Altcoin

Can Ethereum Price Touch $4,000 In 30 Days After ETH ETF Boom?

Despite its underperformance in this market cycle, crypto analysts continue to provide a bullish outlook for the Ethereum price. These analysts have suggested that ETH can rally to $4,000 in thirty days amid the Ethereum ETF boom.

Can The Ethereum Price Touch $4,000 In 30 Days?

Crypto analysts have suggested that the Ethereum price can reach $4,000 in thirty days amid the ETH ETF boom. These analysts include Ted, who recently predicted that ETH will reach $4,500 this month. This came as the analyst also predicted that the crypto could reach $10,000 in the next three to four months.

In a recent X post, the analyst again reaffirmed his conviction about Ethereum and outlined why he is very bullish on ETH. First, he mentioned that Donald Trump’s World Liberty Financial had bought over $200 million worth of ETH.

Secondly, the analyst mentioned that Eric Trump is tweeting about ETH, which he considers bullish for the Ethereum price. Trump has tweeted that he believes now is a “great time” to buy ETH.

The crypto analyst then asserted that Ethereum staking ETF will be approved, which is also a bullish fundamental ETH. It is worth mentioning that Kraken has already relaunched its crypto staking services for US customers, a move that could be geared towards the approval of this staking ETF.

Other fundamentals the analyst alluded to that could drive the ETH price to $4,000 in thirty days include upcoming network upgrades, which could lead to lower fees, better staking, and an improved token burn mechanism.

Ted also added that Ethereum is the only smart contract platform with a commodity-classified coin and spot ETF support. The analyst noted that major players like Deutsche Bank and UBS are building on Ethereum layer-2.

ETH ETF Boom Provides A Bullish Outlook

The Ethereum ETF boom also provides a bullish outlook for the ETH price. These funds recorded $83.6 million in net inflows yesterday, sparking a bullish sentiment among investors.

This development is even more significant considering that the Bitcoin ETFs recorded $2334.4 million in net outflows yesterday. As such, institutional investors look to be heavily bullish on ETH and used the crypto market crash yesterday as an opportunity to accumulate more Ethereum. These investors have been accumulating the crypto since last week, with these funds recording significant inflows.

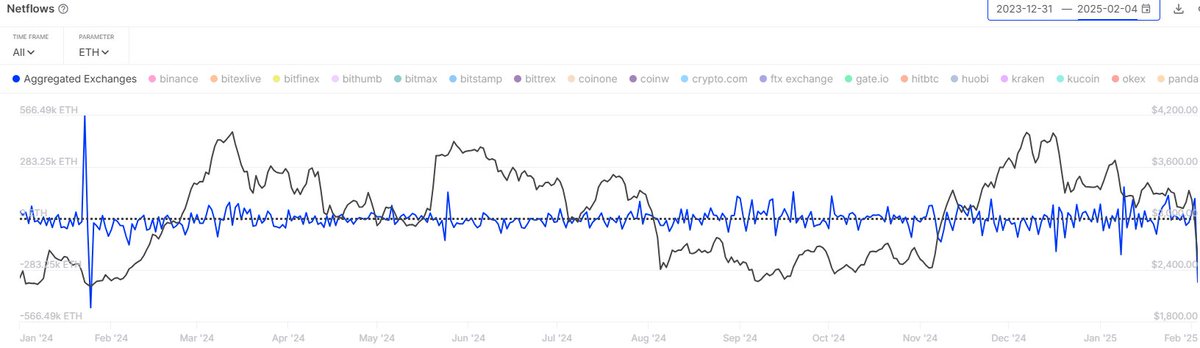

Crypto whales are also still bullish on the Ethereum price despite its underperformance. Market intelligence platform IntoTheBlock revealed that 350,000 ETH worth nearly $1 billion was withdrawn from exchanges yesterday.

The platform further revealed that this is the highest amount of net exchange withdrawals since January 2024. As such, traders took advantage of the dip alongside these institutional investors.

Another Bullish Case For ETH

Crypto analyst Titan of Crypto also shared an Ethereum price analysis, which suggested that ETH could reach $4,000 in the next thirty days. In an X post, the analyst noted that ETH’s current cycle behavior closely mirrors Bitcoin’s past cycle right before its breakout and major run-up.

The analyst added that history repeats, but it often rhymes. His accompanying chart showed that the Ethereum price could break above $4,000 and rally to as high as $8,200 this year as part of this run-up phase.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals XRP Price Can Hit $45 If It Follows This 2017 Pattern

Crypto analyst Egrag Crypto has predicted that the XRP price could rally to as high as $45 if it mirrors a bullish price movement from the 2017 bull run. The analyst also raised the possibility of the altcoin at least touching $19 if it replicates the 2021 price action.

XRP Price Could Rally To $45 If It Mirrors 2017 Bull Run

In an X post, Egrag Crypto predicted that the XRP price could rally to $45 if it mimics the 2017 cycle. He noted that in 2017, the price found heavy support at the 21 Exponential Moving Average (EMA) and experienced a last blow-off top.

This blow-off top led to a price surge of 2,700%, which the analyst believes could lead to XRP’s rally to $45 if the 2017 bull run repeats itself. Meanwhile, Egrag Crypto predicts the altcoin could at least touch $19 if a similar price movement like the 2021 bull run occurs.

He noted that in 2021, the price breached the 21 and 33 EMA and then pumped in a final leg that marked the cycle’s blow-off top. During this period, XRP surged by 1,050%, which the crypto analyst believes could lead to a rally to $19 if history repeats itself. The analyst added that his target has always been $27 and advised market participants to DCA if necessary.

In the short term, the XRP price looks to be eyeing a rally to $5. A CoinGape market analysis revealed that the Hidden Road acquisition may lead to $10 billion in volume to the XRP Ledger, which could push the altcoin to this target.

Meanwhile, XRP’s on-chain metrics also paint a bullish outlook for the altcoin, with the number of wallet addresses hitting a new all-time high (ATH) recently. This indicates that Ripple’s native crypto is enjoying wider adoption.

Ripple’s Native Crypto Has The Potential To Hit $1,000

Crypto analyst BarriC asserted that the XRP price could hit $1,000, although he admitted that it would “absolutely” take time. He claimed it will take a utility run and mass adoption to drive XRP to this price target.

The analyst added that it would also take a big shift in the financial space for the altcoin to reach this $1,000 level. Essentially, BarriC believes something massive has to happen for XRP to reach this target. However, once they do, he assured that there is no going back.

A CoinGape market analysis also once suggested that the XRP price could reach $1,000 if Michael Saylor swapped his $21 billion BTC for Ripple’s native crypto.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Solana Price Eyes Breakout to $200, SOL ETF Approval Timeline

The price of Solana (SOL) is again in the spotlight as the current bullish consolidation has flipped the coin to a new weekly high. The Solana community also anticipates the Exchange Traded Fund (ETF) tied to the asset, prompting the debate on the potential timeline for the offering’s approval. With the price of Bitcoin and altcoin showcasing a rebound, Solana’s performance has stood out from other altcoins.

Is The Solana Price Breakout to $200 Possible?

According to new insight on X from market analyst World of Charts, the price of Solana is currently testing a potential breakout trend. He said the coin is testing crucial resistances that can easily push it to the $200 level if it successfully breaks out.

The World of Charts thesis tips the SOL price to soar by over 86%, with the potential to add $105 in a bull case scenario. However, this does not negate a possible SOL price retest of $75 if crucial support levels fail to hold.

At the time of writing, the price of Solana was changing hands for $120, up by 8.06% in 24 hours.

Despite the Relative Strength Index (RSI) soaring from the low of 34 recorded on April 8 to the current 46.89, SOL is not completely out of the woods. The MA Cross indicator shows that the Death Cross inked on April 2 has yet to be invalidated.

Solana ETF: Potential Approval Timeline

With Solana showcasing a potential rebound trend, many community members are quizzing to determine what will happen to its growing ETF products. Responding to SOL ETF approval queries, Senior Bloomberg ETF Analyst James Seyffart broke the silence on what to expect.

He reiterated that the first ‘final’ deadline for SOL ETFs is October 10. He noted that there is a non-zero chance the new Atkins-led US SEC and Hester Peirce-led Crypto Task Force will move earlier than that.

Despite this definitive timeline, he reiterated that there is a strong expectation of approval by that deadline. In the meantime, the Crypto Task Force is pushing for clear regulations, which is positive for a potential approval.

A Solana ETF could usher in institutional money into the ecosystem, which is bullish for the SOL price, leading to a massive breakout.

More SOL Fundamentals to Watch

According to a recent ecosystem shift, the Proof-of-Stake (PoS) protocol is undergoing a subtle rebranding in the market. Besides introducing Confidential Balances to drive privacy, Solana Developers have also unveiled Open Source Relayers. In partnership with OpenZeppelin, these Relayers are in alpha mode and can power some functionalities within the ecosystem.

A defined attempt to revive the memecoin outlook in the SOL ecosystem through PumpFun also exists. With the return of the livestream, PumpFi, and PumpSwap, the protocol is gearing up for a new wave of meme explosion and price rebound.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Sonic Surges to $1 Billion TVL in 66 Days Amid DeFi Market Slump

The crypto market in 2025 is facing intense turbulence. The capitalization of once-hot trends like meme coins has plummeted. Capital has flowed out of decentralized finance (DeFi) protocols, driving DeFi’s total value locked (TVL) down from $120 billion to around $87 billion.

In this context, Sonic stands out. It has consistently hit new TVL highs, reaching $1 billion in April after growing nearly 40 times since the beginning of the year. So, what makes Sonic a bright spot amid a stormy market?

Investors Are Pouring Capital into Sonic

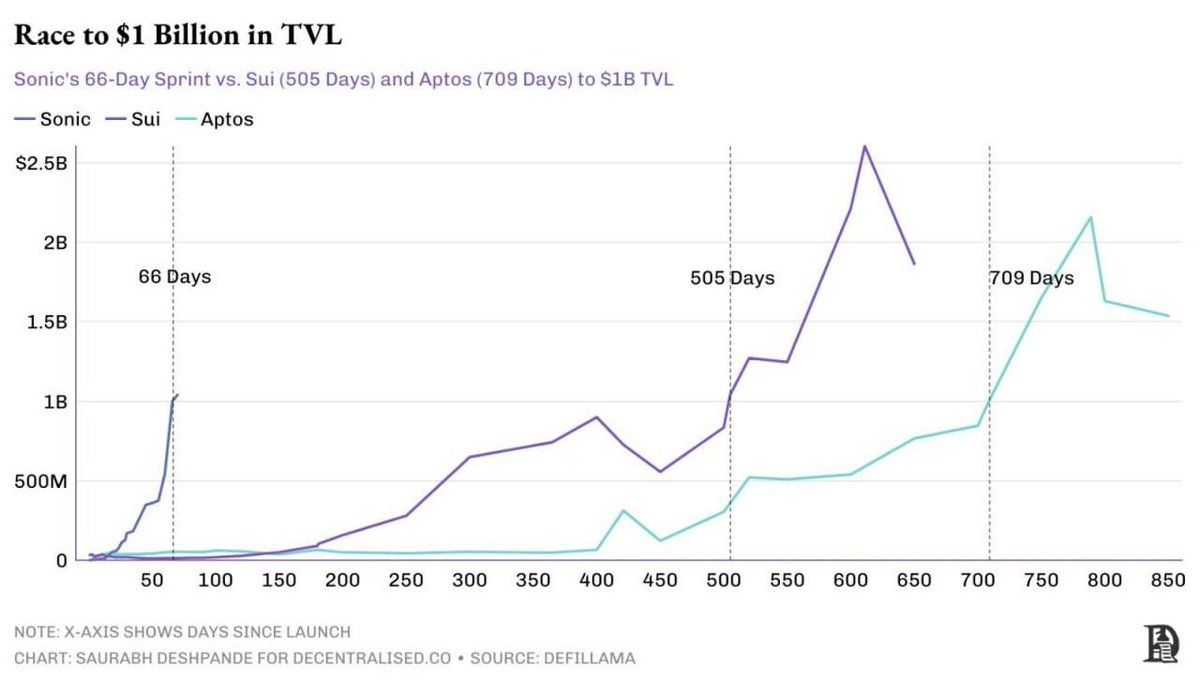

Sonic has made its mark with a rapid TVL growth rate, far outpacing better-known blockchains. According to DefiLlama, Sonic reached $1 billion in TVL within 66 days. In comparison, Sui took 505 days, and Aptos needed 709.

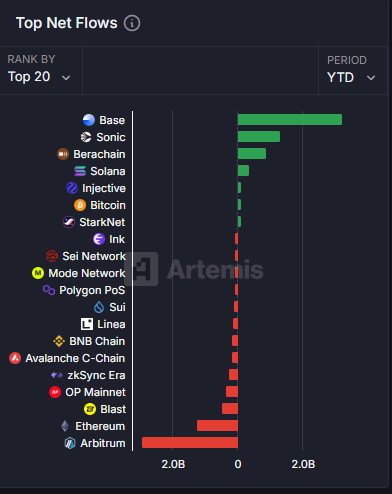

This achievement reflects strong capital inflows into the Sonic ecosystem despite the broader DeFi trend of capital withdrawal. Data from Artemis supports this, ranking Sonic as the second-highest netflow protocol this year—trailing only Base, a blockchain backed by Coinbase.

The growth goes beyond TVL numbers. Sonic’s ecosystem is attracting various projects, including derivatives exchanges like Aark Digital and Shadow Exchange and protocols such as Snake Finance, Equalizer0x, and Beets. These projects still have small TVLs, but they have the potential to draw new users and capital, fueling Sonic’s momentum.

However, the question remains: Can this capital inflow remain sustainable while the market fluctuates?

Andre Cronje on Sonic’s Potential and Strengths

Andre Cronje, the developer behind Sonic, shared his ambition in an interview to push this blockchain beyond its competitors.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Andre Cronje said.

According to Cronje, Sonic isn’t just about speed. The platform also focuses on improving both user and developer experience. He explained that 90% of transaction fees go to dApp, not to validators, creating incentives for developers to build.

Unlike other blockchains, such as Ethereum, which are limited by long block times, Sonic leverages an enhanced virtual machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, however, that current demand has yet to push the network to its full capacity. Still, these technical advantages make Sonic a compelling option for developers seeking more user-friendly dApps.

He also revealed new features on Sonic that have the potential to attract users.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Andre Cronje revealed.

Risks and Challenges Ahead

Despite reaching impressive milestones, Sonic is not immune to risk. The price of its token, S, has declined significantly from its peak. According to BeInCrypto, it has dropped around 20% in the past month—from $0.60 down to $0.47—mirroring the broader market’s volatility.

Furthermore, Grayscale recently removed Sonic from its April asset consideration list. This decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain its TVL should investor sentiment deteriorate.

Sonic also faces fierce competition from other high-performance chains like Solana and Base. Although Sonic holds a clear advantage in speed, long-term user adoption will depend on whether its ecosystem can deliver real value, not just high TVL figures.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin17 hours ago

Altcoin17 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market16 hours ago

Market16 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market15 hours ago

Market15 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market23 hours ago

Market23 hours agoRipple And The SEC File Joint Motion for Final Settlement

-

Market17 hours ago

Market17 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Altcoin15 hours ago

Altcoin15 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market14 hours ago

Market14 hours agoBTC ETF Outflows Continue Amid Institutional Caution,

-

Market22 hours ago

Market22 hours agoControversy Follows Babylon’s BABY Token Launch and Airdrop

✓ Share: