Altcoin

Glassnode Reveals Altcoin Devaluation Amid Bitcoin Stability

New data from Glassnode has revealed that the global altcoin market is undergoing one of its sharpest devaluations in history.

Meanwhile, Bitcoin (BTC) has remained relatively stable despite volatile price swings. This showcases a stark divergence between the largest cryptocurrency and the broader altcoin sector.

Altcoins Face Historic Devaluation

Glassnode’s latest on-chain newsletter detailed the volatility in the Bitcoin market last week. Macroeconomic conditions, including President Trump’s proposed tariffs on Canada, Mexico, and China, were listed as the driving facts behind it.

These geopolitical tensions created an uncertain environment for investors. In addition, the continued strength of the US dollar contributed to a constrained liquidity environment.

Despite these fluctuations, Bitcoin demonstrated relative stability, fluctuating between a low of $93,000 and a high of $102,000. This indicated a generally sideways market.

Glassnode’s analysis attributed the stability to increased liquidity and larger capital flows, which offset the momentum of a growing asset.

“The growing presence of a more resilient and patient holders has contributed to the stability of BTC prices, even amidst a relatively unstable macro backdrop,” Glassnode noted.

In contrast to Bitcoin’s relative resilience, altcoins have faced significant challenges. By using Principal Component Analysis (PCA), Glassnode declared that most ERC-20 tokens were closely clustered, indicating a broad-based sell-off across the altcoin market.

This suggested that very few altcoins managed to avoid the volatility and move independently.

“The Altcoin sector took the heaviest relative losses during the downturn, with the global altcoin market cap experiencing one of its biggest devaluations on record,” the newsletter read.

The severity of this sell-off was evident in the global altcoin market capitalization, which saw a $234 billion decline over a 14-day period. Yet, Glassnode acknowledged that this decline was not as severe as previous crashes. These included the Great Miner Migration in May 2021 and the LUNA/UST and 3AC collapses in late 2022.

Is Altcoin Season Still a Possibility?

Meanwhile, a crypto analyst on X drew attention to a recurring trend in crypto cycles. The analyst highlighted that Bitcoin dominance peaks as it reaches new all-time highs, while altcoin dominance hits lows. This phase often creates a sense of desperation among altcoin investors, who feel late in the cycle.

Nonetheless, based on past trends, the analyst revealed that Bitcoin’s dominance typically declines after its second big price jump to new record highs. This is followed by a rise in altcoin dominance.

“I still expect Bitcoin dominance to drop and Altcoin dominance to increase,” the post read.

However, the analyst addressed that the current cycle is more intense due to more altcoins and fewer investors holding Bitcoin at higher prices. Thus, the money flow follows Bitcoin first, then major altcoins, and finally, mid- and low-cap altcoins.

Another analyst also pointed to a major signal for the altcoin season.

“Some altcoins are decoupling from Bitcoin for the first time since 2022—this is the first signal of the bull run!” he stated.

The analyst believes significant altcoin rallies are likely before Bitcoin is officially declared the reserve currency. He expects profits from Bitcoin to flow into altcoins, which could trigger an altcoin season.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Analyst Reveals Why The Solana Price Can Still Drop To $65

Solana price could be heading toward a major drop, according to crypto analyst Ali. In a recent analysis, Ali suggested that SOL might be retesting the breakout zone from a right-angled ascending broadening pattern.

Analysis Points to Downside Potential For Solana Price

Ali’s SOL analysis expects the price to drop to $65. This bearishness comes after a period of price weakness for Solana. SOL’s price fell by 1.2% in the last 24 hours, according to recent figures.

For all we know, #Solana $SOL might be retesting the breakout zone from a right-angled ascending broadening pattern, with the $65 target still in play. pic.twitter.com/vujFJQWurz

— Ali (@ali_charts) April 16, 2025

The prediction arrives at a time for the Solana network when Canada will launch Solana ETFs today after regulatory approval by the Ontario Securities Commission (OSC).

Ali’s technical analysis focuses on a right-angled broadening ascending pattern that has appeared on Solana’s price chart. SOL, according to the analyst, is re-testing the breakout pattern area, and this could be an indication of more downside action if the level fails to act as support.

This bearish outlook is shared by some other analysts in the crypto space. SatoshiOwl noted that Solana is not looking good and that it is breaking down from trendline on 1h. However, the analyst cautioned that confirmation was still needed from 1-hour and 4-hour candle closings. The analyst suggested that Solana might retest $120 first before possibly moving higher.

Not all analysts share this bearish view, however. Trader David identified what he described as bullish signs for SOL as this channel continues to move upward. He pointed out that after a 33% correction, Solana is now on a strong support level. He expressed hope that the token will reach new heights again.

Bullish signs for $SOL as this channel continues to move upward.

Hopefully we will see Solana on heights again. After 33% correction it is now on a strong support level.#Crypto #CryptoEducation pic.twitter.com/Pvj6RAC0WS

— David (@David_W_Watt) April 16, 2025

Canadian ETF Launch Could Provide Institutional Access

Despite the bearish technical outlook from some analysts, Solana is experiencing a potentially positive development on the institutional front. The Ontario Securities Commission (OSC) has approved multiple ETF issuers to list Solana-based products in Canada, including Purpose, Evolve, CI, and 3iQ.

This regulatory clearance sets the stage for Solana ETFs to come to market. This may make the cryptocurrency available to a new generation of institutional investors who would rather have regulated investment products rather than direct exposure to cryptocurrency. The timing of this news is interesting, as it is happening during technical uncertainty in the price action of Solana.

Bloomberg ETF analyst Eric Balchunas provided some background on the upcoming launches. He clarified that Canada is preparing spot Solana ETFs to launch this week after the regulator waved the green flag to multiple issuers. He added that the ETFs will also offer staking through TD.

But the initial market reaction to this news has been muted, with the Solana price showing little positive momentum in response to the much-awaited launch of the ETF. CoinGape has also released an extensive Solana prediction for April 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Mantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

The Mantra (OM) token price has surged after founder JP Mullin announced plans for a massive token burn. Mullin clarified that he intends to burn his personal team token allocation and implement a “comprehensive burn program for other parts of the OM supply.”

OM Pumps After Founder’s Burn Announcement

The OM token, which had experienced a major price drop over recent weeks, jumped from a low of $0.5115 to as high as $0.8706 following Mullin’s statement on X.

This announcement comes as OM has seen price drops of 87.0% over the past week. CoinGape has released a Mantra OM price prediction for April 2025, which could give you an idea of how the token can perform this month.

Mantra has initially shelved 300 million OM tokens for its team and core contributors. This accounts for 16.88% of the token’s nearly 1.78 billion total supply. These tokens are currently locked and were scheduled for a phased release between April 2027 and October 2029.

To be 100% clear, I am stating that I am burning MY team tokens, and we will create a comprehensive burn program for other parts of the OM supply. https://t.co/Yy6GzRBbM8

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 16, 2025

The planned burn could possibly take out a huge quantity of these tokens from the market for good. A decentralized vote could decide if all 300 million team token issuance needs to be burnt, as proposed by Mullin.

The announcement has been followed by various reactions from the Mantra community. Some members of the community believed that Mullin’s commitment was a positive development for token valuation, while others were concerned about having long-term issues.

Crypto Banter founder Ran Neuner warned against the move: “Burning the incentive may seem like a good gesture but it will hurt the team motivation long term.”

Mantra Refutes Allegations Following Price Collapse

Mullin’s token burn announcement comes at a difficult time for the project. The company has vehemently denied reports that it holds 90% of OM token supply. It has also rejected allegations of market manipulation and insider trading submitted by some community members.

Mantra explained that the latest price drop of OM occurred due to “reckless liquidations” and not due to anything the team had done. The recent history of the token indicates the size of this drop, with the charts reflecting a nearly 90% decline in value over the past month.

Major cryptocurrency exchanges OKX and Binance both experienced major OM trading activity immediately before the token’s collapse. However, both platforms have denied any wrongdoing in relation to the price crash. Binance mentioned that the crash was mainly due to cross-exchange liquidations.

They attributed the collapse to tokenomics adjustments that were made during October 2024 and abnormal market volatility that ultimately led to high-volume cross-exchange liquidations on April 13.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Bitcoin & Others Slip As Trump Imposes Up To 245% Tariff On China

Crypto Market Update: The digital assets continue to bleed as the US President Donald Trump slapped up to 245% tariff on Chinese goods. The intensifying trade war and macroeconomic concerns have continued to weigh on the investors’ sentiment, wiping off the previous gains from the digital assets space. Bitcoin price today slipped more than 2% while ETH, XRP, SOL, DOGE, and Cardano prices fell between 4% and 7%.

Crypto Market Update: Trump’s 245% Tariff On China Sparks Concerns

The crypto market slipped today after US President Donald Trump escalated the long-standing trade war with China by imposing a fresh 245% tariff on a wide range of imports. According to a White House document released in the late US hours on Tuesday, the move targets critical minerals and related products, citing national security and economic resilience as key reasons.

Meanwhile, the fact sheet stated that China now faces tariffs of up to 245% following its “retaliatory actions” and lack of cooperation. However, this is not the first volley in the tariff saga, as it continued to dampen the crypto market sentiment over the past few weeks.

Trump’s Tariff On China

For context, it began with a 20% levy, followed by a 34% hike on April 2nd. As tensions grew, Trump raised the rate again, reaching 104%. In response, China imposed an 84% tariff on the US goods.

Trump responded by increasing the US tariff to 125%. However, it has excluded certain tech products from China, which has boosted market sentiment. However, just last week, China matched that level, lifting its tariffs to 125%. The situation escalated dramatically this week with the 245% blanket tariff.

The White House cited the need to protect America’s defense sector, tech advancement, and infrastructure. As per Reuters, China exports over $400 billion worth of goods to the U.S. annually — far more than any other country. The impact of this aggressive move is now spilling over into the financial sector, including the crypto market.

How Crypto Prices Are Performing?

The global crypto market cap lost more than 2.3% from yesterday to $2.63 trillion while its one-day volume fell 6% to $73.89 billion. Besides, the fear and greed index showed a reading of 29, indicating a “Fear” momentum hovering in the market.

Notably, BTC price today fell nearly more than 2.5% to $83,368.76, while ETH price fell about 5% to $1,566. On the other hand, XRP price today was down nearly 4% to $2.04 and SOL price slipped more than 3% to $124.89.

Simultaneously, Cardano price today slipped nearly 7% to $0.6032. In the meme coins segment, DOGE price was down around 5% to $0.1528 and SHIB’s value lost around 3% to $0.00001160.

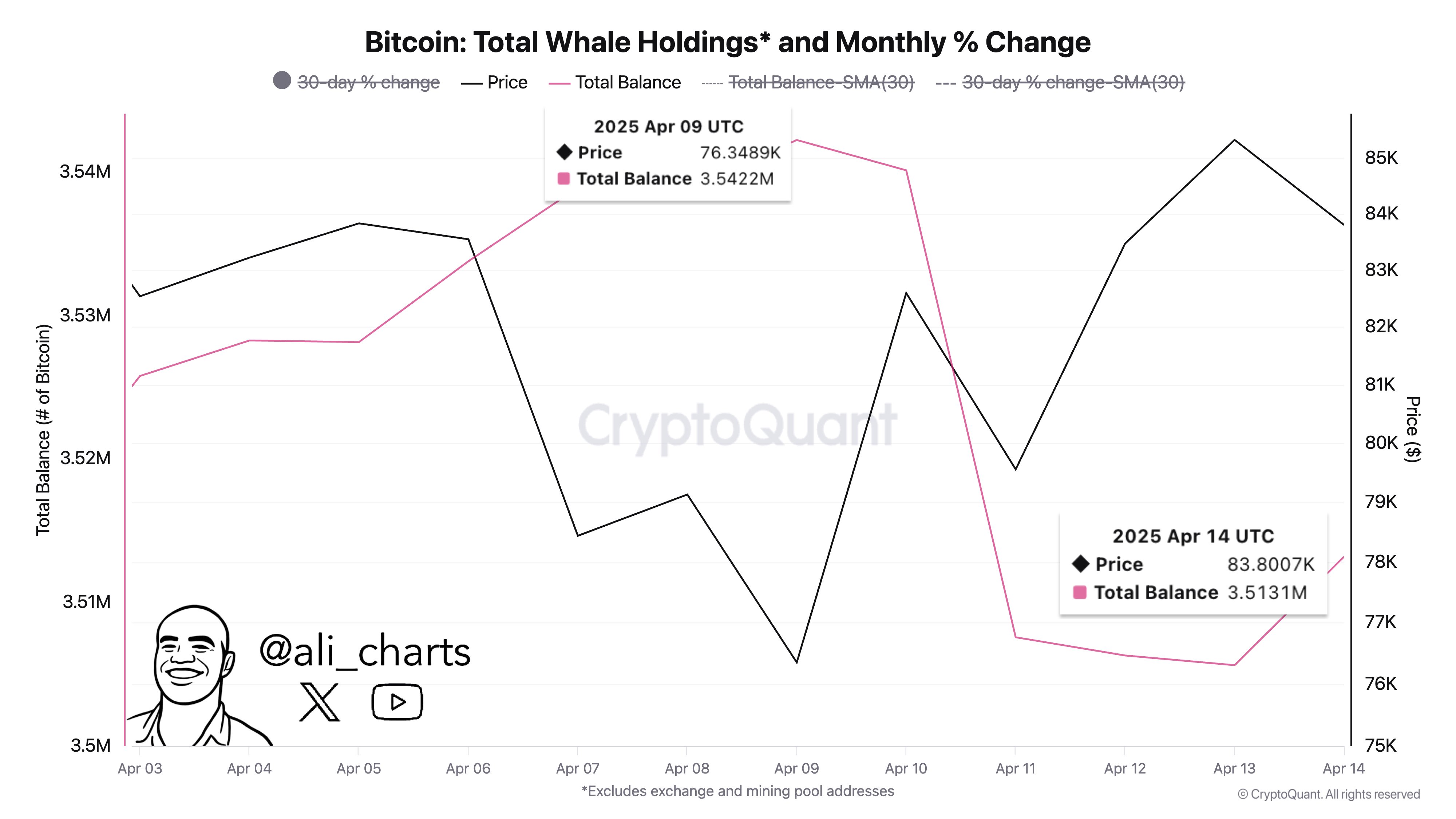

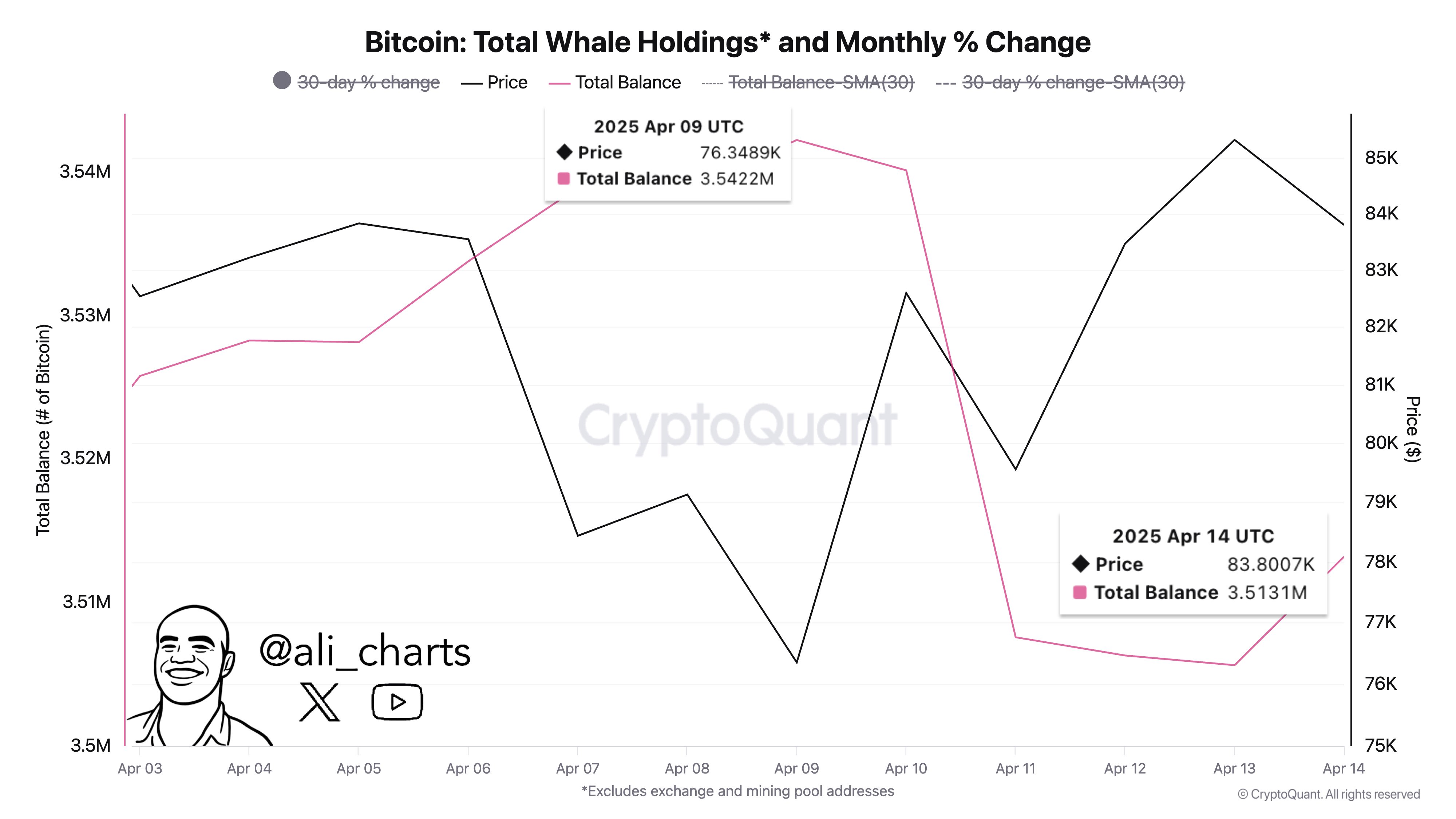

Bitcoin Whale Continues To Dump Amid Crypto Market Woes

The recent slump in BTC price also comes as Bitcoin whales appear to be losing confidence in the asset’s potential amid an intensifying trade war. Besides, speculations are also high that the whales are booking profit, reflecting a waning risk bet appetite of the investors. The US vs China tensions amid Trump’s tariff policies have weighed on the investors’ sentiment, causing a massive selloff in the market.

For context, renowned analyst Ali Martinez recently highlighted the selling trend. In a recent X post, Martinez said “Whales have been taking profits during the recent rally.” According to him, the whales have offloaded more than 29,000 BTC from April 9.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market23 hours ago

Market23 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market18 hours ago

Market18 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Metrics Reveal Critical Support Level – Can Buyers Step In?

-

Market19 hours ago

Market19 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Adoption Grows As Public Firms Raise Holdings In Q1

-

Market17 hours ago

Market17 hours agoEthena Labs Leaves EU Market Over MiCA Compliance

-

Market16 hours ago

Market16 hours ago3 US Crypto Stocks to Watch Today: CORZ, MSTR, and COIN

-

Market15 hours ago

Market15 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

✓ Share: