Altcoin

Bitcoin Leads Market Upswing, Altcoins To Follow Suit?

The cryptocurrency market experienced a modest recovery as Bitcoin briefly surpassed $62,000, leading a positive trend across the top cryptos by market cap. This upswing suggests a potential return of bullish sentiment. However, the market’s volatility was evident in the significant liquidations, totaling over $87 million in the past 24 hours, with $56 million from short positions. Despite the 2.18% increase in the global crypto market cap to $2.29 trillion, the total trading volume saw a notable 29.28% decrease over the same period.

Bitcoin’s Performance and Outlook

At the time of reporting, Bitcoin price trades at $61,725.59, with a 24-hour trading volume of $24.6 billion and a 1.4% price increase. Its market cap stood at $1.2 trillion. Several factors contributed to this uptick:

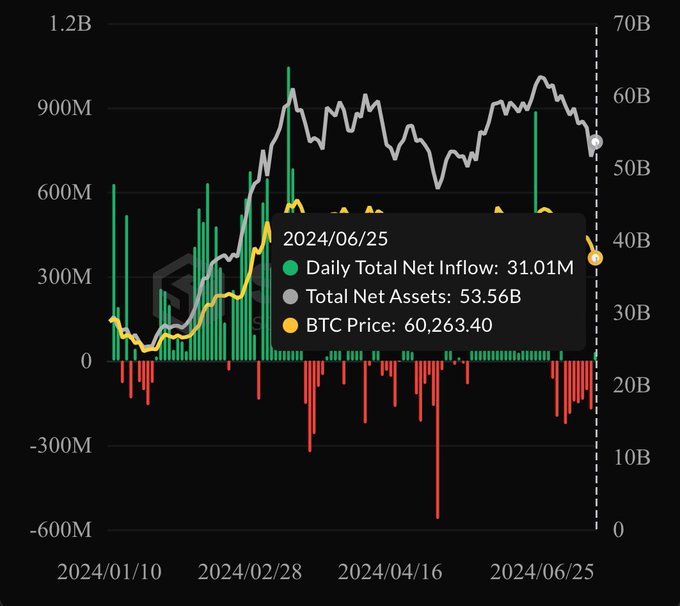

- Bitcoin ETFs saw $31 million in inflows after seven consecutive days of outflows, potentially influencing the recent price movement.

- Analyst Crypto Faibik identified a bullish flag pattern on the weekly chart, predicting a possible surge to $88,000 by July or August. This optimistic view is supported by the current “Fear” sentiment in the market, as indicated by the Bitcoin Fear and Greed Index at 30.

- Analyst Ali Martinez highlighted historical data suggesting significant price increases following similar RSI conditions in the past two years. Martinez also noted the Market Value to Realized Value (MVRV) Ratio’s current level below -8.40%, which has historically preceded price increases ranging from 28% to 100%.

Sequel to this prediction, the Bitcoin relative strength index has moved up beyond the 50% level signaling bullish presence. As at time of writing the RSI is at 52.3 level.

Sequel to this prediction, the Bitcoin relative strength index has moved up beyond the 50% level signaling bullish presence. As at time of writing the RSI is at 52.3 level.

Altcoins Surge as Crypto Market Recovers

In a notable market upswing, leading altcoins have posted significant gains, riding the wave of the broader cryptocurrency market recovery. Ethereum (ETH) and other top altcoins including Solana (SOL), Dogecoin (DOGE), and Shiba Inu (SHIB) have all seen positive price movements, with increases ranging from 0.8% to 2.8%.

Ethereum, the second-largest cryptocurrency by market capitalization, is currently trading at $3,387.68. With a substantial 24-hour trading volume of $10.48 billion, ETH has recorded a 0.82% price increase over the last day.

Solana (SOL) has shown even stronger performance, with its price reaching $136.99. The altcoin has seen a 2.19% uptick in the past 24 hours, accompanied by a trading volume of $2.72 billion.

Meme coins have also joined the rally, with Dogecoin (DOGE) and Shiba Inu (SHIB) posting notable gains. DOGE is currently priced at $0.01253, representing a 2.82% increase, while SHIB is trading at $0.0001763, up 2.74% in the last 24 hours.

The meme coin sector as a whole has experienced significant growth, with its total market capitalization surging by 4.15% to reach $49.25 billion. While Shiba Inu saw an approximate 3% increase, other major players in the segment, including Dogecoin, Pepe Coin, and WIF, have also shown positive momentum.

This widespread rally across various altcoins indicates a potential shift in market sentiment, with investors showing renewed confidence in the cryptocurrency space beyond just Bitcoin. As the market continues to evolve, all eyes will be on whether this positive trend can be sustained in the coming days.

Also Read: Pepe Coin Whale Sparks Concerns With 1 Tln PEPE Transfer To Binance, What’s Next?

Market Dynamics and Future Outlook

The recent market gains have led to significant liquidations, particularly affecting short positions. Long positions also faced some setbacks, with $30.9 million liquidated. The cryptocurrency market had been declining for two weeks prior, influenced by factors such as ETF outflows, Germany’s sale of seized Bitcoin, and anticipated movements of Mt. Gox-held Bitcoin.

Bitcoin and Ethereum were particularly impacted by recent liquidations, which exceeded $360 million on June 24 when Bitcoin fell below $60,000. Analysts are monitoring “accumulation whales” who may be capitalizing on lower prices to increase their holdings.

As Bitcoin shows signs of recovery amid positive technical indicators and market sentiment, the focus shifts to whether altcoins will follow suit. With analysts projecting potential price increases and investors seeking strategic opportunities, the crypto market appears set for an interesting period of broader recovery and evolving market dynamics.

Also Read: Top Reasons Why Shiba Inu Coin Price Soaring, Here’s Price Target As Whales Buy

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

XRP ETF Approval Could Spark a ‘Perfect Storm’ for Ripple Coin: Expert

As the Ripple community eagerly awaits the XRP ETF launch, all eyes are on its potential impact on the token’s price. Experts believe that the US Securities and Exchange Commission’s (SEC) approval of a Ripple ETF and its potential launch spark a ‘perfect storm’ for the coin.

As XRP hovers around the crucial $2 mark, traders and analysts are closely monitoring its movements, particularly in anticipation of the ETF launch. Let’s analyze what expert ‘Good Morning Crypto’ thinks about the ETF’s influence on the coin’s price.

Will XRP ETF Launch Trigger a Ripple Coin Price Surge?

In a podcast, crypto analyst Good Morning Crypto identified an inevitable connection between XRP ETF launch and Ripple coin price surge. According to him, the SEC’s approval of the XRP ETF and the subsequent launch could lead to a price rally that is poised to take the token to new all-time highs.

While acknowledging the exchange-traded fund’s potential to drive a price surge, the analyst used an analogy of “giant vacuum cleaners” to show how ETFs absorb XRP liquidity. This means that the ETFs will remove the asset from circulation, locking it in a secure custodian each time investors buy in. Thus, the launch of an ETF could reduce the availability of the token for trading, which indeed will result in a massive bull run.

ETFs Spark XRP’s Front-Loading Frenzy: A Perfect Storm for Price Growth

Further, the analyst shed light on the favorable regulatory conditions in the US under President Donald Trump. He predicted that with clearer US regulations by August, businesses will start using XRP for payments, leading to increased demand.

As ETFs buy up XRP, creating scarcity, companies may front-load their token purchases. This development could significant trigger a price rally, as pointed out by Good Morning Crypto.

Recently, CoinGape reported that XRP price could hit $15, if the ETF inflows reach $4 billion. This prediction is based on market expert Zach Rector’s analysis, who also forecasted the token’s target of $30 with an ETF inflow of $8 million.

Is XRP Poised for a Rally?

As of press time, XRP is trading at $2.08, with a marginal increase of 0.51%. Despite a 0.96% increase over the past week, the token saw a massive decline of 15.9%.

With speculations of an imminent XRP ETF launch rising, the community expects a bull run in the near future. Analyst Brett recently shared a bullish forecast for XRP price. According to him, XRP’s explosion to an ambitious $10 is imminent.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price To Hit $4 If This Happens, Analyst Says Despite 180M ADA Dump

A renowned crypto market analyst predicted that Cardano price could hit $4 ahead despite the current broader market uncertainty. ‘ALLINCRYPTO’ has forecasted a highly bullish outlook for the crypto recently, primarily against the backdrop of historical data. However, traders and investors are left scratching their heads as the market also saw massive ADA whale dumps, with 180 million coins offloaded.

Cardano Price Eyes $4, Analyst Predicts Citing Historical Data

According to ALLINCRYPTO’s X post on April 18, Cardano price is eyeing $4 as the analyst believes history is set to repeat itself. A major bull run lies ahead as the price is completing its final cycle, per the analyst.

For context, the ALLINCRYPTO’s chart spotlights how ADA had a massive bull run as of 2020 and continued till mid-2021. Citing this past performance, the analyst revealed that a $4 price target lies ahead.

Crypto market traders and investors are left speculating if such a feat is even possible amid broader market trends. It’s also noteworthy that historical performances don’t always guarantee future performances, given the dynamic nature of digital assets.

However, another renowned analyst has joined the fray by projecting a bullish outlook for Cardano price. Analyst Ali Martinez revealed in an X post on April 18 that the crypto is consolidating within a triangle, setting the stage for a potential 30% price move. This bullish prediction has slightly tilted the scales towards the optimistic side.

ADA coin’s price currently rests at $0.6298, up nearly 2.5% over the past day. The coin’s intraday bottom and peak were recorded as $0.612 and $0.6341, respectively.

Massive Whale Dumps Usher Caution

Besides, recent whale metrics have conversely stirred up some caution among investors, underscoring rising selling pressure on the asset. According to another X post by Ali Martinez, whales took advantage of the recent ADA price upswing to offload 180 million coins in the past 5 days.

This massive selling has also hinted at declining market confidence surrounding the cryptocurrency. As a result, market watchers are slightly apprehensive regarding the bullish predictions shared by the analysts.

Besides, a Cardano price prediction by CoinGape also revealed that bears remain in control of the asset at the moment, as per the 3-month bias indicator. In turn, broader market sentiments surrounding the coin’s long-term prospects remain shrouded in an enigma.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Chainlink Price To Hit $26 If LINK Breaks Past This Crucial Level

The Chainlink price is poised for liftoff, with a bullish rebound on the horizon. As LINK has soared past its key support level, analysts and traders remain bullish about the altcoin’s potential rally new heights.

Analysts like Ali Martinez and CRYPTOWZRD have identified critical levels for LINK, invoking the community’s attention. Let’s unveil Chainlink’s potential movements through the analyses of popular analysts.

Is Chainlink Price Ready for a Rebound?

In a detailed analysis, analyst Ali Martinez spotted key support and resistance levels for Chainlink. According to Ali’s analysis, Chainlink’s support level is established at $12.28, while $14.58 acts as a significant resistance hurdle.

With the Chainlink price breaking past its support line, which now acts as a foundation, the stage is set for a potential bullish reversal, signaling an upward trend. And, if LINK breaks past the $14.58 point, which has been a significant resistance point, further upside momentum comes into view, with potential new highs on the horizon.

Chainlink’s Next Target: Is $26 Within Reach?

According to market expert CRYPTOWZRD, Chainlink daily technical outlook is uncertain, with an indecisive close. However, the analyst highlighted that LINK is currently testing the significant $12.50 level. Given LINK’s oversold condition, its price movement is likely to follow Bitcoin’s trend.

Interestingly, as pointed out by CRYPTOWZRD, LINKBTC’s daily falling wedge formation suggests potential for an impulsive upside breakout. LINK itself is forming a daily falling wedge above its lower high trend line, indicating a possible rally towards the $16 resistance target and beyond.

Significantly, the chart presented by the expert indicates that LINK could hit $26 if it passes the resistance point. However, as per CoinGape’s Chainlink Price Prediction, LINK will reach a maximum of $15.24 in 2025.

Meanwhile, LINK’s intraday chart showed a lack of clear direction, with price movements confined to a narrow range. A breakout above $13.20 could present a trade opportunity, while a decline below $11.80 would signal a test of the main support level.

LINK Market Sentiment Analysis

In an “In/Out of the Money Around Price” analysis, Ali Martinez shared insights into the market sentiment for LINK. The analyst detailed the number of traders holding Chainlink at different price points.

At press time, Chainlink is trading at $12.81, up1.46%. Despite a 0.86% surge over the past week, LINK experienced a massive decline of 30.99% over the last month.

Notably, more addresses are holding LINK at a loss than at a profit. According to the chart, 53.06% of the holdings are “out of the money,” which means that they represent 78.24 million LINK bought at a price above the current $12.68.

At the same time, 44.63% of analyzed holdings, representing 65.81 million LINK, are ‘in the money,’ having been bought by traders at a price below $12.68. This data highlights potential support and resistance levels, with significant holdings at $12.47 and $14.19.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market14 hours ago

Market14 hours agoPi Network Roadmap Frustrates Users Over Missing Timeline

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum ETFs Record $32M Weekly Outflow; ETH Price Crash To $1.1K Imminent?

-

Market15 hours ago

Market15 hours agoMEME Rallies 73%, BONE Follows

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Price Stalls In Tight Range – Big Price Move Incoming?

-

Market13 hours ago

Market13 hours agoSolana (SOL) Price Rises 13% But Fails to Break $136 Resistance

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price History Signals July As The Next Bullish Month

-

Market22 hours ago

Market22 hours agoAre Ethereum Whales Threatening ETH Price Stability?

-

Market21 hours ago

Market21 hours agoHow $31 Trillion in US Bonds Could Impact Crypto Markets in 2025

✓ Share: