Altcoin

Crypto Analyst Begins Countdown To Altcoin Season Of 2025, You Won’t Believe How Close It Is

Many crypto analysts and investors are still eagerly anticipating the arrival of a full-blown altcoin season in this market cycle. While some surges have been observed in individual altcoins like Solana and XRP, the broader alt market has yet to see the kind of explosive rally that characterizes an official altcoin season.

This delay is largely attributed to Bitcoin’s continued dominance, which has remained strong despite periodic pullbacks. However, one analyst has now begun the countdown, predicting that the long-awaited altseason is just days away.

Crypto Analyst Predicts Altcoin Season Will Begin In Just Three Days

Bitcoin dominance is still near cycle highs and the market has yet to confirm a definitive shift, but technical analysis suggest that altcoins may soon gain momentum. According to the Bitcoin Dominance Chart from Coinmarketcap, Bitcoin’s dominance is currently at 60.2%, having recently reached a multi-year high of 61% on February 8.

However, according to a crypto analyst known pseudonymously as Pepa (@moonshilla) on social media X, the next official altcoin season is about to kick off within the next three days. Taking to the social media platform to start the countdown, the analyst noted that alts have three days and seven hours before lift-off.

The post was accompanied by a chart of the total altcoin market cap against Bitcoin (OTHERS/BTC), showing that the price action recently touched the lower trendline of a multiyear ascending channel. This trendline has historically been a key inflection point, with a bounce from here preceding the last two altseasons in previous cycles. If the pattern holds, a strong reversal to the upside could be in play for the altcoin market cap.

Historical Patterns Suggest February 14 Could Be The Start

Backing up the prediction, Pepa pointed to historical trends in previous market cycles. In an earlier post, the analyst laid out a timeline of past altcoin seasons, noting that major alt surges have occurred in the year after Bitcoin’s halving event.

According to this data, the first altcoin season began on February 14, 2017, following the 2016 Bitcoin halving. The second alteason kicked off on January 1, 2021, after the 2020 halving. Now, the next projected start date for altcoin season is February 14, 2025, and we could see a potential repeat of the 2017 cycle. Interestingly, this observation is based on a 44-day chart, with the next 44-day candle set to open in just five days.

Despite the analyst’s countdown, alteason cannot truly materialize until Bitcoin dominance begins to weaken. Currently, Bitcoin dominance sits near multi-year highs, meaning that BTC continues to attract most of the capital inflows as it looks to break above $100,000 again.

Additionally, Ethereum’s performance relative to Bitcoin has historically been a precursor to broader altcoin rallies. If ETH/BTC shows strength, it could confirm that the market is shifting in favor of alts. At the time of writing, Ethereum is testing a key support on the ETH/BTC price chart. A bounce from here could be the first step in a new altseason.

Featured image from Adobe Stock, chart from Tradingview.com

Altcoin

Crypto Whales Bag $20M In AAVE & UNI, Are DeFi Tokens Eyeing Price Rally?

Recent crypto whale metrics surrounding DeFi tokens have garnered immense investor optimism, suggesting that price gains for some coins are imminent despite the ongoing market uncertainty. Whale data on Thursday, April 17, indicated that large-scale investors stacked over $20 million in AAVE and UNI. These accumulations have ignited a bullish market torrent, underscoring buying pressure on the assets despite the broader market slump.

Crypto Whales Stack $20M In DeFi Coins Igniting Optimism

According to the data from Spot On Chain, crypto whales are quietly accumulating DeFi tokens via OTC. As per the data, two fresh wallets recently scooped up a total of $20.11 million worth of the abovementioned tokens.

The wallet address “0x3bb..” bought $4.28 million worth of UNI from Cumberland. Further, the same wallet and the address “0x4f7..” collectively bagged $15.83 million worth of AAVE from the same OTC exchange. These massive accumulations have suggested that price gains lie ahead for the DeFi cryptos.

For context, usual market sentiments remain highly bullish in the wake of such whale accumulations, signaling market confidence and buying pressure on an asset. So, traders and investors anticipate price gains in these DeFi tokens shortly.

How Are The Coins Performing Today?

AAVE price was up by roughly 3.5% at the time of reporting, exchanging hands at $138.81. The DeFi token gained after hitting a bottom of $130.43 over the past day. Notably, this rising action potentially aligns with broader trends and the crypto whales’ significant buying.

Also, Coingape has reported that the token’s community proposed a major AAVE buyback plan and liquidity upgrade the previous month. This upgrade aims to uplift the coin’s market and price dynamics. The whale accumulation, in turn, falls in line with this development.

On the other hand, UNI price was up by roughly 2.5% and traded at $5.27. The DeFi crypto hit a low of $5.05 over the past day.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Hurdles For Ripple And The SEC Ahead Of Final Resolution

While the XRP lawsuit is reaching its closing stages, there are a few loose ends that parties are racing to tie up. Digital assets lawyer James Farrell notes that Ripple Labs will pursue an indicative ruling to ease its future IPO proceedings. However, internal processes at the Securities and Exchange Commission (SEC) may see the loose ends become a knotty issue for Ripple Labs.

Ripple Is Chasing An SEC Settlement And An Indicative Ruling

According to crypto lawyer James Farrell, Ripple and the US SEC have to sidestep a raft of hurdles to reach the final resolution in the XRP lawsuit. Farrell revealed via an X post that Ripple Labs is pursuing a settlement with the SEC while having its sights on an indicative ruling from Judge Torres.

Parties are taking a breather from legal proceedings after the US Court of Appeals granted a joint motion to suspend appeals. As parties sheath their swords and head to the negotiating table, Farrell says Ripple is tipped to table a settlement offer.

Furthermore, Ripple is expected to ask the District Court to issue an indicative ruling, seeking for Judge Torres to modify her judgment. Per Farrell, Ripple wants a modification to allow it to carry out private sales of XRP ahead of a Ripple IPO launch date.

“Why do they want it? Because without it, the possibility of an IPO in the next 3+ years is basically zero,” said Farrell. “So while the cool kids are going public, Ripple practically cannot.”

A Complicated Administrative Process In The XRP Lawsuit

According to the legal expert, the process will involve Ripple submitting a settlement offer and a request for an indicative ruling. Farrell notes that Ripple’s legal team can submit both requests to the SEC jointly or separately.

He notes that the settlement is a low-hanging fruit for Ripple, but the indicative ruling may be a knotty issue for parties in the XRP lawsuit. If the SEC assents to the settlement, Ripple will still have to file a motion before Judge Torres, with the expert forecasting a six-month time frame.

After her decision, parties may head to the appellate court as the appeal is still subsisting, and file a voluntary dismissal. Farrell predicts the process at the appellate court to last for one month.

If Judge Torres denies the motion to modify the injunction, Farrell notes that the parties will head back to the Appeal Court with the argument on appeal potentially extending to January 2027.

Following the pause in legal proceedings in the XRP lawsuit, an analysis tips $2 as the XRP price floor for a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

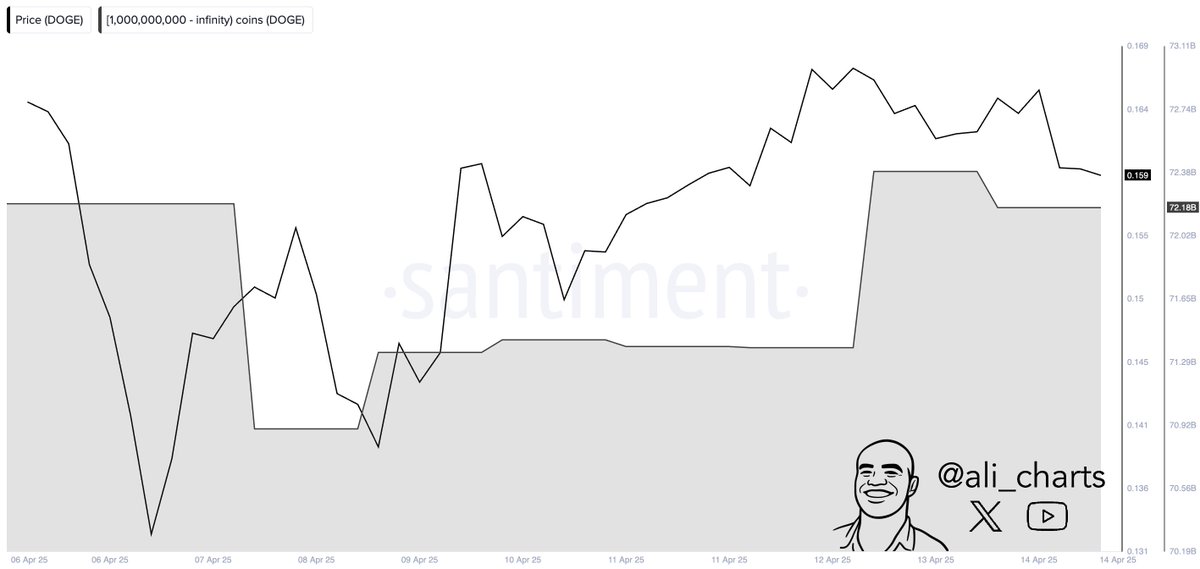

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin18 hours ago

Altcoin18 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Market22 hours ago

Market22 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Bitcoin24 hours ago

Bitcoin24 hours agoChina Liquidates Seized Crypto to Boost Struggling Treasury

-

Altcoin23 hours ago

Altcoin23 hours agoBitcoin & Others Slip As Trump Imposes Up To 245% Tariff On China

-

Market20 hours ago

Market20 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market18 hours ago

Market18 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

-

Market17 hours ago

Market17 hours agoAre TRUMP Meme Coin Investors Selling Before Friday’s Unlock?

✓ Share: