Altcoin

Coinbase Urges Fewer Crypto Banking Restrictions

More bullish news for crypto investors — Coinbase seizes on Trump’s pro-crypto stance and goes gloves-off against unfair crypto regulations. One crypto presale, Solaxy, which plans to upscale the Solana ecosystem, has seen major momentum following this news.

On Tuesday, executives from the Coinbase exchange sent out a letter urging the OCC, Federal Reserve, and FDIC for reforms to allow crypto in traditional banking.

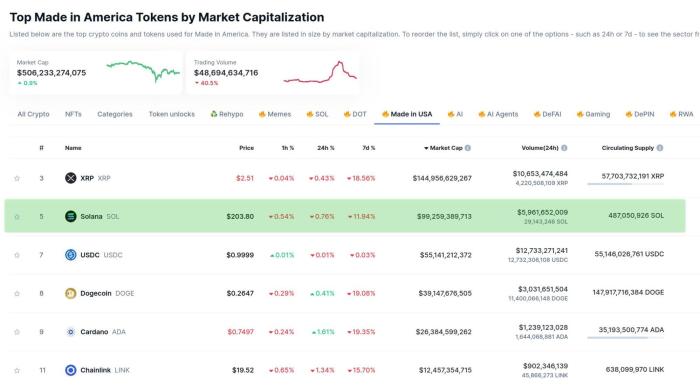

In this context, investors are already eyeing US-made cryptos like Solana, with the potential for $SOL ETFs only further advancing the need for crypto C&E services in the future. This surge in interest in Solana has also translated into a boon for the Solaxy presale.

Coinbase Calls for Crypto Banking Services in the US

On Tuesday, US-based crypto exchange Coinbase sent out a letter urging federal banking regulators — the OCC, FDIC, and the Federal Reserve — to establish clear, consistent, and fair rulings and allow banks to offer custody and execution (C&E) services.

According to Coinbase, C&E providers have been blocked from partnering with banks because of inconsistent and vague guidelines. This legal hurdle stifled innovation and crypto adoption, but a regulatory overhaul could finally bridge the gap between crypto and traditional financial services in the US.

If this request is met, it would make crypto more accessible to everyday users and boost liquidity in the crypto market. Considering Trump’s pro-crypto leadership, Coinbase’s plea couldn’t be more perfectly timed.

The President’s appointment of David Sacks as the White House ‘AI and Crypto Czar,’ and the change in SEC leadership are just two more telling signs of a positive shift in the US crypto market. Moreover, the potential introduction of Made-in-USA crypto ETFs could further speed up this process.

With $SOL being the second-largest US cryptocurrency by market cap, Solana-focused project, Solaxy, is positioned for growth in 2025 and beyond.

That’s because, as crypto adoption booms, Solaxy’s Layer-2 Solana chain could provide the perfect platform for high-volume use cases like bundled transactions and DeFi services.

Solaxy to Turbo-Charge the US’s Solana Blockchain

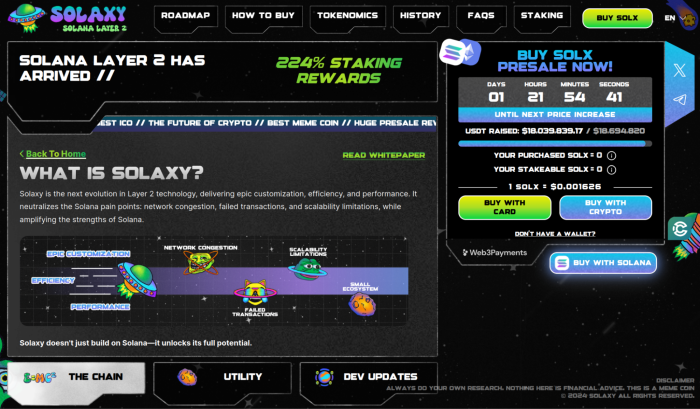

Solaxy ($SOL) is a new cryptocurrency project based on Ethereum that aims to tap into that blockchain’s liquidity to build a Solana Layer 2. The establishment of the Solaxy blockchain will ensure speedy transactions and low slippage, but without Ethereum’s hefty gas fees.

According to the project’s whitepaper, this L2 will supercharge trading on Solana, solving the main blockchain’s pain points like network congestion, downtimes, failed transactions, and scalability limitations.

This will all be made possible thanks to Solaxy’s off-chain transaction processing, which allows for better performance and easier scalability for high-volume use cases. These could include anything from ordinary crypto trading to DApps deployment, DeFi services, and other Web3 applications.

It’s this versatility and the fact that Solaxy bridges two of the major blockchains that give the project great future gains potential, and the market seems to agree.

The project is still in presale, with the token and blockchain coming after the initial coin offering ends. However, $SOLX now sells for $0.001626, a 62% price increase since the presale launched in late 2024.

Investors have already poured in over $18M into the project, pushing Solaxy nearly halfway to its fundraising goal in record time. And the presale momentum is only picking up, with one whale recently picking up as much as $49K worth of $SOLX.

The project is also gaining traction on social media, with a combined following of over 70k followers on X and Telegram.

If you’re looking for a hot new utility token, now’s the time to buy Solaxy and secure a 224% staking reward.

2025 Looks Promising for Solana & US Crypto Projects

President Trump’s pro-crypto approach has emboldened crypto service providers to push for regulatory changes, with Coinbase being the most recent appellant. In this context, made-in-the-USA cryptos and upcoming utility projects like Solaxy could enjoy huge potential gains.

Our $SOLX price predictions suggest the project could be one to watch, however, it’s still important to DYOR before investing, no matter how promising the market sentiment seems. This article doesn’t provide financial advice, and crypto remains prone to wild swings, so always look twice before you leap.

Altcoin

Canary Capital Files For Staked Tron ETF

American asset management company Canary Capital has taken a new leap with a new filing for a staked Tron ETF product. Known as the pioneer of some of the most renowned altcoin ETF products, this new Tron ETF has further placed the firm at the forefront of the exchange-traded fund drive.

The Canary Capital Staked Tron ETF

According to the prospectus released by the firm, the new product is dubbed the Canary Staked TRX ETF. The firm is yet to reveal the trading platform the product will trade on, however, it confirms it will provide exposure to the price of Tron.

Based on the pricing data offered by Coindesk Indices, Canary Capital said it will rely on this to establish the Net Asset Value (NAV) for the product. This latest filing comes barely a month after the asset manager filed for Pengu ETF with the US Securities and Exchange Commission (SEC).

This is a breaking news, please check back for updates!!!

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Price History Signals July As The Next Bullish Month

Based on historical data, July could be the next bullish month for the XRP price, which continues to consolidate amid this crypto market downtrend. Despite the market downturn, crypto analysts like CasiTrades are confident that the altcoin could still reach a new all-time high (ATH) in this market cycle.

Historical Data Points To July Being The Next Bullish Month For The XRP Price

Cryptorank data shows that July could be the next bullish month for the XRP price. This is based on the fact that the altcoin has recorded significant gains in each of the last five Julys.

Unlike July, April to June have been mixed for XRP over the last five years. For April, the last three out of five months have been bearish for the altcoin, although it recorded a 174% gain in April 2021.

For May, three out of the last five months have been bearish for the XRP price, although it recorded meagre gains in May 2023 and 2024. Meanwhile, June has been completely bearish for the altcoin, as it recorded monthly losses in the last five months.

It is worth mentioning that four out of the five monthly gains for XRP in July have been double-digit gains. As such, Ripple’s native crypto could again record double-digit gains this coming July.

Interestingly, crypto analyst Egrag Crypto predicted that XRP could reach double digits by its July 21 cycle peak. He alluded to the altcoin’s previous bull runs as to why July could mark this cycle’s peak. The analyst believes the Ripple price could reach $27 by then.

Analysts Argue XRP’s Consolidation Could End Soon

Amid this historical data, crypto analysts Dark Defender and CasiTrades have suggested that the XRP price consolidation could end soon. In an X post, Dark Defender stated that the altcoin’s consolidation is nearing an end and that he believes this is the final consolidation of the monthly structure.

Once this consolidation is done, the crypto analyst remarked that market participants can expect the Wave 5, which will send Ripple’s native crypto to new highs. He highlighted $2.22 and $2.30 as the major resistances to watch out for, while $1.88 and $1.63 are the major support levels. Meanwhile, the targets on this Wave 5 up are $3.75 and $5.85, which will mark a new ATH for the altcoin.

As CoinGape reported, crypto analyst CasiTrades also predicted that the XRP price could soon reach $6 as Wave 2 correction nears its end. The analyst also raised the possibility of the altcoin rallying to as high as $9.50 and $12 if it reaches the 2.618 and 3.618 Fibonacci extension levels, respectively.

However, there is still the possibility of the XRP price dropping below the $2 level before it rallies to new highs. Egrag Crypto warned that Ripple’s native crypto could still drop to as low as $1.4 in the event of a major liquidation.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ethereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

The ETH price’s bearish sentiment since January 2025 has taken a toll on investor confidence, with Ethereum ETFs witnessing significant outflows. As ETH’s value continues to plummet, investors increasingly withdraw their funds. With Ethereum exchange-traded funds recording a massive $32 million in weekly outflows, analysts caution against a potential downtrend.

As Ethereum lingers below the $2,000 mark for weeks, market experts and traders are bracing for a potential further decline to $1,100. Let’s dive deeper into the reasons behind the significant outflows from Ethereum ETFs and its potential impact on ETH price.

Ethereum ETFs Record $32M Weekly Outflows: What’s Happening?

According to SoSoValue, Ethereum ETFs experienced increasing outflows over the past week, driven by the overarching negative market trend. Last week, the ETFs saw a total net outflow of $32.17 million, pushing the month’s outflows to $170.99 million.

In addition, the Ethereum exchange-traded funds experienced an unusual day of neutral flows yesterday, with neither net inflows nor outflows reported. Analyst Ali Martinez shed light on the increasing whale activity over the past week. According to his X post, ETH whales have offloaded 143,000 tokens last week.

Significantly, this negative sentiment could be attributed to the ETH price’s bearish trend which began in January. Ethereum, which stood high-headed above $3,500 at the onset of 2025, started plummeting to reach a severe low of $1,500 in April. This steady downtrend has caused a stir in the market, with traders showing less interest towards the altcoin.

Is ETH Price Poised for a Crash?

Growing pessimism surrounding Ethereum ETFs has led analysts to warn the community that ETH’s price may extend its downward trajectory. For instance, analyst Altcoin Gordon shared a bearish forecast for ETH price, predicting that the token would further drop to $1,100. However, as per CoinGape’s Ethereum price prediction, ETH could destabilize around a minimum of $1,588 in 2025.

Ethereum market share nears all-time lows as bearish chart signals potential $ETH price drop to $1,100 👀 pic.twitter.com/NKr45vB4V5

— Gordon (@AltcoinGordon) April 15, 2025

As of press time, ETH is valued at $1,592, down by a marginal 0.20% in a day. Despite a 2.3% surge over the past seven days, ETH has seen a massive dip of 21% in a month. This negative vibe is also reflected on the traders’ sentiment, with the 24-hour trading volume decreasing by 23% to reach $10.5 billion.

Significantly, the Ethereum transaction fees’ recent crash to a five-year low has also contributed to the overall bearish sentiment.

Ethereum Bulls Remain Optimistic

Despite these bearish predictions and negative Ethereum ETF trend, bulls remain optimistic about the ETH price. Analysts like Crypto Rover and CryptoGoos shared their bullish outlooks on Ethereum, invoking investors’ enthusiasm.

According to CryptoGoos, ETH is expected to repeat history to surge beyond $2,800 in the near future. Meanwhile, market expert Crypto Rover projected the ETH price’s potential journey to an ambitious $10,000. However, it needs to be seen whether ETH can break through its current resistance levels and achieve these lofty targets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Investors Suffer More Losses Than Bitcoin Amid Ongoing Market Turmoil

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Fee Plunges To 5-Year Low—Is This A Bottom Signal?

-

Altcoin23 hours ago

Altcoin23 hours agoTron Founder Justin Sun Reveals Plan To HODL Ethereum Despite Price Drop

-

Market20 hours ago

Market20 hours agoEthereum Price Fights for Momentum—Traders Watch Key Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Predicts Pi Network Price Volatility After Shady Activity On Banxa

-

Market18 hours ago

Market18 hours agoIs XRP’s Low Price Part of Ripple’s Long-Term Growth Strategy?

-

Altcoin18 hours ago

Altcoin18 hours agoShiba Inu Follows Crypto Market Trend With “Shib Is For Everyone” Post, What’s Happening?

-

Market22 hours ago

Market22 hours agoSui Meme Coins Surge With Rising DEX Volumes

✓ Share: