Altcoin

Kraken Subsidiary Is Major A Beneficiary Of Bitcoin ETFs In US & HK: Bloomberg

Crypto exchange Kraken’s subsidiary is a major beneficiary of the spot Bitcoin exchange-traded funds (ETF) in the United States and Hong Kong, as per a latest report by Bloomberg. The company predicts $1 billion of assets under management (AUM) in spot Bitcoin and Ether ETFs in Hong Kong, as well as other markets to see the listing of spot crypto ETFs.

Kraken’s CF Benchmarks Gains 50% of Crypto Benchmarking Market

CF Benchmarks, a subsidiary of crypto exchange Kraken, saw a massive increase in demand for its indices amid a boon in spot Bitcoin ETFs. The United States and Hong Kong are major financial hubs bringing exposure of already established institutional investors base to Bitcoin.

The company said it represents almost 50% market share in the crypto benchmarking market as a result of launch of spot Bitcoin ETFs in the U.S. in January and in Hong Kong last year. It provides data for about $24 billion in crypto ETFs, primarily BlackRock’s iShares Bitcoin ETF with $16.2 billion AUM.

CF Benchmarks expects its revenue to almost double this year, as per the rising demand for spot Bitcoin ETF. The last available revenue data indicates it reached £6 million ($7.5 million) in 2022. In addition, the firm plans to expand headcount by around a third to more than 40. Kraken acquired CF Benchmarks in 2019.

South Korea and Israel Are Next in Crypto ETFs Race

CF Benchmarks chief executive officer Sui Chung sees them working with crypto ETFs issuers in South Korea and Israel next. South Korea has one of the largest crypto users, with high trading volumes impacting crypto prices.

“South Korea is a market where ETFs have become the wrapper of choice for long-term savings. It is also a market where digital assets have gained a high degree of adoption,” said Sui Chung.

The company expects Hong Kong-based spot Bitcoin and Ether ETFs to witness $1 billion in funds under management by year-end.

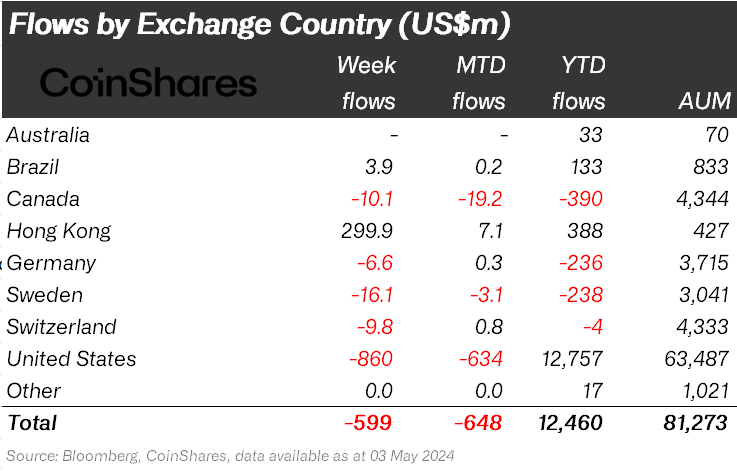

CoinShares head of research James Butterfill revealed Hong while other markets suffer outflows from digital asset products, Hong Kong saw $300 million in inflows so far this week.

Also Read:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Could Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

The Solana community and crypto market are watching closely as the world’s first spot Solana ETFs prepare to launch in Canada tomorrow, April 16, 2025. With this key launch, the speculation has also grown about whether this milestone could push SOL’s price toward the $200 mark.

The Ontario Securities Commission (OSC) has approved multiple ETF issuers, including Purpose, Evolve, CI, and 3iQ, to list their products. This could potentially open Solana to a new class of institutional investors.

Comparing Past ETF Launches To Solana ETF

Bloomberg ETF analyst Eric Balchunas offers a measured perspective on expectations for the Solana ETFs. He noted that “Canada is readying spot Solana ETFs to launch this week after regulator gave green light to multiple issuers, including Purpose, Evolve, CI, and 3iQ. ETFs will include staking via TD.”

Canada is readying spot Solana ETFs to launch this week after regulator gave green light to multiple issuers incl Purpose, Evolve, CI and 3iQ. ETFs will include staking via TD pic.twitter.com/FSw149Xkm4

— Eric Balchunas (@EricBalchunas) April 14, 2025

However, Balchunas cautions against expecting too dramatic a market reaction based on previous altcoin ETF launches. He points out that “the 2 Solana ETFs in US (which track futures so not a perfect ginnea pig) haven’t done much. Very little in aum. The 2x XRP already has more aum than both the Solana ETFs and it came out after.”

This is supported by Volatility Shares Solana ETF (SOLZ) statistics, which launched in March as the first financial derivative-based ETF tracking Solana. SOLZ has accumulated only approximately $5 million in net assets as of April 14. This reflects relatively weak investor interest in Solana ETF products to date.

The reception by Canadian investors may vary from U.S. futures-based products. However, experience has shown that investors must have realistic expectations towards short-term pricing effects.

Analyst SOL Price Forecasts Provide Divergent Outlook

Market analysts are offering varying estimates of SOL price prospects following the listing of the ETF. Some are predicting gains, while others are more cautious in their estimates, according to current market trends.

CoinGape has also published a detailed Solana prediction for April 2025. Analyst MANDO CT expressed optimism about the development, tweeting: “Bullish for the SOL community! ‘The world’s first spot Solana ETF is expected to launch on April 16th!’.

Bullish for the $SOL community! 👇

“The world’s first spot Solana ETF is expected to launch on April 16th!” pic.twitter.com/tD5fTKwk3t

— MANDO CT (@XMaximist) April 15, 2025

This positive sentiment was shared as SOL touched its “HIGHEST $SOL/ ETH WEEKLY CLOSE IN HISTORY” on April 14.

Analyst Momin suggests conditional upside. He noted: “Solana usually front-runs the market. If we see $SOL close above $120 on weekly, expecting it to visit $180 in [the] coming weeks!” However, Momin also cautions that “macro is uncertain due to random decisions.”

Solana usually front-runs the market

If we see $SOL close above $120 on weekly, expecting it to visit $180 in coming weeks!

Onchain activity seems back in action, expect some good plays & action for the next few weeks!

But beware, macro is uncertain due to random decisions! pic.twitter.com/9vfel9SgI4

— Momin (@mominsaqib) April 12, 2025

One of the more bullish perspectives comes from analyst BitBull, who draws parallels to Ethereum’s 2021 performance: “SOL 2025 = $ETH 2021. Just like Ethereum’s run in 2021, Solana is setting up for a massive move in 2025.” BitBull identifies an “Accumulation Zone: $120–$130” with a target of $300+, based on pattern congruity in chart behavior between SOL and ETH’s historical performance.

With all these points kept in mind, it is extremely unlikely that the Canada Solana ETF launch can propel the SOL price towards $200 in the short term. Assuming that the overall market is bullish and with continued fund inflows through the ETFs, Solana can witness a price surge in the short term.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Whispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

The cryptocurrency project Mantra is coming under increasing suspicion after its OM token shed 90% of its value within a single day. The value dropped from $6.27 to only $0.72, erasing more than $5 billion in market value. What transpired next only served to worsen the situation.

Based on blockchain data, Mantra DAO—the project’s behind-the-scenes organization—sent $26.95 million of OM tokens to a Binance wallet on Monday, April 14. This is just after the price’s massive dump, which triggered red flags among observers.

Detractors cite a disturbing fact: the Mantra team owns around 90% of all OM tokens. The high concentration of ownership and timing of the exchange transfers have fueled accusations of potential insider selling.

With 90% already dumped in $OM, it seems like the $OM team is about to sell more.

2 hours ago, the @MANTRA_Chain DAO staked wallet sent 38M $OM ($26.96M) to #Binance Cold Wallet.https://t.co/nSttgmuqzg pic.twitter.com/Vsc2q346fC

— Onchain Lens (@OnchainLens) April 14, 2025

Mantra CEO Denies Token Dumping Accusations

Mantra chief executive JP Mullin has rebutted such allegations. He said the team and investors didn’t dump their holdings during the crash.

Instead, Mullin attributed the price decline to “forced liquidations” instigated by cryptocurrency exchanges. Such liquidations occur when exchanges sell traders’ holdings automatically after they are unable to cover margin calls.

But his account is not to everyone’s liking. Various independent analysts have monitored suspicious token transfers that point to a different narrative.

OM price has sustained a steep drop in the last week. Source: CoinMarketCap

On-Chain Detective Work Reveals Suspicious Transfers

Crypto analyst Max Brown found that Mantra transferred nearly 4 million OM tokens to cryptocurrency exchange OKX shortly before prices began to decline.

The problem for investigators is that once tokens are moved to centralized exchanges like Binance or OKX, they become much more challenging to trace. This is essentially a blind spot where the tokens can be disposed of while leaving behind no clear trail on public blockchains.

MANTRA CHAIN $OM CRASHED 90% IN AN HOUR AND $5.5 BILLION GOT WIPED OUT.

HERE’S HOW AND WHY IT COULD HAVE POSSIBLY HAPPENED 🧵

IT ALL STARTED YESTERDAY WHEN A POSSIBLE $OM TEAM WALLET DEPOSITED 3.9 MILLION OM TOKENS ON OKX.

IT WAS WELL KNOWN IN THE CRYPTO SPACE THAT OM TEAM… pic.twitter.com/9ZQNw4Yrla

— Max Brown (@MaxBrownBTC) April 13, 2025

While analysts cannot prove it for a fact that insiders sold off tokens, the gradient of movements into exchanges just ahead of the price tumble certainly gives room for serious doubt.

Exchanges Provide Varying Account Of The Crash

Major cryptocurrency exchanges launched investigations as to what triggered the spectacular fall of the OM token.

Binance, the largest crypto exchange in terms of trading volume, corroborates Mullin’s account. In early findings, they indicate cross-exchange liquidations most likely caused the crash, which would support the CEO’s explanation.

OKX paints a different picture. The exchange cited “major changes” in OM’s tokenomics as a possible cause. They also noted that multiple blockchain addresses had sent large quantities of tokens to exchanges during the time of the crash.

The contradicting accounts by various players in the market have left investors uncertain about what actually transpired. With $5 billion of market value lost and no certainty, confidence in the project has been severely undermined.

Featured image from Blueberry Markets, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Has XRP Price Already Bottomed? Analyst On How Ripple Coin Can Hit $15

XRP price has recorded marginal gains today and held its $2.15 support as the broader crypto market stayed in the green. Amid this, a top analyst revealed that Ripple’s coin may have already hit its bottom. However, he also highlighted some key conditions that the crypto must attain to confirm the bottom.

Meanwhile, another expert has also shared key insights and mathematical calculations, which showed how Ripple’s native crypto might hit the $15 ahead.

XRP Price Holds $2.15 Support: Has It Already Bottomed Out?

XRP price has added around 0.23% during writing and exchanged hands at $2.15, while its one-day volume fell 25% to $2.99 billion. Notably, the crypto’s current market cap stood at $125.33 billion and the token has touched a 24-hour high of $2.18.

Besides, CoinGlass data showed that XRP Futures Open Interest also rose 0.5%, reflecting renewed market confidence. Amid this, renowned analyst EGRAG CRYPTO suggests that XRP might have already hit its bottom on April 7. However, the analyst outlines some key conditions to confirm this trend reversal.

XRP Really Bottomed?

According to the pundit, Ripple’s coin must close a weekly full-body candle above $2.10, the 21-week EMA, and notably above $2.25. If these conditions are met, it would strongly confirm the bottoming out of XRP price. However, failure to achieve these conditions may lead to other market narratives emerging, the expert noted.

Meanwhile, despite the soaring discussions, another expert recently hinted that the crypto might hit $15, citing XRP ETF inflow as the key factor.

Ripple’s Coin To Hit $15? ETF Inflow Calculation Shows

In a recent analysis, market expert Zach Rector made a bold prediction that XRP price could reach $15 and beyond, driven by anticipated inflows from Exchange-Traded Funds (ETFs). According to Rector, JPMorgan’s estimate of $4 to $8 billion inflows into XRP ETFs in the first year could trigger a significant price surge.

A Closer Look Into The Calculation

Using his market cap multiplier model, Rector calculated that a conservative $4 billion inflow could lead to a 200x multiplier, resulting in an $800 billion increase in XRP’s market cap. Adding this to the current market cap of $125 billion would take the total market cap to $925 billion. With a circulating supply of 60 billion XRP tokens, this would translate to a price of $15.42 per token.

Rector’s analysis is based on the market cap multiplier theory, which measures how inflows can amplify an asset’s valuation. He cited a recent example where XRP’s market cap grew by $7.74 billion in just eight hours, fueled by a mere $12.87 million in inflows, resulting in a 601x multiplier.

While Rector’s prediction seems ambitious, industry leaders are growing more confident about the prospect of an XRP ETF. Ripple CEO has predicted that at least one XRP ETF could launch in the second half of 2025. If Rector’s analysis is correct, the anticipated ETF inflows could trigger a significant rally for XRP price, making $15 a realistic target.

Meanwhile, this also comes as Ripple’s coin continues to witness an influx, outshining BTC, ETH, SOL, and others. A recent report showed that XRP defied the broader market trend last week when the broader digital assets space noted an outflux of over $790 million.

Additionally, a recent Ripple price analysis also showed that the XRP ETF launch, among other factors, could trigger a short-term surge to $5.5 for the crypto. However, investors should exercise caution and conduct their own research before making any investment decisions.

But, this prediction seems to have sparked interest in the crypto community, with many eagerly awaiting the potential launch of XRP ETFs in 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market18 hours ago

Market18 hours agoCan Pi Network Avoid a Similar Fate?

-

Ethereum22 hours ago

Ethereum22 hours agoSEC Delays Decision On Staking For Grayscale’s Ethereum ETFs

-

Market21 hours ago

Market21 hours agoXRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market23 hours ago

Market23 hours agoTrump’s Tariffs Spark Search for Jerome Powell’s Successor

-

Market17 hours ago

Market17 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Market16 hours ago

Market16 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin

-

Market22 hours ago

Market22 hours agoBitcoin ETFs End Dry Spell with Fresh Capital

✓ Share: