Bitcoin

The Next Big Thing Amid WBTC Controversy?

Coinbase indicated plans for a cbBTC against the backdrop of Wrapped Bitcoin (WBTC), which has become controversial in crypto.

While the product’s details are still unknown, Coinbase appears ready to dominate the market once again.

Coinbase Gains Market Edge On WBTC Controversy

The exchange’s announcement of a cbBTC turned heads, with pre-launch registration already live. Coinbase Layer-2 (L2) network Base hinted that it would run atop its blockchain, making it an alternative Bitcoin on Base, but this remains unclear.

It comes amid the WBTC controversy, following reports that BitGo is transitioning its Wrapped Bitcoin custody to a new multi-jurisdictional model. Wrapped Bitcoin is the brainchild of Kyber, Ren, and BitGo, and its January 2019 launch made WBTC the first token that makes Bitcoin (BTC) compatible with the Ethereum (ETH) network.

As a bridge between the two networks, WBTC provides Bitcoin users access to decentralized finance (DeFi) applications and allows Ethereum applications to gain additional liquidity. Specifically, it acts as collateral, enabling Bitcoin holders to participate in activities like lending, borrowing, margin trading, and yield farming on decentralized finance (DeFi) applications.

Read more: Wrapped Bitcoin (WBTC): A Beginner’s Guide

Coinbase deploying its own version of WBTC would be a game changer in the space, especially amid ongoing concerns surrounding the wrapped Bitcoin. Tether CEO Paolo Ardoino smelled foul in 2022, sharing in a post on X.

“If I were BitGo, and I believed my own story that every WBTC is backed by 1 BTC, I’d be buying every token I could right now for $0.98! A risk-free 2% return. Unless I knew it wasn’t backed, of course,” Ardoino shared at the time.

As BeInCrypto reported, Tron founder and Huobi Global advisor Justin Sun is embroiled in controversy. There are concerns that Sun will significantly influence WBTC as BitGo adopts a new multi-jurisdictional and multi-institutional custody model. Fears surrounding Sun emerge given the Tron executive’s past sour relationships with crypto projects like TUSD and Huobi’s USDT reserves.

BitGo CEO Mike Belshe anticipated the concerns around Sun ahead of the announcement and attempted to quell the matter. Nevertheless, his engagement notwithstanding, DeFi investors consider removing WBTC as collateral.

cbBTC Could Pass WBTC in Supply, VC Says

As Coinbase looks to capitalize on this confusion, venture capitalist Dan Elitzer says cbBTC is long overdue and makes his predictions. He says cbBTC could pass WBTC’s supply within six months of launch.

“cbBTC was inevitable and super strategic to Coinbase. Frankly, I am surprised they did not ship it years ago. Predictions: – 0 fees on mint/redeem – 0 fees to withdraw to Base – Passes WBTC in supply within 6 months of launch (unless acquisition falls through),” Elitzer says.

According to Elitzer, the massive mishandling of WBTC will create a shakeup. This comes as protocols and venues move to support alternative forms of bridged BTC. It will also benefit from more decentralized solutions like tBTC. The VC also observes that no competent DeFi user or risk manager will want to maintain exposure to WBTC under Justin Sun- affiliated management.

Indeed, DeFi platform MakerDAO is already evaluating the potential risks associated with BitGo’s new WBTC custody strategy.

“Maker is planning to offboard WBTC due to the change in custody from BitGo. Is BitGo going to fumble its insane moat in WBTC?” DeFi dashboard builder at DefiLlama posed rhetoric in a post on X.

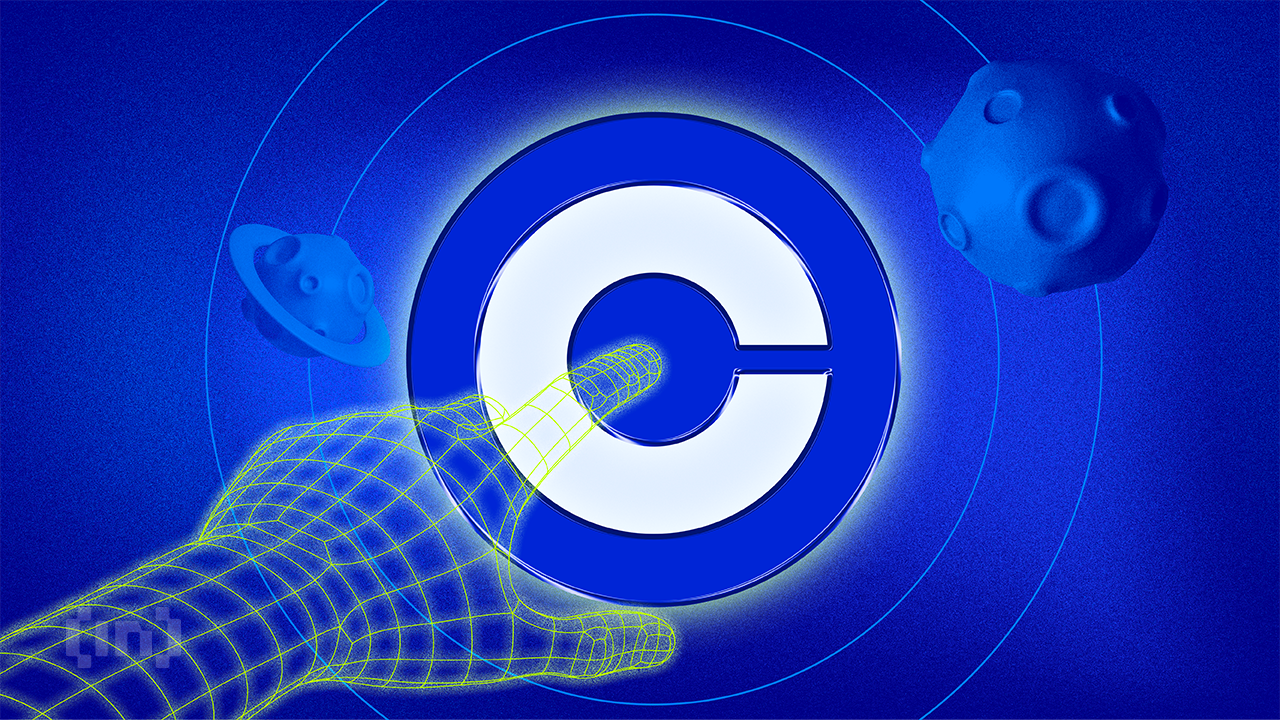

Elsewhere, crypto researcher Wei Dai says, “cbBTC is not the endgame.” The researcher anticipates trust-minimized bridging of BTC, citing the total value locked (TVL) on different Ethereum variants on Base.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

Meanwhile, crypto commentator Marty Party says permissioned bridges and permissioned derivatives like Wrapped Bitcoin on Ethereum are risky to crypto.

“They are moving the Bitcoin collateral from BitGo to Bit Global in the next 60 days. Does this mean the $9.45b of WBTC on Ethereum and Base, Aave, MakerDAO, and Compound, and therefore all those loans and corresponding collateralizations L2s will be uncollateralized during this time? Now I would not normally post this but it’s a perfect example of why I stress – Permissioned Bridges and Permissioned Derivatives like Wrapped Bitcoin on Ethereum are not Web3, and are the biggest risk to crypto,” MartyParty expressed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Why ETF Issuers are Buying Bitcoin Despite Recession Fears

According to new data from Arkham Intelligence, three major Bitcoin ETF issuers are acquiring huge amounts of BTC today. The ETFs had $220 million in net inflows yesterday, and the issuers are potentially expecting a spike in demand.

Although Bitcoin has seen wild fluctuations over the past couple of days, institutional investors might show more confidence in the leading cryptocurrency than the TradFi market.

Why are ETF Issuers Buying Bitcoin?

The crypto market experienced wider liquidations today, and fears of a broader recession are circulating heavily. Since President Trump imposed much higher tariffs than expected, crypto is mirroring the TradFi stock market with notable downturns.

However, the US spot Bitcoin ETFs market shows that institutional demand might rebound in the short term.

“Donald Trump just tariffed the entire world. So? Grayscale is buying Bitcoin, Fidelity is buying Bitcoin, Ark Invest is buying Bitcoin,” Arkham Intelligence noted on social media.

Arkham Intelligence, a prominent blockchain analysis platform, is not the only one noticing this trend in Bitcoin ETFs. Although Bitcoin’s price has been very volatile over the last two days, it has consistently managed to return to a rough baseline.

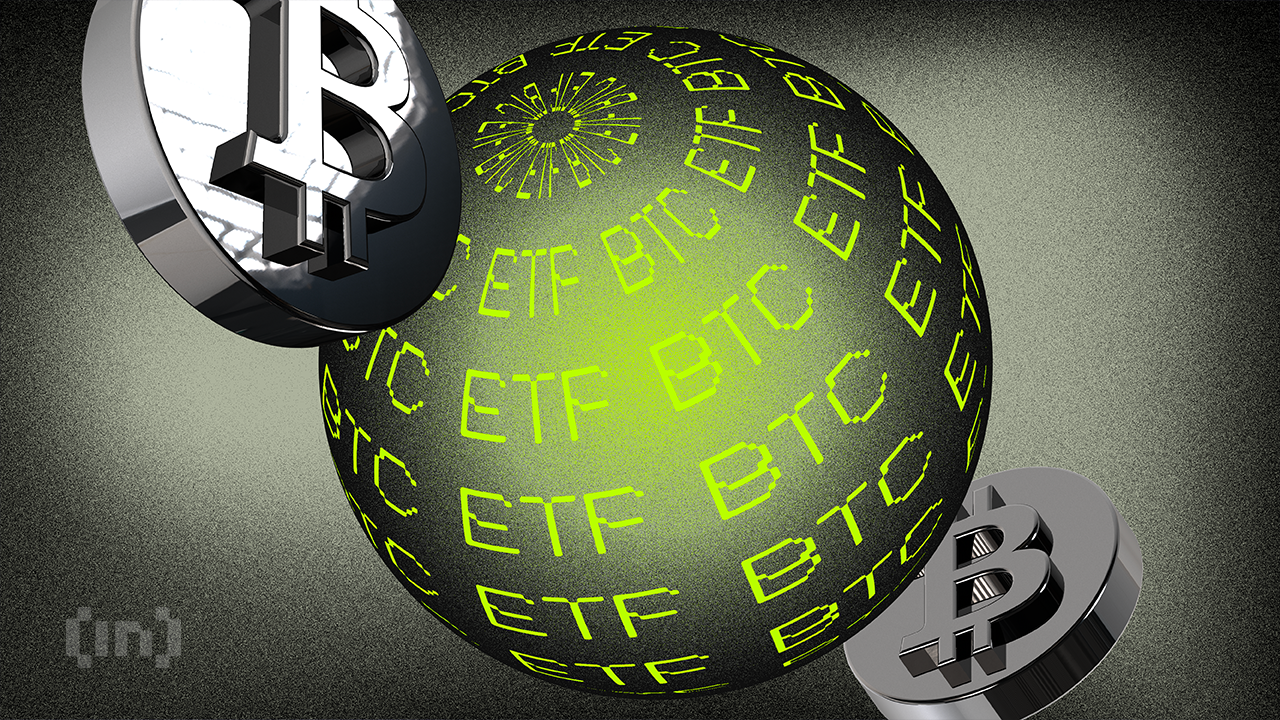

The asset’s long-short ratio was 0.94 last week, and it shifted to 1 today. This signals a move toward more balanced investor positioning.

Previously, with 48.5% long positions against 51.5% short positions, the market exhibited a slight bearish tilt. Today, the equal split—with 50.5% long positions—signals that investors have neutralized their stance, reducing the bearish bias.

This balanced positioning suggests that market sentiment has stabilized, potentially reflecting increased uncertainty about near-term price movements. Bitcoin investors may now be awaiting clearer market signals before committing to a more directional bias.

Additionally, the Bitcoin ETFs have performed well in another key area. According to data from SoSo Value, the entire asset category had net inflows of $220 million yesterday.

Granted, Trump made his Liberation Day announcements after the stock market closed yesterday, but that’s still a very impressive amount of growth.

It is currently unclear exactly what impact today’s market turmoil had on the Bitcoin ETFs as an asset category. However, Arkham’s data suggests that these issuers are making notable investments in BTC.

If nothing else, it suggests that these firms are anticipating an uptick in demand in the near future. There are still many unanswered questions about tariffs, crypto markets, and the global economy as a whole.

If ETF inflows continue throughout this week, it will reflect institutional investors’ betting on BTC to remain more stable and sustainable than TradFi markets amid recession concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

BlackRock Approved by FCA to Operate as UK Crypto Asset Firm

BlackRock, the world’s largest asset manager, received approval from the UK’s Financial Conduct Authority (FCA) to operate as a crypto asset firm.

This marks a significant milestone for the investment giant, allowing it to extend its influence in the growing digital asset market.

BlackRock Joins Crypto Elite with FCA Approval in the UK

With this approval, BlackRock can operate its newly launched European Bitcoin exchange-traded product (ETP) as a UK entity.

According to the FCA’s website, BlackRock officially became the 51st company registered as a crypto asset firm on April 1, 2025. The firm joins a select group of financial entities, including Coinbase, PayPal, and Revolut, which have met the FCA’s stringent regulatory requirements.

BlackRock’s iShares Bitcoin ETP recently launched on the Euronext stock exchanges in Paris and Amsterdam. As BeInCrypto reported, this marked an expansion of the firm’s footprint in the European crypto investment market.

To attract investors, the product was introduced with a temporary fee waiver. It reduced its expense ratio to 0.15% until the end of the year. Once the waiver expires, the fee will revert to 0.25%, aligning with competing products like CoinShares’ Bitcoin ETP.

The iShares Bitcoin ETP is designed for institutional and informed retail investors. It offers a regulated and cost-effective way to gain exposure to Bitcoin. This move also positions BlackRock as a leader in the European digital asset space, catering to the growing demand for crypto-based financial products.

Meanwhile, the FCA has faced criticism for its cautious approach to crypto regulation. It has only approved around 9% of all applicants seeking registration as crypto asset firms.

“This low level of application approval signifies potential concern for the UK’s ambition to become a crypto hub,” Alan Vey, founder of web3 firm Aventus and a former Brevan Howard developer, said recently.

The regulator has defended its strict policies. A statement on its website articulated that many submissions lack essential information or fail to meet compliance standards.

“We have rejected submissions that didn’t include key components necessary for us to carry out an assessment, or the poor quality of key components meant the submission was invalid,” the FCA wrote.

Therefore, BlackRock’s FCA approval is not a mean feat. It marks another step in the mainstream adoption of crypto. With the UK now part of BlackRock’s growing crypto asset operations, the firm continues to push forward in integrating Bitcoin into traditional finance (TradFi).

BlackRock also manages approximately $12 trillion in assets (AUM) and continues actively expanding its crypto market presence. It launched its iShares Bitcoin Trust (IBIT) in the US in January 2024. The financial instrument has since grown into the largest US spot Bitcoin ETF, managing nearly $49 billion in assets.

Moreover, the surge in institutional interest in Bitcoin ETFs has been remarkable. In just one year, US spot Bitcoin ETFs have attracted over $95 billion in investments, SoSoValue data shows. This highlights the increasing demand for regulated Bitcoin investment vehicles.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

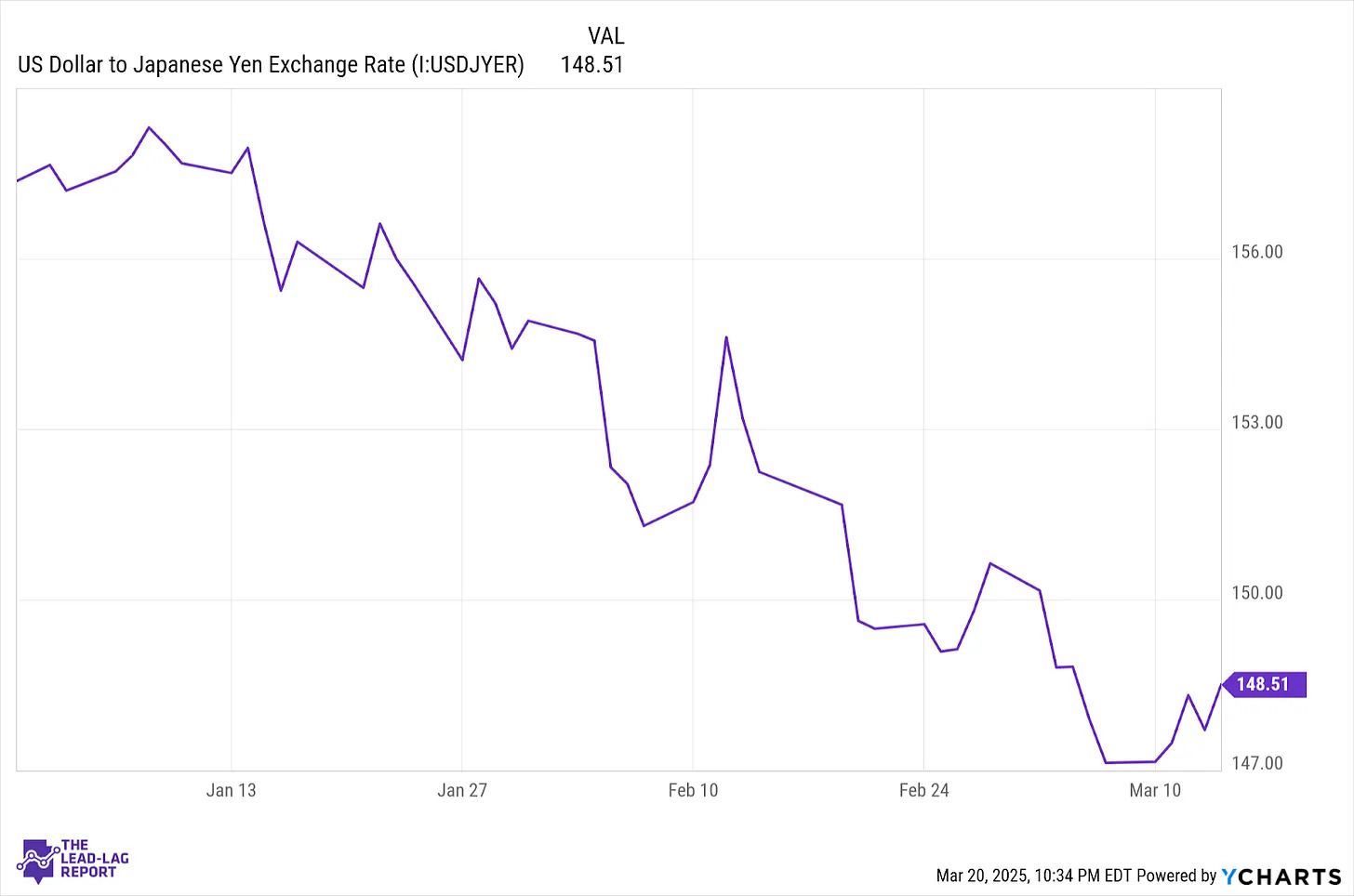

What It Means for Bitcoin

An expert has cautioned that the reverse yen carry trade is currently unfolding, albeit at a slower and more controlled pace.

This could have significant implications not only for traditional financial markets but also for cryptocurrencies like Bitcoin (BTC).

Why Investors Should Pay Attention to the Yen Carry Trade?

For context, the yen carry trade is a strategy in which investors borrow yen at low interest rates and invest the funds in higher-yielding assets, such as the US dollar or technology stocks. The goal is to profit from the difference in interest rates.

Nonetheless, this strategy’s risk arises from currency fluctuations. If the yen appreciates, investors converting the investment back to yen to repay the loan may see reduced or eliminated profits.

According to Michael A. Gayed, this scenario appears to be materializing now.

“The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind,” he said.

In his recent report, Gayed explained that rising borrowing costs compel traders to offload dollar-denominated assets. This, in turn, heightens market volatility and depresses the prices of risk assets.

Notably, this happened last year as well. Gayed pointed out that in August 2024, the Bank of Japan’s decision to raise interest rates twice sparked a significant rally in the yen. Yet, at the same time, the S&P 500 saw an approximate 10% correction.

He added that the subsequent rebound alleviated investor concerns. Nevertheless, he believes the real issue is that the situation was never fully resolved.

“Big carry trade unwinds don’t just last a couple of weeks, and conditions are suddenly normalized,” Gayed stressed.

He added that the current market conditions resemble a similar situation. Notably, the Japanese 10-year yield has surged to 1.56%, the highest since 2008. As these yields climb, the yen strengthens, and the carry trade dynamics begin to shift.

“The 10-year yield continues to climb higher and close the interest rate differential on comparable 10-year US Treasury yields. That’s going to continue fueling strength in the yen that may continue into the later stages of 2025. And as long as the yen continues to strengthen, whether it’s quickly and slowly, that’s going to keep unwinding any outstanding carry trade that’s still out there. And it’s probably a lot,” he stated.

Moreover, Gayed suggested that the Bank of Japan will likely continue raising rates. Meanwhile, the Fed might possibly lower them in the coming months, further solidifying his outlook.

He also focused on the correlation between the S&P 500 and the yen. Gayed noted that the yen’s rise preceded the recent S&P 500 pullback by several weeks.

The correction could also be linked to an anticipated US growth slowdown and potential tariffs. Yet, he emphasized that the reverse carry trade is particularly risky due to its potential to escalate quickly, especially in the current macroeconomic climate.

“The market is plenty capable of correcting on its own, given the fears associated with tariffs and slowing economic growth. If you add people being forced to sell their US equity holdings in order to close out their short yen positions on top of that, it’s easy to see how a bad situation quickly becomes worse. And it’s already happening. Japan is still the real risk,” he claimed.

Now, the question is, why will this impact Bitcoin? Given its close correlation with the S&P 500, a correction in the latter could spell trouble for BTC. Analyst Lark Davis pointed out that Bitcoin and the S&P 500 have been closely linked since 2023.

“So as we’re trying to determine where Bitcoin goes from here, the unfortunate truth is that it all probably depends on what happens to the major stock indices,” he noted

Davis also advised crypto investors to monitor the broader economy, the stock market, and the M2 money supply, both in the US and globally.

For now, the largest cryptocurrency continues to navigate volatility ahead of President Trump’s tariff announcement. In fact, BeInCrypto reported that spot Bitcoin ETFs have recorded outflows for three consecutive days.

On the price front, Bitcoin has dipped 3.1% over the past week. At press time, the coin was trading at $85,042, representing small gains of 0.8% over the past day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market21 hours ago

Market21 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market22 hours ago

Market22 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market17 hours ago

Market17 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Market20 hours ago

Market20 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K

-

Altcoin19 hours ago

Altcoin19 hours agoVanEck Seeks BNB ETF Approval—Big Win For Binance?

-

Market13 hours ago

Market13 hours agoBitcoin’s Future After Trump Tariffs

-

Regulation11 hours ago

Regulation11 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role