Altcoin

Dogecoin Price Hits Double Bottom To Trigger Massive Rally, Here’s The First Target

The Dogecoin price has experienced significant growth, maintaining a steady climb within a well-defined “Channel Up” pattern since December 2024. Recent technical indicators and price action suggest that Dogecoin may be getting ready for a major price rally. A crypto analyst has confirmed this bullish outlook, forecasting Dogecoin’s rise to its first target of $0.432.

Double Bottom Confirms Dogecoin Price Bullish Set-Up

‘TradingShot,’ a crypto analyst on TradingView, has forecasted a new bullish target for Dogecoin, expecting the meme coin to rally above the $0.4325 target. According to the market expert, the Dogecoin price has bounced off the higher lows trendline of its Channel Up pattern, forming a distinct Double Bottom pattern.

The analyst shared a price chart, highlighting that the meme coin was initially trading within the Channel Up pattern since it hit a price bottom on December 20, 2024. Typically, a double bottom pattern forms near the higher lows trendline, signaling a potential for upward reversals.

The TradingView analyst also revealed that a unique buy signal always emerges whenever the Dogecoin price makes a Double Bottom near the higher lows trendline of the pattern. Furthermore, each time this Double Bottom pattern occurs, the 4-hour Moving Average Convergence Divergence (MACD) displays two consecutive bullish crosses.

Previously, Dogecoin formed two Double Bottom and MACDs, triggering a significant price rally in both cases. At the time, the price of the meme coin skyrocketed to the 2.618 Fibonacci extension level, marking new highs. Based on this past trend, the analyst believes that the meme coin could experience a similar rally as its price action appears to repeat the same pattern for the third time.

The TradingView expert’s technical analysis also highlights the role of other moving averages, underscoring that the 4-hour MA50 acts as a crucial support area while the MA200 underscores a broader trend. Currently, the Dogecoin price is rebounding off the Double Bottom near the trend line, and the analyst projects a short-term rally toward $0.4325, aligning with the 2.618 Fibonacci extension level.

Historical Patterns To Trigger Price Rally Above $20

In another X post, crypto analyst Trader Tardigrade projected a massive price surge for Dogecoin in this bull market. The analyst has based his optimistic forecast on historical trends where DOGE experienced bull rallies after surpassing a previous “candle body high” in 2017 and 2021. At the time, the meme coin had jumped by over 3,000% and 8,000% respectively.

Drawing from historical trends, Trader Tardigrade predicts that if Dogecoin follows a similar trend pattern, its price could rally to $8.32 before skyrocketing to an ultimate target of $20.68. As of writing, the price of DOGE is trading at $0.34 after declining by over 12% in the past week. A surge to the analyst’s projected targets would require the meme coin to rally by 2,347% and 5,982%, respectively.

Featured image from Unsplash, chart from Tradingview.com

Altcoin

Expert Predicts Pi Network To Reach $5 As Whales Move 41M Pi Coins Off Exchanges

Crypto expert PiMigrate recently predicted that the Pi Network price could reach a new all-time high (ATH) of $5. This comes amid recent whale movements, with these investors moving 41 million Pi Coins off exchanges.

Expert Predicts Pi Network To Reach $5

In an X post, PiMigrate stated that Pi Network’s journey to $5 has just begun. He remarked that the altcoin has very strong support at $0.6. As such, the expert believes that this $5 price target is a “very possible valuation.” PiMigrate added that good utilities will push the altcoin to this target.

Another expert, Moon Jeff, also predicted that the Pi Coin price can reach this $5 target. In an X post, the expert concluded that the altcoin can reach this price target following his analysis.

He alluded to his accompanying chart, which he described as being bullish, indicating that the Pi Network price can indeed reach this $5 target. The chart also showed that the altcoin has formed a strong support level at its current price.

Crypto analyst Xia also recently claimed that the Pi Coin’s momentum is building fast after it surged past the $0.63 mark with strong volume. She also noted that the RSI and MACD are turning bullish for the altcoin.

This bullish outlook for the Pi Coin comes amid recent huge whale accumulation. A Pi community page revealed that these investors moved a whopping 41 million coins (around $27 million) off exchanges in 48 hours. Specifically, these whales moved over 13 million Pi Coins from OKX to several wallets. This presents a bullish outlook for the coin since exchange supply is declining.

Pi Needs To Reclaim This Symmetrical Triangle

While analyzing the Pi Network’s price on the higher timeframe, analyst Alpha Crypto stated that the altcoin needs to reclaim its symmetrical triangle to resume its upward move.

The analyst remarked that once Pi reclaims this structure, market participants can look for a potential long setup. He added that on the flipside, if the price falls outside the triangle, it could open up a short opportunity. Alpha Crypto urged traders to wait for confirmation rather than rushing.

From a fundamentals perspective, top exchange listings could send the Pi Coin price higher. CoinGape recently reported that top exchange HTX had fueled listing speculations with a cryptic post on its X platform. Meanwhile, Pi community members remain hopeful that Binance will soon list the altcoin.

These community members will have their eyes on the Consensus 2025 conference, where Pi Network founder Nicolas Kokkalis will allegedly join an exclusive list of industry players to speak at the event.

Expert Dr. Altcoin described the event as a pivotal moment for Pi Network, as it will provide an opportunity for the Pi team to promote the network’s ecosystem.

At the time of writing, the Pi Coin price is trading at around $0.63, down almost 3% in the last 24 hours. Trading volume is also down over 36%, with $96.34 million traded during this period.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Traders Go Big On Dogecoin—Majority Holding Long Positions

Dogecoin investors have high faith in the future of the meme currency despite its recent price fall, market data showed, Tuesday.

Dogecoin fell to $0.153 as of April 16 after its price reached a high of $0.168 on April 13, down by 3% in the last 24 hours. This is after the recent price hike following US President Trump’s tariff halt declaration on certain countries on April 10.

Long Positions Dominate Market Activity

The mood among traders on Binance is firmly bullish for the future prospects of Dogecoin. Data from Coinglass show that over 74% of trading accounts have long positions in the cryptocurrency, while only 25% going short. This places the long-to-short account ratio at 2.90, proving widespread optimism among traders.

Long positions increased quickly on April 12, which shows that investors expect Dogecoin to bounce back from its present correction period. They are willing to pay premiums to maintain their positions, as evidenced by positive OI-weighted funding rate signals that have remained above zero since April 7.

Long|Short DOGE by accounts. Source: Coinglass

Holder Patterns Indicate Diversified Strategies

IntoTheBlock statistics reveal substantial shifts in the manner by which people are holding Dogecoin. Investors holding DOGE for over a year increased by marginally 0.13%. These types of “hodlers” as they are called within cryptocurrency forums constitute a solid support base for the currency.

Source: IntoTheBlock

In the meantime, mid-term holders (holders of DOGE for one to 12 months) decreased by 2.50%. Short-term traders experienced the largest increase, with addresses holding for less than 30 days rising by 109%. This new trader surge reflects increasing demand for quick profit from Dogecoin price action.

Technical Analysis Points To Future Price Directions

One TradingView account, FuaCompany, has plotted Dogecoin’s movement in what analysts call a rising channel. On the basis of this trend, two general scenarios for Dogecoin’s future price are on offer.

The first scenario shows Dogecoin rebounding from the lower edge of this channel and continuing to trend upwards. This would comply with what occurred before when the price rebounded back from $0.05 to higher levels.

The second scenario entails a temporary drop below the bottom line of the channel, plunging to around $0.08 before surging higher, both scenarios ultimately carrying long term bullish signals, with some projections estimating Dogecoin to even reach $0.70.

Weekly Performance Still Positive Despite Slump

Despite the recent slump, Dogecoin is still positive overall on the week. In fact, the cryptocurrency has shown quite a hefty rise-on-week for about 7.40% during the past week in spite of that dip.

DOGE price up in the last week. Source: CoinMarketCap

The price started off in early April with an initial volatility before strengthening with the Presidential Tariff declaration by Trump. Following the monthly peak on April 13, reaching 0.168, Dogecoin encountered what traders know to be a consolidation phase, where prices continue to trend sideways while forming in preparation for another move.

According to market observers, this pattern of gains and then consolidation is typical in cryptocurrency markets. The strong level of long positions shows most traders view the current price drop as just a temporary hiccup and not the start of a larger bearish trend.

Featured image from CoinFlip, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

XRP Leads Crypto Shopping List For Latin America Ahead Of ETH, SOL—Report

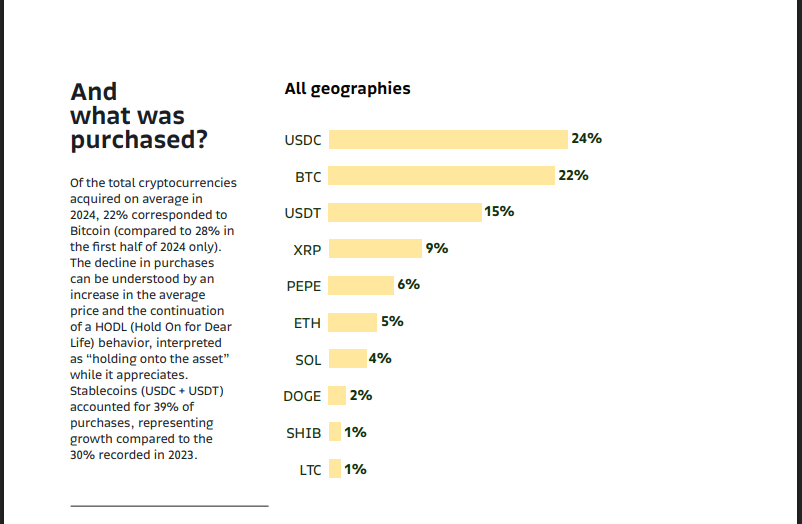

New statistics released by crypto platform Bitso shows that XRP, as a payment option, is gaining traction with Latin American consumers. XRP currently accounts for 9% of all purchases on the platform and is gaining on much older crypto options like Ethereum and Solana. This marks a huge turnaround from 2023 when the token barely registered in an average customer portfolio in Latin America.

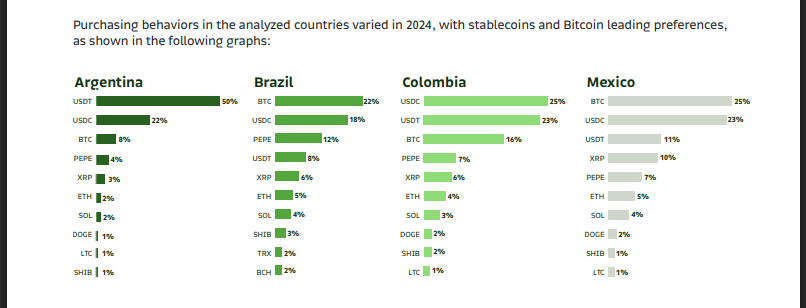

Mexican Users Drive XRP Adoption Throughout The Region

Interest in XRP among the Latin American nations was propelled by Mexican cryptocurrency traders. In Bitso’s report, Mexican users applied 10% of all cryptocurrency buying activity towards stocking up on XRP. This pattern occurred as total platform activity slowed, but XRP buying increased significantly against other cryptocurrencies.

Mexican popularity of XRP is noteworthy because Bitso processed substantial volumes of cross-border payments there. According to their reported volumes, Ripple processed $3.3 billion in remittances through their channel with Bitso in 2022 from the United States into Mexico.

Source: Bitso

Portfolio Composition Reflects Drastic Spike In XRP Holdings

In such a context, the report by Bitso brings out the most impressive discovery: the pace with which XRP came to the portfolios of Latin American cryptos. As of 2023, XRP was non-existent in the typical portfolio composition of Latin American Bitso clients. In 2024, that number had risen to 13%, reflecting a seismic change in local investment patterns.

Source: Bitso

This rapid adoption means portfolios of users in the region now include a significant XRP component, despite the token not registering in portfolio stats just a year earlier. The change signals growing confidence in XRP among Latin American cryptocurrency investors.

Bitcoin And Stablecoins Still Dominate Trading Activity

Though XRP demonstrated impressive growth, Bitcoin and stablecoins are still the leading options among Latin American crypto users. Based on the Bitso report, Bitcoin represented 22% of the total purchases on the platform in 2024, a decrease from nearly 30% during the first half of the year.

Stablecoins led all cryptocurrency categories with almost 40% of purchases attributed to these dollar-pegged cryptocurrencies. Stablecoin appeal is probably due to their application as a local currency inflation hedge and entry point for other crypto investments.

Political Changes And Price Performance Drive Interest

XRP’s 230% price appreciation in 2024 – its best since 2021 – also likely helped to make it so popular. The majority of the rally, as per the report, occurred in the fourth quarter of the year.

The hope for XRP seems linked to US political events. The report indicates Donald Trump’s presidential win and SEC Chair Gary Gensler’s resignation spurred new interest in XRP. These triggered expectations of possible regulatory clarity that could favor XRP and its parent company Ripple, which has faced legal battles with US regulators.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Altcoin20 hours ago

Altcoin20 hours agoUniswap Founder Urges Ethereum To Pursue Layer 2 Scaling To Compete With Solana

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Consolidates In Symmetrical Triangle: Expert Predicts 17% Price Move

-

Altcoin19 hours ago

Altcoin19 hours agoWhat’s Up With BTC, XRP, ETH?

-

Market16 hours ago

Market16 hours agoToday’s $1K XRP Bag May Become Tomorrow’s Jackpot, Crypto Founder Says

-

Bitcoin23 hours ago

Bitcoin23 hours agoAnalyst Says Bitcoin Price Might Be Gearing Up For Next Big Move — What To Know

-

Market10 hours ago

Market10 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Accumulators At A Crucial Moment: ETH Realized Price Tests Make-Or-Break Point

-

Altcoin23 hours ago

Altcoin23 hours agoExpert Reveals Why Consensus 2025 Will Be Pivotal For Pi Network

✓ Share: