Altcoin

This is Why Bittensor (TAO) Price Could Be Set for More Gains

TAO, the utility token of the decentralized network Bittensor, is among the top gainers in the market today. The altcoin, which was trading as low as $181.79 on August 5, has surged to $316.93 at press time.

This rally represents a 15.61% 24-hour increase. However, a few other interesting things are happening on the network, which this on-chain analysis will discuss.

The Hidden Forces Behind Surging Interest

On August 7, BeInCrypto reported that leading crypto asset manager Grayscale added Bittensor to its new investment trusts. The development came a few weeks after the firm created a decentralized AI trust involving other AI-themed tokens.

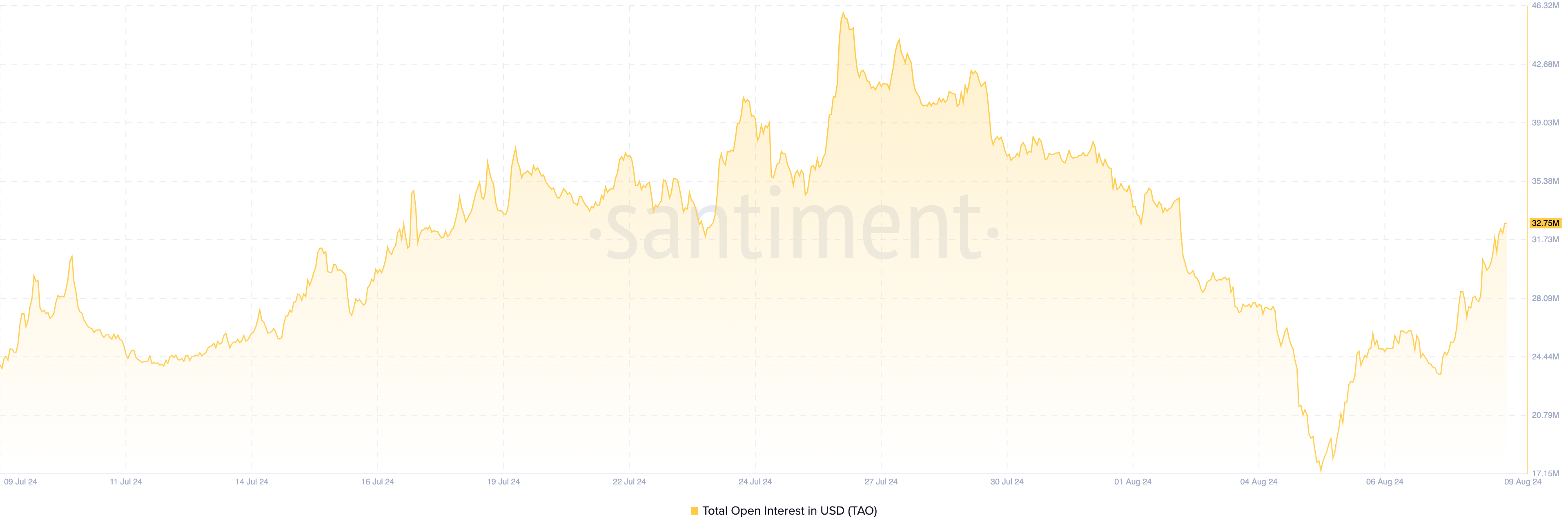

Following the disclosure, traders in the derivatives market increased their exposure to TAO. According to Santiment, Open Interest related to the cryptocurrency was around $17 million. As of this writing, that value has nearly doubled.

Open Interest, often referred to as OI, measures the value of outstanding contracts in the market. An increase in OI indicates that traders are adding more liquidity to contracts, while a decrease signals a reduction in net positioning.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

When critically analyzed, Open Interest (OI) can indicate whether a trend is likely to continue. If OI and price both move in the same direction, the trend is likely to persist. However, if they move in opposite directions, a trend reversal may occur.

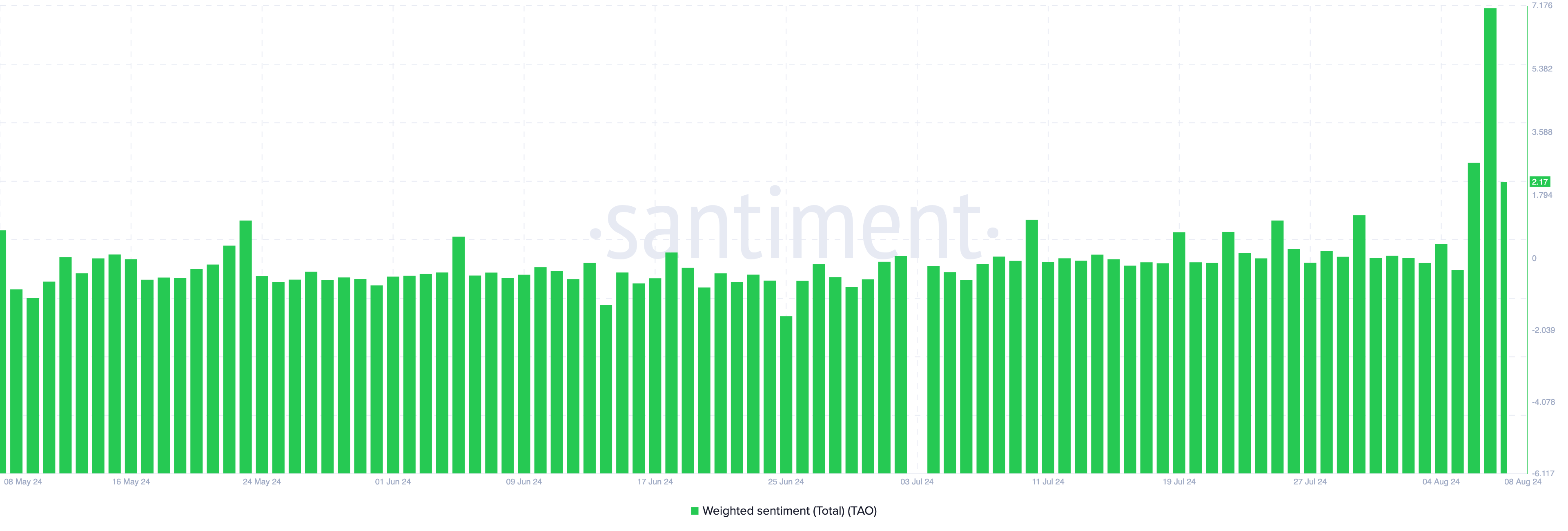

With TAO’s price and OI both on the rise, the token could reach a higher value in the short term. Additionally, on-chain data reveals that Weighted Sentiment spiked on August 7, reflecting extremely optimistic comments about Bittensor.

Although this sentiment has slightly decreased, it remains positive, suggesting that the broader market still holds a bullish outlook. If this sentiment continues in the positive range in the coming days, demand for TAO may grow, potentially driving the price even higher.

TAO Price Prediction: Can It Break the $360 Barrier?

Before TAO’s recent surge, the daily chart showed it had formed a rounded top. Often viewed as a bearish sign, the inverted bowl-shaped pattern indicates increasing selling pressure.However, the support level at $217.87 prevented a breakdown from happening.

Meanwhile, the Relative Strength Index (RSI) is 54.31, suggesting solid bullish momentum for the cryptocurrency. Typically, the RSI is a technical indicator that uses speed and price changes to determine momentum.

When it increases, buying momentum dominates, while a decrease suggests that sellers are in control. For TAO, the rise in the RSI rating could strengthen the uptrend just like the Open Interest.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Based on the analysis, TAO could target the overhead resistance at $323.18. If it breaks through this level, the price might reach $361.51. However, if bears overpower the bulls, the cryptocurrency’s value could drop to $272.58.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Top Neiro Ethereum Holder Dumps $3M NEIRO Sparking Price Dip Concerns

One of the top Neiro Ethereum holders has surprisingly sparked bearish sentiments amid a bull market, heavily dumping the dog-themed meme token. Recent on-chain data pointed out that the 2nd largest holder of the token, Wintermute, took action to dump $3M worth of coins. This dump has raised substantial investor concerns, further solidified by the coin’s waning price movement amid a broader bull market.

Top Neiro Ethereum Holder Offloads Over 100M Coins

According to data by Arkham Intelligence, Wintermute deposited 35 million Neiro Ethereum tokens worth $3.08 million to Bybit over the past three days. Notably, the market maker remains the 2nd largest holder of the crypto, holding 10.9% of the total supply worth 108.95 million tokens.

Besides, it’s noteworthy that the same market maker totally withdrew 121.466M of the same token from Bybit before the abovementioned selloff to become the 2nd largest holder of this Shiba Inu dog breed-themed crypto. Nevertheless, despite the selloff weighing in, Wintermute is still the 2nd largest holder of the asset.

In light of this dynamic, market participants remain apprehensive as future selloffs by the top holder could negatively influence the renowned meme coin’s price movements. Meanwhile, despite a bullish sentiment over top meme coins, as witnessed by Dogecoin, Pepe coin, Bonk, and other tokens’ phenomenal gains, the Neiro Ethereum selloff has solidified market concerns.

Token Price Remains Volatile

At the time of reporting, NEIRO price traded near the flatline over the past 24 hours to rest at $0.079. The coin’s intraday low and high were $0.0753 and $0.08385, respectively. Notably, the weekly chart for the crypto showcased a 10% dip. This waning action has sparked severe market concerns in the wake of the abovementioned selloff.

However, a recent CoinGape Media report revealed that Neiro Ethereum has partnered with the market maker DWF Labs, adding investor intrigue on future price movements. Notably, another massive holder of the crypto is GSR Markets, a renowned market maker, holding 33.52 million tokens. Wintermute and GSR collectively hold 142.47 million tokens worth 14.25% of the total supply.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Hidden Bullish Divergence Appears On Dogecoin Price Chart, Here’s What To Expect Next

A hidden Bullish Divergence pattern has just been identified on the Dogecoin price chart, signaling possibilities of a significant uptrend. With this new technical pattern, a crypto analyst has projected a target of $0.7 for the Dogecoin price.

Bullish Divergence Hint At Dogecoin Price Surge

On November 20, crypto analyst Trader Tardigrade on X (formerly Twitter) announced the appearance of a hidden bullish divergence on the Dogecoin 4-hour Relative Strength Index (RSI) chart. Based on this unique technical indicator, the analyst’s Dogecoin price analysis suggests that the meme coin may be gearing up for a significant rally to the upside.

Typically, an RSI hidden bullish divergence occurs when the price of a cryptocurrency forms higher lows while its RSI forms lower lows. This indicates that despite Dogecoin’s RSI showcasing declining momentum, its price is still maintaining strength, suggesting a higher potential for an uptrend continuation.

Recently, the Dogecoin price has been on a major bullish run, as it skyrocketed from above $0.1 to over $0.35 in just a few weeks. This impressive rally has allowed the popular meme coin to test the $0.4 resistance level, a critical threshold that could trigger a significant rally for the Dogecoin price.

Based on Trader Tardigrade’s Dogecoin chart, the RSI Hidden Bullish Divergence can be seen forming at around the $0.37 price level. The analyst has set a bullish target at $0.7 for Dogecoin, highlighting a steady but continuous growth from its current price if it can maintain positive momentum.

As of writing, the price of Dogecoin is trading at $0.38, marking a 165.19% surge over the past month, according to CoinMarketCap. Despite repeatedly failing to break the $0.4 threshold, Dogecoin could see an 84.2% price increase from its current value if the projected positive growth driven by the Hidden Bullish Divergence holds valid. This would effectively push the meme coin close to or even above it’s All-Time High (ATH) of $0.73 in May 2021 during the last bull market.

DOGE Targets New ATH

In another X post, crypto analyst, Steph, has maintained an optimistic outlook on the Dogecoin price. According to Steph, Dogecoin could be gearing up for a new ATH this bull cycle.

The analyst shared a 2-year Dogecoin price chart, pinpointing a bullish target between $1.4 and $1.8 for the meme coin. Following the target’s position on the Dogecoin chart, the analyst suggests that this ATH rally could either take place before the end of 2024 or in 2025.

Based on current market trends, this massive price surge to a new ATH could be potentially driven by Elon Musk’s influence through his newly proposed organization, the Department of Government Efficiency (D.O.G.E). Additionally, Donald Trump’s upcoming inauguration as the 47th United States (US) President could also serve as a strong catalyst that could propel the Dogecoin price higher.

Altcoin

XRP Price Rally to $2 As Paul Atkins Leads to Replace US SEC Chair Gary Gensler

XRP price shot up 26% in hours as the US SEC Chair Gary Gensler announced his resignation. Ripple’s native token XRP hit a high of $1.43, the levels last seen during the 2021 bull run. Crypto market analyst predicts the continuation of the rally all the way to $2 following a bullish pattern breakout. The news of pro-crypto Paul Atkins replacing Gensler as SEC Chair could fuel the XRP rally further.

XRP Price Rally to $2 Coming?

Following the resignation announcement by SEC Chair Gary Gensler, the XRP bulls have charged in leading to another 26% price rally. Gensler’s last day at the office will be January 20, 2025, the same day when President-elect Donald Trump takes charge at the White House. It is clear that the XRP community sees Gensler’s resignation as positive, following the tough four-year legal battle in the Ripple lawsuit.

Crypto market analyst Ali Martinez believes that this rally will continue to $2. Martinez suggested that Gensler leaving the SEC would mark a significant turning point for Ripple, potentially easing regulatory pressures on the company.

“Gary Gensler leaving the SEC is the best thing that could happen to Ripple,” Martinez stated. He further added that XRP price could now set its sights on a $2 target, amid the fresh breakout from the flag-and-pole pattern.

Crypto analyst CrediBULL Crypto highlighted that XRP’s monthly Relative Strength Index (RSI) is on the verge of entering overbought territory for the first time in three years. “XRP/ETH just reclaimed and retested a 4 year long range, with the first target being ~250% higher,” he added.

Paul Atkins to Replace US SEC Chair Gary Gensler?

As Gary Gensler puts his resignation, the biggest question in everyone’s mind is whom will Donald Trump appoint as the next SEC Chair? Fox Business reported that former SEC Commissioner Paul Atkins is the front-runner to succeed Gary Gensler.

Paul Atkins is popular for his free-market regulatory approach and pro-crypto stance. He has also garnered strong support from the business community and the digital asset industry. His appointment could also open the gates for the spot XRP ETF by 2025.

21Shares, Canary Capital, and Bitwise have already filed with the US SEC for the XRP ETF in the last two months. The arrival of this investment product could fuel institutional interest in XRP.

Gary Gensler’s decision not to complete his term at the SEC has been met with widespread approval from the business sector, which has been critical of his regulatory approach. The narrative towards the end of Ripple vs SEC lawsuit now looked more obvious.

As of press time, the XRP price is trading 26% up at $1.40 with a market cap of $80 billion. As per the Coinglass data, the open interest in XRP has shot up 35% to $2.47 billion. In the last 24 hours, $25.64 million worth of XRP positions were liquidated with $14 million in short liquidations and $11.62 million in long liquidations.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Bitcoin19 hours ago

Bitcoin19 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation13 hours ago

Regulation13 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market19 hours ago

Market19 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Altcoin19 hours ago

Altcoin19 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K

-

Market18 hours ago

Market18 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Altcoin22 hours ago

Altcoin22 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Ethereum16 hours ago

Ethereum16 hours agoAnalyst Reveals When The Ethereum Price Will Reach A New ATH, It’s Closer Than You Think

✓ Share: