Market

July’s Crypto Mining Highlights: Russia’s New Law, Iris Energy’s Funding, and More

July 2024 saw interesting developments in the crypto mining industry. Significant legal advancements and strategic corporate developments shaped the sector.

From Russia’s implementation of stringent regulations to key investments in mining infrastructure, these series of events showcase the sector’s swift evolution.

Crypto Mining Gets Legal Framework in Russia

Russia’s State Duma passed a law in late July to regulate crypto mining and digital asset circulation. The legislation targets large-scale operations by requiring them to be listed in the mining infrastructure operators’ registry.

Home miners can continue without registration, provided they adhere to government-set energy consumption limits. However, this law excludes individuals with criminal records related to economic crimes. The exclusion is designed to ensure that only compliant and trustworthy entities can participate in Russia’s growing crypto mining industry.

President Vladimir Putin further solidified these regulations by signing the law on August 8, introducing official terminology like “digital currency mining” and “mining infrastructure operator.” This legal framework clarifies the operational settings, recognizing mining as part of the turnover process, which may influence future regulatory and taxation policies.

Read more: What is Cryptocurrency Mining?

Australian Bitcoin Miner Iris Energy Boosts Capacity with New Funds

Iris Energy, a Bitcoin miner based in New South Wales, raised $413 million in July. The company plans to use these funds to boost its operational capacity, adding 30 EH/s and 510 megawatts (MW) of data centers, fully supporting its 2024 expansion goals.

This financial maneuver also strengthens Iris Energy’s position and provides flexibility for future procurement, additional power capacity, and strategic monetization opportunities. Particularly in the US, the company focuses on its 1,400 megawatt (MW) project in West Texas.

Riot Platforms Expands with $92.5 Million Block Mining Acquisition

Riot Platforms also made headlines in July by acquiring Block Mining, a Kentucky-based Bitcoin miner, for $92.5 million. This acquisition is part of Riot’s strategy to diversify and expand its operations across the US.

The deal, funded through a mix of cash and stock, provides Riot with an additional 60 MW of developed capacity, with the potential to scale to over 300 MW. Riot’s CEO, Jason Les, highlighted that this acquisition is crucial for achieving their growth target of 100 EH/s and expanding into new power markets.

“The acquisition of Block Mining also diversifies Riot geographically into new power markets and brings onboard a proven operating team,” Les added.

Northern Data Eyes U.S. IPO for AI and Data Center Units

European Bitcoin miner Northern Data is reportedly exploring an initial public offering (IPO) for its AI cloud computing and data center businesses in the US. The potential IPO, targeted for the first half of next year, could value the combined businesses between $10 billion and $16 billion.

The Frankfurt-based company is considering listing its cloud computing activities, Taiga, and its data centers, Ardent, on the Nasdaq. This move could boost Northern Data’s market presence and supply the capital needed for its US expansion. Additionally, the firm’s decision to pursue a US IPO reflects its strategy to capitalize on the growing intersection of AI, cloud computing, and crypto mining.

This news has also positively impacted Northern Data’s stock price. Data revealed that on July 2, NB2 jumped from €25 to as high as €32.85. However, during the market after-hours on August 9, its price had stabilized at €20.60.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

Former Executive Wins $138 Million Verdict Against Marathon Digital

Marathon Digital was penalized $138 million in late July following a jury’s decision. The company had violated a non-disclosure agreement with its former executive, Michael Ho, who now serves as Chief Strategy Officer at Hut 8.

David W. Affeld and Edward E. Johnson, from Affeld England & Johnson LLP, represented Michael Ho in a trial against Marathon’s counsel at Weil Gotchal and Manges LLP. Affeld explained that the unanimous jury verdict of $138 million vindicates Michael Ho’s efforts and expertise. Furthermore, it reinforces the importance of honoring contractual obligations and respecting professional relationships.

The post July’s Crypto Mining Highlights: Russia’s New Law, Iris Energy’s Funding, and More appeared first on BeInCrypto.

Market

Why SUI Network Outage Did Not Cause a Price Crash

Earlier today, the Layer-1 blockchain Sui experienced a two-hour blackout, halting block production and rendering transaction processing impossible. This network outage led to a slight dip in SUI’s price, falling from $3.73 to $3.64.

Despite concerns of a more significant decline, the price stabilized after the project announced that the network was fully restored and operational.

Sui Comes Back Online, Altcoin Still in Good Position

Around 10:52 UTC, web3 security firm ExVull disclosed that a DOS bug caused the Sui network outage. Fully known as a Denial-of-Service (DoS) attack, the bug” refers to a software attack that overwhelms a system with excessive traffic or requests, causing it to become unavailable to legitimate users by crashing or severely slowing its functionality.

“After our analysis, it was found that the Sui Network node occur DOS due to integer overflow,” ExVul stated.

Following this development, several exchanges halted SUI transactions as the price also dipped a little. However, nearly two hours later, the project updated its community, saying that validators had assisted in resolving the issue.

“The Sui network is back up and processing transactions again, thanks to swift work from the incredible community of Sui validators. The 2-hour downtime was caused by a bug in transaction scheduling logic that caused validators to crash, which has now been resolved,” it explained.

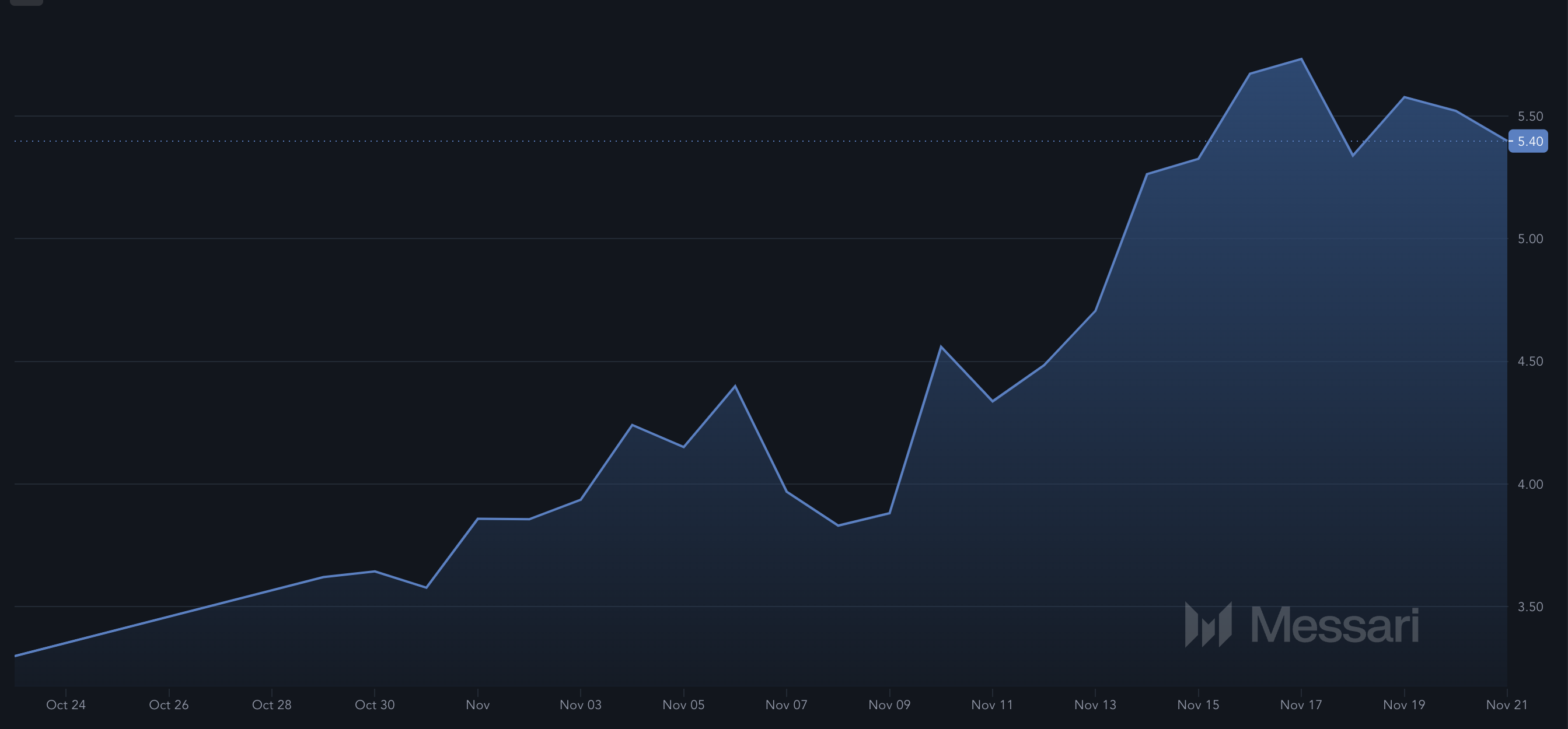

Meanwhile, data from Messari showed that, amid the outage, the Sharpe ratio remained positive. The Sharpe ratio is a key measure of risk-adjusted return, indicating how much excess return an investment generates relative to its volatility.

It helps investors assess whether the returns of a riskier asset justify the risk taken. A higher ratio signifies better risk-adjusted performance. Typically, when the ratio is negative, it means that the risk might not be worth the reward.

However, since it is positive for SUI, it indicates that accumulating the altcoin around its current value could still yield positive returns.

SUI Price Prediction: Run Above $4

On the daily chart, SUI continues to trade within an ascending channel. An ascending channel, also called a rising channel or channel up, is a chart pattern defined by two parallel upward-sloping lines.

It forms when the price shows higher swing highs and higher swing lows, indicating an ongoing uptrend. Furthermore, the Chaikin Money Flow (CMF) has increased, suggesting that buying pressure has outpaced distribution.

If this continues, SUI’s price could climb above $4. However, if a Sui network outage occurs again, this might not happen. In that scenario, the value could drop below $3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Aptos Partners with Circle and Stripe to Revitalize Network

The Aptos Foundation announced a new partnership with Circle and Stripe, hoping to revolutionize its network functionality. Circle’s CCTP and USDC stablecoin will enhance blockchain interoperability, while Stripe will attract TradFi by simplifying fiat interactions.

Aptos has set ambitious goals with this partnership, but APT’s upward momentum has stagnated.

Aptos Partners with Circle and Stripe

According to a new announcement from the Aptos (APT) Foundation, its network is integrating Circle’s USDC stablecoin and Cross-Chain Transfer Protocol (CCTP). Additionally, Aptos is integrating the payment platform Stripe, generally streamlining fiat-related features. These include on- and off-ramps, payment processing, and TradFi ease of adoption.

“Once the integration is complete, users will be able to seamlessly transfer USDC between Aptos and 8 major blockchains. In addition to USDC and CCTP, Stripe will soon launch its payment services on Aptos, creating a reliable fiat on-ramp to streamline merchant pay-ins and payouts using Aptos-compatible wallets,” the firm claimed via press release.

In other words, Aptos aims to use this partnership to make itself “the ultimate hub for interoperable DeFi.” These companies will approach this goal from both ends: enticing new users and investors while substantially improving the core experience. This partnership marks a new development for Stripe’s integration with crypto.

Indeed, Stripe took a six-year hiatus from cryptocurrency payments, which only ended this April. Since then, however, it’s been engaging seriously with the industry. The firm entered an earlier partnership with Circle this June, hoping to promote USDC adoption. Additionally, Stripe acquired Bridge, a crypto payment platform, last month.

For its part, Aptos is undertaking a recovery process. Despite a major price spike in March, it suffered a lingering decline for most of 2024. The asset began regaining steam in October, and the November bull market has brought increased optimism. Still, its gains have stagnated for about a week.

This partnership between Aptos, Circle, and Stripe may help APT regain its forward momentum. These ambitious new features will greatly add functionality and accessibility to Aptos’ network. Still, the firm has set a very ambitious goal for itself: to solidify “its place as a leader in interoperable DeFi and enterprise-grade blockchain technology.” Only time can tell its success level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

The SEC is quietly meeting with several issuers to discuss approving a Solana ETF, claims Fox Business reporter Eleanor Terrett. With Trump’s impending pro-crypto administration, the SEC seems more inclined to approve such a product.

However, anti-crypto figure Gary Gensler is still nominally in charge of the SEC, and public progress might not begin until 2025.

Solana ETF Approval Is Getting Closer

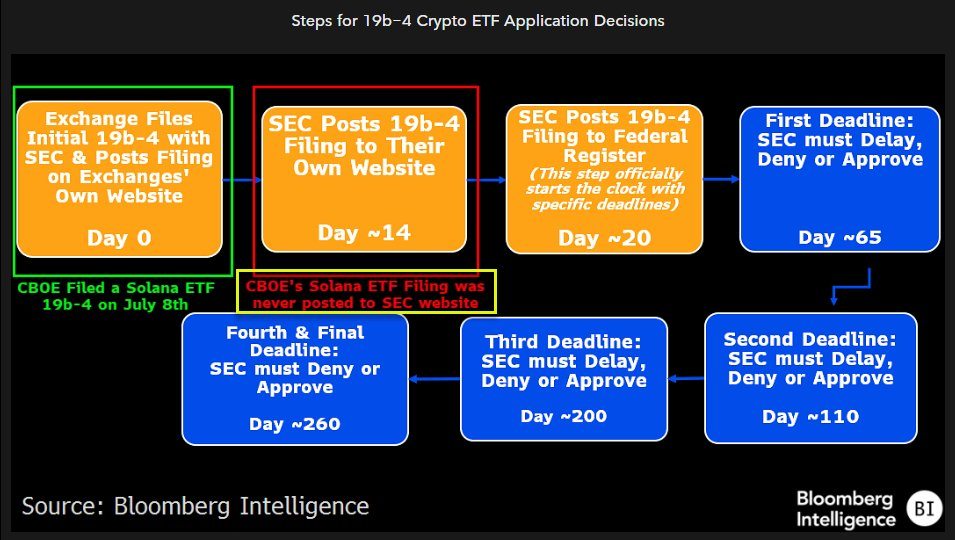

According to a scoop from Fox Business reporter Eleanor Terrett, the SEC and several ETF issuers are in talks to approve a Solana ETF. Currently, Brazil is the only country that has given this product a green light. As recently as September, Polymarket odds gave the SEC a dismal 3% chance of approving it. This reluctance, however, might soon be changing:

“Talks between SEC staff and issuers looking to launch a Solana spot ETF are “progressing” with the SEC now engaging on S-1 applications. Recent engagement from staff, coupled with the incoming pro-crypto administration, is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025,” Terrett claimed.

Terrett was very clear about the impetus for this progress in negotiations: Donald Trump’s re-election. On the campaign trail, Trump vowed to significantly reform US crypto policy, and one cornerstone was firing anti-crypto SEC Chair Gary Gensler. Gensler has apparently conceded to his impending ouster, and his replacement will undoubtedly support the industry.

Previous attempts have floundered at an early step in the process. Once the SEC officially acknowledges an application, it must confirm or deny it within a 240-day window. Previous filings have lingered in limbo at this stage. However, the list of candidates is now growing: Canary Capital filed for a Solana ETF in October, and BitWise did the same earlier today.

Nonetheless, these positive negotiations still only consist of anonymous rumors. The Commission has not publicly moved to begin this process, and Gensler is still nominally in charge. Terrett posits that the SEC will only make serious progress on the Solana ETF at the start of 2025. Compared to previous pessimism, however, this is a complete sea change.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum12 hours ago

Ethereum12 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Pushes Timeline For Franklin Templeton Crypto Index ETF

-

Market20 hours ago

Market20 hours agoRENDER Price Soars 48%, But Whale Activity Declines

-

Regulation19 hours ago

Regulation19 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Regulation23 hours ago

Regulation23 hours agoDonald Trump’s transition team considering first-ever White House crypto office

-

Market19 hours ago

Market19 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates

-

Market17 hours ago

Market17 hours agoDogecoin (DOGE) Price Momentum Weakens Despite Rally