Altcoin

Ethereum Price Surge to $4,000 Delayed After ETH Whale Dump?

Just as Ethereum price has been showing strength above $3,500 levels, selling by Ethereum whales picked up once again. The heavy ETH offloading to exchanges by whales has caught investors’ attention on whether the profit-booking begins even before reaching $4,000. Notably, Ethereum co-founder Jeffrey Wilcke also dumped a staggering 20,000 ETH worth $72.5 million.

Ethereum Price Breakout to $4000 Faces Headwinds

Popular crypto analyst Rekt Capital shows the latest ETH attempt to breach the crucial $3,700 resistance. The analyst added that Ethereum price needs a strong weekly close above this level to confirm a breakout. Only after this, ETH Price rally to $4,000 and beyond can continue.

Rekt Capital described the recent ETH price action as a “picture-perfect rejection” from the resistance, emphasizing that Ethereum is not ready to break out just yet.

Another popular analyst CrediBULL Crypto points out a critical resistance level in the ETH/BTC pairing. With the recent upward momentum, this pair is approaching the first “trouble area”. The analyst suggests that a rejection at this point, coupled with a potential 10% correction in Bitcoin, could push Ethereum price toward a significant buy zone between $2,700 and $2,800.

While long-term spot holders may opt to hold through this short-term volatility, CrediBULL emphasizes that traders should watch the $2,700-$2,800 range closely for potential entry opportunities.

One thing that brings some optimism is the rise of ETH’s funding rates. Funding rates, a crucial indicator of sentiment in the futures market, have seen a notable rise in recent weeks. This uptick signals growing bullish momentum among traders and investors as Ethereum’s price continues its upward trajectory.

ETH Whale Dumping on the Rise

Ethereum co-founder Jeffrey Wilcke made headlines today after transferring 20,000 ETH, valued at $72.5 million, to the Kraken exchange. The move coincided with an Ethereum price rally above $3,500.

This is the fourth major ETH transfer by the Ethereum co-founder this year in 2024. So far he has offloaded 44,300 ETH, worth approximately $148 million, at an average price of $3,342 per token. On the other hand, Ethereum co-founder Vitalik Buterin has been selling meme coins off-lately.

Furthermore, Spot on Chain reported that another significant Ethereum sale has been reported as Winslow Strong, director of the Qualia Research Institute, transferred 9,380 ETH, worth $33.7 million, to Coinbase just two hours ago.

This move follows a broader trend of liquidation by Strong, who has sold a total of 14,233 ETH, worth $48.8 million, since ETH price began its recovery in early November.

As of press time, ETH price is trading 1.27% down at $3,570 with a 32% drop in daily trading volumes moving under $30 billion. As per the Coinglass data, the 24-hour liquidation has shot up to $32 million, with $19 million in long liquidation and $13 million in short liquidation.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

Cardano price is repeating a pattern from 2024 that experts say is a signal for a massive pump in the coming weeks. While present figures are largely underwhelming for ADA, investors are brimming with confidence for a strong reversal in the near future.

Cardano Price Can Reach $2.5 In May

According to pseudonymous cryptocurrency analyst Master Kenobi, Cardano price is exhibiting cyclical behavior. In a post on X, Master Kenobi notes that ADA’s consolidation in recent days mirrors its price action from Q3 of 2024.

At the time, Cardano’s price suffered a steep correction in early August and endured a lengthy consolidation period before rallying. Presently, Cardano’s price is consolidating after the deep in early February that sent prices to $0.49.

“ADA is currently in a consolidation phase that resembles its behavior from August-September 2024,” said Master Kenobi. “Since the dip on August 5, it hasn’t recorded a new low – just as it hasn’t now, following the dip on February 3.”

According to Master Kenobi, a lengthy consolidation phase will be the precursor for an impressive rally for Cardano’s price. The analyst theorizes that the incoming rally will send Cardano to impressive levels in May. In the short term, analysts are eyeing ADA to hit $1, citing rising whale activity and positive fundamentals.

“If this pattern holds, May could bring a massive pump, potentially pushing the price toward $2.5,” said Master Kenobi.

ADA Ripples With Bullish Activity

At the moment, Cardano price is trading at $0.6646, a far cry from its all-time high of $3.10. Despite the lull in price action, the ecosystem is brimming with bullish activity for higher valuation.

Investors have their eyes on $10 after ADA outperformed top S&P 500 companies in a strong show of resilience. Futhermore, increased whale activity in the space is signaling an impending rally for ADA as community sentiment reaches an all-time high.

Analysts have opined that an ADA rally to $10 is not a crazy prediction, citing a slew of positive fundamentals for the network. However, pundits are urging investors to brace for multiple corrections in the march to reach a valuation of $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

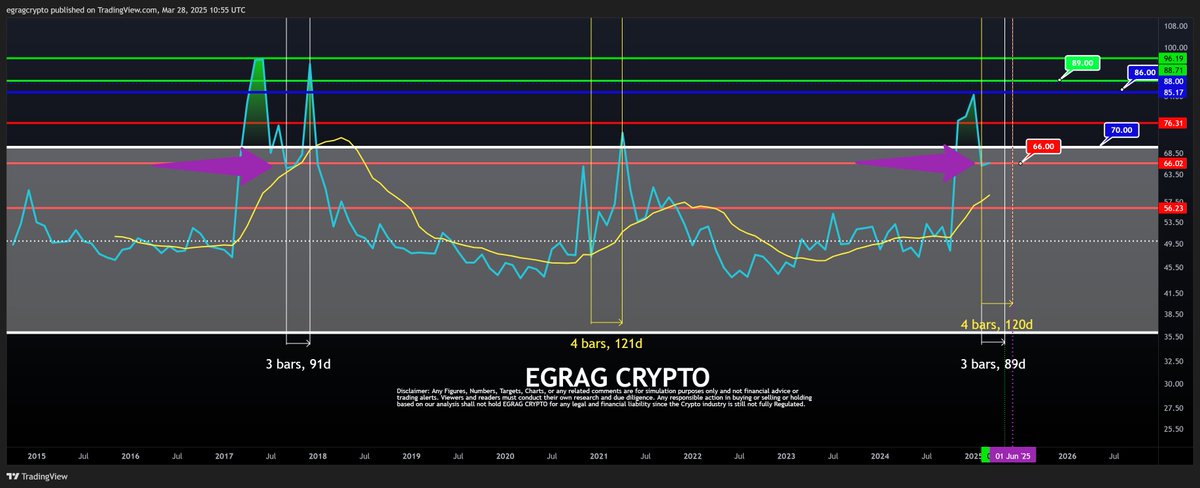

Crypto analyst Egrag Crypto has again provided a bullish outlook for the XRP price. This time, he alluded to historical trends to explain why the altcoin can hit a new all-time high (ATH) in 90 to 120 days.

Why The XRP Price Can Hit ATH In 90 To 120 Days

In an X post, Egrag Crypto alluded to historical patterns to explain why the XRP price can hit a new ATH in the next 90 to 120 days. He noted that the RSI chart shows important historical patterns and stated that the altcoin usually has two peaks during its bull runs.

The crypto analyst further revealed that in 2021, the second peak occurred after 90 days, while in 2017, it occurred after 120 days. Based on this, Egrag Crypto affirmed that this historical timeframe provides market participants with a potential for a “great opportunity,” hinting at the altcoin hitting a new ATH.

In another post, he raised the possibility of the XRP price reaching a new ATH of $3.9 by May. This came as he identified an Inverse Head and Shoulder pattern, which was forming for the altcoin. The crypto analyst stated that the measured move is $3.7 to $3.9.

For now, an XRP analysis has shown that the altcoin is struggling at $2.15 amid regulatory uncertainty over SEC Chair nominee Paul Atkins. In his update on this Inverse Head and Shoulder pattern, Egrag Crypto remarked that a close above $2.24, the Fib 0.888, is the next minor target. He affirmed that the pattern is still unfolding as anticipated.

Ripple’s Native Token Could Still Drop Below $2

Crypto analyst Dark Defender has predicted that the XRP price could still drop below $2 before the next leg up. In an X post, he stated that Ripple’s native token is in the 4th Wave of the Monthly Elliott Wave structure.

His accompanying chart showed that XRP could drop to as low as $1.88 on this Wave 4 corrective move. Once that is done, the altcoin will witness its next leg up, rallying to as high as $5.8, which would mark a new ATH.

Dark Defender assured that Wave 4 will end soon and that XRP will continue to reach its targets. The crypto analyst recently affirmed that the altcoin is the “one” and explained why it would dominate Bitcoin and Ethereum.

Crypto analyst CasiTrades also suggested that XRP could further decline before its next leg to the upside. She noted that after the drop to $2.27, the altcoin showed no bullish RSI divergence, which signaled that the drop wasn’t quite done yet.

She added that the coin is now likely heading down to test the 0.618 golden retracement at $2.17, or possibly the golden pocket at $2.15 for a final low before “lift-off.” However, CasiTrades also mentioned that RSI is starting to build the bullish divergence and that the selling pressure is exhausting.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Gemini Crypto Exchange Announces Rewards For XRP Users, Here’s How To Get In

Gemini, the crypto exchange founded by the Winklevoss twins, is promoting its previously launched XRP cashback program, which offers crypto rewards to users. This initiative allows eligible participants to earn rewards on their XRP transactions. Here’s a look at the program details and the steps required to join.

Gemini Founder Unveils XRP Cashback Rewards

On March 27, Tyler Winklevoss reminded the XRP community and Ripple army on X (formerly Twitter) that they can earn rewards in the token whenever they use the Gemini Credit Card for purchases. The Gemini credit card, launched in partnership with Mastercard in 2021, allows users to choose cryptocurrencies from Bitcoin, Ethereum, XRP, and over 50 other digital assets for cashback.

Since adding XRP to its long portfolio of crypto cashback offerings in August 2023, Gemini has continued to support the third-largest cryptocurrency as an option for crypto enthusiasts. The Credit Card reward information announced by Winklevoss was well received by the XRP community.

He explained that the Gemini Credit Card allows users to earn crypto back each time they spend fiat. He clarified that this feature is only available to residents in the United States (US) currently. The Gemini founder also revealed that he has been using the Credit Card for years and has had a great experience accumulating significant crypto rewards from the cashback program.

Gemini’s Credit Card offers tiered cashback rates depending on the purchase categories. A 4% XRP cashback is offered on gas and EV charging, with up to $200 monthly. A 1% XRP cashback is available for fuel and EV charging after exceeding the monthly limit. Finally, a 3%, 2%, and 1% XRP cashback is provided for dining, groceries, and other purchases, respectively.

As XRP continues to push for widespread adoption, this Gemini cashback reward program strengthens its utility and encourages greater usability and investments.

Notably, Gemini isn’t the only crypto exchange embracing XRP in its rewards programs. Platforms like WhiteBIT and Bit2Me have also introduced similar programs. By offering an XRP cashback, Gemini and other crypto exchanges can make crypto more accessible, encourage faster adoption, and reinforce XRP’s role as a digital payment solution.

How To Participate In Gemini’s XRP Cashback

Gemini has specified that users interested in earning XRP rewards from Gemini’s cashback program must first qualify for the exchange’s Credit Card, which depends on their credit score. Approved applicants must secure their cards by June 30, 2025, to participate in the promotional offer.

The crypto exchange also stated that new cardholders could earn up to $200 in XRP cashback if they spend at least $3,000 within the first 90 days. Once earned, the XRP reward will be automatically deposited into their trading accounts on Gemini, enabling users to hold, trade, or sell whenever they wish. The Credit Card also comes with no extra annual, exchange, or foreign transaction fees, allowing crypto users to grow their portfolios continually.

Featured image from SCMP, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Ethereum22 hours ago

Ethereum22 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Bitcoin23 hours ago

Bitcoin23 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Regulation19 hours ago

Regulation19 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market18 hours ago

Market18 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market23 hours ago

Market23 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

✓ Share: