Altcoin

Here’s Why Bitcoin, ETH, XRP Risk Massive Liquidations

Crypto market selloff intensified gradually as global affairs, macroeconomic events, and technical weakness spurred panic among investors. The global crypto market lost more than $100 billion over the last 24 hours, with market cap falling to $2.05 trillion.

Bitcoin and Ethereum prices dropped more than 4% to hit intraday lows of $58,207 and $2,513, respectively. Other top altcoins such as BNB, SOL, XRP, TON, and ADA fell 4-7% in the last 24 hours. Major selloffs were seen in AI coins and meme coins.

Here are the reasons why the crypto market will remain under pressure and further liquidation may continue in the coming days.

Speculation Over Bank Of Japan Rate Hike Next Year

While the Bank of Japan (BOJ) cleared that they won’t raise interest rates this year after the recent market turmoil, Yen carry trades still haunt markets. Experts and traders anticipate a second wave of crypto market selloff as people have swapped on cash and carry trade after Bitcoin ETF launch.

Former BOJ board member Makoto Sakurai recently said “They won’t be able to hike again, at least for the rest of the year.” However, it’s still unclear whether Bank of Japan can do one more rate hike next March.

Japan’s Financial Services Agency Commissioner Hideki Ito also took a cautious stance on approving crypto ETFs and cited no long-term value and investor protection concerns. The move came during the recent market meltdown after rate hike by Japan.

Geopolitical Tensions, US Recession Fears, and More

The crypto market selloff continues amid the Russia-Ukraine war, with recent tensions regarding fire at Europe’s largest nuclear power plant. Russia and Ukraine accused each other of starting a fire at Russian-occupied Zaporizhzhia nuclear power plant in Ukraine.

Several reports now claim that Israel expects a major Iranian attack to be launched within days. As per a report by The Times of Israel, it could happen possibly before renewed ceasefire-hostage deal talks are held on Thursday.

Meanwhile, Hindenburg Research’s allegations directly on the SEBI Chairperson of having stake in obscure offshore entities linked to Adani money siphoning scandal raised risks. SEBI Chief Madhabi Puri Buch denied these allegations. But Hindenburg Research in a new post on X platform claimed that Buch’s new statements raise critical questions about her consulting companies and involvement.

US recession fears still exist as some economists believe the economy could be in recession, contradicting CEOs and businesspeople’s view that the US economy is resilient and there are no signs of recession. The crypto market also awaits the jobs numbers this week for further data on the labor market conditions.

US Inflation Data May Drive Further Crypto Market Selloff

The week has key US macro readings this week. The US Producer Price Index (PPI) on Tuesday, US CPI inflation data on Wednesday, Initial Jobless Claims and U.S. Retail Sales on Thursday. The US Federal Reserve to consider these before deciding on its monetary policy plans. Lower inflation data to stop crypto market selloff.

According to the CME FedWatch Tool, there are 53.5% odds of a 25 bps rate cut and 46.5% odds of 50 bps rate cut by the Federal Reserve at their September meeting.

Bloomberg’s latest survey of economists showed that nearly four-fifths of respondents expected the Federal Reserve to only cut interest rates by 25 bps in September. Moreover, the average estimate showed that the probability of an emergency rate cut before the September meeting was only 10%.

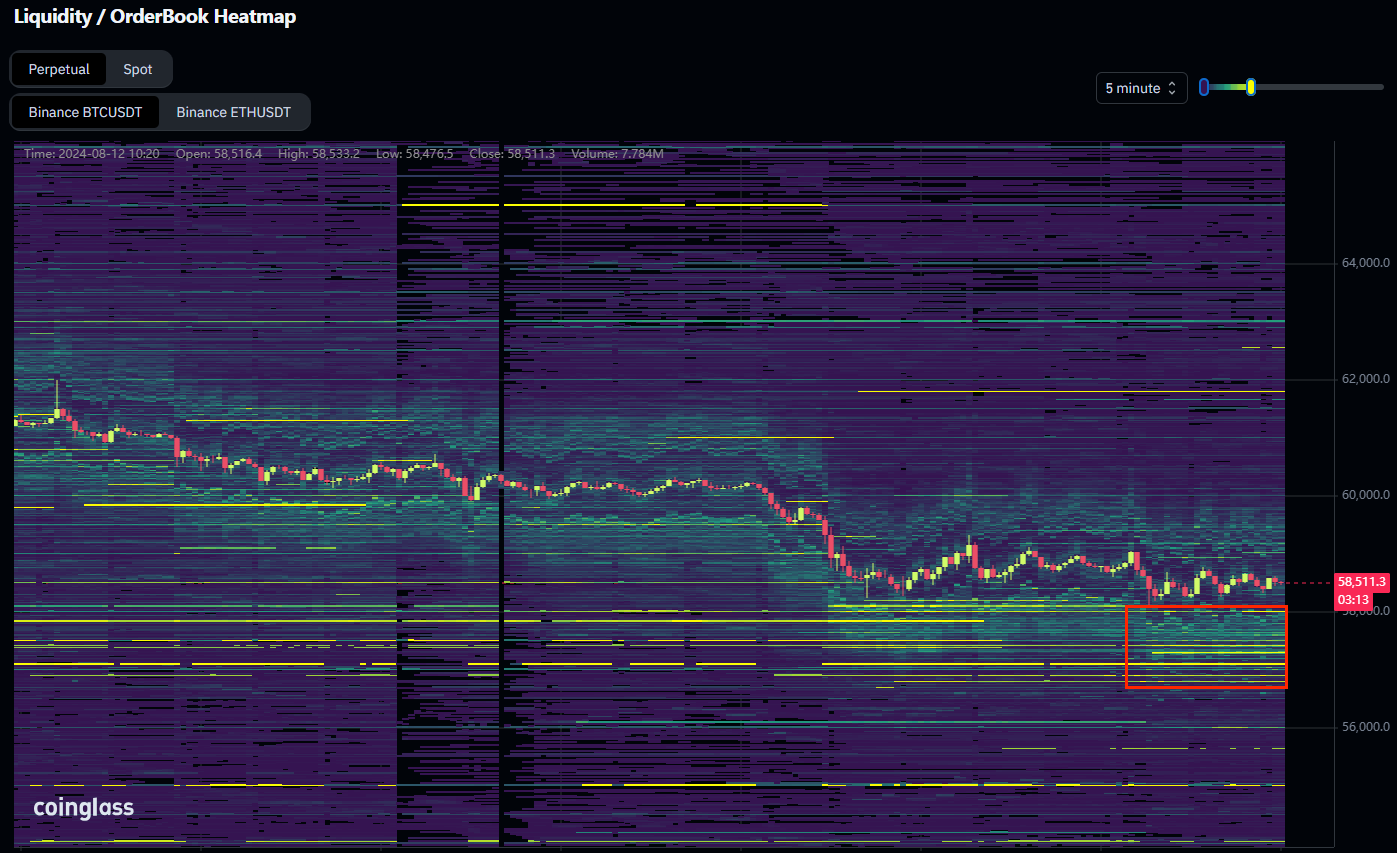

CoinGlass reports that BTC Liquidity / OrderBook Heatmap indicates weakness. It predicts that BTC price can further drop to $56,800. However, if the bounce is strong, BTC will test higher levels. However, the prices could drop to lower levels, if the bounce is weak. Notably, Bitcoin death cross could trigger further crypto market selloff.

Moreover, $2 billion in BTC longs risks getting liquidated below $58,600, as per BTC exchange liquidation map data. In the last 24 hours, 61k traders were liquidated as total liquidation rose above $166 million for top cryptocurrencies. The largest single liquidation order happened on crypto exchange OKX for ETH-USD-SWAP trade valued at $2.17 million.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

HashKey Launches First XRP Tracker Fund With Ripple’s Backing

In remarkable XRP news, HashKey Capital has rolled out Asia’s first XRP Tracker Fund in an attempt to open the floodgates for institutional investors. The digital asset investment firm has tapped Ripple as an anchor investor, building on previous high-level partnerships between both entities.

HashKey Capital Launches Asia-first Tracker Fund

Digital asset investment giant HashKey Capital has announced its first investment product to track XRP’s price. According to a press release, HashKey Capital launched the first XRP Tracker Fund in Asia, providing investors with institutional-grade exposure to XRP price.

The newly minted fund will provide institutional investors with XRP exposure without the hassle of direct ownership, trading or custody. Per the announcement, the XRP Tracker Fund will mirror the price of XRP with investors with cash subscription and monthly redemptions.

The latest fund is HashKey’s third tracker fund after the successful rollout of its Bitcoin and Ethereum exchange-traded funds (ETFs). According to the XRP news, plans are underway to convert the XRP Tracker Fund into an ETF with HashKey Capital targeting a two-year timeline.

Hashkey Capital disclosed that Ripple will provide the first round of funding for the tracker fund. Apart from seeding the initial investment, Ripple is tapped to become an anchor investor, committing a significant amount of cash.

Ripple, fresh from its Hidden Road broker deal is keen on deepening existing ties with HashKey Capital. Top on the list for both parties is the exploration of new investment products, tokenization, and DeFi solutions.

XRP ETFs Are Gathering Steam

HashKey says choosing XRP as its third tracker fund in Asia was an obvious choice for the investment firm. The press release mentions XRP’s functionalities in enabling efficient transactions beyond traditional alternatives. Already, conversations of a SWIFT integration with Ripple is growing louder and the impact on XRP price.

“XRP stands out as one of the most innovative cryptocurrencies in today’s market attracting global enterprises who use it to transact, tokenize and store value,” HashKey Capital Liquid Funds partner Vivien Wong.

While XRP is gaining traction, anticipation for an XRP ETF has reached an all-time high. An XRP leveraged ETF had a strong start to life, outperforming Solana to set a new altcoin record.

At the moment, a handful of XRP spot ETFs from top investment firms are awaiting approval by the SEC. Industry expert All Things XRP predicts that nine XRP spot ETFs will be approved by the SEC.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Shiba Inu Follows Crypto Market Trend With “Shib Is For Everyone” Post, What’s Happening?

Shiba Inu meme coin has recently rattled the crypto market by following one of the latest trends in the sector. The crypto’s team shared an X post this Friday that read, “Shib is for everyone.” This post follows the recent “Base is for everyone” token buzz.

Notably, Coinbase Layer 2 network Base earlier posted a very similar comment on X. As an upshot, the crypto realm saw the unintended launch of a new coin, with its price skyrocketing momentarily before falling from grace.

Shiba Inu Team Shares “Shib Is For Everyone” Post After Base, Here’s The Scoop

Shiba Inu team’s account @Shibtoken shared an X post on April 18 that read, “Shib is for everyone.” Further, the team shared another post soon after that read “Coined it.” The latter post was linked to Zora, a platform that allows users to mint content as tokens.

As mentioned above, these posts mainly follow the Coinbase L2 network’s recent chronicle. It’s noteworthy that the Layer 2 network shared an X post that read “Base is for everyone, followed by another post that read, “Just coin it,” linking it to the platform Zora.

The upshot? A domino effect kicked in, and these posts by the Layer 2 network ignited the launch of a new token that wasn’t even officially verified. Notably, this new token soon hit a market cap of over $20 million before erasing over 40% in value and retracing to $11 million. In turn, crypto market traders and investors are left abuzz amid this token’s launch, whilst the Shiba Inu team is now following similar footsteps.

It’s notable that some crypto traders even turned a mere $4.5K investment into a whopping $666K with the new “Base is for everyone” token. This saga put a major spotlight on the crypto project, with some even tossing insider trading and rug-pull allegations.

Did SHIB Price React Similarly To “Base Is For Everyone” Token?

Meanwhile, the hourly SHIB price chart shows that the meme coin witnessed a 1% uptick after the post by @Shibtoken, reaching $0.0000118. Its price recovered after hitting a low of $0.00001164 intraday. Notably, market experts like IAmCryptoWolfy are wondering about the sudden jump in Shiba Inu price, highlighting the surge on X.

However, this upward trajectory is relatively diminished compared to what the new Base token witnessed before falling. Besides, CoinGape recently reported that SHIB’s daily volume has also hit remarkable levels. As a result, traders and investors remain optimistic about what lies next for the meme coin’s price as it taps into one of the latest market trends amid bullish dynamics.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Predicts Pi Network Price Volatility After Shady Activity On Banxa

Pi Network price is staring down the barrel of a gun as it faces the grim prospects of heightened price volatility. Cryptocurrency analyst Dr Altcoin warns that an avalanche of new accounts on Banxa with small Pi balances poses increased danger for the Pi Network price.

Dr Altcoin Warns Of Price Volatility From Banxa Account Activity

Pseudonymous cryptocurrency analyst Dr Altcoin has urged Pi Network investors to brace for the impact of incoming price volatility. Dr Altcoin revealed in an X post that a coordinated account activity on the cryptocurrency trading platform Banxa may affect Pi Network price stability.

He opines that Banxa is allowing the creation of multiple accounts, with a common denominator being their funding with small Pi Coin balances. The new accounts all have a balance of 0.98 Pi valued at around $0.61 in coordinated fashion.

“Banxa is creating many new accounts, each with a balance of 0.98 Pi,” said Dr Altcoin. “This could lead to price volatility.”

While the entity behind the synchronized account creation remains unknown, Dr Altcoin notes that extreme price volatility is on the horizon. Firstly, small wallets have seen action in wash trading scams to simulate fake market activity. Secondly, a concerted sale of Pi Coins in the wallets can create artificial sell pressure for Pi Network.

By keeping Pi balances under the 1 Pi mark, there is chatter that the entity is attempting to sidestep exchange rules and avoid detection.

In early April, Banxa rolled out support for Pi Network allowing users to buy, sell and hold Pi Coins on the platform. Since the integration, there have been over 1.2 million Pi Coin buys on Banxa,

Pi Network Records Significant Whale Activity

While Banxa accounts are buying miniscule amounts of Pi, whales are loading up their holdings with seismic purchases. The number of Pi Coins on exchanges dropped from 365 million to 359 million in under 48 hours. The decline of 6 million Pi Coins from exchanges is considered a clear sign of whales stacking up on the asset.

For now, it is unclear if the heightened whale activity is connected to the Banxa account activity. If connected, a classic pump and dump scheme may be in the offing for Pi Network price.

At the moment, Pi Network price is trading at $0.6 and shows no signs of wild price volatility. Pi Network’s momentum is surging to new levels, flashing indicators to reclaim the $1 dollar mark.

There is speculation that Pi Coin can reach highs of $30 if top banks start using Pi with a chain link integration driving up a short-term burst to $3,

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin23 hours ago

Altcoin23 hours agoHow Rising Solana Network Inflows Could Drive SOL Price to $150?

-

Bitcoin22 hours ago

Bitcoin22 hours agoGary Gensler Explains Why Bitcoin Will Outlast Altcoins

-

Market22 hours ago

Market22 hours agoBitcoin Whales Withdraw $280 Million: Bullish Signal?

-

Altcoin15 hours ago

Altcoin15 hours agoCZ Honors Nearly $1 Billion Token Burn Promise

-

Market15 hours ago

Market15 hours agoOver $700 Million In XRP Moved In April, What Are Crypto Whales Up To?

-

Altcoin22 hours ago

Altcoin22 hours agoHow Crypto Traders Made $666K from $4.5K in One Trade?

-

Market20 hours ago

Market20 hours agoExpanding Blockspace and Enhancing Privacy

-

Market18 hours ago

Market18 hours agoBitcoin Price Poised for $90,000 Surge

✓ Share: