Market

Defiance Launches 1.75x Leveraged MicroStrategy ETF

On August 15, exchange-traded fund issuer Defiance ETFs announced the launch of MSTX, MicroStrategy’s first-ever leveraged single-stock ETF. This development followed approval from the US Securities and Exchange Commission (SEC).

Designed to provide 175% long daily exposure to MicroStrategy’s stock, MSTX offers investors amplified access to the company’s performance, closely tied to Bitcoin’s volatility.

MicroStrategy’s Bitcoin Strategy Drives ETF Interest

MicroStrategy is a Virginia-based software company famous for its aggressive Bitcoin acquisition strategy. As of Q2 2024, the company holds 226,500 BTC, making it the largest public company holder of Bitcoins. The company’s stock has effectively become a proxy for Bitcoin, attracting investors looking for leveraged exposure to the digital asset without directly holding it.

MSTX targets sophisticated investors who actively manage their portfolios. It offers the potential for significant gains by amplifying MicroStrategy’s stock’s daily performance.

“Given MicroStrategy’s inherent higher beta compared to Bitcoin, MSTX offers a unique opportunity for investors to maximize their leverage exposure to the Bitcoin market within an ETF wrapper,” Sylvia Jablonski, CEO of Defiance ETFs, stated.

Read more: Who Owns the Most Bitcoin in 2024?

Leveraged ETFs, like MSTX, aim to multiply an underlying asset’s daily returns. For instance, if MicroStrategy’s stock rises 5% in a day, a 1.75x leveraged ETF would target for an 8.75% increase.

However, leverage recalculation happens on a daily basis. Such a mechanism means the returns can vary over longer periods due to the effects of compounding. Furthermore, this daily reset can lead to performance that differs from what investors might expect over time.

Therefore, Defiance emphasizes that MSTX is most appropriate for experienced investors who fully understand these risks and are prepared to monitor their investments closely.

Market analysts have cautiously welcomed MSTX, acknowledging its potential appeal to a niche market. Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, described MSTX as one of the most volatile ETFs on the market, with performance metrics equivalent to 13 times that of the S&P 500 ETF (SPY).

He also noted that “Defiance beat Tuttle to market with this,” referring to Tuttle and REX Financial’s (T-Rex) plan to launch a similar ETF. Earlier in June, T-Rex filed with the SEC for the T-Rex 2X Long MSTR Daily Target ETF. This fund seeks to double the daily performance of MicroStrategy.

MicroStrategy’s stock has seen remarkable growth since the company began regularly purchasing Bitcoin in August 2020. Initially trading at around $14, MSTR quickly surged past the $100 mark by February 2021, reflecting an impressive 605% increase in just six months.

Read more: 5 Best Web3 Stocks To Invest in 2024

As of 20:00 ET in after-hours trading, MSTR is priced at $131.93. This figure represents a 1.2% gain over the last 24 hours and a 92.49% increase year-to-date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Price Surge Signals a Potential Breakout

The value of Cardano’s ADA has soared nearly 10% in the past 24 hours, joining the broader crypto market in a strong recovery rally.

The coin’s technical indicators point to renewed bullish momentum, suggesting that ADA may be gearing up for further gains in the near term.

Cardano Gathers Steam with an 8% Gain

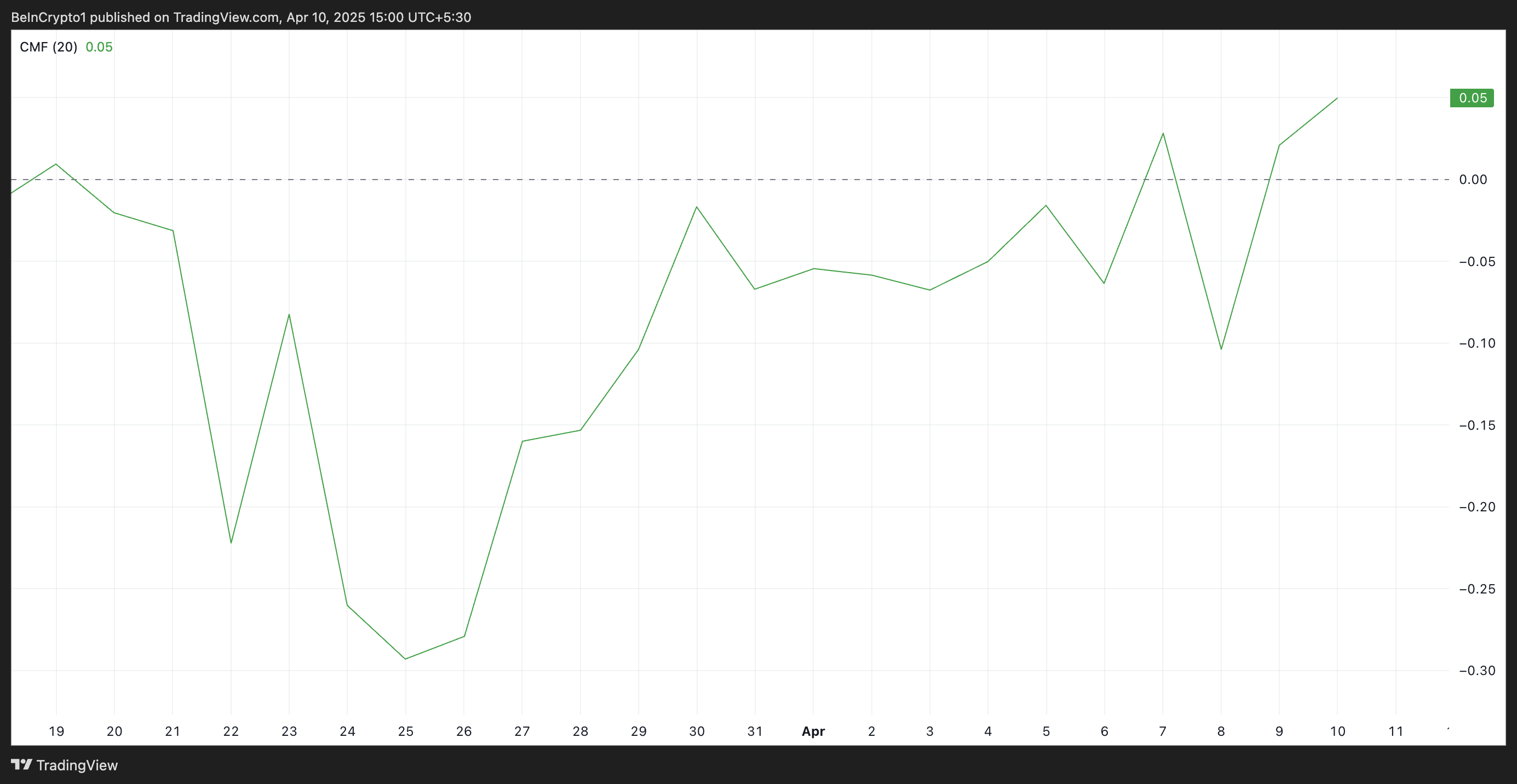

ADA is up 8% over the past day, with its recent price action hinting at growing investor confidence. A key factor supporting this upward trajectory is the rise in its Chaikin Money Flow (CMF), signaling increased capital inflow and accumulation.

At press time, this indicator, which measures the flow of money into and out of an asset, rests above the zero line at 0.05 and is in an uptrend.

An asset’s positive CMF reading indicates that buying pressure is stronger than selling pressure, suggesting accumulation. This signals growing bullish sentiment in the ADA spot markets as more investors buy the altcoin.

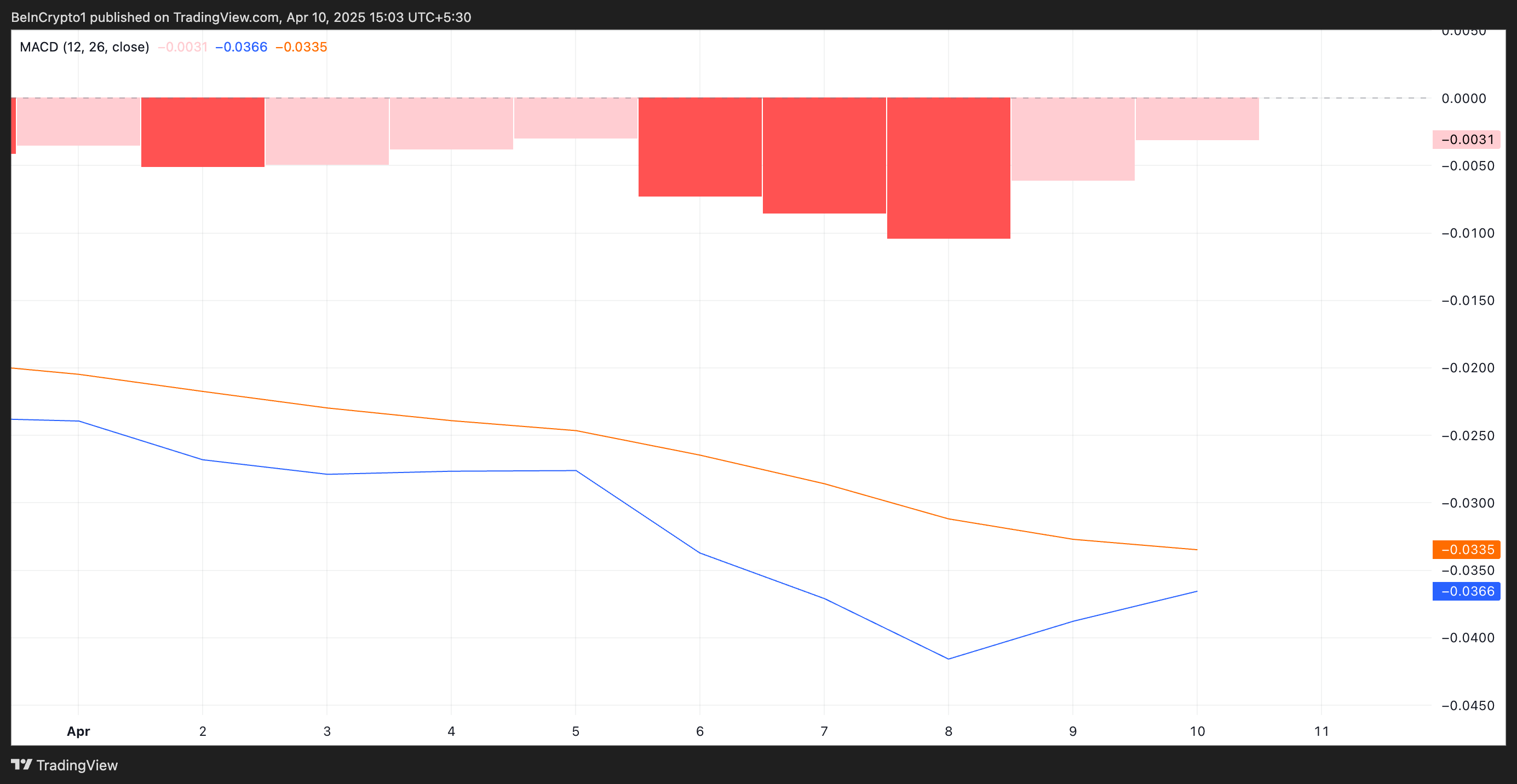

Additionally, ADA’s Moving Average Convergence Divergence (MACD) is approaching a potential golden cross—a historically bullish indicator that occurs when the MACD line (blue) crosses above the signal line.

The MACD indicator measures asset price trends and identifies reversal points. When a potential golden cross emerges, it hints at an upcoming bullish crossover, often seen as an early indicator of upward momentum.

This suggests that ADA’s short-term price strength is increasing, which, if confirmed, could lead to a sustained price rally.

Cardano Bulls Eye $0.76 as Buying Pressure Mounts

A combined reading of these bullish signals reflects strong buying pressure behind ADA, with traders potentially anticipating a breakout. If momentum continues to build, ADA could soon challenge and surpass the resistance level at $0.64.

A break above this barrier may open the door for an extended rally, especially if broader market sentiment remains supportive. In that case, the coin’s price could reach $0.76.

On the other hand, if ADA loses its bullish momentum, it could drop to $0.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Jumps 14%—More Gains Ahead?

Hedera (HBAR) has recovered over 5% in the past week. Despite some corrections today, multiple technical indicators flash bullish signals, suggesting a potential shift in momentum.

The DMI shows buyers firmly in control, the Ichimoku Cloud has flipped bullish, and a golden cross appears close to forming on the EMA lines. With key resistance levels approaching, HBAR could be gearing up for an extended move—if the current momentum holds.

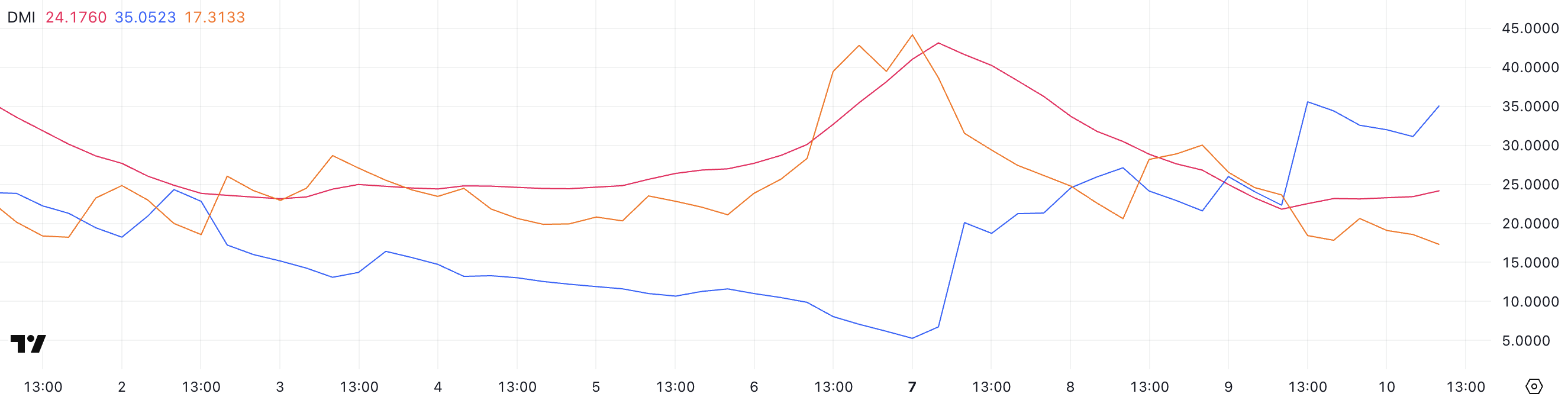

HBAR DMI Shows Buyers Are In Full Control

Hedera’s DMI chart is showing signs of strengthening trend momentum, with the ADX (Average Directional Index) rising to 24.17 from 21.82 just a day ago.

The ADX measures the strength of a trend regardless of its direction. Readings above 25 typically indicate a strong trend, while values between 20 and 25 suggest a trend may be developing.

With the ADX nearing that threshold, Hedera could be preparing for a more decisive move if momentum continues building.

Looking at the directional indicators, the +DI has surged to 35.05 from 22.33, while the -DI has dropped to 17.31 from 23.65. This widening gap between the bullish and bearish pressure signals a strong shift in favor of buyers.

If this setup holds, it could indicate a developing uptrend for HBAR, especially if the ADX continues to climb above 25.

The combination of rising bullish momentum and weakening selling pressure is a positive technical signal, suggesting that Hedera may be gearing up for further upside in the short term.

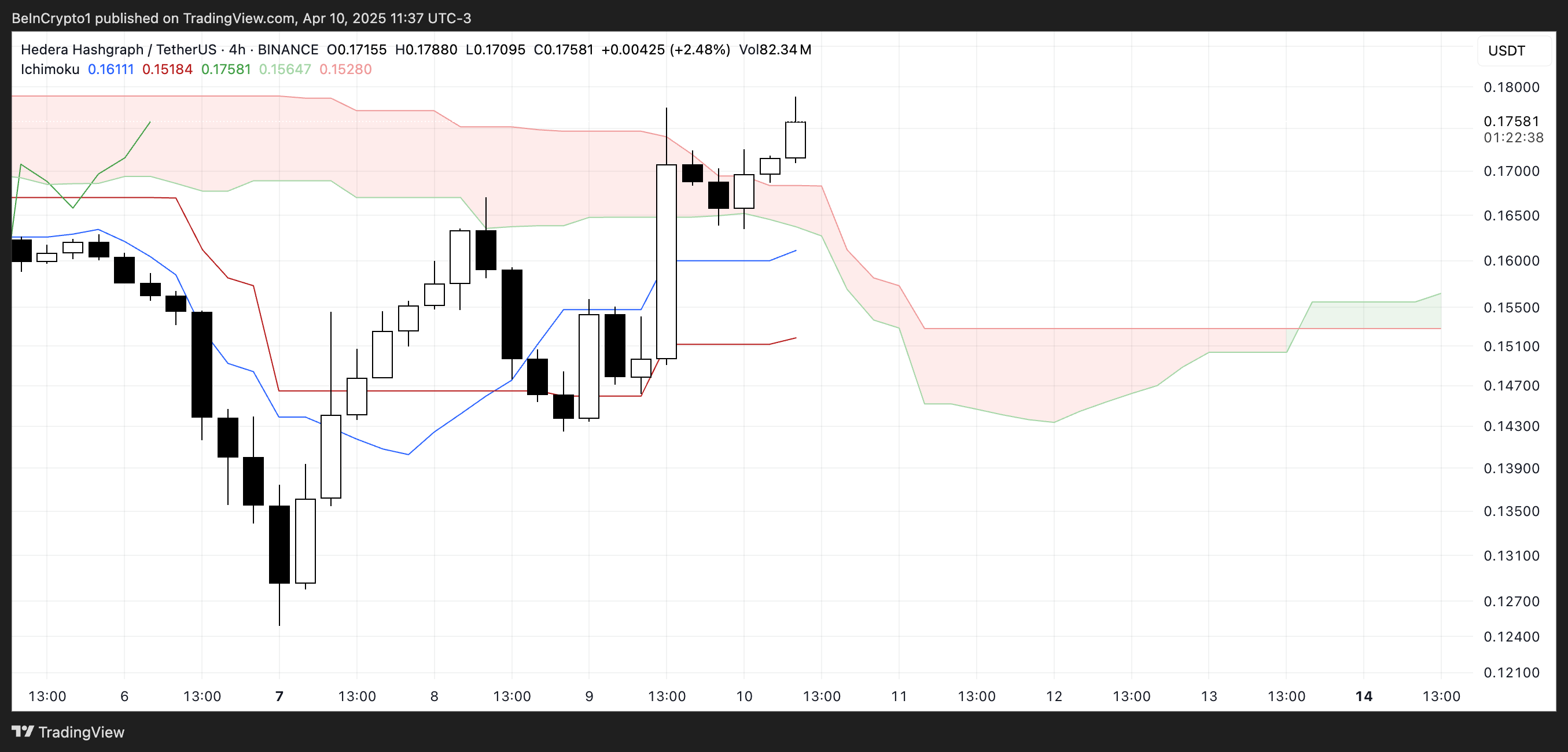

Hedera Ichimoku Cloud Shows A Bullish Setup

Hedera’s Ichimoku Cloud chart is flashing a bullish signal. After a strong move upward, price action broke above the red cloud (Kumo).

This breakout places the candles above both the Tenkan-sen (blue line) and the Kijun-sen (red line), which is generally seen as a sign of bullish momentum and short-term trend strength.

The cloud ahead has also started to thin, suggesting that resistance may be weakening. If momentum holds, further upside is more achievable.

The Chikou Span (lagging green line) is now positioned above the price candles and the cloud, reinforcing the bullish bias. However, with the cloud still showing a mostly flat and narrow structure, the current trend doesn’t yet show strong continuation signals.

If the price remains above the cloud and the Tenkan-sen continues to lead above the Kijun-sen, Hedera could sustain this upward trajectory.

But traders should watch closely for any signs of a reversal back into or below the cloud, which would weaken the bullish setup.

Hedera Could Surge Soon If The Golden Cross Emerges

Hedera’s EMA lines are tightening, signaling a potential breakout. A golden cross—where short-term EMAs move above long-term ones—appears to be forming, which would typically indicate a bullish trend reversal.

If confirmed, this setup could push Hedera price toward resistance levels at $0.18 and $0.20, and if the momentum holds, even higher targets like $0.21 and $0.258 may come into play.

However, this bullish scenario hinges on a successful break above the immediate resistance. If HBAR fails to clear the $0.18 level, it could trigger a pullback toward the support at $0.168.

Losing that support would likely expose Hedera to further downside. The next key levels are $0.153 and possibly below $0.13 if selling pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Bullish Altcoins Surging After Trump’s Tariff Pause

Altcoins are showing fresh signs of life following Trump’s 90-day tariff pause, and three names in particular—XRP, HYPE, and ONDO—are catching investor attention.

Each has its own catalyst: XRP is getting a regulatory boost with Paul Atkins taking over the SEC, HYPE is defying the broader market downturn with impressive protocol revenue, and ONDO is riding the wave of rising institutional interest in Real-World Assets (RWA).

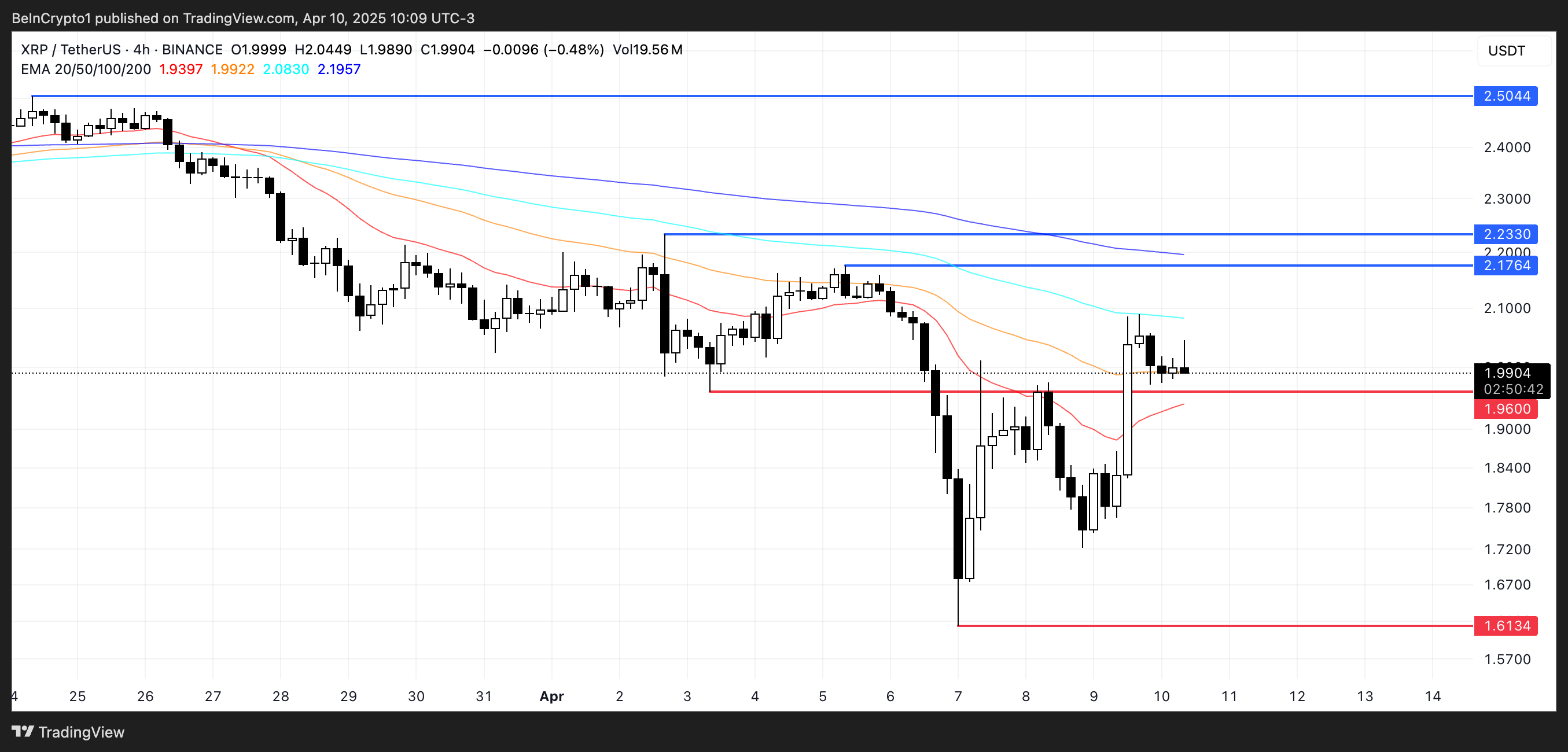

XRP

XRP fell sharply in the past month, losing 34% and dropping below $1.70 for the first time since November 2024. The decline came as macro uncertainty and regulatory pressure weighed on sentiment.

However, with Trump’s 90-day tariff pause and Paul Atkins confirmed as the new, pro-crypto SEC Chair, optimism is starting to return.

These developments could give XRP the regulatory breathing room it needs to regain momentum as one of the top-performing altcoins.

If that shift materializes, XRP may retest resistance at $2.17 and $2.23.

A break above those levels could set the stage for a push toward $2.50. Standard Chartered has even suggested XRP could overtake Ethereum by 2028, and Ripple’s acquisition of Hidden Road has fueled new expectations for rising institutional demand.

Still, holding $1.96 as support is key—if that level fails, a drop back toward sub-$1.70 lows remains possible.

Hyperliquid (HYPE)

HYPE has climbed 21.5% over the past week, defying the broader altcoin market downturn. The rally comes despite lingering criticism of the platform following the JELLY crisis, which raised concerns about Hyperliquid’s stability.

Still, traders seem to be regaining confidence, especially as the macro backdrop improves after Trump’s 90-day tariff pause.

Hyperliquid remains a powerhouse in terms of protocol revenue, pulling in $38 million in fees over the past month—$2.4 million of that in just the last 24 hours—ranking it 6th globally, ahead of names like PancakeSwap and Tron.

If momentum holds, HYPE could push toward resistance at $14.77, and a breakout could lead to $17.33 or even $21. But if the rally stalls support at $12.81 becomes key; losing that could send the price back to $11 or even below $10 in a deeper correction

Ondo Finance (ONDO)

Real-world asset (RWA) tokens are gaining momentum as a defensive narrative in crypto, especially in light of global economic uncertainty.

Binance Research recently stated that RWA altcoins remain safer than Bitcoin during tariff-driven volatility.

At the same time, BlackRock’s BUIDL token is nearing $1.5 billion in assets, and Fidelity has entered the RWA tokenization race—signaling growing institutional commitment to this emerging sector.

ONDO, one of the key tokens in the RWA space, is showing signs of strength on the charts, with a golden cross nearly forming.

If confirmed, ONDO could climb toward resistance levels at $0.90 and $0.95, with a breakout possibly pushing it above $1.

However, the price is hovering just above a key support at $0.82. If that level fails, the next downside target is $0.73, with a deeper slide potentially taking it below $0.70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin21 hours ago

Bitcoin21 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market21 hours ago

Market21 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin23 hours ago

Altcoin23 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

-

Market22 hours ago

Market22 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Regulation20 hours ago

Regulation20 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market20 hours ago

Market20 hours agoPaul Atkins Confirmed as SEC Chair, Crypto Rules to Ease

-

Market19 hours ago

Market19 hours agoSolana (SOL) Drops 4% as Selling Pressure Intensifies