Market

Analyst Says XRP Price Will Rally 10,400% To $60, Here’s When

A crypto analyst has shared an optimistic outlook for the XRP price, the native token of the XRP Ledger (XRPL), predicting a potential rally of up to 10,400% with a price target of $60. The analyst has also outlined when to expect this anticipated price increase.

XRP Price Set To Hit $60 With Projected 10,400% Surge

In an X (formerly Twitter) post on August 12, crypto analyst, Brett Hill expressed bullish optimism about XRP’s future price. The analyst suggests that XRP could be on the verge of a significant breakout, potentially propelling it to new all-time highs.

Related Reading

He shared a chart tracking XRP’s price movements from March 2023 to 2025. Based on his analysis, the analyst predicts that XRP is poised to reach a price range of $50 to $60, representing a substantial 10,400% surge from its current value.

While outlining his bullish forecast for XRP, Hill pointed to XRP’s weekly Moving Average Convergence Divergence (MACD). The MACD is a trend-following momentum indicator that is used to identify entry and exit points for crypto traders.

The analyst disclosed that this unique indicator is currently signaling a strong bullish momentum for XRP, solidifying its potential price increase to new all time highs. He further highlighted a key support level at the $0.5403 mark.

Hill has forecasted that XRP would potentially surge between $50 to $60 if it stays above the aforementioned support level. With XRP currently trading at $0.57, well above the crucial support level, this could mean that the $50 to $60 price target may be achieveable in the coming weeks.

The analyst has also affirmed that as long as XRP holds this support level, it is well-positioned for “big gains.” Despite his rather ambitious and bullish prediction for the cryptocurrency, Hill warns that investors should watch out for a resistance level of $0.6836.

He disclosed that if XRP can break through this resistance level, it could potentially trigger a powerful upward momentum that could send its price even higher.

Analysts Stay Bullish On XRP After Legal Win

In a previous X post, Hill forecasted that the XRP Ledger is poised for an explosive growth following Ripple’s recent legal victory over the United States Securities and Exchange Commission (SEC).

On August 8, the United States (US) South District Court fined Ripple $125 million in civil penalties for violating securities laws by selling XRP to institutional investors. Ripple’s Chief Executive Officer (CEO), Brad Garlinghouse sees the settlement fee as a significant win, given that the SEC had previously requested a whopping $2 billion in settlement.

Related Reading

Following the Court’s rule, analysts and market watchers have expressed optimistic outlooks about XRP’s future value. Crypto enthusiast, Amelie disclosed that XRP’s newfound regulatory clarity was set to inject trillions of dollars into XRPL projects.

Additionally, a crypto analyst identified as ‘CryptoBull’ on X has projected a major bullish price target for XRP. According to the analyst, XRP could surge anywhere between $13 and $46 within the next 1 to 18 months.

Featured image created with Dall.E, chart from Tradingview.com

Market

Key Solana Holders’ 6-Month High Accumulation Signal Price Rise

Solana (SOL) has struggled to gain momentum over the past couple of weeks, and its price has failed to recover significantly.

Despite this, the altcoin has seen signs of stabilization, with long-term holders (LTHs) showing increasing support. This shift could indicate a potential price rise, provided the current trend holds.

Solana Investors Move To Accumulate

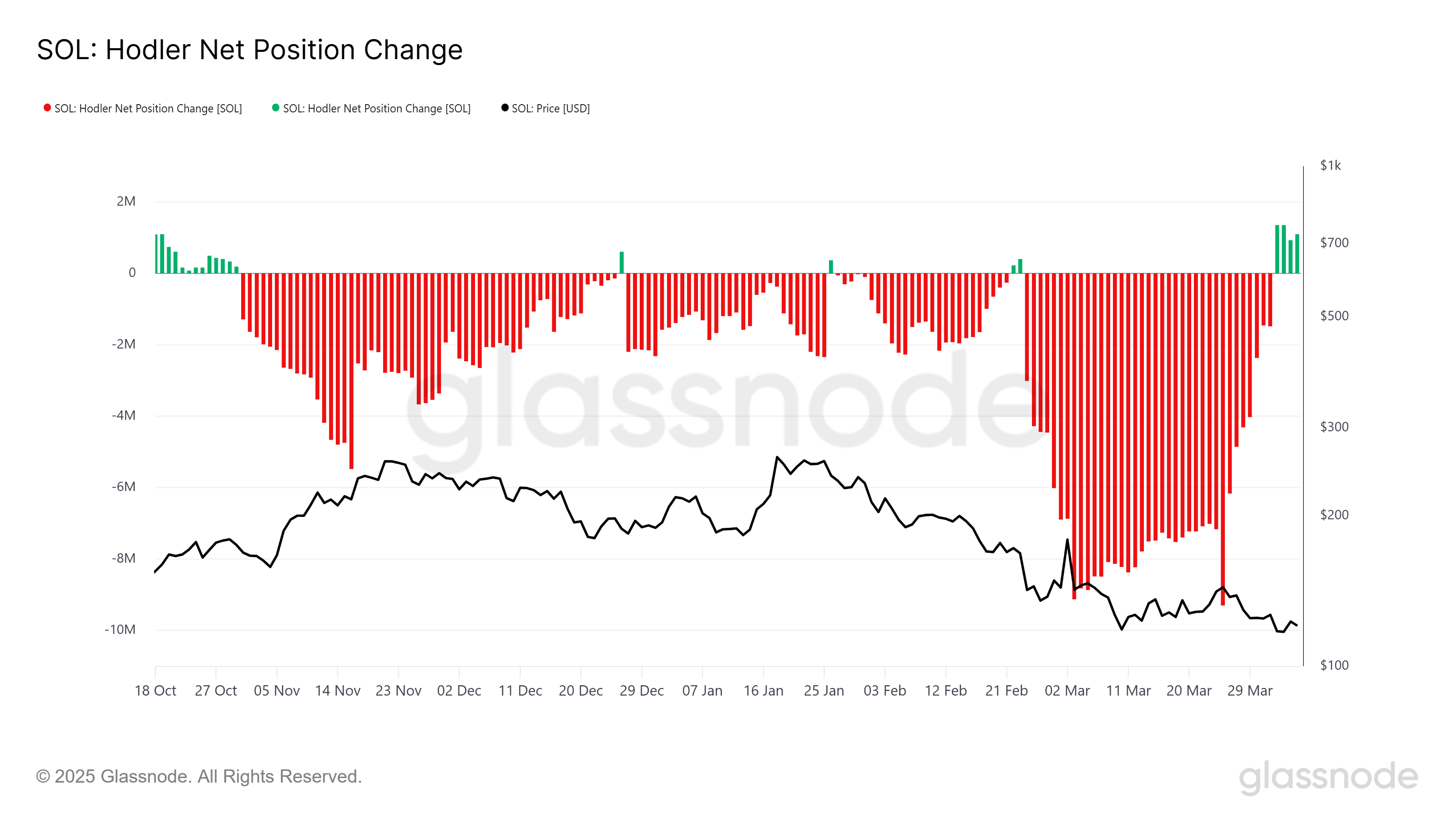

The HODLer Net Position Change for Solana has been positive for the past four days, with consistent green bars indicating that LTHs are accumulating more SOL. This is the longest streak of accumulation in over six months, signaling confidence from long-term investors.

As these investors continue to add to their positions, Solana could build a solid foundation for a price rebound.

LTHs tend to significantly influence Solana’s price, as their holdings reflect longer-term confidence in the cryptocurrency. If this trend continues, the growing support from LTHs could provide the necessary backing to help Solana break through key resistance levels.

However, despite the support from LTHs, Solana’s overall market sentiment is still mixed.

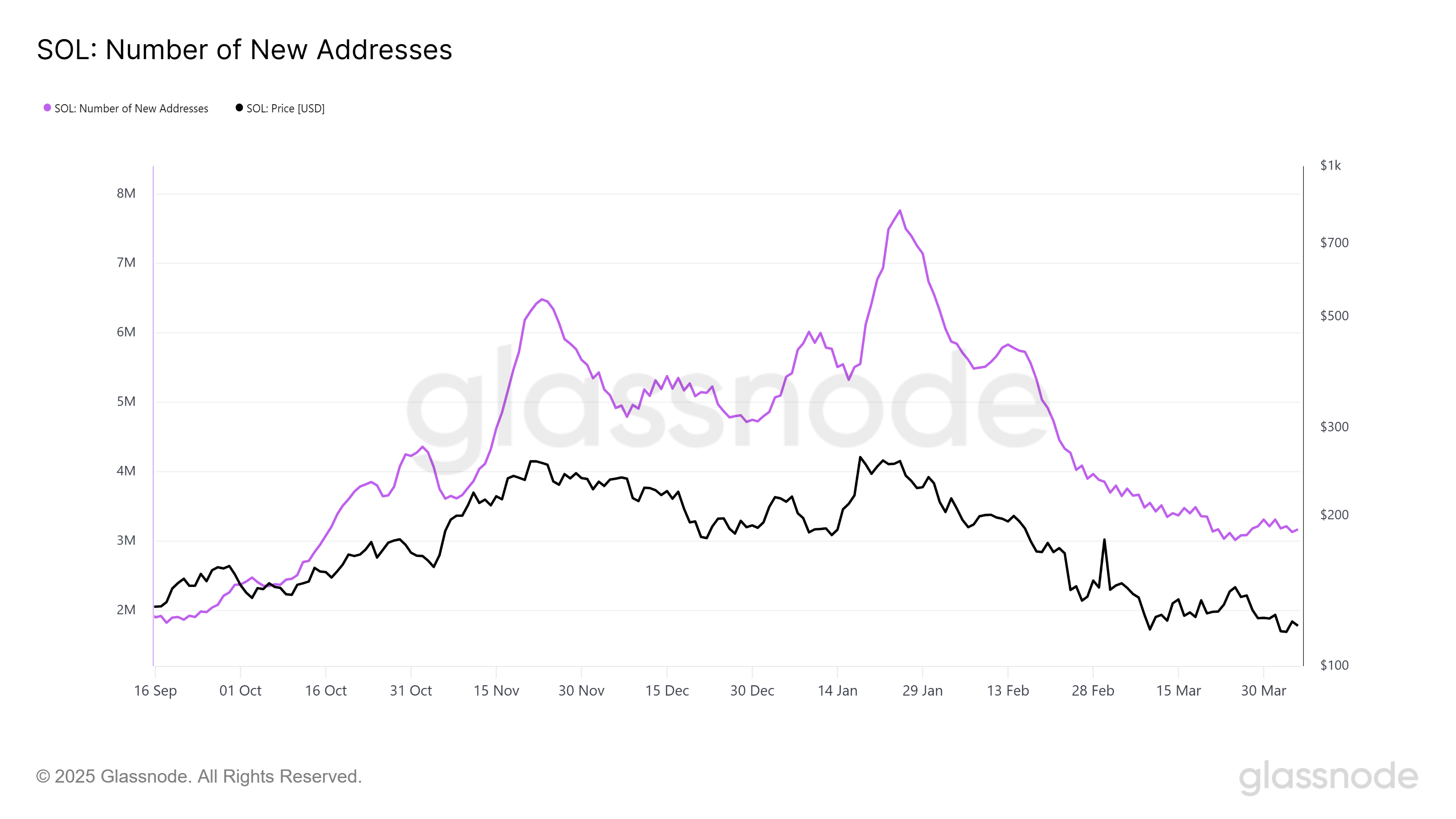

New addresses, an important metric for investor interest, have recently hit a six-month low. This indicates that fewer new investors are entering the market, reflecting a lack of optimism for a recovery in the short term. The last time new address activity was this low was in October, suggesting that investor confidence is currently subdued.

The drop in new addresses could signal caution among potential buyers, affecting the altcoin’s overall momentum. While LTHs continue to accumulate, the lack of fresh interest from new investors could delay any significant upward movement for Solana.

SOL Price Vulnerable To Correction

Solana is currently trading at $119, holding just above the crucial support level of $118. While the altcoin is attempting to make its way to $135, mixed market sentiments suggest it may struggle to break through this resistance.

The price could consolidate between $118 and $135 as it builds enough momentum for a potential rally.

If Solana manages to bounce back, it may continue to trade within this range, allowing time for the market to stabilize and support further price appreciation. Consolidation could help SOL gather strength before another attempt to breach the $135 level.

However, if the price falls below $118, it could signal a shift in momentum, invalidating the bullish-neutral outlook. A drop below this support level would likely lead to further declines, potentially taking Solana down to $109, which would extend investors’ losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Highlights UK’s Potential to Become Global Crypto Hub

Blockchain firm Ripple has called on UK policymakers to seize the moment and position the country as a global leader in digital assets.

Matthew Osborne, Policy director of Ripple Europe, revealed that panelists at Ripple’s recent London Policy Summit stated that the country has the right mix of financial expertise, infrastructure, and international reputation to lead this evolving sector.

UK Has ‘Second-Mover Advantage’

In a blog post, Osborne pointed out that one of the key takeaways from the summit was that the UK holds a “second-mover advantage” in the race for crypto regulation.

According to the post, the UK can adopt a more balanced and innovation-friendly regulatory framework by observing the early efforts of jurisdictions like the EU, Singapore, and Hong Kong.

They believe that this approach could ensure consumer protection while encouraging responsible growth across the sector.

“There is a huge opportunity for digital assets in the UK. With growing consensus that blockchain technology will transform financial markets, the UK already boasts a globally leading, competitive financial services center. And with particular strengths in FX, capital markets, insurance and professional services, the UK has all the building blocks to be a global leader in digital assets,” Osborne wrote.

The panelists furthered that these clear rules will improve institutional confidence, raise industry standards, and lower systemic risks. However, they also warned that the window to act is quickly closing.

“The window of opportunity is narrowing, and one clear theme that emerged from industry participants is the need to provide regulatory clarity with greater pace and urgency,” the blockchain firm noted.

The need for urgency stems from projections that digital assets could represent up to 10% of global capital markets by 2030, potentially holding a combined value of $4 to $5 trillion.

Osborne stressed that the UK must act boldly and collaboratively to remove unnecessary legal obstacles and create an innovation-friendly environment.

Meanwhile, another pressing concern the panelists highlighted was the lack of clarity around stablecoins.

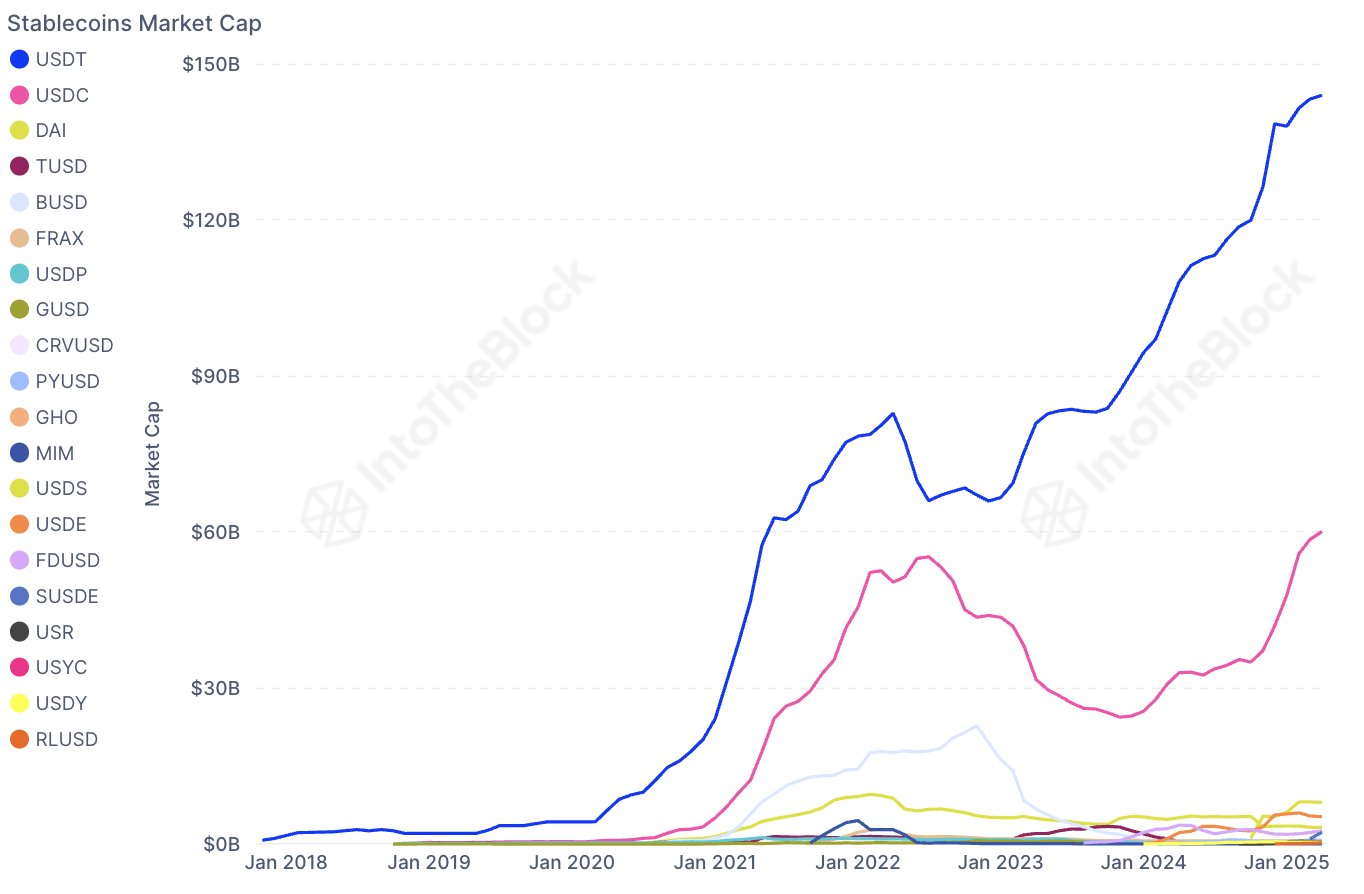

Stablecoins are digital tokens pegged to fiat currencies like the US dollar and are essential to the broader crypto economy. As they are increasingly used for trading, payments, and settlements, stablecoins have become the backbone of the digital asset ecosystem.

With a current market valuation exceeding $230 billion, stablecoins are expected to grow further as adoption increases.

Considering this, there are calls for the Financial Conduct Authority (FCA) to fast-track its stablecoin framework. The panelists emphasized the need for policies that support both domestically issued and foreign stablecoins operating within the UK.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Celestia (TIA) Price’s 30% Crash Prolonging Could Bring Recovery

Celestia (TIA) has recently experienced a significant drawdown, losing nearly 30% of its value in the past two weeks. This decline has been attributed to the broader bearish market conditions, which caused panic among investors.

As a result, many TIA holders decided to pull their funds, adding to the downward pressure on the price.

