Altcoin

CoinMarketCap’s Altcoin Season Index Hits Record Low

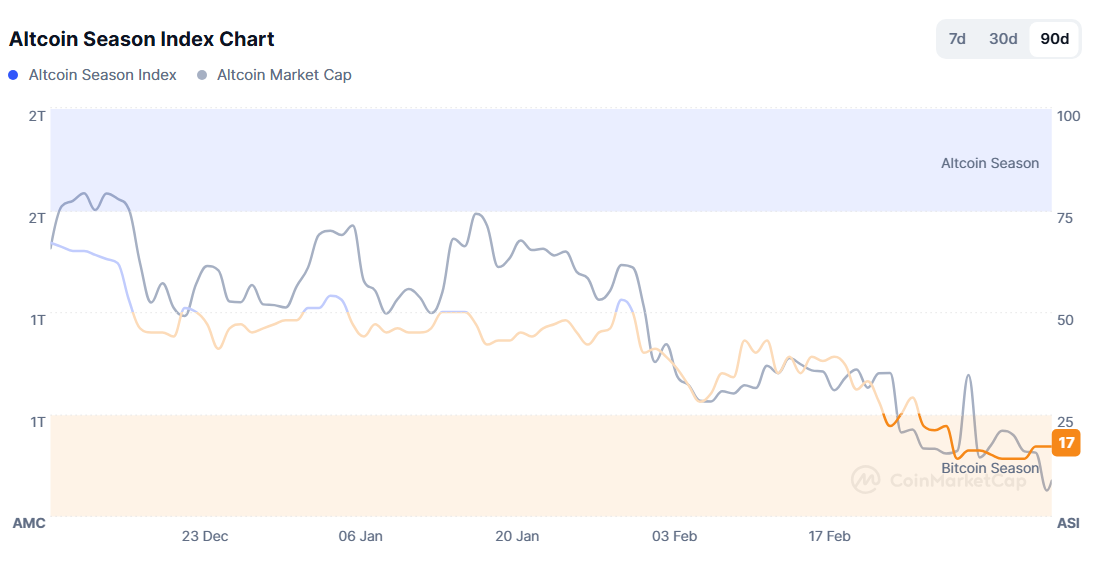

The Altcoin Season Index by CoinMarketCap (CMC) has fallen to its lowest level since its inception. The number of altcoins delivering better performance than Bitcoin has significantly declined.

Altcoin market capitalization (TOTAL2) has plummeted by 38% from its all-time high (ATH), with $600 billion exiting the market. Despite this, many analysts remain optimistic.

Only 17 Altcoins Outperformed BTC in the Last 90 Days

CMC’s Altcoin Season Index provides real-time insights into whether the crypto market is currently in an Altcoin Season. The index is based on the performance of the top 100 altcoins relative to Bitcoin over the past 90 days.

The index stands at 17 at the time of writing. This means that only 17 altcoins have outperformed Bitcoin in the last three months.

Meanwhile, CZ—the former CEO of Binance, the exchange that owns CMC—has suggested that an index level of 50 or higher is a positive sign.

“I think this is a tough ranking system. 50 is probably a really good score,” CZ commented.

Therefore, a level of 17 is alarming. It is also the lowest point since the index was introduced.

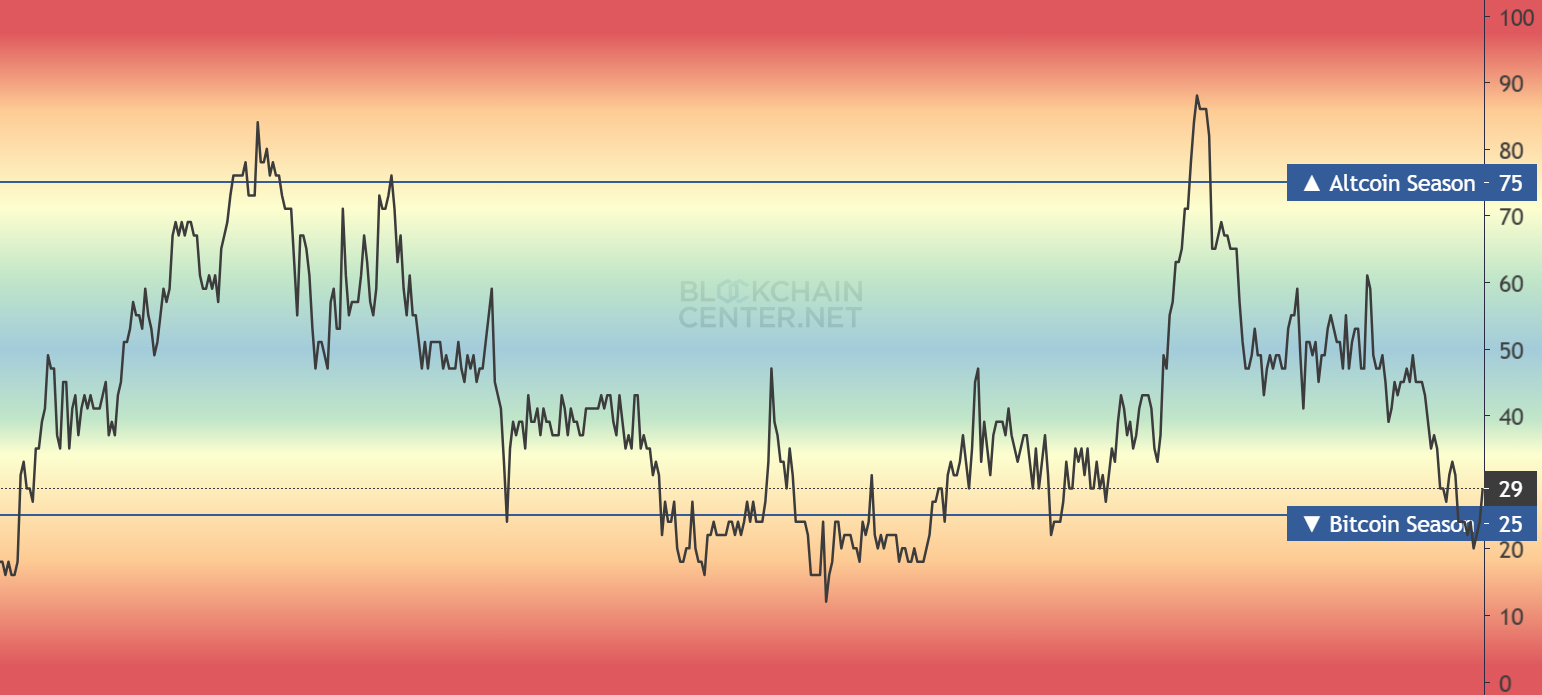

A separate Altcoin Season Index by Blockchain Center currently stands at 29. This index assumes that if 75% of the top 50 coins outperform Bitcoin in the last 90 days, it is considered an Altcoin Season. On March 7, the index even dropped to 10—the lowest level since October 2024.

These declining indices align with a significant drop in altcoin market capitalization. The total altcoin market cap has fallen by 38%, from its ATH of $1.64 trillion to around $1 trillion.

Analysts Remain Optimistic Despite the Sharp Decline

However, market analyst Master of Crypto, who has been active since 2016, believes that this downturn signals a promising future.

“The Altcoin Season Index has fallen to its lowest since October 2024. Interestingly, the last time the index was this low, altcoins staged an impressive rally. While each dip may worry new investors, those who hold on usually see significant returns,” Master of Crypto predicted.

Bitcoin investor Coinvo, active since 2017, also believes that current market volatility is not concerning but rather a repetition of previous cycles.

Coinvo observes that altcoin market capitalization expansions in 2017 and 2021 could repeat in 2025. According to Coinvo’s chart, the altcoin market cap could surge to $5 trillion in 2025—more than triple its current level.

Additionally, Ki Young Ju, CEO of CryptoQuant, offers a redefined perspective on Altcoin Season. He argues that the old Altcoin Season theory no longer applies. Instead, the new Altcoin Season will primarily direct capital into stablecoins or widely accepted altcoins rather than smaller, speculative tokens.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Expert Defends $280 XRP Price Prediction, Updates Target To $333

Crypto expert Dark Defender maintained his ultra bullish stance that the XRP price could rally to as high as $280 at some point. Interestingly, the expert has even updated his XRP price prediction, stating that the crypto could reach $333.

Expert Defends $280 XRP Price Prediction

Dark Defender has defended his $280 XRP price prediction following criticisms from the crypto community. In an X post, the expert reacted to a post by another crypto expert who seemed to mock the prediction. He stated that the pattern is close to $280 but added that the precise Fibonacci level sits at $333, indicating that XRP could reach this price level.

