Market

Top Altcoins to Watch After Recent Dip: Analyst’s Picks

Popular analyst Michaël van de Poppe shares a list of altcoins that could bounce off more strongly after the last dip. This comes as crypto markets reel from the recent correction that saw Bitcoin (BTC) test the depths of $49,000.

Portfolio rebalancing is a favored investment strategy among intentional traders, especially during periods of market volatility. To effectively manage risk, traders should diversify their investments across promising crypto narratives, establish a clear exit strategy, and maintain a disciplined dollar-cost averaging approach.

Analyst Top Altcoin Picks as Market Attempts Recovery

Van de Poppe observes how altcoins are doing after the correction. He notes that Ethereum (ETH) DeFi has been bouncing off more strongly than Solana DeFi tokens, which shows the potential of the respective ecosystem. He also observes the commendable performance among meme coins, AI, and DePIN categories.

“If we are looking at the data, then you want to be positioned at AI and DePIN, meme coins, or you want to be positioned into ETH DeFi. You want to be into the biggest bounces because those are likely going to continue with the momentum as traders are looking at the hype coins or the strongest bounces and start allocating toward those,” van de Poppe noted.

Bittensor (TAO)

An analyst has predicted a 5 to 10X potential for TAO, an AI-driven crypto coin, following its 70% rally from recent lows. This surge has caught the attention of many traders. Michaël van de Poppe is not alone in his optimism; other experts also foresee further gains for the Bittensor token, considering it a strong investment.

“If you’re aiming for a significant boost in your portfolio, TAO might be a compelling choice. Currently, the market cap stands at an impressive $2 billion, reflecting the strong performance and potential of TAO,” noted Lucky, a seasoned Bitcoin investor.

Meanwhile, TAO is a front-runner for the artificial intelligence (AI) sector, which has shifted market sentiment from bearish to bullish. This shift is attributed to the rising global demand for AI technologies. The Relative Strength Index (RSI) also indicates that bulls maintain control, as the RSI remains above the midpoint of 50.

Read more: What Is Altcoin Season? A Comprehensive Guide

Aave (AAVE)

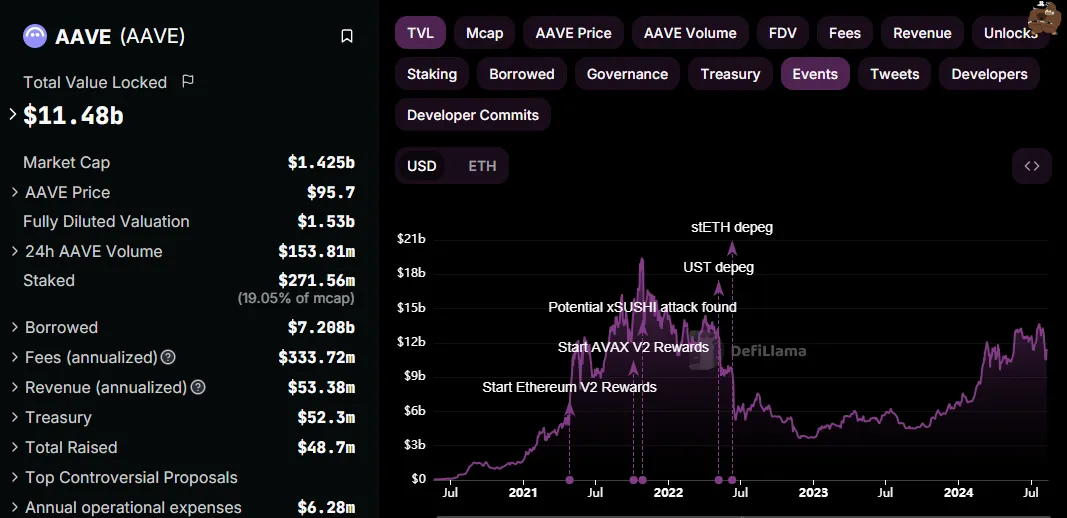

Michaël van de Poppe has also pointed to AAVE as a promising asset, noting significant accumulation against Bitcoin and the formation of higher highs against the USDT stablecoin, both signs of growing bullish momentum. He observes that AAVE has been in horizontal consolidation, with no significant price drops, which he sees as a strong indicator.

Beyond the bullish technical outlook, on-chain metrics for AAVE are also favorable. The Aave blockchain boasts a total value locked (TVL) of around $11.5 billion, against a market capitalization of over $1.4 billion. This valuation suggests considerable upside potential, according to van de Poppe.

Notably, the Aave DAO recently launched the first $100 million yield loan alongside key partners. The move, which exemplifies how tokenization and blockchain technology can revolutionize the issuance and management of bonds and securities, could bode well for the AAVE token.

Aevo (AEVO)

Michaël van de Poppe also highlights AEVO as a promising buy, pointing to its predictions and options market. From a technical perspective, he notes a bullish divergence in the Relative Strength Index (RSI), where the RSI shows higher lows against the price’s lower highs, indicating growing bullish momentum.

Van de Poppe further identifies a falling wedge pattern on AEVO’s one-day chart, which suggests a potential breakout to the upside. This pattern is widely regarded as a bullish reversal signal, confirmed when the price breaks above the upper trend line. The profit target for this pattern is typically calculated by adding the maximum distance between the upper and lower trend lines to the breakout point.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

The analyst did not highlight any projects on his radar for the DePIN category. Nevertheless, experts are already looking at Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), and Storj (STORJ).

Investors are actively preparing for an altcoin season despite skepticism that the capital rotations will happen. Notwithstanding, getting ahead of things is a safer option than succumbing to the fear of missing out. Nevertheless, traders and investors must also conduct their own research.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Struggles to Break Out as Bear Trend Fades

Ethereum (ETH) enters the week with mixed signals as traders brace for tomorrow’s “Liberation Day” tariff announcement, a potential macro catalyst that could impact risk assets. While the BBTrend indicator remains deeply negative, it’s beginning to ease, hinting at a possible slowdown in bearish momentum.

On-chain data shows a slight uptick in whale accumulation, suggesting cautious optimism from large holders. Meanwhile, Ethereum’s EMA setup shows early signs of a trend reversal, but the price still needs to break key resistance levels to confirm a shift in direction.

ETH BBTrend Is Easing, But Still Very Negative

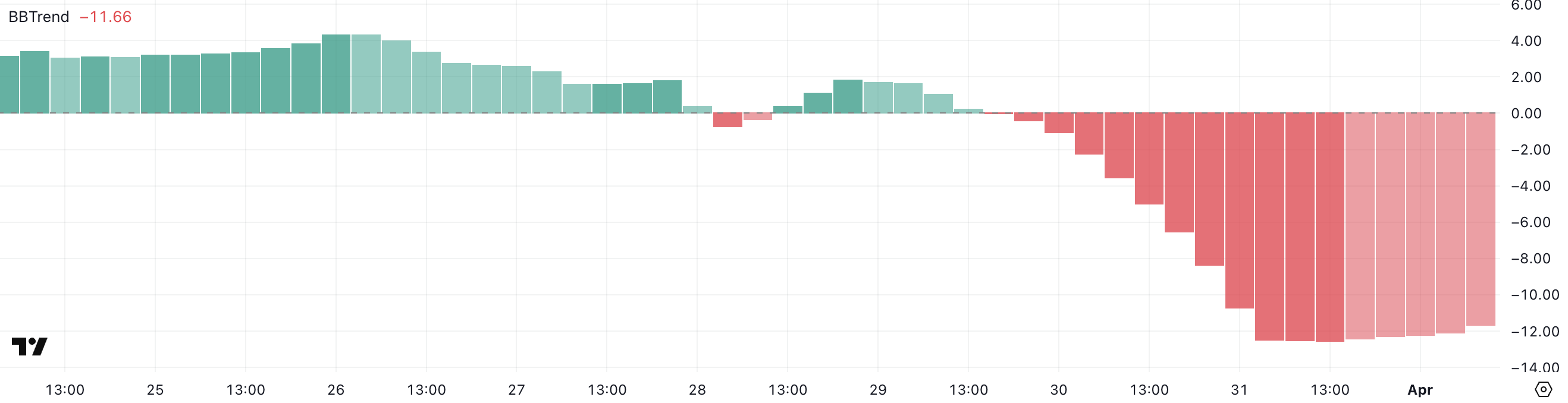

Ethereum’s BBTrend indicator is currently reading -11.66, slightly improved from -12.54 the day before, but still in negative territory for the second consecutive day.

The Bollinger Band Trend (BBTrend) measures the strength and direction of a trend based on how price interacts with the upper and lower Bollinger Bands.

A positive BBTrend suggests bullish momentum, with the price expanding toward the upper band, while a negative BBTrend indicates bearish momentum, with the price leaning toward the lower band. Typically, a value beyond 10 is considered a strong trend signal, making the current -11.66 reading a sign of continued downside pressure.

The persistent negative BBTrend suggests that Ethereum remains in a short-term bearish phase, with sellers still dominating the price action.

While yesterday’s slight uptick hints at a potential slowing of downward momentum, the indicator remains well below the neutral zone, meaning any reversal is still unconfirmed, despite Ethereum flipping Solana in DEX trading volume for the first time in 6 months.

Traders may interpret this as a warning to stay cautious, especially if ETH continues hugging the lower Bollinger Band. For now, price action remains fragile, and any bounce will need to be supported by a decisive shift in volume and sentiment to signal a meaningful reversal.

Ethereum Whales Are Accumulating Again

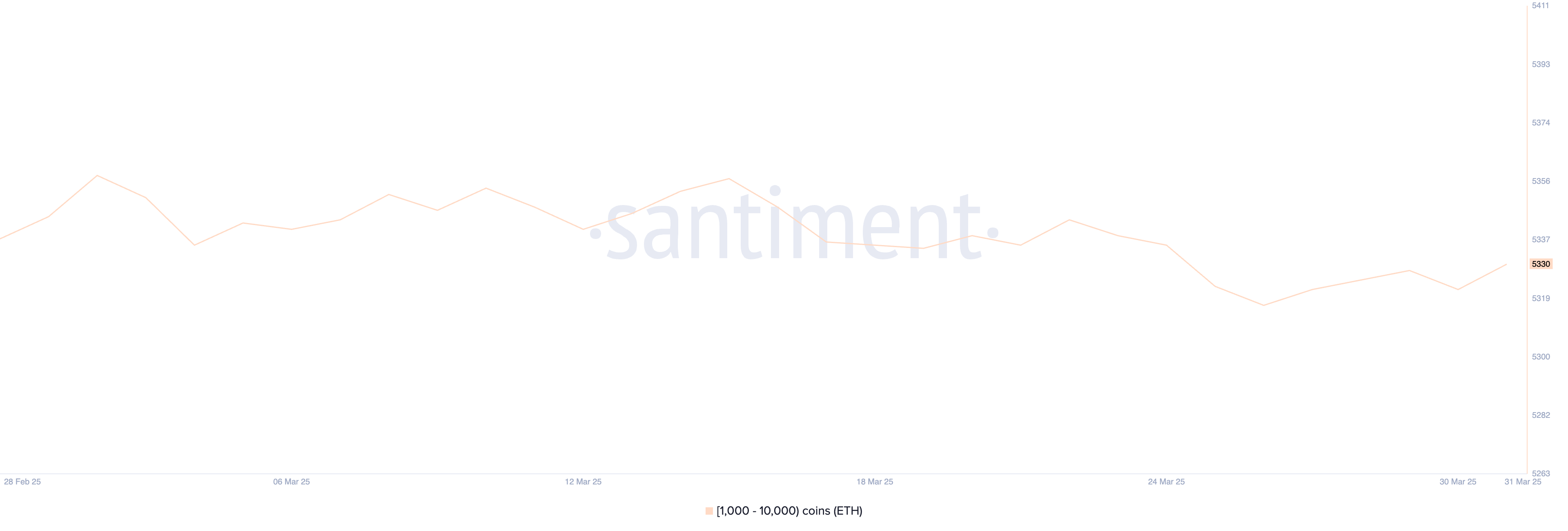

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has ticked up slightly, rising from 5,322 to 5,330 in the past 24 hours.

While this is a modest increase, whale activity remains one of the most closely watched on-chain metrics, as these large holders often influence market direction. Whales’ accumulation can signal growing confidence in Ethereum’s medium—to long-term prospects, especially during periods of price uncertainty or consolidation.

Conversely, a decline in whale addresses typically suggests weakening conviction or profit-taking.

Although the recent uptick is a positive sign, it’s important to note that the current number of Ethereum whales is still below the levels observed in prior weeks.

This means that while some large holders may be re-entering the market, the broader whale cohort has yet to fully commit to an accumulation phase.

If the upward trend in whale numbers continues, it could support a bullish shift in sentiment and price. However, for now, the data points to cautious optimism rather than a decisive reversal.

Will Ethereum Break Above $2,100 Soon?

Ethereum’s EMA lines are showing early signs of a potential trend reversal, with price action attempting to break above key short-term averages.

If Ethereum price can push through the resistance at $1,938, it may signal the start of a broader recovery, potentially targeting the next resistance levels at $2,104, and if momentum builds—especially with supportive macro catalysts—increasing toward $2,320 and even $2,546.

On the flip side, if Ethereum fails to maintain its upward push and bearish momentum resumes, the focus will shift back to downside levels.

The first key support sits at $1,823; a break below that could expose Ethereum to further losses toward $1,759.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Megadrop Launches KernelDAO

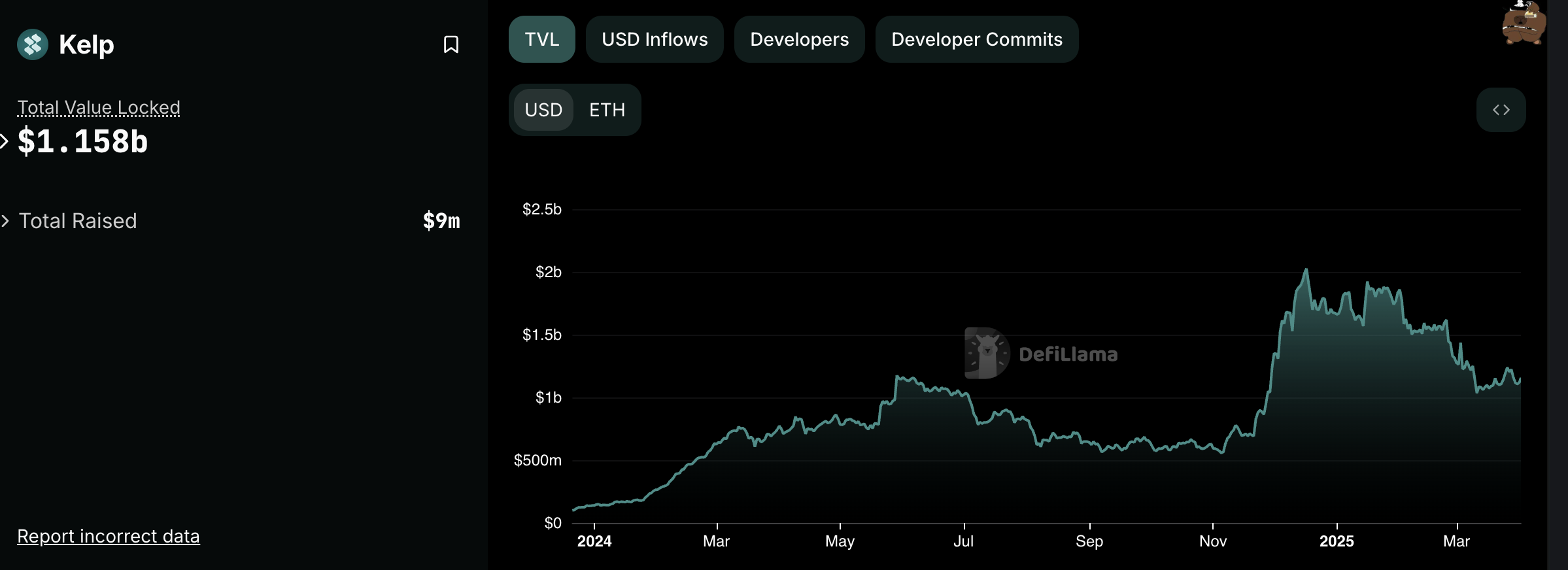

Binance Megadrop has announced its fourth project – KernelDAO (KERNEL), a restaking protocol supporting three key tokens Kernel, Kelp, and Gain.

Introduced in 2024, Binance Megadrop is a token launch platform that provides users with early access to promising crypto projects before their official listing.

KernelDAO and Binance Megadrop: Overview

KernelDAO is a restaking protocol that allows users to repurpose staked assets (such as ETH or BNB) to participate in other protocols, maximizing yield. The protocol launched its mainnet in December 2024.

The KernelDAO Megadrop event kicks off on April 1, 2025, and lasts for 20 days, rewarding participants with KERNEL tokens. Kelp, a KernelDAO component, manages over $1.15 billion in Total Value Locked (TVL) across 10 blockchains, including Ethereum and BNB Chain.

KernelDAO has a maximum supply of 10 billion KERNEL tokens. Binance has allocated 40 million KERNEL (4% of the total supply) for participants. Upon listing on Binance, the initial circulating supply will be 162,317,496 KERNEL (16.23% of the total supply).

After the Megadrop event, KERNEL will be listed on Binance Spot with trading pairs such as KERNEL/BTC, KERNEL/USDT, and KERNEL/BNB.

KernelDAO is the fourth project on Binance Megadrop, following Lista (LISTA) and Xai (XAI). Previously, Binance Labs invested in Kernel to build recovery infrastructure on the BNB Chain.

Binance’s inclusion of KernelDAO could contribute to the growth of the restaking sector. According to DeFiLlama, the total TVL of restaking protocols surpassed $15 billion in early 2025, with EigenLayer and Kelp leading the market.

With 40 million KERNEL tokens distributed through Megadrop, many participants may sell immediately after receiving their tokens, potentially creating downward price pressure. Additionally, increasing competition from protocols like EigenLayer could pose challenges for KernelDAO.

Additionally, not all projects listed on Binance have performed impressively. In 2024, Binance-listed tokens all fell, with 29 out of 30 tokens posting significant losses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

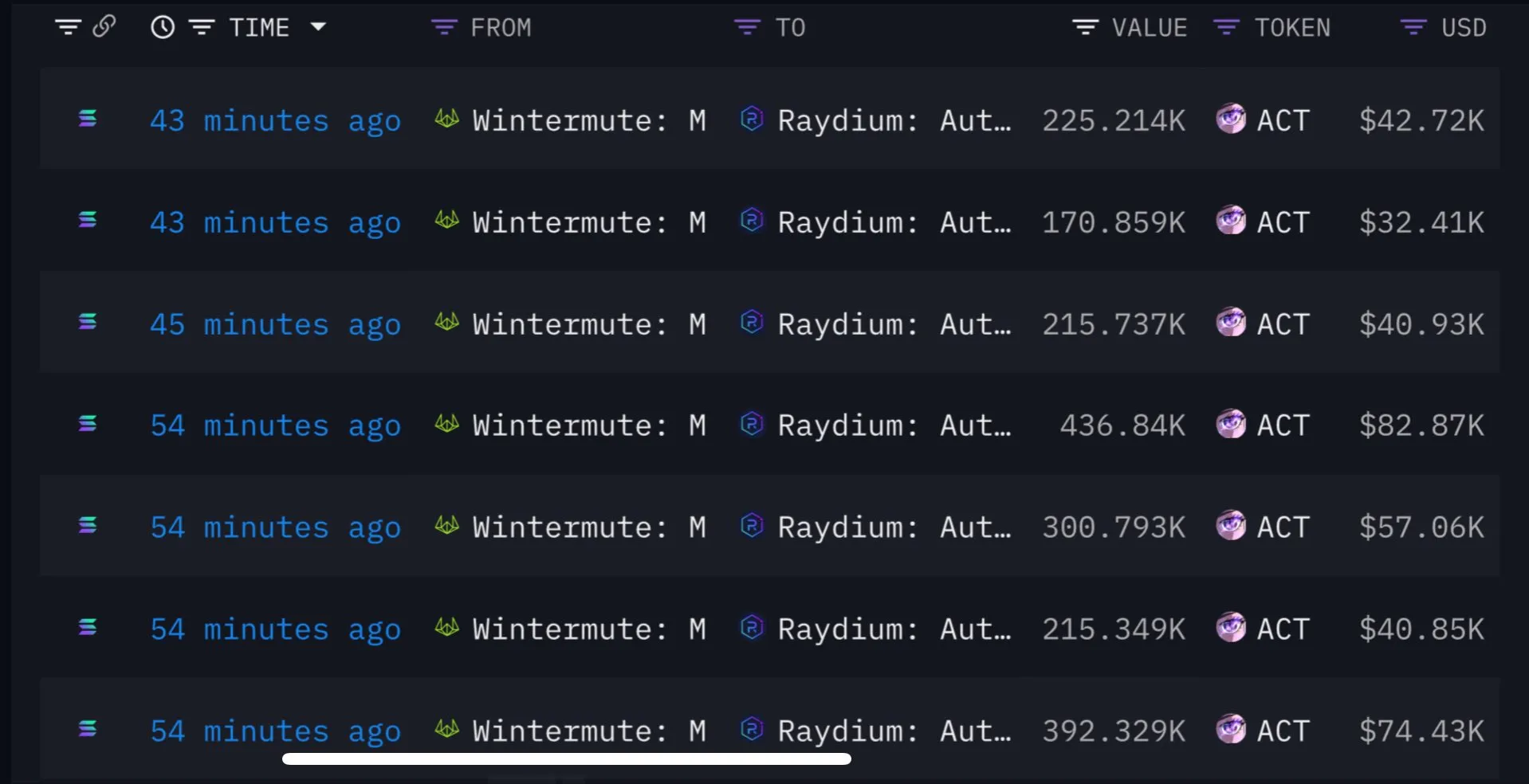

Wintermute Sells ACT Tokens Due To Binance Limit Changes

Market maker Wintermute sold off huge quantities of ACT and other BNB meme coins on April 1, tanking their prices by as much as 50%. Wintermute CEO denied intentionally selling these assets and started re-buying them.

Community sleuths believe that Binance is to blame, quietly lowering the leverage position limit for ACT and other tokens. This incident may cause further mistrust and uncertainty in a shaky meme coin market.

Why Did Wintermute Sell ACT?

A chaotic incident is currently unfolding in the meme coin sector. At the center of the story is Wintermute, a market maker that recently made headlines by interacting with World Liberty’s USD1 stablecoin before the official announcement.

Today, Wintermute has sold off large quantities of BNB meme coins, especially ACT.

After Wintermute’s massive sell-off, the price of ACT subsequently fell 50%. This caused a stampede in other BNB meme coins, erasing millions of dollars and generating a lot of market chaos.

However, in a strange development, Wintermute’s CEO Evgeny Gaevoy denied deliberately causing the sale.

“Not us, for what it’s worth! [I’m] also curious about that postmortem. If I were to guess, we reacted post move, arbitraged the Automated Market Maker (AMM) Pool,” Gaevoy claimed in a social media thread.

This raised more questions than it answered. If Wintermute didn’t intend to sell off these ACT tokens and other meme coins, what triggered them? The firm even began buying ACT again after the sale. Subsequently, crypto sleuths started suspecting a quiet rule change from Binance, the world’s largest crypto exchange.

Both data from Lookonchain and analysis from 0xwizard, an important community leader for ACT, alleged that Binance was involved in the Wintermute debacle. Specifically, they claimed that the exchange quietly lowered the leverage position limit for ACT. This meant that market makers who held more positions than this limit were automatically liquidated at market price.

Naturally, these allegations caused a lot of outrage. Yi He, co-founder of Binance, responded, claiming that the relevant team is “collecting details and preparing a reply.” She further said that there might be another player involved but didn’t elaborate on this. This is not her first time responding to major criticism about Binance’s meme coin policies.

Ultimately, the dust is far from settled on this issue. Most of the impacted tokens are still substantially down from their positions yesterday, which is unfortunate in this fearful market. Between HyperLiquid’s short squeeze last week and this incident with Wintermute and ACT, overreach from crypto exchanges could damage market confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoElon Musk Rules Out The Use Of Dogecoin By The US Government

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum May Have To Undo This Death Cross For Bull’s Return

-

Market22 hours ago

Market22 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Market21 hours ago

Market21 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin21 hours ago

Altcoin21 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market20 hours ago

Market20 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Market23 hours ago

Market23 hours agoXRP Bears Lead, But Bulls Protect Key Price Zone

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum Bitcoin Ratio Drops to Record Low, What Next for ETH?