Celestia Holders Opt To Back Out

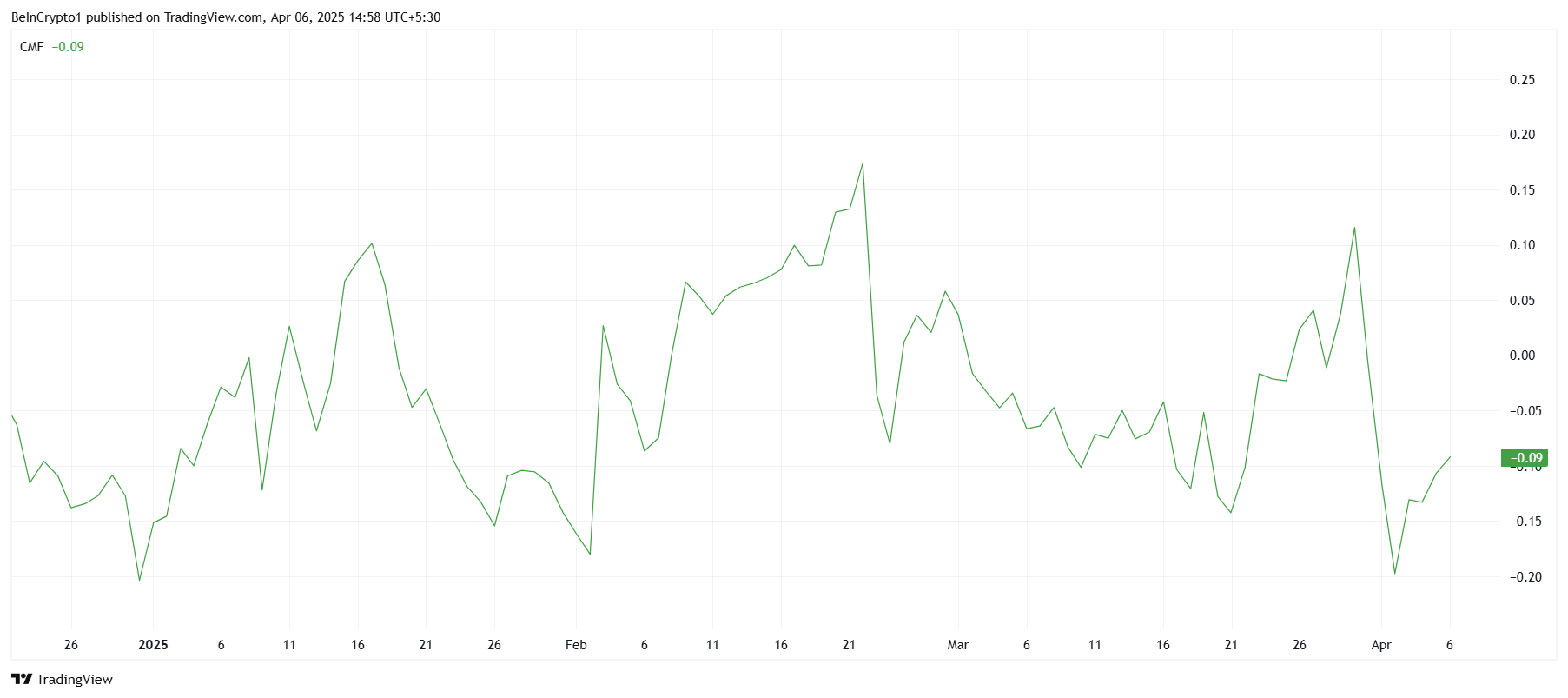

The Chaikin Money Flow (CMF) indicator has shown significant outflows from Celestia, marking the largest selling activity since the beginning of 2025. This reflects the growing fear among investors after the 30% price correction.

However, despite the negative sentiment, there has been an uptick in the CMF recently, indicating that some new investors are beginning to see value in the low prices. These inflows could potentially help stabilize the price and set the stage for a recovery.

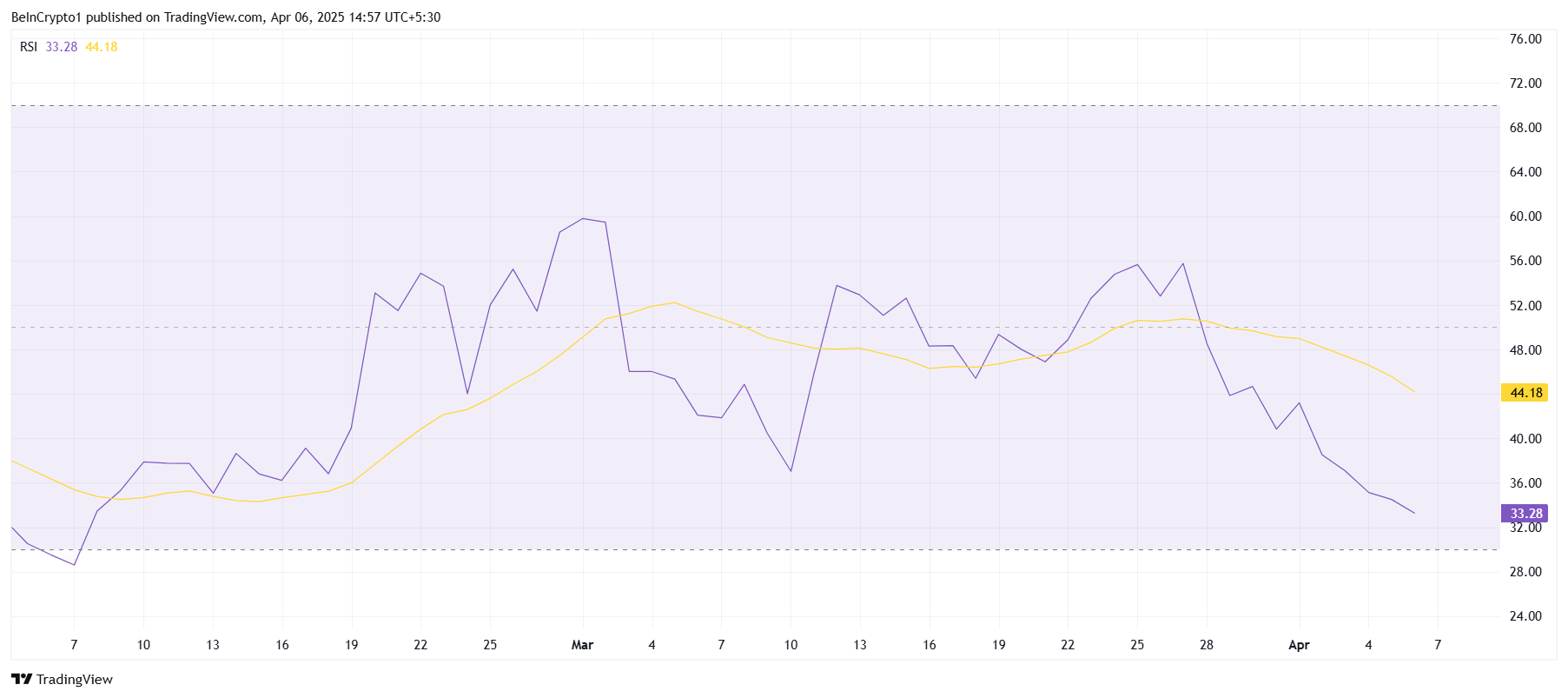

The Relative Strength Index (RSI) for Celestia shows that cryptocurrency is currently on a bearish trend. Stuck below the neutral line at 50.0, the RSI is moving closer to the oversold threshold of 30.0. Historically, when an asset reaches this level, it is considered a signal for a potential reversal, as selling typically slows, and accumulation begins.

If the RSI falls below 30, it could trigger buying interest, as many traders may view the low prices as an opportunity to enter the market.

The current state of the RSI suggests that while bearish momentum is still strong, the conditions are ripe for a reversal. If the selling pressure wanes and buyers begin to step in, Celestia’s price could find support and begin an upward move.

TIA Price Could Be Looking At Recovery

Celestia is currently priced at $2.62, reflecting a nearly 30% decline over the past two weeks. It is holding just above the critical support level of $2.53. If the market sentiment improves and the RSI hits the oversold zone, there is potential for a recovery.

The influx of new investors could provide the momentum needed to drive the price higher.

A successful bounce from the $2.53 support level could see Celestia pushing through $2.73 and heading towards $2.99. This would signal the beginning of a recovery rally and possibly set the stage for further price appreciation as market conditions improve.

However, if Celestia fails to hold the $2.53 support, it could trigger a further decline towards $2.27. This would invalidate the bullish outlook, prolonging the downtrend and extending investors’ losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Market24 hours ago

Market24 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Ethereum23 hours ago

Ethereum23 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market22 hours ago

Market22 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off

-

Bitcoin24 hours ago

Bitcoin24 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Market23 hours ago

Market23 hours agoSEC’s Guidance Raises Questions About Tether’s USDT

-

Market21 hours ago

Market21 hours agoKey Levels To Watch For Potential Breakout

-

Market20 hours ago

Market20 hours agoSolana Altcoin Saros Rallies 1000% Since March, Hits New High