As CoinGape reported, Dark Defender had laid out a bullish XRP analysis yesterday, suggesting that the crypto could replicate its 2017 bull run performance again. His accompanying chart showed that the coin could reach as high as $280. However, based on his recent statement, XRP could surpass this price target and reach $333.

One of the major criticisms regarding this XRP price prediction is the market cap, which the crypto would have to attain to reach this price target. For context, based on the crypto’s current circulating supply, XRP’s market cap would sit around $1.6 trillion if its price reaches $280.

However, the expert suggested that the total market cap doesn’t matter in this regard. According to him, the total market cap doesn’t mean that much amount of money poured into the asset. He gave an example and then remarked that market cap in crypto is an illusion.

An Insight Into The Current Price Action

Amid this development, crypto analyst CrediBULL Crypto has provided insights into the current XRP price action. The analyst noted that the crypto has witnessed a pullback from range highs back to prior flipped resistance levels, which should now act as support.

He remarked that holding these levels as support would be incredibly bullish. However, if XRP loses this support zone, the analyst remarked that it is almost certain that the crypto will drop below $2 again, which he claimed would make for an “epic buy opportunity.”

CrediBULL Crypto stated that it is a win-win situation regardless of what happens as far market participants stay patient and play the current price action correctly.

As to what they could do correctly, the analyst advised market participants to do nothing as long as XRP holds this support zone and rise their spot bags to higher highs. If the XRP price drops below $2, he advised that they should look for potential long opportunities and spot buys below $2, starting at $1.80.

Based on a CooinGape market analysis, XRP could soon rebound after the number of addresses and transaction count surged. Santiment data showed that weekly active addresses have surged to a record high above 1.15 million.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Continues To Outpace Bitcoin in Weekly Inflows: Key Takeaways

Despite the prevailing bearish market trends, XRP continues to outpace Bitcoin in weekly inflows. While digital asset investment products saw significant outflows in the fourth consecutive week, XRP marks remarkable gains.

XRP has surpassed not only Bitcoin but also Ethereum, signaling a shift in market sentiment. Let’s dive into the evolving market trends and explore how XRP is outpacing the top cryptocurrencies.

XRP Secures Inflows, Flips Bitcoin and Ethereum

XRP defied broader market trends, drawing significant investor interest with a notable inflow of $5.6 million. This substantial investment, as per CoinShares’ weekly data, underscores XRP’s growing appeal in the market.

Notably, digital asset investment products have witnessed a streak of significant outflows, with the current week marking the fourth consecutive week of substantial withdrawals. Over the past week, these products recorded an outflow of $876 million, taking the total net outflow to $4.75 billion.

Significantly, Bitcoin was the biggest loser in terms of weekly outflows. Bitcoin experienced significant outflows of $756 million last week. Meanwhile, short-Bitcoin investments also saw outflows of $19.8 million, indicating that investors may be nearing a state of capitulation. Ethereum followed Bitcoin with an outflow of $89.2 million. Cardano was also one of the losers with an outflow of $1.9 million.

Interestingly, Solana became the top gainer with a weekly inflow of $16.4 million. Closely following was XRP, which saw inflows of $5.6 million. Sui also gained attention with more than $2 million in weekly inflows.

What Drives XRP’s Positive Market Sentiment?

In recent weeks, XRP has garnered significant investor support, fueled by several key developments. These developments include the Securities and Exchange Commission’s (SEC) XRP ETF acknowledgements, Rpple lawsuit updates, and Donald Trump’s crypto reserve plans.

The SEC’s recognition of multiple asset managers’ XRP ETFs has invoked a positive sentiment across the community. In addition, increasing anticipations surrounding the Ripple lawsuit settlement have significantly contributed to the positive sentiment surrounding the token.

Triggered by President Donald Trump’s crypto reserve proposal that includes Bitcoin, XRP, SOL, and ADA as the country’s reserve assets, the Ripple coin gained notable attention. XRP’s significant inflows over the past week highlights its increasing investor demand and adoption.

Crypto Market Crash: How Top Cryptocurrencies Perform?

Today, the crypto market has seen a severe downturn, with top cryptocurrencies recording notable dips. Bitcoin is trading below $83k, marking a decline of 10% over the last week. Ethereum experienced a 10.61% plummet over the week, currently trading at $2,123.

Meanwhile, XRP is exchanging hands at $2.20, with a massive decrease of 17% over the last seven days. Though the Ripple coin hit a monthly high of $2.9 recently, the current crypto market crash pushed the price down.

During the period that saw key developments, XRP bucked the market trend, attracting investors even as top assets suffered massive outflows. Previously, when Bitcoin and Ethereum saw severe withdrawals of $2.59 billion and $300 million, respectively, XRP secured notable gains of $5 million.

Now, despite the downtrend, the token is showcasing remarkable investor sentiment with the 121.9% hike in the daily trading volume, at $7.69 billion. It needs to be seen if Ripple’s token will continue to attract investors on a similar pace. Traders remain keen to know how the token price will be impacted with the potential developments in the XRP ETF and Ripple lawsuit.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here’s Why BTC, ETH, XRP & Others Face $630M Liquidation

President Donald Trump’s highly anticipated crypto reserve announcement and the White House Crypto Summit have fallen flat, failing to ignite a crypto market rally. The global crypto space is currently navigating a bearish period with the total market cap slipping to $2.73 trillion, down by 3.09%. This week begins by witnessing a steep crypto market crash, with top cryptocurrencies facing $685 million liquidation.

What Drives the Current Crypto Market Crash?

According to Matrixport, the perpetual futures funding rates remain low, with the crypto market failing to attract significant gains despite the much-anticipated Bitcoin reserve adoption and the White House Crypto Summit. The current market sentiment reveals a notable absence of enthusiasm from retail investors, marking a stark contrast to the heightened funding rates observed in April and December 2024.

Despite high expectations, Trump’s executive order on the Bitcoin reserve failed to invoke a significant rally in Bitcoin’s price. The highly anticipated crypto summit also concluded without making any significant waves in the crypto market. Instead, these moves preceded a crypto market crash, with top cryptocurrencies falling severely.

$685M Liquidated: Crypto Market Crash Intensifies

Notably, the crypto market has begun the week on a bleak note, with a huge wave of liquidations totaling $685 million in the past 24 hours. This massive sell-off was primarily triggered by Bitcoin’s plummet below $80k. This rapid sell-off intensified the crypto market crash, creating a ripple effect throughout the cryptocurrency ecosystem.

Significantly, Bitcoin was leading the liquidation frenzy, with a staggering $270.75 million in positions being wiped out. According to CryptoQuant data, Bitcoin’s long liquidations skyrocketed to 14,714 yesterday, marking a significant spike in forced sell-offs.

In addition to Bitcoin, other major cryptocurrencies also suffered significant losses. Ethereum (ETH) saw$123.55 million in positions wiped out over the past 24 hours. Meanwhile, XRP and Solana (SOL) also experienced substantial liquidations, with $32.31 million and $28.79 million in positions respectively being forced to close.

Whales Suffer the Market Correction

A whale, holding 65,675 ETH (worth $135.8 million) on Maker, is at risk of liquidation due to the crypto market crash. In addition, Donald Trump’s World Liberty Financial suffered a significant loss of a $110 million. In addition, Donald Trump’s personal crypto portfolio has taken a significant hit, with its value plummeting by 13%.

While many whales are struggling in the current crypto market downturn, one savvy trader has defied the trend. According to Lookonchain data, this whale has successfully shorted Bitcoin multiple times during recent price drops. This helped them gain an impressive unrealized profit of over $7.5 million. The trader’s strategy remains aggressive, with new short positions set between $92,449 and $92,636. They’ve also placed limit orders to take profits between $70,475 and $74,192, indicating a potential exit strategy.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market22 hours ago

Market22 hours agoShiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

-

Market23 hours ago

Market23 hours agoSafeMoon (SFM) Selling Pressure Threatens Previous Gains

-

Altcoin21 hours ago

Altcoin21 hours agoPro XRP Lawyer Outlines Reasons To Accumulate Despite Crypto Market Crash

-

Market20 hours ago

Market20 hours ago5 Token Unlocks to Watch for the Second Week of March

-

Altcoin19 hours ago

Altcoin19 hours agoDogecoin Price Eyes Explosive Rally To $2.74 If Support Holds At $0.17

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Founder Criticizes ‘Degens’, Advocates Support For Credible Projects

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Liquidation Heatmap Signals Potential Bitcoin Price Swings – What’s Next

-

Market11 hours ago

Market11 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays

✓ Share: