Altcoin

Charles Hoskinson Explains Why Trump Is Better Than Biden For Crypto

In a recent statement by Charles Hoskinson, the founder of Cardano (ADA), he voiced his concerns over the potential impact of the upcoming November 2024 presidential elections on the crypto industry. Hoskinson’s remarks come in response to a report by Blockworks, a crypto insights and news provider, which suggested that only a “fool” would base their vote solely on crypto-related issues. In addition, Hoskinson spotlighted how the Trump administration could be better than Biden.

Hoskinson Opposes Blockworks’ Remark

Hoskinson vehemently opposed the above-mentioned narrative by Blockworks. Moreover, the Cardano founder emphasized the critical importance of crypto in shaping a new social contract that holds governments and corporations accountable to the people. He stated, “Crypto gives us our voices, financial freedom, and shared humanity back. Any politician who wants to rob us of that is dangerous.”

Expressing his stance as a ‘single-issue voter’, Hoskinson highlighted the significance of a presidential candidate’s stance on crypto. He asserted that being anti-crypto equates to the deepest form of totalitarianism. The Cardano founder also emphasized, “Being anti-crypto is the deepest and worst totalitarianism possible. It robs us of our human agency, freedoms, and economic identity.”

Furthermore, Hoskinson warned against the potential consequences of neglecting the crypto industry’s interests in the electoral process. He cautioned that failing to support candidates who prioritize crypto could lead to the implementation of central bank digital currencies (CBDCs), increased financial surveillance, and limited social mobility.

In addition, he clarified that he isn’t endorsing Biden as some people in the community believe. The Cardano pioneer wrote, “I’m on the left and understand that the 20 percent of America that holds crypto is pretty pissed that Biden caused massive harm to our entire industry arbitrarily and capriciously.”

Also Read: Cardano (ADA) Whale Transaction Jumps 6% As Bulls Eyes $0.5 Retest

Cardano Founder Says Trump Is Better Than Biden

Responding to queries regarding his reluctance to mention the other candidate [Donald Trump], Hoskinson addressed the issue directly. stating, “Trump? No, I’m not afraid to mention him.” He portrayed Trump as an ‘average’ president who largely left the crypto industry unhindered, providing an environment conducive to innovation and growth.

“He was an average president and mostly left our industry alone, giving us the ability to build in peace the future of the world,” Cardano’s Hoskinson remarked. In contrast, Hoskinson criticized President Joe Biden’s approach toward the crypto industry.

He also accused him of actively seeking to undermine the industry’s growth. He lamented Biden’s actions, stating, “Biden has served Well’s notices to everyone and their uncle and is actively trying to destroy the American crypto industry.”

The Cardano pioneer further added, “Our industry isn’t about building arbitrary products or debating taxes and regulations.” This reflects on the recent crackdown initiated by the U.S. Securities and Exchange Commission (SEC) and the Biden administration.

Also Read: Cardano Founder Charles Hoskinson Reveals Why Crypto Matters In Choosing Next US President

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Hurdles For Ripple And The SEC Ahead Of Final Resolution

While the XRP lawsuit is reaching its closing stages, there are a few loose ends that parties are racing to tie up. Digital assets lawyer James Farrell notes that Ripple Labs will pursue an indicative ruling to ease its future IPO proceedings. However, internal processes at the Securities and Exchange Commission (SEC) may see the loose ends become a knotty issue for Ripple Labs.

Ripple Is Chasing An SEC Settlement And An Indicative Ruling

According to crypto lawyer James Farrell, Ripple and the US SEC have to sidestep a raft of hurdles to reach the final resolution in the XRP lawsuit. Farrell revealed via an X post that Ripple Labs is pursuing a settlement with the SEC while having its sights on an indicative ruling from Judge Torres.

Parties are taking a breather from legal proceedings after the US Court of Appeals granted a joint motion to suspend appeals. As parties sheath their swords and head to the negotiating table, Farrell says Ripple is tipped to table a settlement offer.

Furthermore, Ripple is expected to ask the District Court to issue an indicative ruling, seeking for Judge Torres to modify her judgment. Per Farrell, Ripple wants a modification to allow it to carry out private sales of XRP ahead of a Ripple IPO launch date.

“Why do they want it? Because without it, the possibility of an IPO in the next 3+ years is basically zero,” said Farrell. “So while the cool kids are going public, Ripple practically cannot.”

A Complicated Administrative Process In The XRP Lawsuit

According to the legal expert, the process will involve Ripple submitting a settlement offer and a request for an indicative ruling. Farrell notes that Ripple’s legal team can submit both requests to the SEC jointly or separately.

He notes that the settlement is a low-hanging fruit for Ripple, but the indicative ruling may be a knotty issue for parties in the XRP lawsuit. If the SEC assents to the settlement, Ripple will still have to file a motion before Judge Torres, with the expert forecasting a six-month time frame.

After her decision, parties may head to the appellate court as the appeal is still subsisting, and file a voluntary dismissal. Farrell predicts the process at the appellate court to last for one month.

If Judge Torres denies the motion to modify the injunction, Farrell notes that the parties will head back to the Appeal Court with the argument on appeal potentially extending to January 2027.

Following the pause in legal proceedings in the XRP lawsuit, an analysis tips $2 as the XRP price floor for a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

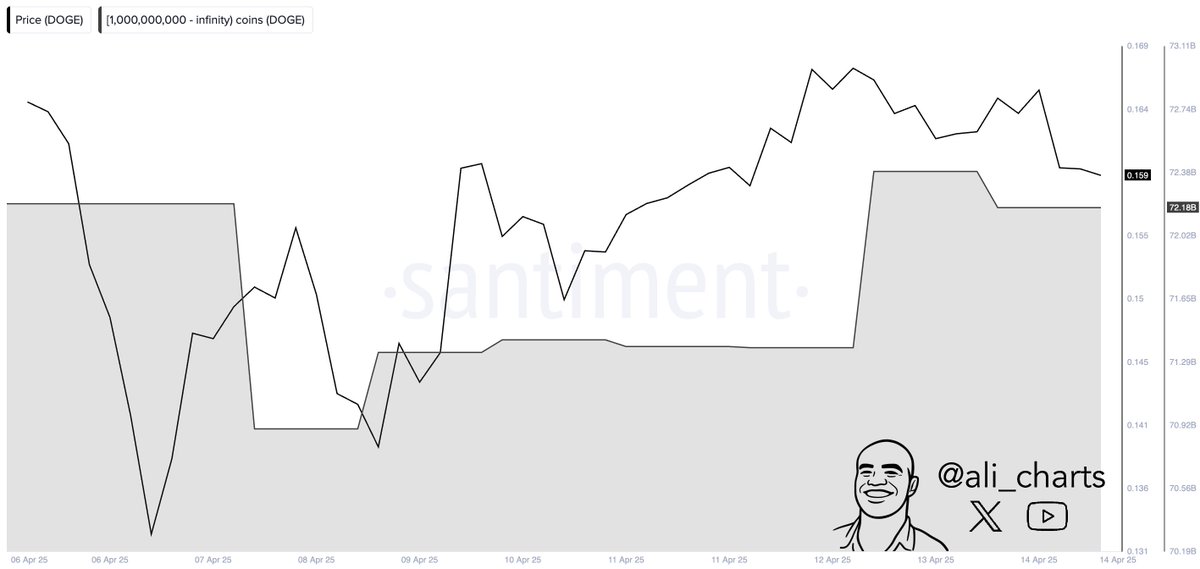

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The Solana Price Can Still Drop To $65

Solana price could be heading toward a major drop, according to crypto analyst Ali. In a recent analysis, Ali suggested that SOL might be retesting the breakout zone from a right-angled ascending broadening pattern.

Analysis Points to Downside Potential For Solana Price

Ali’s SOL analysis expects the price to drop to $65. This bearishness comes after a period of price weakness for Solana. SOL’s price fell by 1.2% in the last 24 hours, according to recent figures.

For all we know, #Solana $SOL might be retesting the breakout zone from a right-angled ascending broadening pattern, with the $65 target still in play. pic.twitter.com/vujFJQWurz

— Ali (@ali_charts) April 16, 2025

The prediction arrives at a time for the Solana network when Canada will launch Solana ETFs today after regulatory approval by the Ontario Securities Commission (OSC).

Ali’s technical analysis focuses on a right-angled broadening ascending pattern that has appeared on Solana’s price chart. SOL, according to the analyst, is re-testing the breakout pattern area, and this could be an indication of more downside action if the level fails to act as support.

This bearish outlook is shared by some other analysts in the crypto space. SatoshiOwl noted that Solana is not looking good and that it is breaking down from trendline on 1h. However, the analyst cautioned that confirmation was still needed from 1-hour and 4-hour candle closings. The analyst suggested that Solana might retest $120 first before possibly moving higher.

Not all analysts share this bearish view, however. Trader David identified what he described as bullish signs for SOL as this channel continues to move upward. He pointed out that after a 33% correction, Solana is now on a strong support level. He expressed hope that the token will reach new heights again.

Bullish signs for $SOL as this channel continues to move upward.

Hopefully we will see Solana on heights again. After 33% correction it is now on a strong support level.#Crypto #CryptoEducation pic.twitter.com/Pvj6RAC0WS

— David (@David_W_Watt) April 16, 2025

Canadian ETF Launch Could Provide Institutional Access

Despite the bearish technical outlook from some analysts, Solana is experiencing a potentially positive development on the institutional front. The Ontario Securities Commission (OSC) has approved multiple ETF issuers to list Solana-based products in Canada, including Purpose, Evolve, CI, and 3iQ.

This regulatory clearance sets the stage for Solana ETFs to come to market. This may make the cryptocurrency available to a new generation of institutional investors who would rather have regulated investment products rather than direct exposure to cryptocurrency. The timing of this news is interesting, as it is happening during technical uncertainty in the price action of Solana.

Bloomberg ETF analyst Eric Balchunas provided some background on the upcoming launches. He clarified that Canada is preparing spot Solana ETFs to launch this week after the regulator waved the green flag to multiple issuers. He added that the ETFs will also offer staking through TD.

But the initial market reaction to this news has been muted, with the Solana price showing little positive momentum in response to the much-awaited launch of the ETF. CoinGape has also released an extensive Solana prediction for April 2025.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Reveals Current Status Of 9 Ripple ETFs

-

Market23 hours ago

Market23 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin23 hours ago

Altcoin23 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market22 hours ago

Market22 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin21 hours ago

Bitcoin21 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Market19 hours ago

Market19 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market17 hours ago

Market17 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market21 hours ago

Market21 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

✓ Share: