Altcoin

Can The XRP Price Reach $10,000 Following XRP’s Inclusion In Strategic Reserve?

Crypto analyst Crypto Pal has shared an ultra-bullish prediction for the XRP price and how it could rally to $10,000 thanks to its inclusion in the crypto Strategic Reserve. Meanwhile, other crypto analysts have given more conservative XRP predictions, predicting that the crypto’s price could at least reach triple digits.

XRP Price To Reach $10,000 Following Inclusion In Strategic Reserve

In an X post, Crypto Pal shared a prediction of the XRP price rallying to between $10,000 and $35,000. The analyst then asserted that the XRP Strategic Reserve will make this happen easier than ever.

US President Donald Trump recently announced XRP’s inclusion in the proposed crypto Strategic Reserve, which provides a bullish outlook for XRP. The XRP price had even surged on the back of this announcement, coming close to reaching a new all-time high (ATH).

However, despite the Strategic Reserve providing a bullish outlook for XRP, there remain doubts that this initiative could send the crypto’s price to such ambitious targets. A rally to $10,000 would put XRP’s market cap in trillions of dollars and make it worth more than the global economy, making this prediction far-fetched.

Amid this ultra-bullish price prediction for XRP, crypto analysts have offered more conservative price targets for the crypto. Crypto analyst Egrag Crypto recently predicted that Ripple’s native coin could still hit $320 between now and next year. Meanwhile, he predicted that the crypto would rally to $30 by May this year.

Crypto analyst Dark Defender also recently predicted that XRP could reach $8 irrespective of the outcome in the Ripple SEC case. However, a settlement in the Ripple lawsuit could undoubtedly spark a significant price surge for the crypto.

XRP Gearing Up For Its Next Big Leap

In an X post, Egrag Crypto stated that the XRP price is gearing up for its next big leap. He explained that the crypto is holding above critical support trend level and has successfully retested the Bull Market Support Band.

He also revealed that XRP is consolidating above the Fibonacci 0.888 level while another macro consolidation zone, the Fib 1.0 zone, is in play. The Fib 1.0 level puts XRP at $3.37. Crypto analyst CasiTrades also predicted that Ripple’s native coin could soon rally above $3 if it stays above the trendline at $2.42.

Meanwhile, Egrag Crypto predicts that there will be a “noise consolidation” for XRP between $3.40 and $2.00. Once that consolidation is done, the analyst predicts XRP’s next major leg would lead to a rally to between $8.5 and $13, which are the Fib 1.272 and 1.414 level. He also remarked that market participants should not ignore Fib 1.618 at $27.

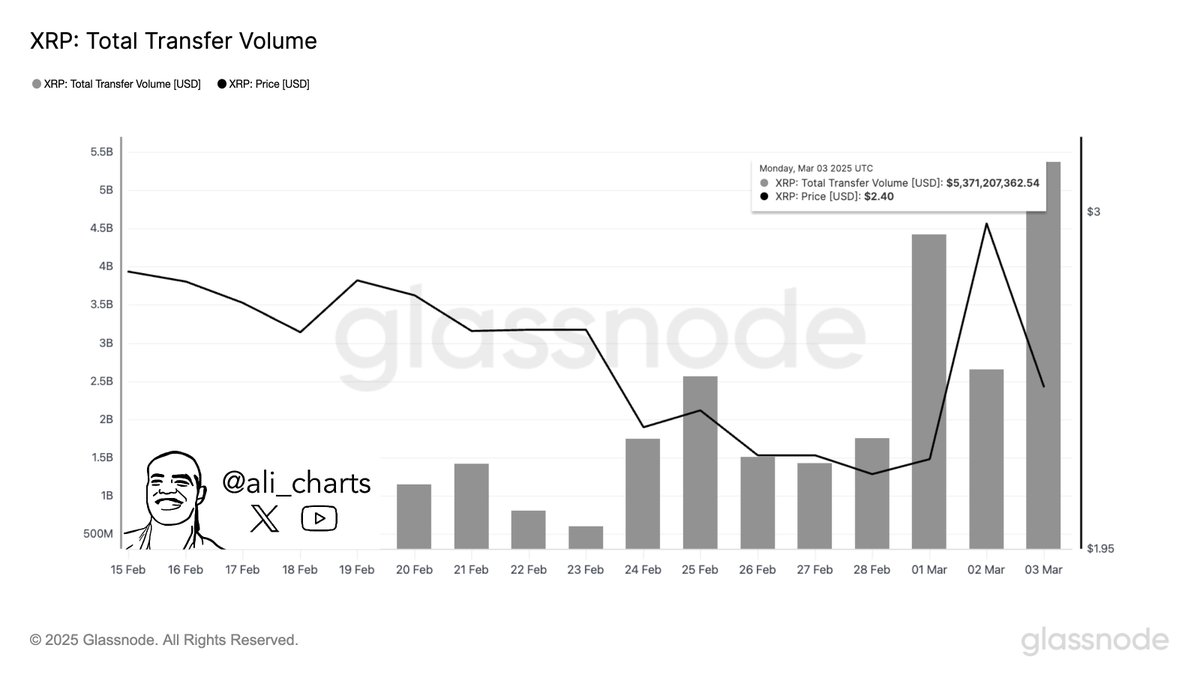

Crypto whales look to be preparing for this parabolic XRP price rally, as they continue to move significant coins around, indicating active accumulation. Crypto analyst Ali Martinez recently revealed that over $5.37 billion worth of XRP has been transferred in the last 24 hours.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

BNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

The renowned blockchain ecosystem BNB Chain has achieved a monumental stride this Friday, revealing that it completed the Lorentz testnet hardforks. According to an X post on April 10, this upgrade on the blockchain ecosystem brings faster blocks and smoother performance. “opBNB is now running at 0.5s block times & BSC testnet is live with 1.5s block times,” the X post added.

BNB Chain’s New Hardforks Boast Faster Blocks & Smoother Performance

BNB Chain revealed that the Lorentz Hardforks reduces opBNB block times to 0.5 seconds and BSC testnet to 1.5 seconds, offering its user base faster and smoother operations. opBNB is a layer-2 scaling solution built atop BSC, a layer-1 blockchain.

Notably, with the ecosystem upgrade, builders, validators, and users remain poised to witness a more responsive blockchain. Faster block times mainly bring increased throughput but risk syncing issues for dApps not designed for such speeds.

The blockchain’s team urged node operators and developers to upgrade and test dApps to check the upgrade’s compatibility.

Timeline For Mainnet Launch On BNB Chain

- opBNB mainnet hardfork will take place on April 21 at 03:00 AM UTC.

- BSC mainnet hardfork will take place on April 29 at 05:05 AM UTC.

Binance’s blockchain ecosystem is aiming to foster faster and smoother operations by the end of April, given the abovementioned advancements. This development could in turn magnetize more developers, builders, and users toward the ecosystem.

Native Coin Retaliate On This Development?

At the time of reporting, BNB coin’s price traded at $579.45, up marginally by 0.2%. The blockchain’s native token is currently consolidating within a tight range of $567 and $579.

Crypto market traders and investors have kept the coin on their radars as the abovementioned advancements could fuel more demand for the token. Also, BNB Chain can witness a flurry of activity ahead as it enhances its ecosystem’s potential with upgrades. A BNB coin price prediction by CoinGape further revealed that bulls are currently in control, as per the 3-month bias indicator.

As a result, market sentiments orbiting the coin are optimistic and investors could see a price rally ahead, although it’s worth mentioning that the broader crypto market faces immense pressure amid Donald Trump’s tariff flip-flopping.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

Despite a few positive developments, XRP price has failed to gather momentum and is flirting at the crucial support of $2.0; failing to hold can cause another 40% crash to $1.20. The macro uncertainty and Trump tariff war escalation have cast dark clouds on the crypto space, impacting XRP equally, despite key developments in the SEC vs Ripple lawsuit.

XRP Price In A Make It or Break It Position

XRP price has been flirting at a crucial support of $2.0, and any directional move can decide the next market action. In the last 24 hours, the Ripple cryptocurrency has bounced back once again from the $1.9 levels and is currently trading at $2.0. However, the daily trading volumes have crashed 51% to $4.21 billion.

Although the bounce back has been sharp, crypto analyst Ali Martinez noted that XRP needs to surge past this breakout zone to continue with the rally. As shown in the image below, XRP price is forming a head and shoulders pattern. Also, the immediate support is $1.80, while the gates of a 40% drop to $1.20 are still open.

However, if the Ripple cryptocurrency manages to roar back above $2.0, it can chart its path for an upside breakout to $22, $30, and beyond. Crypto analyst EGRAG Crypto cited the multi-year time-frame, stating that the breakout on a multi-year timeframe can lead to a strong breakout on the upside. The analyst noted:

“I’m looking at the last pump from the 2017 cycle, which was an incredible 2,600%! Starting from $1.20, if we see a retracement back to the edge of the triangle, then $30 is definitely within reach!”

On-Chain and Ripple Lawsuit Developments

XRP’s on-chain metrics highlight huge growth for the Ripple blockchain. On-chain analyst Ali Martinez reports that over 6.26 million addresses now hold at least one XRP, marking a record high for the network. This milestone highlights strong investor confidence despite ongoing market volatility. At the same time, talks of a spot XRP ETF are also on the rise amid positive developments in the Ripple lawsuit, which can be a catalyst to XRP price upside.

On Thursday, the United States Securities and Exchange Commission (SEC) and Ripple Labs have jointly filed a pivotal motion following their settlement of the XRP lawsuit. According to the filing submitted to the US Court of Appeals for the Second Circuit, both parties have requested that the appeal be held in abeyance until the court formally approves the resolutions.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Dogecoin (DOGE) Reclaims Previous Breakdown, Will This Mark The Bottom?

After a long-running streak of breaking down from support levels, Dogecoin (DOGE) is set to reverse the trend. Recent Dogecoin price action reveals that the bottom is in for the memecoin amid growing chatter for a strong rally.

Dogecoin Price Reclaims Breakdown Signaling The Bottom

Cryptocurrency analyst Trader Tardigrade says recent Dogecoin price action indicates a positive trend reversal following multiple support breakdowns. In his analysis on X, Tardigrade notes that DOGE has reclaimed a previous price breakdown at $0.15300 after a small rally.

After prices dipped below the support level, DOGE quickly recovered, powered by a rally that saw the asset record double-digit gains over the last day. Tardigrade notes that reclaiming the breakdown signals the end of a long-drawn price decline for Dogecoin.

Since the start of the year, the Dogecoin price has been in steep decline, recording three steep price breakdowns without an attempt to reclaim support levels.

“Dogecoin has successfully reclaimed its previous breakdown, marking the first time since the downtrend began in January 2025,” said Tardigrade. “This price action suggests that Doge is gaining strength and may have already reached its bottom.”

The claims that Dogecoin bottom has gathered steam with crypto analyst Master Kenobi predicting that DOGE price will bounce back. Master Kenobi goes on to predict a new all-time high for DOGE in early June, confirming the bottom as well.

Fundamentals Stoke Support For DOGE Bottom Claims

Apart from technicals, certain fundamentals suggest that the bottom is in for the Dogecoin price. 21Shares’ filing for a spot Dogecoin ETF is fuelling a small rally for the dog-themed meme coin.

A previous collaboration between 21Shares and House of Doge for a Dogecoin ETP on the SIX Swiss Exchange is a tailwind for the asset. DOGE has survived the scare stemming from Elon Musk’s imminent departure from DOGE as it eyes the $1 mark.

However, DOGE will have to contend with heavy selling pressure from whales and the broader macroeconomic pressures impacting the cryptocurrency markets to avoid slipping below the support level again.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin22 hours ago

Altcoin22 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

-

Market20 hours ago

Market20 hours agoSolana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

-

Market19 hours ago

Market19 hours agoOnyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

-

Bitcoin20 hours ago

Bitcoin20 hours agoBullish Signal for Bitcoin in 2025?

-

Altcoin19 hours ago

Altcoin19 hours agoBinance Lists BABY As Bitcoin Protocol Babylon Goes Live

-

Market23 hours ago

Market23 hours agoRSR Price Climbs 22% After Paul Atkins Gets Named SEC Chair

-

Market17 hours ago

Market17 hours agoSolana Price Attempts Recovery, Nears $120, But Needs A Push

✓ Share: