Altcoin

Can Cardano Price Reach $1 As Whales Gobble 130 Million ADA?

Cardano price has taken a hit in recent days but analysts are confident of a fresh rally for the asset. A massive whale accumulation by Cardano (ADA) whales is fuelling speculation for a price spike amid rising network activity.

Whales Can Send Cardano Price Across The $1 Mark

According to an X post by on-chain analyst Ali Martinez, Cardano whales have gobbled up 130 million ADA in the last three days. The total value of ADA accumulated by the whales stands at $97.5 million with retail traders contributing their fair share.

Pundits say the recent accumulation spree is an indicator for a potential rally for Cardano price. There is significant optimism that ADA can cross the $1 mark after prices fell to $0.70.

Prior to the decline to $0.70, Cardano’s price traded as high as $1.13 over a 30-day period. Now, rising whale activity is stoking belief for ADA to reclaim its previous highs but several hurdles stand in the way.

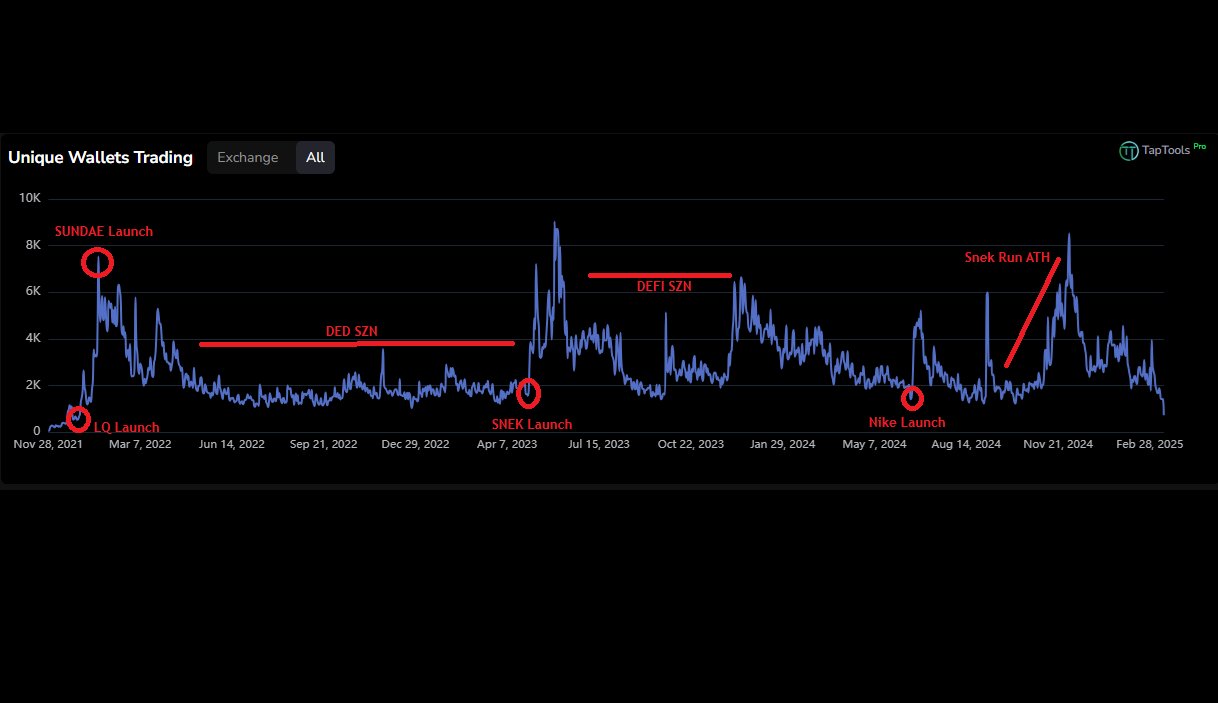

For starters, the network’s unique wallets trading (UWT) indicator has reached all-time lows. However, analysts say the dip in unique wallets is “the calm before the storm” before the start of a rally.

“Usually when the number of UWT dips below 1.5k per day, it doesn’t take long until something happens,” said one analyst.

ADA’s Ecosystem Continues To Buzz Despite Price Decline.

At the moment, ADA price is floating around the $0.7 mark but the ecosystem is alive with activity. Still reeling from the highs of its inclusion in the Crypto Strategic Reserve, institutional interest is climbing.

Furthermore, speculation around ADA for X payments has triggered theories that the asset is headed to $10. Cardano Foundation CEO Frederik Gregaard has confirmed that the network is working with NASA on satellite data and provenance capabilities.

Daily trading volumes for ADA stands at $777 million, down by 22.7% over the last. Despite the decline in volumes, analysts say Cardano is on course to flip Solana if it attracts more decentralized applications.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Crypto Whales Bag $20M In AAVE & UNI, Are DeFi Tokens Eyeing Price Rally?

Recent crypto whale metrics surrounding DeFi tokens have garnered immense investor optimism, suggesting that price gains for some coins are imminent despite the ongoing market uncertainty. Whale data on Thursday, April 17, indicated that large-scale investors stacked over $20 million in AAVE and UNI. These accumulations have ignited a bullish market torrent, underscoring buying pressure on the assets despite the broader market slump.

Crypto Whales Stack $20M In DeFi Coins Igniting Optimism

According to the data from Spot On Chain, crypto whales are quietly accumulating DeFi tokens via OTC. As per the data, two fresh wallets recently scooped up a total of $20.11 million worth of the abovementioned tokens.

The wallet address “0x3bb..” bought $4.28 million worth of UNI from Cumberland. Further, the same wallet and the address “0x4f7..” collectively bagged $15.83 million worth of AAVE from the same OTC exchange. These massive accumulations have suggested that price gains lie ahead for the DeFi cryptos.

For context, usual market sentiments remain highly bullish in the wake of such whale accumulations, signaling market confidence and buying pressure on an asset. So, traders and investors anticipate price gains in these DeFi tokens shortly.

How Are The Coins Performing Today?

AAVE price was up by roughly 3.5% at the time of reporting, exchanging hands at $138.81. The DeFi token gained after hitting a bottom of $130.43 over the past day. Notably, this rising action potentially aligns with broader trends and the crypto whales’ significant buying.

Also, Coingape has reported that the token’s community proposed a major AAVE buyback plan and liquidity upgrade the previous month. This upgrade aims to uplift the coin’s market and price dynamics. The whale accumulation, in turn, falls in line with this development.

On the other hand, UNI price was up by roughly 2.5% and traded at $5.27. The DeFi crypto hit a low of $5.05 over the past day.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals Hurdles For Ripple And The SEC Ahead Of Final Resolution

While the XRP lawsuit is reaching its closing stages, there are a few loose ends that parties are racing to tie up. Digital assets lawyer James Farrell notes that Ripple Labs will pursue an indicative ruling to ease its future IPO proceedings. However, internal processes at the Securities and Exchange Commission (SEC) may see the loose ends become a knotty issue for Ripple Labs.

Ripple Is Chasing An SEC Settlement And An Indicative Ruling

According to crypto lawyer James Farrell, Ripple and the US SEC have to sidestep a raft of hurdles to reach the final resolution in the XRP lawsuit. Farrell revealed via an X post that Ripple Labs is pursuing a settlement with the SEC while having its sights on an indicative ruling from Judge Torres.

Parties are taking a breather from legal proceedings after the US Court of Appeals granted a joint motion to suspend appeals. As parties sheath their swords and head to the negotiating table, Farrell says Ripple is tipped to table a settlement offer.

Furthermore, Ripple is expected to ask the District Court to issue an indicative ruling, seeking for Judge Torres to modify her judgment. Per Farrell, Ripple wants a modification to allow it to carry out private sales of XRP ahead of a Ripple IPO launch date.

“Why do they want it? Because without it, the possibility of an IPO in the next 3+ years is basically zero,” said Farrell. “So while the cool kids are going public, Ripple practically cannot.”

A Complicated Administrative Process In The XRP Lawsuit

According to the legal expert, the process will involve Ripple submitting a settlement offer and a request for an indicative ruling. Farrell notes that Ripple’s legal team can submit both requests to the SEC jointly or separately.

He notes that the settlement is a low-hanging fruit for Ripple, but the indicative ruling may be a knotty issue for parties in the XRP lawsuit. If the SEC assents to the settlement, Ripple will still have to file a motion before Judge Torres, with the expert forecasting a six-month time frame.

After her decision, parties may head to the appellate court as the appeal is still subsisting, and file a voluntary dismissal. Farrell predicts the process at the appellate court to last for one month.

If Judge Torres denies the motion to modify the injunction, Farrell notes that the parties will head back to the Appeal Court with the argument on appeal potentially extending to January 2027.

Following the pause in legal proceedings in the XRP lawsuit, an analysis tips $2 as the XRP price floor for a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

DOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

A DOGE whale has drawn the crypto community’s attention following a recent transfer involving millions of the meme coin. This development comes as crypto analyst Master Kenobi predicted that a Dogecoin price breakout will happen “within hours.”

DOGE Whale Moves 478 Million Coins As Dogecoin Price Eyes Breakout

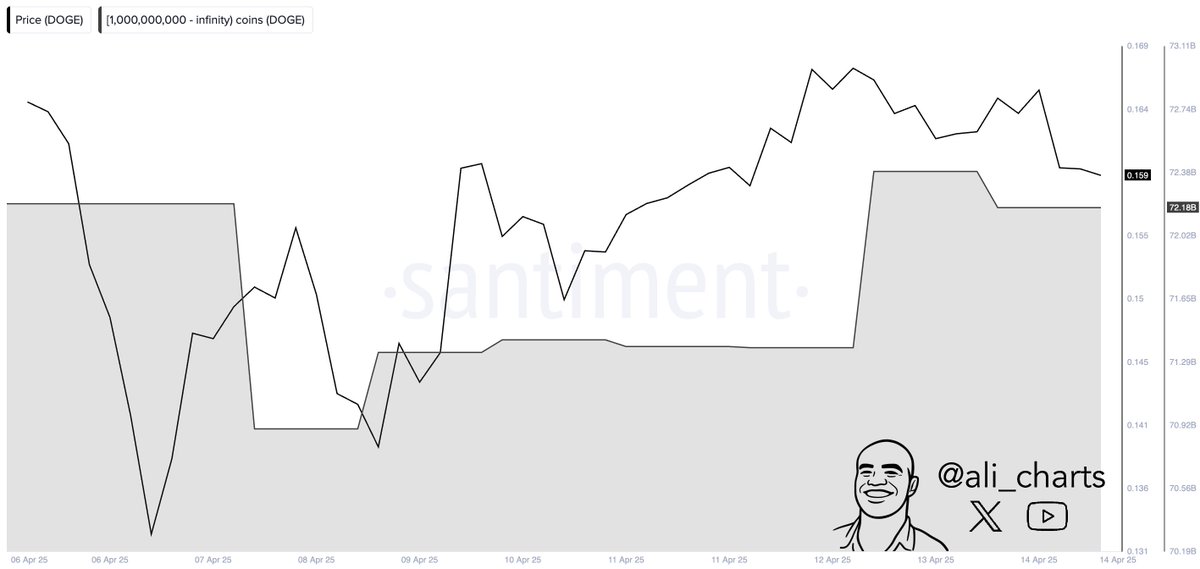

Whale Alert data shows a DOGE whale moved 478 million coins worth $72.9 million from an unknown wallet to another unknown wallet, hinting at active accumulation from this investor. Other whales also look to be actively accumulating, as crypto analyst Ali Martinez revealed that DOGE whales bought over 800 million coins in 48 hours.

This accumulation comes amid Master Kenobi’s prediction that a Dogecoin price breakout will happen within hours. His accompanying chart highlighted an ascending rectangle, from which the breakout could occur. The analyst further remarked that the breakout will also likely surpass the downtrend line.

The crypto analyst stated that this is arguably the most significant event for DOGE this year so far. He added that the Dogecoin price’s peak is anticipated around late May to early June, aligning with the BNB price and other major altcoins.

Meanwhile, his accompanying chart also showed that Dogecoin could rally to as high as $0.8 if it reaches the upper boundary of this rectangular channel.

Martinez also recently predicted that the top meme coin could soon reach $0.29. He stated that price needs to hold the key support at $0.13 and sustain a break above $0.17 to reach this level.

More Bullish Outlook For DOGE

In a series of X posts, crypto analyst Trader Tardigrade provided a bullish outlook for the Dogecoin price. In one post, he stated that DOGE is breaking out of a falling wedge pattern on the 1-hour chart. He added that DOGE’s Relative Strength Index (RSI) also shows a breakout after hitting the oversold zone.

In another post, the crypto analyst stated that Dogecoin is forming a prolonged symmetrical triangle. Trader Tardigrade remarked that the longer the consolidation within the triangle, the stronger the momentum builds, leading to a higher pump for the DOGE price.

His latest X post also showed that the Dogecoin price was eyeing a rally to the $0.8 target, just like Master Kenobi predicted.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin19 hours ago

Altcoin19 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Breakout Imminent? Analyst Expects ETH Price Surge To $2,000

-

Market24 hours ago

Market24 hours agoEthereum Price Dips Again—Time to Panic or Opportunity to Buy?

-

Market21 hours ago

Market21 hours agoBNB Burn Reduces Circulating Supply by $916 Million

-

Market16 hours ago

Market16 hours agoHow It’s Impacting the Network

-

Ethereum24 hours ago

Ethereum24 hours agoDid Ethereum Survive The Storm? Analyst Eyes Breakout Next

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65

-

Market19 hours ago

Market19 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

✓ Share: