Altcoin

Ethereum Needs A Leader—Or Its Future Could Be In Jeopardy, Ex-Engineer Warns

A former Ethereum Foundation engineer has raised concerns about the platform’s future, warning that a lack of clear leadership is slowing down critical development.

Harikrishnan Mulackal, who worked as a Solidity expert and compiler engineer, pointed out that Ethereum’s upgrade process has become sluggish, with only one major Ethereum Virtual Machine (EVM) change proposed in five years.

Lack Of Leadership Could Hurt The Network

According to Mulackal, Ethereum’s decentralized nature has led to delays in decision-making. He noted that while decentralization is a key strength, it has also made it difficult to push through necessary changes.

The only proposed EVM upgrade, transient storage, was almost scrapped at the last minute. He believes that without a more structured approach, the network could struggle to stay ahead of competitors.

This is why I left the Ethereum Foundation.

There is a lack of a clear and cohesive vision for Ethereum and EVM, making progress in EVM impossible.

I’ve seen EVM changes repeatedly shut down because they don’t check a certain box. The issue is that everyone has a different… https://t.co/TkAngYnycX

— Hari (@_hrkrshnn) March 14, 2025

Mulackal suggested that the network should prioritize execution over research, proposing a schedule of one hard fork per quarter to speed up improvements.

He argues that faster updates could help maintain the platform’s dominance in the blockchain space.

Internal Disagreements May Be A Bigger Problem

Mulackal’s concerns echo similar warnings from industry figures. Wintermute CEO Evgeny Gaevoy has previously said that leadership issues, not its technology, could be its downfall.

Gaevoy pointed out that there are contradictions within the organization’s leadership, with some pushing for market-driven incentives while others focus on social justice goals. This internal conflict, he warned, could lead to setbacks.

Vitalik Buterin, a co-founder of Ethereum, has admitted the difficulties and is apparently working on reordering the leadership of the Ethereum Foundation. Still up for contention, though, is whether these developments will support or undermine the network’s basic values.

Development Slows Down

Ethereum’s development speed has slowed even if it remains a major participant in the blockchain scene. Mulackal’s assertion that only one major EVM modification was suggested in five years begs issues about whether the network can keep up with ideas from competing blockchains.

Before “redesigning” Ethereum, developers have always stressed thorough research. Mulackal, however, feels that this cautious approach is currently dragging the platform back. Ethereum should, he contends, concentrate more on providing useful improvements than on spending years researching possible hazards.

Featured image from Equiti, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Bitcoin & Others Slip As Trump Imposes Up To 245% Tariff On China

Crypto Market Update: The digital assets continue to bleed as the US President Donald Trump slapped up to 245% tariff on Chinese goods. The intensifying trade war and macroeconomic concerns have continued to weigh on the investors’ sentiment, wiping off the previous gains from the digital assets space. Bitcoin price today slipped more than 2% while ETH, XRP, SOL, DOGE, and Cardano prices fell between 4% and 7%.

Crypto Market Update: Trump’s 245% Tariff On China Sparks Concerns

The crypto market slipped today after US President Donald Trump escalated the long-standing trade war with China by imposing a fresh 245% tariff on a wide range of imports. According to a White House document released in the late US hours on Tuesday, the move targets critical minerals and related products, citing national security and economic resilience as key reasons.

Meanwhile, the fact sheet stated that China now faces tariffs of up to 245% following its “retaliatory actions” and lack of cooperation. However, this is not the first volley in the tariff saga, as it continued to dampen the crypto market sentiment over the past few weeks.

Trump’s Tariff On China

For context, it began with a 20% levy, followed by a 34% hike on April 2nd. As tensions grew, Trump raised the rate again, reaching 104%. In response, China imposed an 84% tariff on the US goods.

Trump responded by increasing the US tariff to 125%. However, it has excluded certain tech products from China, which has boosted market sentiment. However, just last week, China matched that level, lifting its tariffs to 125%. The situation escalated dramatically this week with the 245% blanket tariff.

The White House cited the need to protect America’s defense sector, tech advancement, and infrastructure. As per Reuters, China exports over $400 billion worth of goods to the U.S. annually — far more than any other country. The impact of this aggressive move is now spilling over into the financial sector, including the crypto market.

How Crypto Prices Are Performing?

The global crypto market cap lost more than 2.3% from yesterday to $2.63 trillion while its one-day volume fell 6% to $73.89 billion. Besides, the fear and greed index showed a reading of 29, indicating a “Fear” momentum hovering in the market.

Notably, BTC price today fell nearly more than 2.5% to $83,368.76, while ETH price fell about 5% to $1,566. On the other hand, XRP price today was down nearly 4% to $2.04 and SOL price slipped more than 3% to $124.89.

Simultaneously, Cardano price today slipped nearly 7% to $0.6032. In the meme coins segment, DOGE price was down around 5% to $0.1528 and SHIB’s value lost around 3% to $0.00001160.

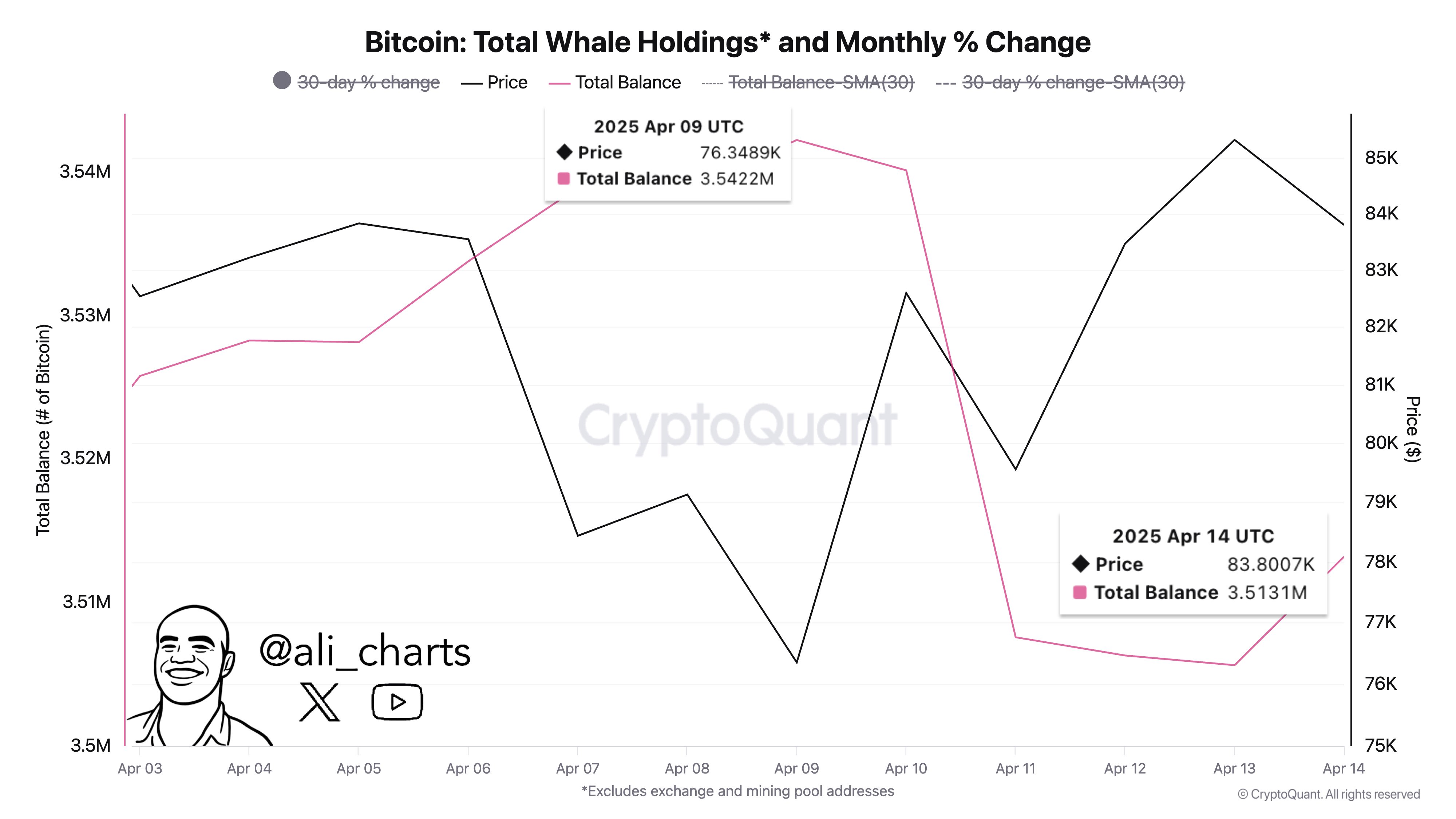

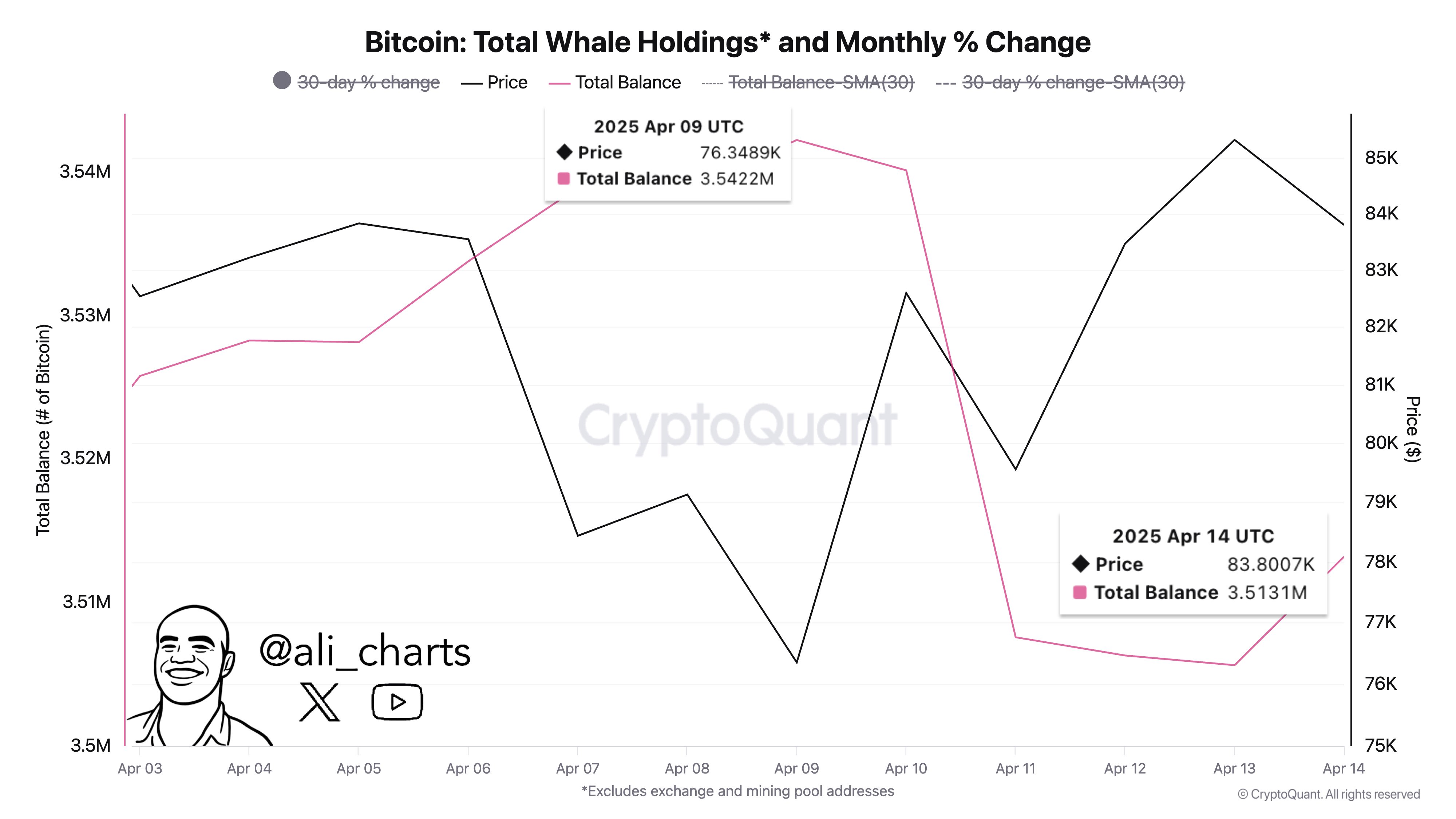

Bitcoin Whale Continues To Dump Amid Crypto Market Woes

The recent slump in BTC price also comes as Bitcoin whales appear to be losing confidence in the asset’s potential amid an intensifying trade war. Besides, speculations are also high that the whales are booking profit, reflecting a waning risk bet appetite of the investors. The US vs China tensions amid Trump’s tariff policies have weighed on the investors’ sentiment, causing a massive selloff in the market.

For context, renowned analyst Ali Martinez recently highlighted the selling trend. In a recent X post, Martinez said “Whales have been taking profits during the recent rally.” According to him, the whales have offloaded more than 29,000 BTC from April 9.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Current Status Of 9 Ripple ETFs

As the Ripple vs SEC lawsuit nears its conclusion, the anticipation surrounding XRP ETFs has reached a fever pitch. With multiple asset managers receiving green light from the US Securities and Exchange Commission (SEC), the community is eagerly awaiting the regulator’s approval.

Offering a closer examination of the XRP ETFs’ current status and their possible approval dates, expert All Things XRP shared a series of X posts. Let’s examine the expert’s views and the spot Ripple ETFs’ possible launch.

Expert Reveals Possible Dates for Spot XRP ETFs Approval

In a recent X post, All Things XRP, a Ripple expert, shared insights into the current status of all nine spot XRP ETFs. Top asset managers Bitwise, Canary Capital, and 21Shares have officially tossed their hats into the XRP ETF arena, with the US SEC acknowledging their applications.

While the XRP community is eagerly awaiting the SEC’s regulatory approval of the Ripple ETFs and their potential launch, All Things XRP revealed crucial dates. All nine XRP ETF applications have cleared the initial hurdle, receiving formal acknowledgment from the US SEC, and are now awaiting further review.

Bitwise, 21Shares, Grayscale & Canary To Receive Approval in May

According to All Things XRP, the ETF applications submitted by prominent asset managers like Bitwise, 21Shares, Grayscale, and Canary Capital are poised to receive approval in May 2025.

Bitwise

Reportedly, investment giant Bitwise applied for its spot XRP ETF on October 2, 2024 and received the SEC’s recognition on February 18, 2025. As cited by the expert, Bitwise is expected to gain regulatory approval for its ETF by May 18, 2025.

Canary Capital

Canary Capital’s XRP ETF application, filed on October 8, 2024, and acknowledged by the SEC on February 18, 2025, is pending approval, with an expected decision date of May 22, 2025.

21Shares

21Shares filed for a Ripple ETF on November 1, 2025. The firm received green light from the US SEC on February 14, 2025. As highlighted by the expert, 21Shares also expects a regulatory approval for its ETF by May 22, 2025.

Grayscale

Investment behemoth Grayscale, which filed to convert its XRP Trust into an exchange-traded fund on January 30, 2025, secured the SEC’s acknowledgement on February 14, 2025. The expert predicted that the SEC will legally approve the platform’s Ripple ETF by May 21, 2025.

Asset Managers Pushing for XRP ETF Approval in July-August

Furthermore, All Things XRP pointed out that asset managers like WisdomTree and CoinShares are expected to gain approval for Ripple ETF launch by August.

WisdomTree

Filed on December 2, 2024, WidsomTree’s XRP ETF received the SEC’s recognition on February 19, 2025. Reportedly, the asset manager will gain regulatory approval for its exchange-traded fund by July 2025.

CoinShares

CoinShares submitted its XRP ETF application on January 24, 2025. The SEC acknowledged the application on February 19, 2025. And now, the platform expects its ETF to be approved by the Commission by August 2025.

All 9 Will Be Approved By December, Says Expert

Moreover, the expert predicts that all nine ETFs will be approved in 2025. This development comes on the heels of increasing whale activity within the XRP community.

ProShares

ProShares filed and received recognition for its ETF on January 17 and March 3, respectively. Further, the ETF is expected to gain SEC’s approval by November 2025.

Volatility Shares

Volatility Shares applied to launch its XRP ETF on March 7, 2025. The SEC recognized it on March 24. The estimated approval date for the ETF falls by December 2025.

Franklin Templeton

Franklin Templeton filed to launch its Ripple ETF on March 11 and gained recognition on March 27. As per the expert insights, the platform is expected to gain regulatory approval for its ETF by December. Recently, NYSE Arca approved the listing and registration of Teucrium’s 2X Long Daily XRP ETF.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ripple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

In the latest development within the Ripple community, a whale moved $273 million worth of XRP, contributing to increased activity. If XRP continues to face rejection at the $2.17 mark, its price could drop to $1.90 due to the whale activity and unfavorable technical indicators.

Whale Transfers 131 Million XRP In A Single Transaction

A Ripple whale has created a buzz in the ecosystem following a hefty transfer of XRP between wallets, leaving investors scanning the horizon. According to data from Whale Alerts, the Ripple whale moved 131,000,000 XRP between two wallets in a single transaction.

The market value of the moved XRP stands at a staggering $273 million, stoking speculation for an incoming dump. Per the announcement, the wallets involved in the transfers are unknown as investors scan the horizons for clues about the heightened whale activity.

“131,000,000 XRP (273,945,648 USD) transferred from unknown wallet to unknown wallet,” read the Whale Alert post on X.

There is increased chatter that the wallets may belong to an exchange but details remain under wraps. In this scenario, the transfers are a primer for a massive sale that will adversely affect the XRP price. Typically, whale activity piques the interest of retail traders, stoking panic that leads to sell-offs even without the whale selling their XRP holdings.

Conversely, the whale activity may be an over-the-counter (OTC) transaction without any immediate impact on XRP price. However, investors have their eyes peeled on a chain reaction from other Ripple whales following the latest XRP transfers. A cascading effect is forming after a Ripple whale transferred $63 million in a single transaction barely 12 hours ago.

XRP Price Faces Stern Test At Resistance Level

Amid the rising whale activity in the ecosystem, XRP price faces an uphill climb in the push for higher figures. XRP price has previously attempted to breach the $2.17 mark but a streak of rejections have soured traders sentiments.

Cryptocurrency analyst CasiTrades notes that while $2.17 continues to operate as a ceiling, the XRP price will fall to a new support level. XRP is trading at $2.06 amid speculation that the XRP price has bottomed despite the rejection at the $2.17 level.

According to CasiTrades, XRP price is headed toward $1.90 but a steeper decline to $1.55 remains a grim possibility. CasiTrades predicts that prices will not remain stagnant at the new support levels, noting that the level will be “quickly bought up.”

“But if this rejection continues to play out, support at $1.90 and $1.555 remains firmly in play.

Over the last week, XRP price has gained 15% but whale activity has seen it lose 4% over 24 hours. The XRP ETF buzz and a potential SWIFT integration with Ripple could send XRP price beyond $3.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market23 hours ago

Market23 hours agoCan Pi Network Avoid a Similar Fate?

-

Altcoin18 hours ago

Altcoin18 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Delists This Crypto Causing 40% Price Crash, Here’s All

-

Market22 hours ago

Market22 hours agoEthereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

-

Market17 hours ago

Market17 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Bitcoin22 hours ago

Bitcoin22 hours agoBolivia Reverses Crypto-for-Fuel Plan Amid Energy Crisis

-

Market21 hours ago

Market21 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin

-

Market18 hours ago

Market18 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

✓ Share: