum options expiry today to put further pressure on the crypto market as on-chain data indicate the real panic hasn’t started yet.

Bitcoin and Ethereum Set to Expire Today

The crypto market crash saw the global crypto market cap tumble by more than 13% in 48 hours, causing investors to over 250 billion.

Over 18,300 BTC options of notional value $1 billion are set to expire on Deribit, with a put-call ratio of 0.65. The max pain is at $61,500, sliding from $63,500 as Bitcoin remains under selling pressure. BTC price fell below $55k support and risks falling to $52k support if it fails to rebound.

Notably, the put/call ratio in the last 24 hours is 0.88 as put bets rose significantly in the crypto market crash. The 24-hour put volume is above 19,552 and the 24-hour call volume is near 22,088. Also, Historical Volatility and BTC Volatility Index (DVOL) witnessed a sharp 10% rise surge. This indicates options traders have turned highly bearish on Bitcoin.

Meanwhile, 163,170 ETH options of notional value $472 million are set to expire. The put-call ratio is 0.35 and the max pain price is $3,350, indicating massive losses for traders as ETH price fell below $2,890. In the last 24 hours, the put volume has increased to 98,643 and call volume remained higher at 126,788. The put-call ratio is 0.78.

$700 Million Liquidated From Crypto Market

According to a CryptoQuant verified on-chain analyst, the real panic hasn’t even started yet. He predicts it will start when orange bars appear on BTC Daily Realized Profit Loss Ratio 30DMA metric. “In the current situation, 47K doesn’t look as terrible as it did three weeks ago when we were at 70K,” he added.

The crypto market saw over $700 million in crypto liquidations, as per Coinglass data. Over 235k traders were liquidated, with the largest single liquidation order on crypto exchange Binance valued at $18.48 million as someone sold ETH.

The crypto market bleeds as over $600 million in long positions and $100 million in short positions were liquidated over the last 24 hours. Along with top altcoins, major liquidations were observed in PEPE, PEOPLE, ORDI, WLD, LTC, FIL, ADA, BCH, and others.

Beleaguered crypto exchange Mt. Gox has started $10 billion in BTC and BCH repayments, as per an official announcement on July 5. According to Arkham, Mt. Gox moved 47.229k BTC worth $2.97 billion today.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Hurdles For Ripple And The SEC Ahead Of Final Resolution

While the XRP lawsuit is reaching its closing stages, there are a few loose ends that parties are racing to tie up. Digital assets lawyer James Farrell notes that Ripple Labs will pursue an indicative ruling to ease its future IPO proceedings. However, internal processes at the Securities and Exchange Commission (SEC) may see the loose ends become a knotty issue for Ripple Labs.

Ripple Is Chasing An SEC Settlement And An Indicative Ruling

According to crypto lawyer James Farrell, Ripple and the US SEC have to sidestep a raft of hurdles to reach the final resolution in the XRP lawsuit. Farrell revealed via an X post that Ripple Labs is pursuing a settlement with the SEC while having its sights on an indicative ruling from Judge Torres.

Parties are taking a breather from legal proceedings after the US Court of Appeals granted a joint motion to suspend appeals. As parties sheath their swords and head to the negotiating table, Farrell says Ripple is tipped to table a settlement offer.

Furthermore, Ripple is expected to ask the District Court to issue an indicative ruling, seeking for Judge Torres to modify her judgment. Per Farrell, Ripple wants a modification to allow it to carry out private sales of XRP ahead of a Ripple IPO launch date.

“Why do they want it? Because without it, the possibility of an IPO in the next 3+ years is basically zero,” said Farrell. “So while the cool kids are going public, Ripple practically cannot.”

A Complicated Administrative Process In The XRP Lawsuit

According to the legal expert, the process will involve Ripple submitting a settlement offer and a request for an indicative ruling. Farrell notes that Ripple’s legal team can submit both requests to the SEC jointly or separately.

He notes that the settlement is a low-hanging fruit for Ripple, but the indicative ruling may be a knotty issue for parties in the XRP lawsuit. If the SEC assents to the settlement, Ripple will still have to file a motion before Judge Torres, with the expert forecasting a six-month time frame.

After her decision, parties may head to the appellate court as the appeal is still subsisting, and file a voluntary dismissal. Farrell predicts the process at the appellate court to last for one month.

If Judge Torres denies the motion to modify the injunction, Farrell notes that the parties will head back to the Appeal Court with the argument on appeal potentially extending to January 2027.

Following the pause in legal proceedings in the XRP lawsuit, an analysis tips $2 as the XRP price floor for a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

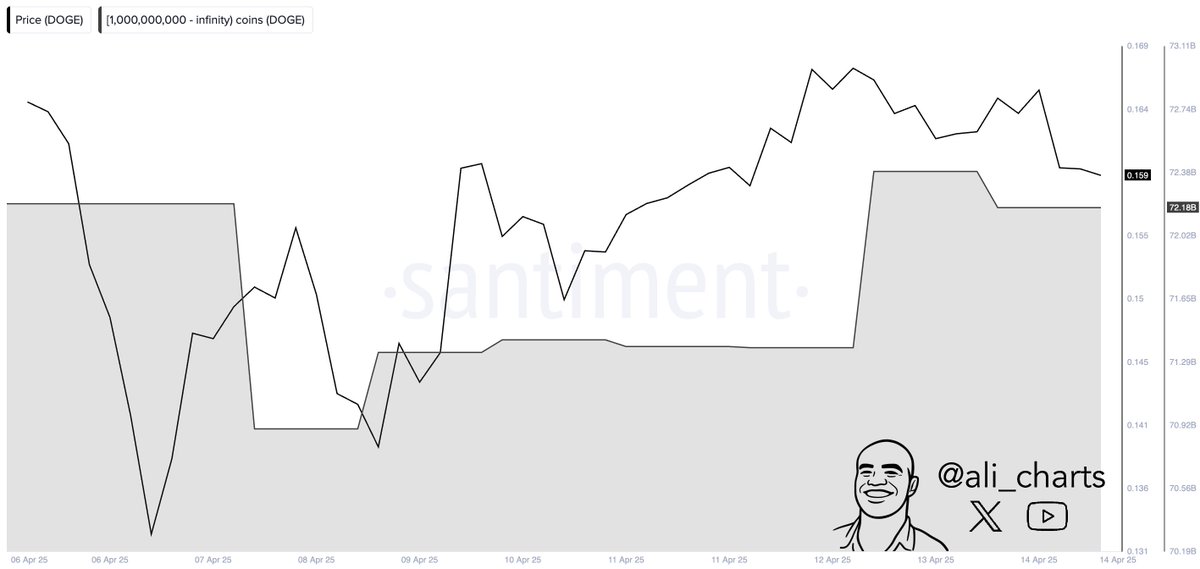

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The Solana Price Can Still Drop To $65

Solana price could be heading toward a major drop, according to crypto analyst Ali. In a recent analysis, Ali suggested that SOL might be retesting the breakout zone from a right-angled ascending broadening pattern.

Analysis Points to Downside Potential For Solana Price

Ali’s SOL analysis expects the price to drop to $65. This bearishness comes after a period of price weakness for Solana. SOL’s price fell by 1.2% in the last 24 hours, according to recent figures.

For all we know, #Solana $SOL might be retesting the breakout zone from a right-angled ascending broadening pattern, with the $65 target still in play. pic.twitter.com/vujFJQWurz

— Ali (@ali_charts) April 16, 2025

The prediction arrives at a time for the Solana network when Canada will launch Solana ETFs today after regulatory approval by the Ontario Securities Commission (OSC).

Ali’s technical analysis focuses on a right-angled broadening ascending pattern that has appeared on Solana’s price chart. SOL, according to the analyst, is re-testing the breakout pattern area, and this could be an indication of more downside action if the level fails to act as support.

This bearish outlook is shared by some other analysts in the crypto space. SatoshiOwl noted that Solana is not looking good and that it is breaking down from trendline on 1h. However, the analyst cautioned that confirmation was still needed from 1-hour and 4-hour candle closings. The analyst suggested that Solana might retest $120 first before possibly moving higher.

Not all analysts share this bearish view, however. Trader David identified what he described as bullish signs for SOL as this channel continues to move upward. He pointed out that after a 33% correction, Solana is now on a strong support level. He expressed hope that the token will reach new heights again.

Bullish signs for $SOL as this channel continues to move upward.

Hopefully we will see Solana on heights again. After 33% correction it is now on a strong support level.#Crypto #CryptoEducation pic.twitter.com/Pvj6RAC0WS

— David (@David_W_Watt) April 16, 2025

Canadian ETF Launch Could Provide Institutional Access

Despite the bearish technical outlook from some analysts, Solana is experiencing a potentially positive development on the institutional front. The Ontario Securities Commission (OSC) has approved multiple ETF issuers to list Solana-based products in Canada, including Purpose, Evolve, CI, and 3iQ.

This regulatory clearance sets the stage for Solana ETFs to come to market. This may make the cryptocurrency available to a new generation of institutional investors who would rather have regulated investment products rather than direct exposure to cryptocurrency. The timing of this news is interesting, as it is happening during technical uncertainty in the price action of Solana.

Bloomberg ETF analyst Eric Balchunas provided some background on the upcoming launches. He clarified that Canada is preparing spot Solana ETFs to launch this week after the regulator waved the green flag to multiple issuers. He added that the ETFs will also offer staking through TD.

But the initial market reaction to this news has been muted, with the Solana price showing little positive momentum in response to the much-awaited launch of the ETF. CoinGape has also released an extensive Solana prediction for April 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin21 hours ago

Bitcoin21 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Market22 hours ago

Market22 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin22 hours ago

Altcoin22 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market20 hours ago

Market20 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Market23 hours ago

Market23 hours agoEthereum Leads Q1 2025 DApp Fees With $1.02 Billion

-

Market18 hours ago

Market18 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

✓ Share: