Altcoin

Top 3 in the First Week of August 2024

The first week of August 2024 began turbulently for the crypto market, causing widespread concern.

Despite the ill-fated development, a few tokens saw notable gains, particularly as the week drew to a close. This analysis highlights the biggest altcoin gainers of the last days, including Sui (SUI), Zcash (ZEC), and Helium (HNT).

Sui (SUI) Price Heeds Grayscale’s Call

The price of SUI, the native token of the Move-programmed Layer-1 blockchain, registered one of its biggest one-day jumps on August 8. Rallying to $0.83, it ends the first week of August 2024 with a significant 28.77% increase.

SUI’s jaw-dropping growth is connected to a recent Grayscale announcement. On August 7, the crypto asset management firm disclosed that it had added SUI and Bittensor (TAO) to its list of investment trust products.

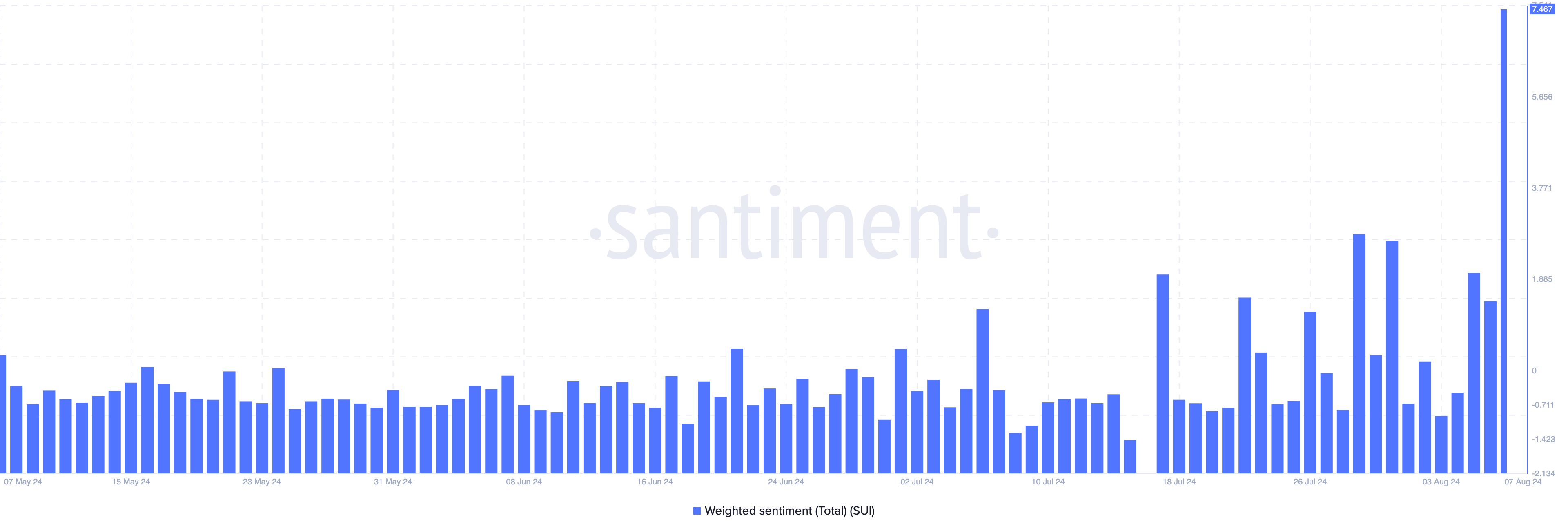

Before the announcement, SUI’s price was $0.60. Moments later, it experienced a surge in positive comments online, leading the Weighted Sentiment to reach its highest point year-to-date.

The technical perspective shows that SUI experienced a notable 42% price drop before the recent recovery. For instance, on August 5, the price was as low as $0.46. However, the rise above the 20 (blue) and 50 (yellow) EMAs helped validate the bullish trend.

Read more: 10 Best Altcoin Exchanges In 2024

The Exponential Moving Average (EMA) tracks trend direction over time. If SUI’s price had fallen below the EMAs, the bullish trend would have been uncertain.

Although the price has slightly retraced, the Moving Average Convergence Divergence (MACD) indicates that the uptrend might resume. The MACD measures momentum by analyzing the difference between two moving averages.

If the MACD reading is above the zero line, as it is in SUI’s case, momentum is upward. A negative reading suggests the opposite. If the uptrend continues, SUI could reach $0.90. However, if the token encounters rejection, it might fall to $0.71.

Zcash (ZEC) Capitalizes on the Double-Bottom

Zcash, a decentralized cryptocurrency that allows users to attain a high level of privacy, is second on the list. ZEC joined the list of the biggest altcoin gainers after its price increased by 24.50% in the last seven days.

At press time, ZEC trades at $37.32. According to the daily chart, its price jumped after it appeared to have formed a double bottom. This pattern, which suggests a trend reversal, is characterized by a W-shaped movement where the price rises after hitting two similar lows.

As shown below, ZEC confirmed the bullish reversal by breaking out of the neckline around $32.54. Meanwhile, the Relative Strength Index (RSI), which measures momentum, indicates that the token is overbought, with a reading of 71.28.

Typically, an RSI reading of 30.00 or below indicates an asset is oversold, while readings of 70.00 or above suggest it is overbought. As a result, ZEC’s price could retrace, especially if profit-taking appears.

If this happens, the value could fall to $32.96. However, if buying pressure stays strong, the token’s price might approach $40.

Helium (HNT) Enters the Fold for the Second Consecutive Week

Last week, HNT was one of the biggest altcoin gainers. This week, it is part of the group again, thanks to a 15.60% increase. The token, which is ranked as the 74th most valuable cryptocurrency and trades at $5.88, operates as a Decentralized Physical Infrastructure Network (DePIN) on Solana.

Helium’s upswing last week was followed by a steep decline, but the token quickly recovered, forming a V-shaped pattern that indicates a strong rebound.

Currently, the token trades at $5.90. However, the On Balance Volume (OBV) suggests that the value could be higher. OBV measures whether the volume flowing in and out of a cryptocurrency is positive or negative.

An increase in OBV signals strong buying pressure, while a decrease suggests sellers are in control. For HNT, the rising OBV indicates that buyers are currently driving the market direction.

Read More: Which Are the Best Altcoins To Invest in August 2024?

If buying pressure continues, HNT may attempt to retest $6.50. However, if selling pressure outweighs buying volume, the token’s price could decrease to $5.73.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Dormant Ethereum Whale Dumps $224M Tokens, Has ETH Price Topped?

In an unprecedented event, a dormant Ethereum whale caused a stir across the broader market on Friday, heavily dumping tokens amid the hovering bullish sentiment. Recent data pointed out that the whale dumped nearly $224 million worth of tokens, raising price drop concerns among crypto enthusiasts globally. Despite that, ETH price soared today, setting off waves of speculation over future movements across the industry.

Dormant Ethereum Whale Wakes Up To Sell, Investors Apprehensive

According to the latest data by Lookonchain, an Ethereum whale that was dormant for eight years was revived and started selling. According to the data, the whale used various addresses to sell a staggering $224 million worth of the abovementioned token.

Notably, this whale accumulated 398,889 ETH at around just $2.4 million between January 18 and March 10, 2016, at an average cost of $6 per token. Following eight years of dormancy, the whale revived on November 7, 2024, and commenced offloading.

Meanwhile, the whale has been recorded selling 73,356 ETH, worth $224.42 million, the latest data showed. This massive dump brought selling pressure to the asset. Besides, the colossal amount of Ethereum remaining with the whale has sparked speculations over his future moves.

On the other hand, it’s also noteworthy that the latest Whale Alert data indicated nearly 20.8 million ETH dumped to Coinbase. Although these dumps raised bearish market sentiments, the top crypto by market cap has defied usual trends to trade in the green territory.

ETH Price Soars Defying Selling Pressure

Despite the abovementioned selloffs, ETH price today traded dominantly in the green at $3,337, up 5% intraday. Its 24-hour low and high were $3,147 and $3,428.46, respectively. Intriguingly, the monthly chart for the token showcased 29% gains. This bullish trajectory has raised uncertain investor sentiments over the coin’s future movements.

Further, Coinglass data pointed out a 10% increase in Ethereum’s futures OI to $70.79 billion. Moreover, even the derivatives volume soared 63% to $70.79 billion. This data further points to a bullish scenario for the token, adding to market speculations amid massive selloffs.

Additionally, a recent CoinGape Media report spotlighted key indicators that signal further gains for Ethereum price. Considering these bullish trends and the recent rally in the crypto’s price, it appears that market watchers continue to remain optimistic about the asset despite the recent selloffs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Top Neiro Ethereum Holder Dumps $3M NEIRO Sparking Price Dip Concerns

One of the top Neiro Ethereum holders has surprisingly sparked bearish sentiments amid a bull market, heavily dumping the dog-themed meme token. Recent on-chain data pointed out that the 2nd largest holder of the token, Wintermute, took action to dump $3M worth of coins. This dump has raised substantial investor concerns, further solidified by the coin’s waning price movement amid a broader bull market.

Top Neiro Ethereum Holder Offloads Over 100M Coins

According to data by Arkham Intelligence, Wintermute deposited 35 million Neiro Ethereum tokens worth $3.08 million to Bybit over the past three days. Notably, the market maker remains the 2nd largest holder of the crypto, holding 10.9% of the total supply worth 108.95 million tokens.

Besides, it’s noteworthy that the same market maker totally withdrew 121.466M of the same token from Bybit before the abovementioned selloff to become the 2nd largest holder of this Shiba Inu dog breed-themed crypto. Nevertheless, despite the selloff weighing in, Wintermute is still the 2nd largest holder of the asset.

In light of this dynamic, market participants remain apprehensive as future selloffs by the top holder could negatively influence the renowned meme coin’s price movements. Meanwhile, despite a bullish sentiment over top meme coins, as witnessed by Dogecoin, Pepe coin, Bonk, and other tokens’ phenomenal gains, the Neiro Ethereum selloff has solidified market concerns.

Token Price Remains Volatile

At the time of reporting, NEIRO price traded near the flatline over the past 24 hours to rest at $0.079. The coin’s intraday low and high were $0.0753 and $0.08385, respectively. Notably, the weekly chart for the crypto showcased a 10% dip. This waning action has sparked severe market concerns in the wake of the abovementioned selloff.

However, a recent CoinGape Media report revealed that Neiro Ethereum has partnered with the market maker DWF Labs, adding investor intrigue on future price movements. Notably, another massive holder of the crypto is GSR Markets, a renowned market maker, holding 33.52 million tokens. Wintermute and GSR collectively hold 142.47 million tokens worth 14.25% of the total supply.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Hidden Bullish Divergence Appears On Dogecoin Price Chart, Here’s What To Expect Next

A hidden Bullish Divergence pattern has just been identified on the Dogecoin price chart, signaling possibilities of a significant uptrend. With this new technical pattern, a crypto analyst has projected a target of $0.7 for the Dogecoin price.

Bullish Divergence Hint At Dogecoin Price Surge

On November 20, crypto analyst Trader Tardigrade on X (formerly Twitter) announced the appearance of a hidden bullish divergence on the Dogecoin 4-hour Relative Strength Index (RSI) chart. Based on this unique technical indicator, the analyst’s Dogecoin price analysis suggests that the meme coin may be gearing up for a significant rally to the upside.

Typically, an RSI hidden bullish divergence occurs when the price of a cryptocurrency forms higher lows while its RSI forms lower lows. This indicates that despite Dogecoin’s RSI showcasing declining momentum, its price is still maintaining strength, suggesting a higher potential for an uptrend continuation.

Recently, the Dogecoin price has been on a major bullish run, as it skyrocketed from above $0.1 to over $0.35 in just a few weeks. This impressive rally has allowed the popular meme coin to test the $0.4 resistance level, a critical threshold that could trigger a significant rally for the Dogecoin price.

Based on Trader Tardigrade’s Dogecoin chart, the RSI Hidden Bullish Divergence can be seen forming at around the $0.37 price level. The analyst has set a bullish target at $0.7 for Dogecoin, highlighting a steady but continuous growth from its current price if it can maintain positive momentum.

As of writing, the price of Dogecoin is trading at $0.38, marking a 165.19% surge over the past month, according to CoinMarketCap. Despite repeatedly failing to break the $0.4 threshold, Dogecoin could see an 84.2% price increase from its current value if the projected positive growth driven by the Hidden Bullish Divergence holds valid. This would effectively push the meme coin close to or even above it’s All-Time High (ATH) of $0.73 in May 2021 during the last bull market.

DOGE Targets New ATH

In another X post, crypto analyst, Steph, has maintained an optimistic outlook on the Dogecoin price. According to Steph, Dogecoin could be gearing up for a new ATH this bull cycle.

The analyst shared a 2-year Dogecoin price chart, pinpointing a bullish target between $1.4 and $1.8 for the meme coin. Following the target’s position on the Dogecoin chart, the analyst suggests that this ATH rally could either take place before the end of 2024 or in 2025.

Based on current market trends, this massive price surge to a new ATH could be potentially driven by Elon Musk’s influence through his newly proposed organization, the Department of Government Efficiency (D.O.G.E). Additionally, Donald Trump’s upcoming inauguration as the 47th United States (US) President could also serve as a strong catalyst that could propel the Dogecoin price higher.

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Bitcoin21 hours ago

Bitcoin21 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation16 hours ago

Regulation16 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market21 hours ago

Market21 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Market20 hours ago

Market20 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift

-

Market13 hours ago

Market13 hours agoGOAT Price Sees Slower Growth After Reaching $1B Market Cap

-

Market19 hours ago

Market19 hours agoAptos Partners with Circle and Stripe to Revitalize Network

-

Altcoin13 hours ago

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

✓ Share: