Altcoin

EU Sanctions Crypto Exchange Garantex – Is Best Wallet Token the Best Crypto to Buy Now?

In a historic first, the European Union has slapped sanctions on Russian cryptocurrency exchange Garantex, a key player in Moscow’s crypto market. The move stems from Garantex’s close ties to sanctioned Russian banks and its role in facilitating activities that threaten global financial stability.

This latest action solidifies a growing, unified international front against the exchange, which has already faced sanctions from the UK and the US.

The EU’s sanctioning of Garantex demonstrates a clear escalation, highlighting the severity of the concerns around the platform’s operations.

Are non-custodial wallets like Best Wallet and their token $BEST a solution to help investors mitigate risks associated with crypto trading—and is $BEST the best crypto to buy?

Garantex Scrutiny & Impact on Investors Point to Bigger Issues

Whilst this isn’t Garantex’s first rodeo against international sanctions, it is the first time that the EU has sanctioned a crypto exchange, marking a historic first.

In 2022, the US Treasury sanctioned Garantex for facilitating illicit transactions, anti-money laundering, and the counter-financing of terrorism deficiencies.

Simultaneously, Garantex lost its Estonian license following an investigation by the Estonian Financial Intelligence Unit.

In response to the Russian invasion of Ukraine in 2024, the US and UK imposed further sanctions on Garantex. Despite this, US officials raised questions about how to prevent the exchange’s attempts to circumvent them.

In fact, more recent sanctions arise from the concerns of the European Council (the official Council of the European Union) that the trading platform is getting all too familiar with avoiding their punishment

This is a significant step in combating illicit financial crypto flows from the exchange.

The imposed sanctions will restrict investor access to their funds, diminish their trading capacity, and severely disrupt Garantex’s operations, effectively undermining the exchange’s ability to operate.

Crypto Security in Exchanges – Insufficient Safety Guarantees?

Crypto is a volatile investment, with market trends changing rapidly. Investors approach the market in different ways, with some employing a short-term trading system and others invoking a HODLing (Holding On for Dear Life) approach, hoping for long-term gains.

The latest data from CoinMarketCap, shows that although in a current positive trend overall (a bull market), investors are experiencing recent market dips. This experience is evident, with notable highs and lows throughout the year.

Being a centralized exchange (CEX), Garantex offers convenience and ease of use. However, you relinquish control of your private keys and rely on their security measures to safeguard your funds.

But when the unexpected happens (like sanctions), your funds might be frozen.

Other risks include security breaches (like the Bybit hack), exchange failures, and the ever-present threat of regulatory uncertainty.

If you want more control over the security of your crypto, non-custodial wallets like Best Wallet are the safer bet. Even better if you can invest in a promising presale like the Best Wallet Token, which promises long-term gains.

Protection and passive income? Where do we sign up?

With advanced cryptographic techniques, multi-factor authentication, and biometrics, Best Wallet prioritizes the security of user funds—making its native token a strong contender for the best crypto to buy.

Currently standing at a token price of $0.024225 and an impressive total raised of $10.8M, $BEST demonstrates it continues to grow, even in the recent market dip. Rewarding investors with a dynamic 147% APY, Best Wallet continues to build on its good reputation and attract new investors.

Unlike centralized exchanges, non-custodial wallets like Best Wallet remain unaffected by events such as the recent Garantex sanctions, providing a safe haven for crypto assets.

Crypto is very volatile, and like with any investment, you run the risk of losing it all. Always do your own research before making any investments.

Altcoin

Sonic Surges to $1 Billion TVL in 66 Days Amid DeFi Market Slump

The crypto market in 2025 is facing intense turbulence. The capitalization of once-hot trends like meme coins has plummeted. Capital has flowed out of decentralized finance (DeFi) protocols, driving DeFi’s total value locked (TVL) down from $120 billion to around $87 billion.

In this context, Sonic stands out. It has consistently hit new TVL highs, reaching $1 billion in April after growing nearly 40 times since the beginning of the year. So, what makes Sonic a bright spot amid a stormy market?

Investors Are Pouring Capital into Sonic

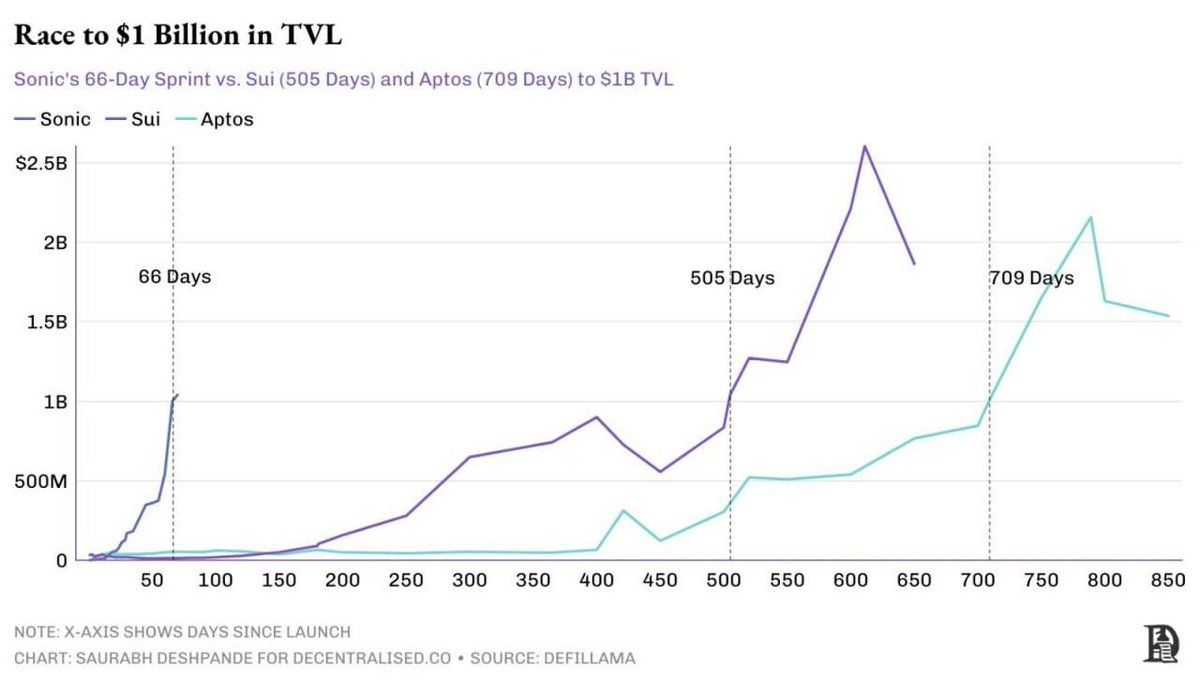

Sonic has made its mark with a rapid TVL growth rate, far outpacing better-known blockchains. According to DefiLlama, Sonic reached $1 billion in TVL within 66 days. In comparison, Sui took 505 days, and Aptos needed 709.

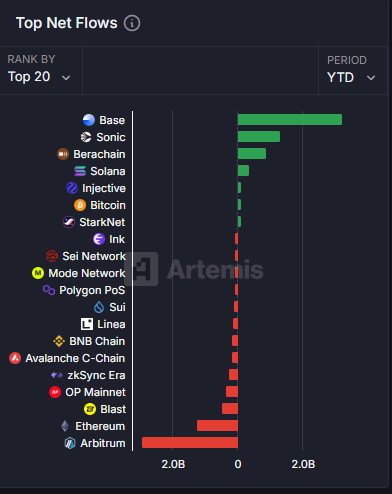

This achievement reflects strong capital inflows into the Sonic ecosystem despite the broader DeFi trend of capital withdrawal. Data from Artemis supports this, ranking Sonic as the second-highest netflow protocol this year—trailing only Base, a blockchain backed by Coinbase.

The growth goes beyond TVL numbers. Sonic’s ecosystem is attracting various projects, including derivatives exchanges like Aark Digital and Shadow Exchange and protocols such as Snake Finance, Equalizer0x, and Beets. These projects still have small TVLs, but they have the potential to draw new users and capital, fueling Sonic’s momentum.

However, the question remains: Can this capital inflow remain sustainable while the market fluctuates?

Andre Cronje on Sonic’s Potential and Strengths

Andre Cronje, the developer behind Sonic, shared his ambition in an interview to push this blockchain beyond its competitors.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Andre Cronje said.

According to Cronje, Sonic isn’t just about speed. The platform also focuses on improving both user and developer experience. He explained that 90% of transaction fees go to dApp, not to validators, creating incentives for developers to build.

Unlike other blockchains, such as Ethereum, which are limited by long block times, Sonic leverages an enhanced virtual machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, however, that current demand has yet to push the network to its full capacity. Still, these technical advantages make Sonic a compelling option for developers seeking more user-friendly dApps.

He also revealed new features on Sonic that have the potential to attract users.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Andre Cronje revealed.

Risks and Challenges Ahead

Despite reaching impressive milestones, Sonic is not immune to risk. The price of its token, S, has declined significantly from its peak. According to BeInCrypto, it has dropped around 20% in the past month—from $0.60 down to $0.47—mirroring the broader market’s volatility.

Furthermore, Grayscale recently removed Sonic from its April asset consideration list. This decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain its TVL should investor sentiment deteriorate.

Sonic also faces fierce competition from other high-performance chains like Solana and Base. Although Sonic holds a clear advantage in speed, long-term user adoption will depend on whether its ecosystem can deliver real value, not just high TVL figures.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

6.96 Billion Dogecoin In 24 Hours As DOGE Price Adds 1%

The leading meme coin Dogecoin has surged nearly 1% today, defying the broader market downturn momentum, with 6.96 billion coins traded over the last 24 hours. However, although the number seems big, it appears that the ongoing DOGE price surge is less likely to be sustained ahead. Despite that, some of the recent market trends hint that the meme coin may gain more exposure in the market due to soaring institutional interest.

Dogecoin price has mitigated some of its recent losses and traded at $0.157. Notably, it comes as the digital assets space stayed in the red, with the global crypto market losing 0.25% to $2.58 trillion. Ethereum was one of the top laggards among the top 10 coins, losing nearly 3% over the last 24 hours.

However, despite the recent gains, DOGE price has lost more than 6% in the weekly chart, while touching a 24-hour high and low of $0.158 and $0.1494. Besides, a total of 6.96 billion tokens were traded in the last 24 hours, totaling $1.09 billion.

Despite that, the one-day trading volume was down more than 45%, suggesting a volatile period ahead. Besides, CoinGlass data showed that DOGE Futures Open Interest fell 1% to $1.43 billion, reflecting the still gloomy sentiment hovering in the market.

For context, if high prices are not being supported by soaring trading volumes, it signals a concerning trend for the asset. This disparity can be a warning sign that the uptrend is weakening or a reversal is imminent.

Having said that, Dogecoin’s current low volume indicates a lack of broad market support, leaving the price vulnerable to a decline. With fewer traders actively buying, the top meme coin may be due for a correction.

Recent Trends Suggests Otherwise: Dogecoin (DOGE) Price To Rally?

One of the most recent positive developments on the meme coin is the 21Shares filing for DOGE ETF with the US SEC. The asset manager has revealed this significant step towards launching the investment instrument by filing the S-1 form with the US SEC on April 9.

Meanwhile, this move makes 21Shares the third company, after Grayscale and Bitwise, to seek approval for a DOGE ETF. The next step involves filing the 19b-4 form, which will officially start the approval process.

If approved, the ETF would provide investors with a new way to gain exposure to Dogecoin, potentially increasing its mainstream acceptance and market accessibility. Besides, 21Shares has also planned to launch DOGE ETP in Europe through a partnership with the House of Doge.

However, despite these bullish developments, investors should exercise due diligence before entering the market in this volatile scenario. For context, a recent Dogecoin price prediction indicates that the crypto might hover near the $0.1499 mark through April.

Having said that, it appears that the crypto might hover near the flatline in the coming days unless any major catalyst boosts the market sentiment further.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Why Pi Network Price Should Hit $10, Or Its Over for Pi Coin

After a steep fall to $0.40 earlier this week, the Pi Network price bounced back to $0.60 levels, with its market cap above $4.1 billion. However, on-chain data shows that investors’ interest in the Pi Coin is waning quickly, with daily trading volumes dropping another 44% to $158 million. Analysts point out that the increasing supply of PI tokens at the exchanges can further dampen the upside and could put the ecosystem growth in the shadows.

Why Is Pi Network Investor Sentiment Down

Pi Network community member Edycabas recently shared his take on the collapse of transaction activity on the blockchain. He noted that the Pi blockchain is underwhelming, reportedly processing less than one transaction per second, despite years of promotion suggesting thousands of transactions per block during its Open Mainnet phase.

Responding to this, another community member, Dr Altcoin, noted that the blockchain itself remains operationally robust, boasting a 99.5% transaction success rate and averaging 20 transactions per block. “The real issue lies in transparency concerns surrounding the co-founders, which continue to deter major investors and centralized exchanges (CEXs),” he said.

Besides, Dr Altcoin also shared aspirations for the Pi Network price to reach a minimum token value of $10, which, as per the analyst, would significantly boost engagement with decentralized applications (DApps) and broader adoption. Dr Altcoin has also previously suggested for Pi token burns to boost the Pi Coin price higher.

Pi Coin Core Team Lacks Transparency

Dr. Altcoin has also questioned the Pi Network co-founders’ reluctance to engage publicly, urging them to address the community and investors. “Why do the co-founders avoid interviews?” Dr. Altcoin asked, adding that the “Pi Community has kept this project alive for years, and it deserves greater recognition”.

Dr. Altcoin stressed that co-founders Nicolas Kokkalis and Chengdiao Fan must step up to showcase the project’s potential to prevent the token from declining further, warning of a possible Pi Coin price dip below $0.30 in the coming week.

Crypto analyst Dr. Altcoin has issued a statement predicting significant activity on centralized exchanges (CEXs) as unlocked Pi tokens flood the market. Starting next week, an average of 134 million Pi tokens will reportedly enter circulation monthly.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Bitcoin24 hours ago

Bitcoin24 hours agoFlorida Bitcoin Reserve Bill Passes House With Zero Votes Against

-

Market21 hours ago

Market21 hours agoADA Price Surge Signals a Potential Breakout

-

Market24 hours ago

Market24 hours agoFuser on How Crypto Regulation in Europe is Finally Catching Up

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin (DOGE) Reclaims Previous Breakdown, Will This Mark The Bottom?

-

Market23 hours ago

Market23 hours ago3 Bullish Altcoins Surging After Trump’s Tariff Pause

-

Altcoin12 hours ago

Altcoin12 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market10 hours ago

Market10 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

✓ Share: