Altcoin

Bitwise Files S1 for Dogecoin ETF With US SEC

Asset management firm Bitwise is pushing its crypto ETF agenda with a new filing targeting Dogecoin (DOGE). The firm has officially submitted the S-1 registration statement with the United States Securities and Exchange Commission (SEC) for the Bitwise Dogecoin ETF.

Bitwise Dogecoin ETF Is Inevitable

As per the US SEC prospectus, this new filing comes with no defined ticker symbol yet, and the firm has yet to confirm the trading platform it will list. However, Bitwise said the new fund is designed to provide exposure to DOGE, the industry’s largest memecoin.

Bitwise said the fund will hold Dogecoin directly and establish the ETF product’s Net Asset Value (NAV). It confirmed that the Fund will rely on the Dogecoin-Dollar settlement benchmark provided by the CF trading platform. Other key details, like the sponsor fee, remains unannounced.

This Dogecoin ETF filing comes barely a week after Bitwise initiated its first move for the asset. As reported by CoinGape, it registered a legal entity for the DOGE ETF, sending the coin’s price up at the time.

Commenting on the S-1 filing, Bloomberg Senior ETF Analyst James Seyffart noted that a Bitwise DOGE ETF remains inevitable.

NEW: @BitwiseInvest officially files an S-1 for the Bitwise Dogecoin ETF. pic.twitter.com/GT9JjU67CY

— James Seyffart (@JSeyff) January 28, 2025

Dogecoin ETF Comes After Multiple Crypto ETF Filings

Earlier this week, CoinGape reported that Tuttle Capital filed for a new crop of crypto leverage ETF products with the SEC. Some unusual coins in the filing include Solana, XRP, Litecoin, BONK, TRUMP, MELANIE, Chainlink, Polkadot, and Cardano ETF. The asset management firm misspelled “BNB” as “BNP” as the 10 crypto-linked ETF products in the filing.

In about 24 hours, Tuttle Capital withdrew the initial leverage ETF filing. It then submitted another to show it is also pushing for a BNB ETF product. The speculation surrounding Dogecoin ETF is picking pace amid connection with Elon Musk’s Department Of Government Efficiency (DOGE).

The US SEC has continued to see a growing number of crypto ETF filings. Analysts say these diverse products are the issuer’s way of testing the regulator’s boundaries. Some believe that with the new pro-crypto leaders at the markets regulator, these crypto ETF products will gain approval.

Coins With Best ETF Approval Odds

Despite the growing number of crypto ETF products being filed with the US SEC, experts believe Litecoin, XRP, Solana and Dogecoin ETF products have the best offs of approval. Beyond their respective market capitalizations, technology, and ecosystem, some of these coins have ETPs tracking their prices.

Experts believe these assets have attained maturity, and the SEC may consider them so. Mark Uyeda formed a crypto task force after his appointment as acting Chairman of the US SEC. ETF experts remain convinced that this task force by Hester Peirce will play a major role in determining which crypto ETF scales through.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Sonic Surges to $1 Billion TVL in 66 Days Amid DeFi Market Slump

The crypto market in 2025 is facing intense turbulence. The capitalization of once-hot trends like meme coins has plummeted. Capital has flowed out of decentralized finance (DeFi) protocols, driving DeFi’s total value locked (TVL) down from $120 billion to around $87 billion.

In this context, Sonic stands out. It has consistently hit new TVL highs, reaching $1 billion in April after growing nearly 40 times since the beginning of the year. So, what makes Sonic a bright spot amid a stormy market?

Investors Are Pouring Capital into Sonic

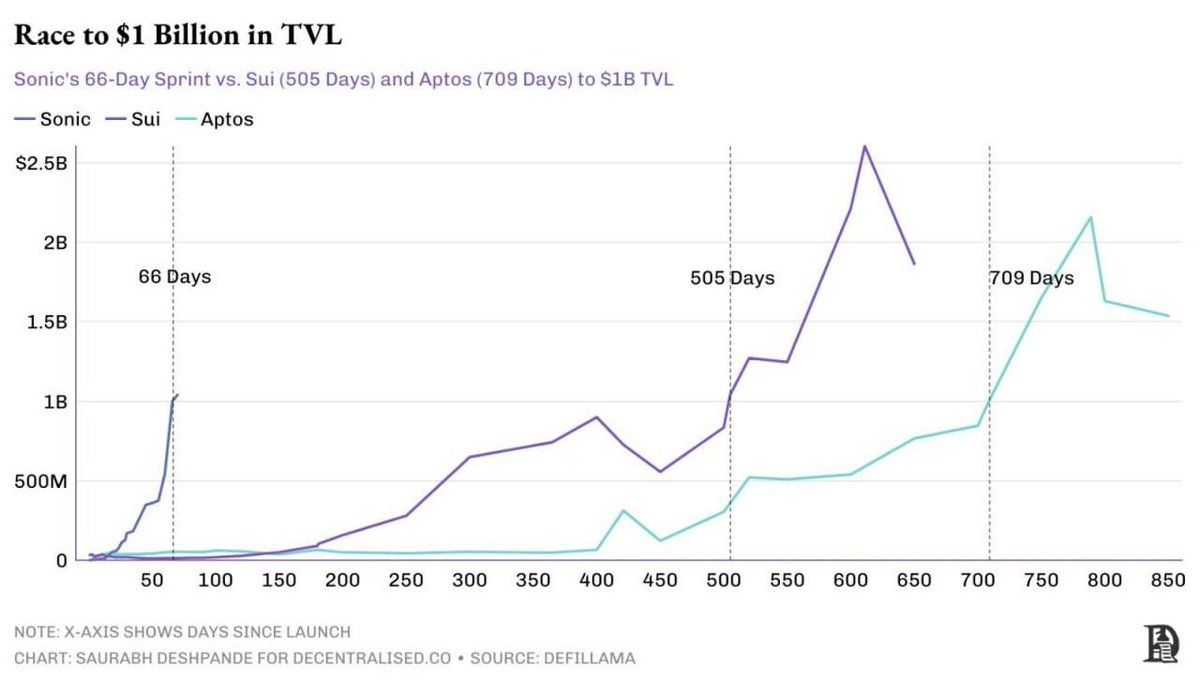

Sonic has made its mark with a rapid TVL growth rate, far outpacing better-known blockchains. According to DefiLlama, Sonic reached $1 billion in TVL within 66 days. In comparison, Sui took 505 days, and Aptos needed 709.

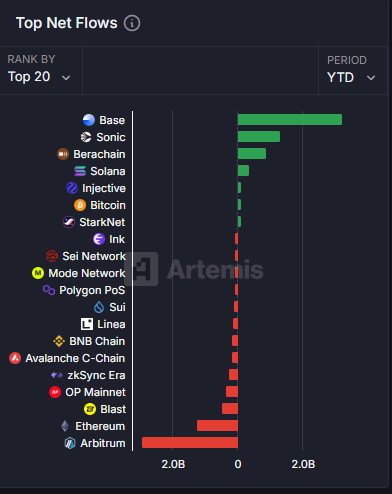

This achievement reflects strong capital inflows into the Sonic ecosystem despite the broader DeFi trend of capital withdrawal. Data from Artemis supports this, ranking Sonic as the second-highest netflow protocol this year—trailing only Base, a blockchain backed by Coinbase.

The growth goes beyond TVL numbers. Sonic’s ecosystem is attracting various projects, including derivatives exchanges like Aark Digital and Shadow Exchange and protocols such as Snake Finance, Equalizer0x, and Beets. These projects still have small TVLs, but they have the potential to draw new users and capital, fueling Sonic’s momentum.

However, the question remains: Can this capital inflow remain sustainable while the market fluctuates?

Andre Cronje on Sonic’s Potential and Strengths

Andre Cronje, the developer behind Sonic, shared his ambition in an interview to push this blockchain beyond its competitors.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Andre Cronje said.

According to Cronje, Sonic isn’t just about speed. The platform also focuses on improving both user and developer experience. He explained that 90% of transaction fees go to dApp, not to validators, creating incentives for developers to build.

Unlike other blockchains, such as Ethereum, which are limited by long block times, Sonic leverages an enhanced virtual machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, however, that current demand has yet to push the network to its full capacity. Still, these technical advantages make Sonic a compelling option for developers seeking more user-friendly dApps.

He also revealed new features on Sonic that have the potential to attract users.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Andre Cronje revealed.

Risks and Challenges Ahead

Despite reaching impressive milestones, Sonic is not immune to risk. The price of its token, S, has declined significantly from its peak. According to BeInCrypto, it has dropped around 20% in the past month—from $0.60 down to $0.47—mirroring the broader market’s volatility.

Furthermore, Grayscale recently removed Sonic from its April asset consideration list. This decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain its TVL should investor sentiment deteriorate.

Sonic also faces fierce competition from other high-performance chains like Solana and Base. Although Sonic holds a clear advantage in speed, long-term user adoption will depend on whether its ecosystem can deliver real value, not just high TVL figures.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

6.96 Billion Dogecoin In 24 Hours As DOGE Price Adds 1%

The leading meme coin Dogecoin has surged nearly 1% today, defying the broader market downturn momentum, with 6.96 billion coins traded over the last 24 hours. However, although the number seems big, it appears that the ongoing DOGE price surge is less likely to be sustained ahead. Despite that, some of the recent market trends hint that the meme coin may gain more exposure in the market due to soaring institutional interest.

Dogecoin price has mitigated some of its recent losses and traded at $0.157. Notably, it comes as the digital assets space stayed in the red, with the global crypto market losing 0.25% to $2.58 trillion. Ethereum was one of the top laggards among the top 10 coins, losing nearly 3% over the last 24 hours.

However, despite the recent gains, DOGE price has lost more than 6% in the weekly chart, while touching a 24-hour high and low of $0.158 and $0.1494. Besides, a total of 6.96 billion tokens were traded in the last 24 hours, totaling $1.09 billion.

Despite that, the one-day trading volume was down more than 45%, suggesting a volatile period ahead. Besides, CoinGlass data showed that DOGE Futures Open Interest fell 1% to $1.43 billion, reflecting the still gloomy sentiment hovering in the market.

For context, if high prices are not being supported by soaring trading volumes, it signals a concerning trend for the asset. This disparity can be a warning sign that the uptrend is weakening or a reversal is imminent.

Having said that, Dogecoin’s current low volume indicates a lack of broad market support, leaving the price vulnerable to a decline. With fewer traders actively buying, the top meme coin may be due for a correction.

Recent Trends Suggests Otherwise: Dogecoin (DOGE) Price To Rally?

One of the most recent positive developments on the meme coin is the 21Shares filing for DOGE ETF with the US SEC. The asset manager has revealed this significant step towards launching the investment instrument by filing the S-1 form with the US SEC on April 9.

Meanwhile, this move makes 21Shares the third company, after Grayscale and Bitwise, to seek approval for a DOGE ETF. The next step involves filing the 19b-4 form, which will officially start the approval process.

If approved, the ETF would provide investors with a new way to gain exposure to Dogecoin, potentially increasing its mainstream acceptance and market accessibility. Besides, 21Shares has also planned to launch DOGE ETP in Europe through a partnership with the House of Doge.

However, despite these bullish developments, investors should exercise due diligence before entering the market in this volatile scenario. For context, a recent Dogecoin price prediction indicates that the crypto might hover near the $0.1499 mark through April.

Having said that, it appears that the crypto might hover near the flatline in the coming days unless any major catalyst boosts the market sentiment further.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Why Pi Network Price Should Hit $10, Or Its Over for Pi Coin

After a steep fall to $0.40 earlier this week, the Pi Network price bounced back to $0.60 levels, with its market cap above $4.1 billion. However, on-chain data shows that investors’ interest in the Pi Coin is waning quickly, with daily trading volumes dropping another 44% to $158 million. Analysts point out that the increasing supply of PI tokens at the exchanges can further dampen the upside and could put the ecosystem growth in the shadows.

Why Is Pi Network Investor Sentiment Down

Pi Network community member Edycabas recently shared his take on the collapse of transaction activity on the blockchain. He noted that the Pi blockchain is underwhelming, reportedly processing less than one transaction per second, despite years of promotion suggesting thousands of transactions per block during its Open Mainnet phase.

Responding to this, another community member, Dr Altcoin, noted that the blockchain itself remains operationally robust, boasting a 99.5% transaction success rate and averaging 20 transactions per block. “The real issue lies in transparency concerns surrounding the co-founders, which continue to deter major investors and centralized exchanges (CEXs),” he said.

Besides, Dr Altcoin also shared aspirations for the Pi Network price to reach a minimum token value of $10, which, as per the analyst, would significantly boost engagement with decentralized applications (DApps) and broader adoption. Dr Altcoin has also previously suggested for Pi token burns to boost the Pi Coin price higher.

Pi Coin Core Team Lacks Transparency

Dr. Altcoin has also questioned the Pi Network co-founders’ reluctance to engage publicly, urging them to address the community and investors. “Why do the co-founders avoid interviews?” Dr. Altcoin asked, adding that the “Pi Community has kept this project alive for years, and it deserves greater recognition”.

Dr. Altcoin stressed that co-founders Nicolas Kokkalis and Chengdiao Fan must step up to showcase the project’s potential to prevent the token from declining further, warning of a possible Pi Coin price dip below $0.30 in the coming week.

Crypto analyst Dr. Altcoin has issued a statement predicting significant activity on centralized exchanges (CEXs) as unlocked Pi tokens flood the market. Starting next week, an average of 134 million Pi tokens will reportedly enter circulation monthly.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market22 hours ago

Market22 hours agoADA Price Surge Signals a Potential Breakout

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market12 hours ago

Market12 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market21 hours ago

Market21 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish

-

Altcoin14 hours ago

Altcoin14 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market14 hours ago

Market14 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market23 hours ago

Market23 hours agoHedera (HBAR) Jumps 14%—More Gains Ahead?

-

Ethereum23 hours ago

Ethereum23 hours agoIs Donald Trump’s World Liberty Finance Behind The Crash To $1,400?

✓ Share: