Market

Can It Gain Bullish Momentum?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Investors Says Rally Is Not Over

Crypto investor Raoul Pal has shared a bullish outlook for Solana (SOL), suggesting the altcoin could see further gains despite recently reaching a new all-time high. His prediction coincides with two new ETF filings featuring SOL, which could increase the cryptocurrency’s demand and visibility in mainstream markets.

For investors, this forecast aligns with Solana’s expanding ecosystem and growth. The key question remains: How high can SOL rise before hitting the ceiling of this bull cycle?

Pal Expects Solana to Continue Climbing

Pal’s comment after SOL’s price climbed above its previous peak of $260. According to the investor, who is also the founder of Real Vision, a crypto education platform, the rally is far from over, suggesting that the recent hike could be the start of another incredible run.

“SOL — been quite the ride so far from the low to new all time highs. Plenty more to go,” Pal shared on X.

Furthermore, this Raoul Pal Solana prediction might not surprise market observers. Since the FTX collapse in 2022, Pal has consistently argued that Solana was undervalued, especially after it plunged to as low as $8.

What makes this forecast even more intriguing is its timing. It coincides with two notable developments in the institutional space: asset management giants VanEck and 21Shares filing for Solana-based ETFs.

These filings signify the growing institutional interest in Solana, potentially driving demand and reinforcing the bullish sentiment around its price potential.

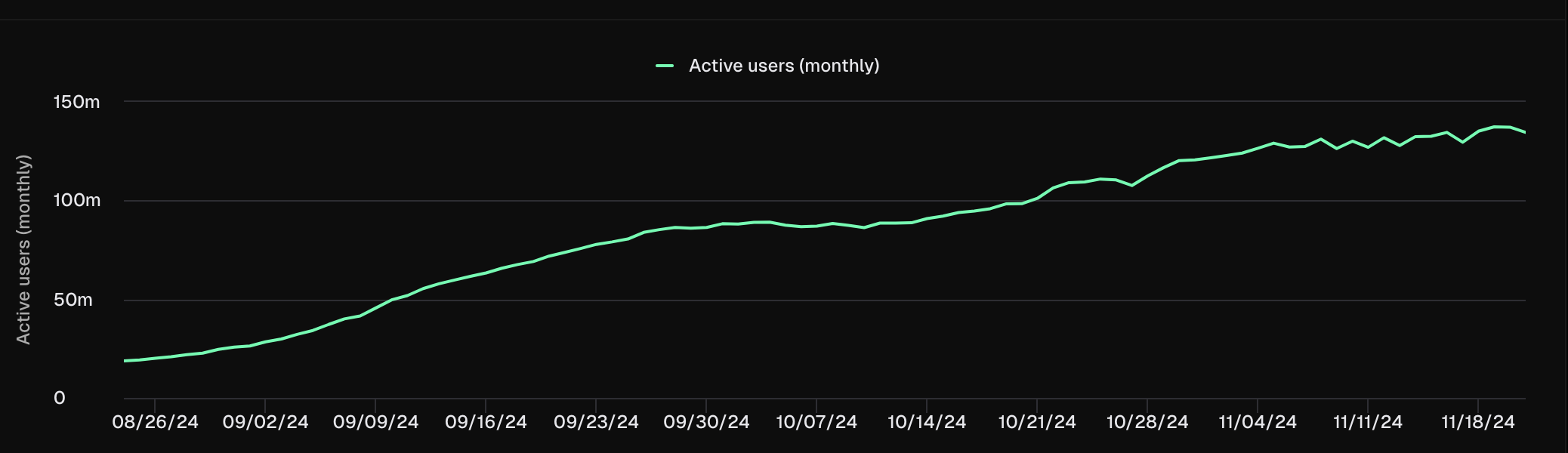

Besides institutional developments, retail investors are also contributing to Solana’s growing momentum. According to Token Terminal, Solana’s monthly active users have seen a significant increase, reaching 134.60 million.

This uptick reflects a rise in the number of addresses actively transacting with SOL, suggesting a broad-based interest in the ecosystem.

Such sustained growth in active users typically suggests healthy network activity and adoption — both of which are bullish indicators for the altcoin’s long-term outlook.

SOL Price Prediction: $300 Looks Feasible

On the daily chart, Solana’s price, currently at $258.81, rallied due to the formation of an inverse head-and-shoulders pattern. An inverse head and shoulders is a bullish chart pattern indicating a potential reversal from a downtrend to an uptrend

Furthermore, a neckline connects the highs of the two troughs and serves as a key resistance level. When the price breaks above this neckline, it confirms the reversal, often accompanied by increased volume.

As seen below, SOL’s price has broken out of the pattern. Should buying pressure increase, the altcoin could climb as high as $300 in the short term.

However, a breakdown below the $235.91 support could invalidate the thesis. In that scenario, the cryptocurrency could decline to $215.21.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stellar (XLM) Price Climbs to Three-Year High

Stellar (XLM) price has surged more than 20% in the last 24 hours and is up an impressive 124.86% over the past seven days, reaching $0.30, its highest price since December 2021. This rapid ascent reflects strong bullish momentum, supported by key indicators like RSI, which remains in the overbought zone.

However, the relatively weak CMF suggests that the current trend may not yet have the strength to sustain further gains without renewed capital inflows. Whether XLM can push toward a $10 billion market cap or face a potential correction will depend on how well it holds key support levels in the days ahead.

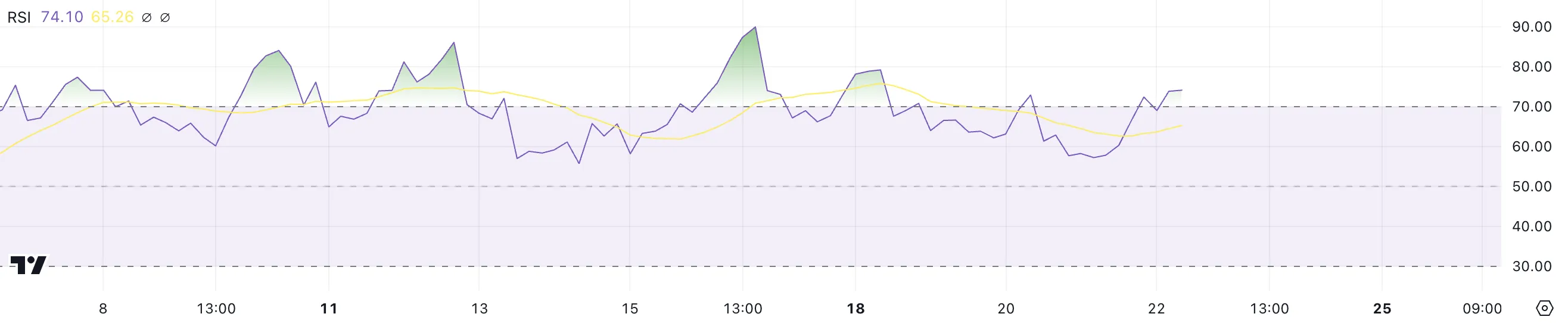

XLM RSI Is In The Overbought Zone

Stellar RSI is 74.10, rising sharply from below 60 just a day ago. This increase signals strong bullish momentum, pushing XLM into the overbought zone, where RSI values above 70 indicate heightened buying activity.

While an RSI above 70 often suggests that a correction could be on the horizon, it also reflects strong market enthusiasm driving the current uptrend.

The RSI measures the speed and magnitude of price movements, with values above 70 signaling overbought conditions and below 30 indicating oversold levels. Historically, Stellar has experienced periods where its RSI remained above 70 for several days, during which the price continued to climb before eventually correcting.

This suggests that while caution is warranted, the current overbought conditions do not necessarily mean an immediate reversal, as the rally could still have room to grow before cooling off.

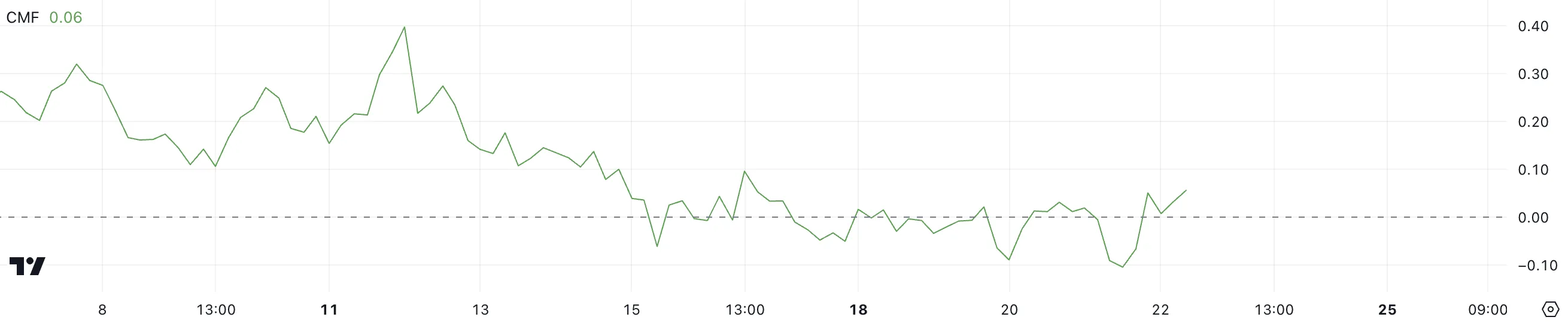

Stellar CMF Is Positive But Not That Strong Yet

XLM currently has a CMF of 0.06, recovering from -0.10 just one day ago. This shift into positive territory indicates an inflow of capital back into the asset, suggesting renewed buying pressure after recent selling activity.

However, the relatively low CMF value highlights that the inflow is not yet as strong as it was during earlier periods of significant bullish momentum.

The Chaikin Money Flow (CMF) measures the volume and direction of money flow, with positive values indicating capital inflows (bullish) and negative values reflecting outflows (bearish).

While XLM’s CMF turning positive is a good sign for its short-term trend, it remains far below the levels seen in mid-November when the CMF peaked at 0.40 and stayed above 0.10 for almost a week.

XLM Price Prediction: Can Stellar Reach The $10 Billion Market Cap Threshold?

If Stellar maintains its current uptrend, it could rise further to test a market cap of $10 billion. Achieving this milestone would require a 15.7% increase in XLM price, signaling continued strong bullish momentum and renewed investor interest.

However, as indicated by the relatively weak CMF, the current trend may lack the strength to sustain this upward trajectory.

If the trend reverses, XLM price could first test its strongest nearby support at $0.14. Should this level fail, Stellar price could drop further to $0.0994, representing a steep 67% correction from recent highs.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 altcoins that could go ballistic if Bitcoin (BTC) crosses $120,000 mark

Some altcoins are setting themselves up to profit from the positive wave as the crypto market prepares for Bitcoin’s possible breakout above the $120,000 mark. Rexas Finance (RXS), SUI, and Solana (SOL) are being hailed by some industry insiders as particularly outstanding performers and ready to go ballistic during the anticipated Bitcoin rally.

Rexas Finance (RXS): The future of real-world asset tokenization

Rexas Finance provides creative ideas for real-world asset (RWA) tokenization. By letting users tokenize real estate, artwork, and other highly valuable assets, Rexas Finance is changing the crypto scene. The initiative has enormous market potential since the real estate sector alone is valued at around $379.7 trillion.

Rexas Finance attracts retail and institutional investors by lowering transaction costs, improving liquidity, and raising transparency. Rexas Finance, in Stage 6 of its presale, has raised $9.5 million with 166 million tokens sold as of writing, indicating 81.74% completion. In this stage, the token price is $0.080; from its initial $0.03 price two months ago, this shows an impressive 166% increase.

It will list on three tier-1 exchanges at $0.20 post-presale, providing a wider global reach and more potential for gains. Rexas Finance recently received a Certik audit, which is a sign of security and trustworthiness in blockchain initiatives, improving investor confidence. Furthermore, its inclusion on CoinGecko and CoinMarketCap improves visibility and accessibility.

The ongoing $1 million giveaway, which offers 20 winners $50,000 in RXS apiece, has piqued investor interest. Based on projections for RXS, price appreciation seems to be strong as adoption rises. Some analysts believe Rexas Finance, with features such as AI integration, DeFi utilities, and yield optimization, could be poised to go ballistic if Bitcoin rallies above $120,000.

SUI: Consistently Hitting new all-time highs

Rising 105% in the past two weeks, SUI is among the top-performing altcoins in the current bull run. As of writing, SUI trades at $3.72, just below its all-time high of $3.94, which it attained last weekend.

Reflecting increased investor demand and confidence, its Open Interest (OI) has lately topped $826 million. The Chaikin Money Flow (CMF) indicator of the token indicates significant inflows, highlighting its positive trend. With a constant tendency to new all-time highs, SUI’s upward trajectory exactly matches market expectations of a possible surge. Driven by its excellent foundations and growing market visibility, SUI is expected to rise sharply if Bitcoin crosses $120,000.

Solana (SOL): Poised for a new all-time high?

Riding a surge of positive momentum, Solana broke past the $240 barrier twice in the current bull run. SOL trading at $246.89 as of writing has increased 59.9% over the past month. With analysts predicting a surge to $600 or more, its market capitalization of $115 billion ranks it among the top four leading cryptocurrencies, recently flipping Binance Coin.

Technical indicators supporting this optimistic view include a declining triangle breakout and a cup-and-handle pattern. Solana-based decentralized exchanges (DEXs), which account for 33.59% of DEX trade activity as of November, support its bullishness even more. So, Solana might see significant inflows if Bitcoin crosses the $120,000 mark, increasing its price to new highs.

Conclusion

Rexas Finance, SUI, and Solana could be ready to go ballistic if Bitcoin surges past $120,000. Each altcoin has unique qualities and solid foundations that guarantee a place of strength in the next positive market phase. Although SUI and Solana present interesting development chances, Rexas Finance distinguishes itself with its innovative RWA tokenizing, unparalleled presale expansion, and rich possibilities.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

-

Bitcoin23 hours ago

Bitcoin23 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation17 hours ago

Regulation17 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market22 hours ago

Market22 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market14 hours ago

Market14 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Market20 hours ago

Market20 hours agoAptos Partners with Circle and Stripe to Revitalize Network

-

Altcoin14 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

-

Regulation20 hours ago

Regulation20 hours agoGary Gensler To Step Down As US SEC Chair In January

-

Ethereum20 hours ago

Ethereum20 hours agoAnalyst Reveals When The Ethereum Price Will Reach A New ATH, It’s Closer Than You Think