Market

US CPI Data Release and More

This week, the crypto market is bracing for significant developments, with the US Consumer Price Index (CPI) data release and substantial token unlocks totaling over $230 million taking center stage.

These events are expected to drive volatility and shape the market’s direction.

MakerDAO’s Spark Tokenization Grand Prix Set to Commence on Monday

MakerDAO, a major player in the decentralized finance (DeFi) sector, is kicking off its Spark Tokenization Grand Prix on August 12, 2024. This initiative aims to onboard up to $1 billion in tokenized assets, focusing on US Treasury Bills and similar products. It also showcases MakerDAO’s strategic efforts to bolster its DeFi ecosystem.

Participants in the competition will be evaluated on pricing, liquidity, and alignment with SparkDAO’s vision. The goal is to identify proposals that promote innovation and financial inclusion.

Maker Governance will review the competition results. They will make final decisions on which assets to onboard while ensuring compliance with global financial regulations.

The Spark Tokenization Grand Prix has already garnered interest from major issuers of tokenized treasury bills. In an email to BeInCrypto, representatives from Superstate and OpenEden expressed their intention to participate with their flagship products, USTB and TBILL. Other reports indicate that BlackRock will also join the competition with its BUIDL token.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

US CPI Report Looms Over Crypto Market Sentiment

The July US Consumer Price Index (CPI) report is scheduled for release on August 14, 2024. Market participants expect the data to confirm a continuation of the disinflation trend seen in recent months.

Analysts believe that unless the CPI data reveals a significant uptick in inflation, the Federal Open Market Committee (FOMC) is likely to proceed with the anticipated interest rate cut in September. Such a rate cut could increase liquidity in the market, potentially driving up asset prices, including cryptocurrencies.

In June, the CPI data indicated a modest 0.1% monthly increase in core inflation, with an annual inflation rate of 3%. Meanwhile, projections from the Federal Reserve Bank of Cleveland and the prediction market Kalshi suggest that July’s CPI will continue to indicate a cooling economy.

Notably, the broader crypto market experienced a sharp decline last week, with Bitcoin dropping to as low as $49,000. Although it has since rebounded to around $60,000, the upcoming CPI data is expected to determine whether this recovery will continue or if further volatility is in store.

Ethena Labs to Reveal Details on Using Solana as New Backing Assets

Ethena Labs has expanded its synthetic dollar, USDE, to the Solana network as of August 7, 2024. This integration allows Solana users to transact in USDE while earning native rewards through sUSDE.

Alongside this integration, Ethena Labs also plans to incorporate Solana’s SOL token as a backing asset for USDE. The process is currently waiting for governance approval, which is anticipated to happen sometime within this week.

“SOL as a backing asset for USDe will be proposed to governance for implementation next week and open up an extra $2-3 billion of open interest across major exchanges, improving USDe’s scalability even further,” the Ethena Labs team said on their X (Twitter).

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

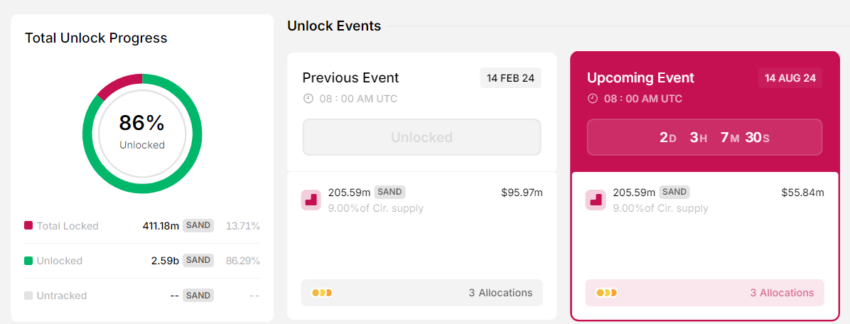

The Sandbox (SAND) and Other Major Token Unlocks This Week

This week, the crypto market will see significant token unlocks exceeding $230 million, with The Sandbox and Arbitrum leading the charge. The Sandbox will release 205.59 million SAND tokens, which account for 9% of its circulating supply.

These tokens, valued at approximately $55.84 million, will be allocated to team members, advisors, and the company reserve. This allocation also marks the final unlock for SAND’s private investors.

Similarly, Arbitrum will unlock over 90 billion ARB tokens, valued at around $53.5 million. Read this article for further detailed information on major crypto token unlocks this week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Forms Rounded Bottom Within Descending Channel, Target Set Above $3

Despite breaking above $3 earlier this year, the XRP price has since gone on to disappoint investors with multiple crashes that have rocked the altcoin. This has seen the cryptocurrency lose almost 50% of its acquired value between late 2024 and early 2025. Nevertheless, this has failed to erode bullish sentiment, with predictions for higher prices dominating the community.

Time To Go Long On The XRP Price?

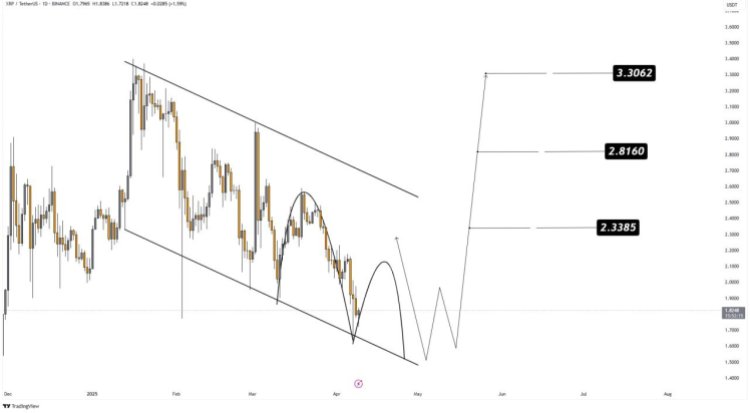

A crypto analyst on X (formerly Twitter) has renewed bullish hope after identifying an important formation on the XRP price chart. The analysis pointed out that the XRP Price is still moving within a descending channel, a formation that usually signals a bearish move.

However, the downtrend has pushed the altcoin’s price to the point where it is now testing the bottom trend line. This bottom trend line has been known to act as strong support previously and is expected to do so this time around.

With the support forming, it is likely that the XRP Price is gearing up for a bounce from this level. Furthermore, the crypto analyst points out that XRP is also forming a rounded bottom inside this descending channel. Such a rounded bottom could signal an end to the downtrend from here.

As the formation grows, the main level of support is now sitting at $1.6. So far, this level has held up quite nicely and bulls have been using it as a bounce-off point for recovery. Given this, the crypto analyst advises that entries for the XRP price are best at around $1.70 to $1.85.

This is not the only good news for the XRP price with support forming. If it holds and the altcoin does indeed bounce from this level toward $2, then the next important levels lie between $2 and $2.2. These serve as the levels for the bulls to beat to confirm a bullish continuation toward a possible all-time high.

If the bulls are successful, then three profit targets are placed by the crypto analyst. These include $2.3385, $2.8160, and $3.3062, pushing it toward January 2025 highs.

The Bearish Case

While the analysis is inherently bullish, there is still the possibility of invalidation that could send the XRP price tumbling further. As the analyst points out, the major support currently lies at $1.6. This means that bulls must hold this level. Otherwise, there is the risk of a much deeper correction as a liquidity sweep could send support further down to $1.3.

Nevertheless, with buy sentiments building once again, it is likely that XRP will follow the bullish scenario in this case.

Chart from TradingView.com

Market

RSR Price Climbs 22% After Paul Atkins Gets Named SEC Chair

Reserve Rights (RSR) has experienced a notable 22% increase in its price over the last 24 hours. This surge follows the news of Paul Atkins, former Reserve Rights Foundation advisor, becoming the new chair of the US Securities and Exchange Commission (SEC).

Additionally, US President Donald Trump’s decision to pause reciprocal tariffs has added a layer of optimism to the cryptocurrency market, further buoying RSR’s price.

Reserve Rights Investors May Note Profits Soon

The market sentiment surrounding RSR remains cautiously optimistic, driven by a significant accumulation of tokens. According to the IOMAP, around 46.73 billion RSR tokens, valued at over $350 million, are currently sitting at a price range between $0.007983 and $0.008202.

These tokens have not yet reached a profit zone, but an 8% rally would make them profitable for investors. As these large holders are likely to maintain a bullish outlook, the anticipation of possible profits could further strengthen the buying sentiment, contributing to a price increase.

However, if the holders aim to sell for a break-even, it might negatively impact the RSR price rally.

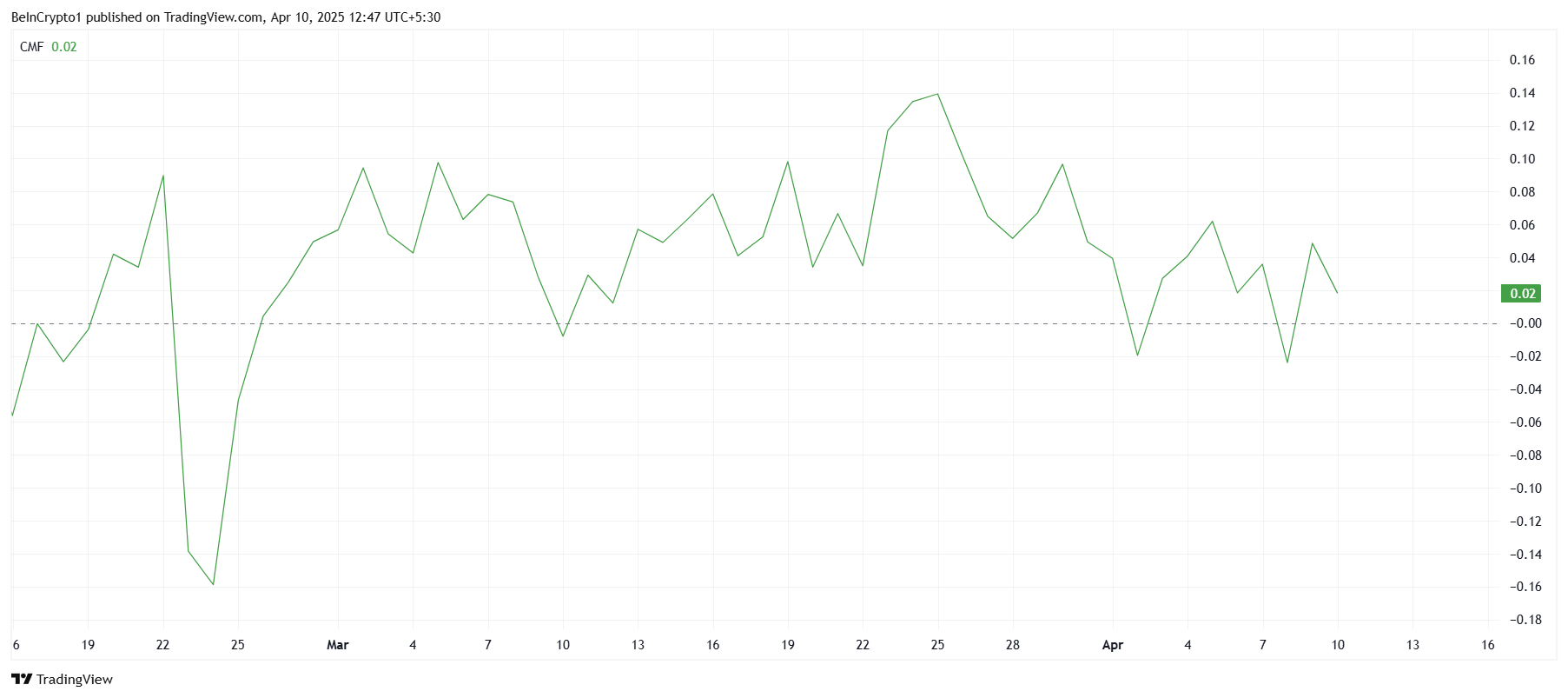

Despite the news of Paul Atkins becoming SEC Chair, the overall macro momentum for RSR appears to be lackluster. The Chaikin Money Flow (CMF) indicator, which measures market liquidity and investor buying pressure, has not seen any sharp upticks, even after the recent announcements.

This suggests that, while the netflows have been positive, they remain underwhelming compared to the size of the positive developments. If RSR’s price continues its uptick in the coming days, there is a chance that the CMF will start to reflect stronger positive sentiment.

RSR Price Is Rising

Reserve Rights (RSR) price is currently trading at $0.007543, with a strong support level at $0.007386. Given the 22% rally over the last 24 hours, it is possible that the token will continue to rise if it holds above this support.

A bounce off $0.007386 could see RSR making its way to $0.008196. This would bring the altcoin closer to a profitable range for many investors as well as imbue confidence regarding further rally.

However, should RSR fail to breach the $0.008196 resistance or fall below the support of $0.007386, the altcoin’s price could drop to $0.006601 or even lower towards $0.005900. This would significantly damage the bullish thesis and extend recent losses, potentially leading to a further period of consolidation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is Trump’s Tariff Delay Masking a Crypto Dead Cat Bounce?

President Donald Trump’s latest decision to pause most of his tariffs has sparked a rally in stocks, bonds, the dollar, and cryptocurrencies. However, experts believe that the tariff delay may be creating a “dead cat bounce” in the market.

This recovery follows Trump’s earlier imposition of reciprocal tariffs on all nations, including a significant 104% tariff on Chinese imports. The announcement rattled markets, triggering a considerable downturn.

Is the Crypto Market Surge Just Another Dead Cat Bounce in Disguise?

BeInCrypto reported that Trump’s 90-day tariff pause excluded China. Importantly, following Beijing’s retaliatory measures, the tariffs have now escalated to 125%.

Nevertheless, the move has significantly boosted markets. The total cryptocurrency market capitalization surged by 5.5% in the past 24 hours, with Bitcoin (BTC) reclaiming the $80,000 mark.

Other major cryptocurrencies, such as Ethereum (ETH), XRP (XRP), and Solana (SOL), also recorded double-digit gains, signaling renewed investor optimism.

Yet, beneath the surface of this rally, skepticism remains prevalent. Jacob King, analyst and CEO of WhaleWire newsletter, warned that the tariff delay is setting a trap for retail investors.

“We’ve officially entered the dead cat bounce phase: delay the tariffs, bait the retail crowd back in, and set the stage for the next red wave,” he posted.

He predicts that while retail investors pile into the market, institutions will use the opportunity to “quietly dump their bags,” foreshadowing a sharp downturn. Many echo King’s concerns. Moreover, economics professor Steve Hanke was even more direct.

“If Trump continues to play his tariff cards, the rally will represent nothing more than a dead cat bounce,” Hanke said.

In fact, some investors are planning to sell to avoid losses.

“This is the 90 day dead cat exit bounce. sell in may and go away,” another analyst wrote.

Nonetheless, Amit, an investor and analyst, offered a different view. He suggested that the previous market bounce was a dead cat bounce because it was not based on any solid, fundamental reason.

This time, however, the analyst pointed out that there is an actual reason for market optimism.

“The difference here, and why selling into the rip *might* not be the best, is that if tariffs are truly delayed — well folks we have a fundamental catalyst for the markets,” he remarked.

He explained that the initial 10% tariffs were already priced in the market. However, the market could stabilize if the 90-day tariff pause extends indefinitely and leads to a deal with China.

“We also have sold off a ton assuming these tariffs would be in effect. Jobs data is fine. If the tariffs aren’t the issue, not saying we need to visit 7000 spx anytime soon, but it may not be a deadcat given this catalyst could be long-lasting,” Amit added.

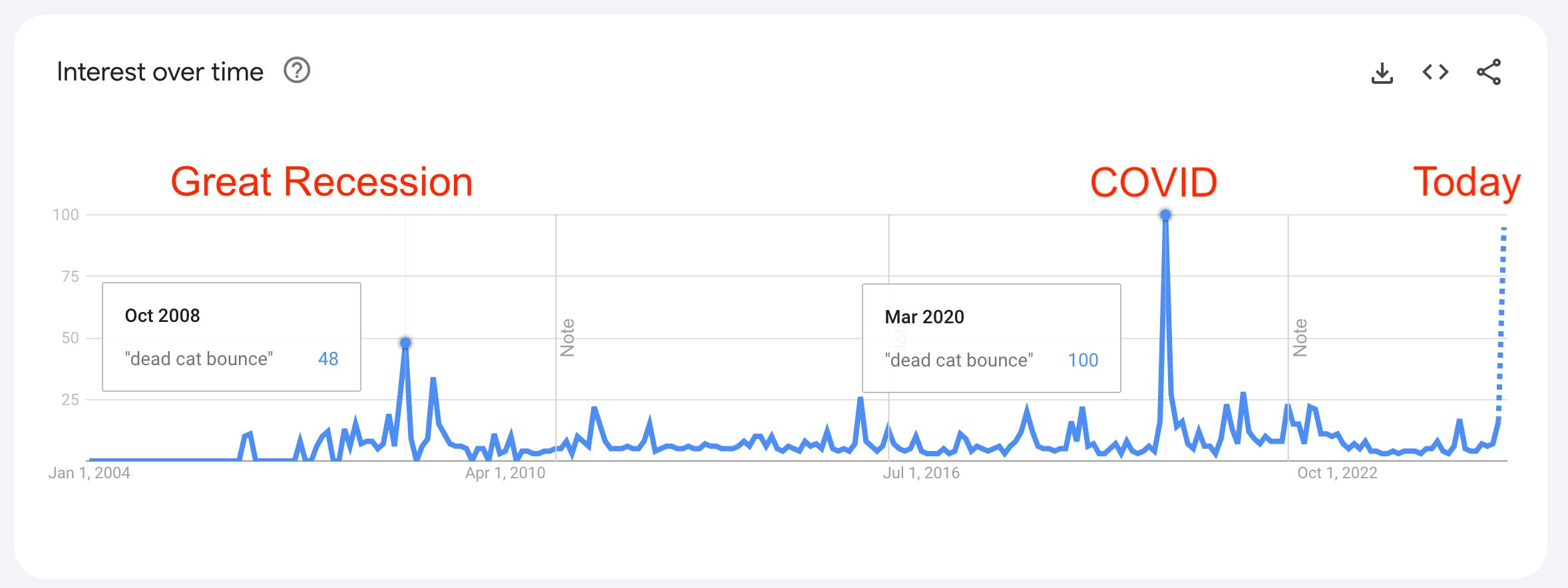

It is worth noting that the term “dead cat bounce”—a temporary recovery in asset prices after a steep decline, followed by a continued downtrend—has surged in online searches, reaching levels not seen since the COVID-19 pandemic.

During that period, markets like Bitcoin and stocks staged a V-shaped recovery fueled by quantitative easing (QE). BeInCrypto reported that this time, there is increased speculation that the Fed might return to QE in response to rising market volatility and financial instability.

If QE is revived, it could have a major impact on financial markets, including cryptocurrencies. The sector could see a strong rebound similar to past QE periods. Previously, Arthur Hayes, former CEO of BitMEX, predicted that Bitcoin could surge to $250,000 by the end of 2025 if this materializes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin11 hours ago

Bitcoin11 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market23 hours ago

Market23 hours agoHow Ripple’s $1.25 Billion Deal Could Surge XRP Demand

-

Altcoin14 hours ago

Altcoin14 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Bitcoin23 hours ago

Bitcoin23 hours agoGoldman Sachs Raises US Recession Odds to 45%

-

Market10 hours ago

Market10 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin21 hours ago

Altcoin21 hours agoPepe Coin Whales Offload Over 1 Trillion PEPE

-

Bitcoin20 hours ago

Bitcoin20 hours agoWill the Corporate Bitcoin Accumulation Trend Continue in 2025?

-

Altcoin13 hours ago

Altcoin13 hours agoIs Dogecoin Price Levels About To Bounce Back?