Altcoin

Bitwise CIO Predict Altcoins Will Benefit From A Donald Trump Win

Bitwise Chief Investment Officer Matt Hougan commented on the potential impact of the upcoming U.S. presidential election on cryptocurrencies. He suggested that a Donald Trump victory may be more favorable for Ethereum and other altcoins than for Bitcoin. According to Hougan, altcoins stand to benefit from a Trump-led administration due to anticipated regulatory clarity. Hougan’s comments, shared just days before the November 5 election, indicate the market’s growing anticipation.

Bitwise CIO: Regulatory Clarity Under Donald Trump Could Spark Altcoin Rally

In a recent interview, Bitwise CIO Matt Hougan suggests that regulatory clarity under a Donald Trump administration could benefit Ethereum and other altcoins more than Bitcoin. Hougan explained that while Bitcoin is already well-regulated as a commodity under the SEC and CFTC, other cryptos face a less certain regulatory environment.

For Ethereum and similar assets, a Trump victory might reduce ambiguity, creating a more favorable landscape for development and investment. The current lack of clarity has left some altcoins like XRP exposed to varying levels of scrutiny.

For Bitwise CIO Hougan, the possibility of clearer guidelines and more stable frameworks under Trump could allow altcoins to thrive in ways they haven’t before. Altcoins typically involve a broader range of use cases, including decentralized finance (DeFi), cross-chain interoperability, and smart contracts that require tailored regulatory approaches.

Hougan believes a Trump administration may take a more hands-off approach, which could encourage innovation across the altcoin market. These sentiments are shared across the crypto space. Most recently, Founder and CEO of Consensys, Joseph Lubin, emphasized that the US SEC’s regulatory actions have led to “lost jobs and halted productive investments” in blockchain.

Moreover, Hougan emphasized that broader regulatory clarity would likely drive institutional adoption across the altcoin market. Large institutions often wait for explicit guidelines before entering emerging markets. According to Bitwise CIO Hougan, clearer regulations would help reduce market volatility and make it easier for institutions to manage risk. As a result, a Trump administration prioritizing crypto clarity might unlock capital flows into the altcoin space

Polymarket Betting Odds Favor Donald Trump

Recent data from Polymarket, an Ethereum-based prediction market, indicates growing confidence in a Republican win. CoinGape recently reported the former president’s winning odds reached an all-time high of 66.7%. Polymarket has seen a surge in betting activity during this election season, amassing over $3 billion in cumulative wagers. More so, analysts from Presto have noted that a Trump-led Republican sweep in the presidency, Senate, and House could improve the chances of passing crypto-friendly legislation.

However, Polymarket has come under scrutiny for alleged wash trading, which may have artificially inflated trading volumes and popularity metrics. Blockchain analysis firms Chaos Labs and Inca Digital reported that about one-third of Polymarket’s trading volume could be attributed to wash trading.

Meanwhile, Amid Bitwise CIO prediction, Elon Musk has announced an investigation into the Kamala Harris campaign’s alleged use of Discord to coordinate social media support. Reports suggest that campaign volunteers were instructed to manipulate social media algorithms.

In addition, according to a report by CoinGape, some prominent U.S. politicians remain opposed to cryptocurrencies. The report noted figures like Senator Elizabeth Warren, Sherrod Brown, and Congressman Brad Sherman actively supported anti-crypto legislation. Their stance could influence crypto-related legislation, depending on the outcome of the upcoming US election.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

Cardano price is repeating a pattern from 2024 that experts say is a signal for a massive pump in the coming weeks. While present figures are largely underwhelming for ADA, investors are brimming with confidence for a strong reversal in the near future.

Cardano Price Can Reach $2.5 In May

According to pseudonymous cryptocurrency analyst Master Kenobi, Cardano price is exhibiting cyclical behavior. In a post on X, Master Kenobi notes that ADA’s consolidation in recent days mirrors its price action from Q3 of 2024.

At the time, Cardano’s price suffered a steep correction in early August and endured a lengthy consolidation period before rallying. Presently, Cardano’s price is consolidating after the deep in early February that sent prices to $0.49.

“ADA is currently in a consolidation phase that resembles its behavior from August-September 2024,” said Master Kenobi. “Since the dip on August 5, it hasn’t recorded a new low – just as it hasn’t now, following the dip on February 3.”

According to Master Kenobi, a lengthy consolidation phase will be the precursor for an impressive rally for Cardano’s price. The analyst theorizes that the incoming rally will send Cardano to impressive levels in May. In the short term, analysts are eyeing ADA to hit $1, citing rising whale activity and positive fundamentals.

“If this pattern holds, May could bring a massive pump, potentially pushing the price toward $2.5,” said Master Kenobi.

ADA Ripples With Bullish Activity

At the moment, Cardano price is trading at $0.6646, a far cry from its all-time high of $3.10. Despite the lull in price action, the ecosystem is brimming with bullish activity for higher valuation.

Investors have their eyes on $10 after ADA outperformed top S&P 500 companies in a strong show of resilience. Futhermore, increased whale activity in the space is signaling an impending rally for ADA as community sentiment reaches an all-time high.

Analysts have opined that an ADA rally to $10 is not a crazy prediction, citing a slew of positive fundamentals for the network. However, pundits are urging investors to brace for multiple corrections in the march to reach a valuation of $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

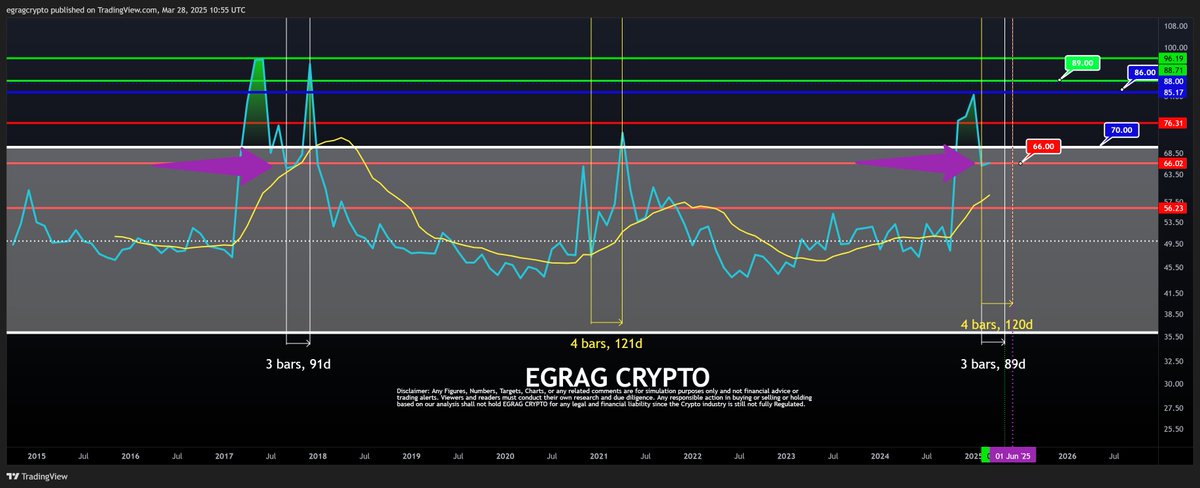

Crypto analyst Egrag Crypto has again provided a bullish outlook for the XRP price. This time, he alluded to historical trends to explain why the altcoin can hit a new all-time high (ATH) in 90 to 120 days.

Why The XRP Price Can Hit ATH In 90 To 120 Days

In an X post, Egrag Crypto alluded to historical patterns to explain why the XRP price can hit a new ATH in the next 90 to 120 days. He noted that the RSI chart shows important historical patterns and stated that the altcoin usually has two peaks during its bull runs.

The crypto analyst further revealed that in 2021, the second peak occurred after 90 days, while in 2017, it occurred after 120 days. Based on this, Egrag Crypto affirmed that this historical timeframe provides market participants with a potential for a “great opportunity,” hinting at the altcoin hitting a new ATH.

In another post, he raised the possibility of the XRP price reaching a new ATH of $3.9 by May. This came as he identified an Inverse Head and Shoulder pattern, which was forming for the altcoin. The crypto analyst stated that the measured move is $3.7 to $3.9.

For now, an XRP analysis has shown that the altcoin is struggling at $2.15 amid regulatory uncertainty over SEC Chair nominee Paul Atkins. In his update on this Inverse Head and Shoulder pattern, Egrag Crypto remarked that a close above $2.24, the Fib 0.888, is the next minor target. He affirmed that the pattern is still unfolding as anticipated.

Ripple’s Native Token Could Still Drop Below $2

Crypto analyst Dark Defender has predicted that the XRP price could still drop below $2 before the next leg up. In an X post, he stated that Ripple’s native token is in the 4th Wave of the Monthly Elliott Wave structure.

His accompanying chart showed that XRP could drop to as low as $1.88 on this Wave 4 corrective move. Once that is done, the altcoin will witness its next leg up, rallying to as high as $5.8, which would mark a new ATH.

Dark Defender assured that Wave 4 will end soon and that XRP will continue to reach its targets. The crypto analyst recently affirmed that the altcoin is the “one” and explained why it would dominate Bitcoin and Ethereum.

Crypto analyst CasiTrades also suggested that XRP could further decline before its next leg to the upside. She noted that after the drop to $2.27, the altcoin showed no bullish RSI divergence, which signaled that the drop wasn’t quite done yet.

She added that the coin is now likely heading down to test the 0.618 golden retracement at $2.17, or possibly the golden pocket at $2.15 for a final low before “lift-off.” However, CasiTrades also mentioned that RSI is starting to build the bullish divergence and that the selling pressure is exhausting.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Gemini Crypto Exchange Announces Rewards For XRP Users, Here’s How To Get In

Gemini, the crypto exchange founded by the Winklevoss twins, is promoting its previously launched XRP cashback program, which offers crypto rewards to users. This initiative allows eligible participants to earn rewards on their XRP transactions. Here’s a look at the program details and the steps required to join.

Gemini Founder Unveils XRP Cashback Rewards

On March 27, Tyler Winklevoss reminded the XRP community and Ripple army on X (formerly Twitter) that they can earn rewards in the token whenever they use the Gemini Credit Card for purchases. The Gemini credit card, launched in partnership with Mastercard in 2021, allows users to choose cryptocurrencies from Bitcoin, Ethereum, XRP, and over 50 other digital assets for cashback.

Since adding XRP to its long portfolio of crypto cashback offerings in August 2023, Gemini has continued to support the third-largest cryptocurrency as an option for crypto enthusiasts. The Credit Card reward information announced by Winklevoss was well received by the XRP community.

He explained that the Gemini Credit Card allows users to earn crypto back each time they spend fiat. He clarified that this feature is only available to residents in the United States (US) currently. The Gemini founder also revealed that he has been using the Credit Card for years and has had a great experience accumulating significant crypto rewards from the cashback program.

Gemini’s Credit Card offers tiered cashback rates depending on the purchase categories. A 4% XRP cashback is offered on gas and EV charging, with up to $200 monthly. A 1% XRP cashback is available for fuel and EV charging after exceeding the monthly limit. Finally, a 3%, 2%, and 1% XRP cashback is provided for dining, groceries, and other purchases, respectively.

As XRP continues to push for widespread adoption, this Gemini cashback reward program strengthens its utility and encourages greater usability and investments.

Notably, Gemini isn’t the only crypto exchange embracing XRP in its rewards programs. Platforms like WhiteBIT and Bit2Me have also introduced similar programs. By offering an XRP cashback, Gemini and other crypto exchanges can make crypto more accessible, encourage faster adoption, and reinforce XRP’s role as a digital payment solution.

How To Participate In Gemini’s XRP Cashback

Gemini has specified that users interested in earning XRP rewards from Gemini’s cashback program must first qualify for the exchange’s Credit Card, which depends on their credit score. Approved applicants must secure their cards by June 30, 2025, to participate in the promotional offer.

The crypto exchange also stated that new cardholders could earn up to $200 in XRP cashback if they spend at least $3,000 within the first 90 days. Once earned, the XRP reward will be automatically deposited into their trading accounts on Gemini, enabling users to hold, trade, or sell whenever they wish. The Credit Card also comes with no extra annual, exchange, or foreign transaction fees, allowing crypto users to grow their portfolios continually.

Featured image from SCMP, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

-

Market18 hours ago

Market18 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum May Have Hit Cycle Bottom, But Pricing Bands Signal Strong Resistance At $2,300

-

Market16 hours ago

Market16 hours agoBitcoin (BTC) Whales Accumulate as Market Faces Uncertainty

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Analyst Eyes $1,200-$1,300 Level As Potential Acquisition Zone – Details

-

Bitcoin15 hours ago

Bitcoin15 hours agoGold Keeps Outperforming Bitcoin Amid Trump’s Trade War Chaos

-

Regulation23 hours ago

Regulation23 hours agoKentucky Governor Signs Off On ‘Bitcoin Rights’ Bill, Strengthening Crypto Protections

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Reveals Why The XRP Price Can Hit ATH In The Next 90 To 120 Days

✓ Share: