Market

Aave DAO’s $100M Loan: Here’s What to Know

Aave DAO, Trident Digital, TokenLogic, and on-chain aggregator IntoTheBlock joined hands for the first $100 million fixed yield loan launch.

The fixed-yield loan locks 33,000 Ethereum (ETH) for three months, supported by a non-custodial smart contract from IntoTheBlock’s institutional DeFi solutions. Lenders receive aETH tokens as collateral, guaranteeing a yield that doubles the returns from staking in ETH.

Aave DAO Launches $100M Fixed-Yield Loan

The fixed-yield loan functions as a type of tokenized bond or security with interest payments directly tied to the Aave protocol’s revenue. This setup ensures a fair balance of interests and reduces the chances of “wrong-way risk” associated with traditional structures, where creditors face higher exposure and risk when a debtor’s credit quality declines.

Therefore, it allows investors to participate in a fixed-yield opportunity by supplying capital in the form of ETH and receiving aETH tokens as collateral. aETH is a synthetic derivative asset bridging the currently illiquid Ethereum 2.0 and the regular Ethereum network.

The fixed-yield loan exemplifies how tokenization and blockchain technology can revolutionize the issuance and management of bonds and securities. This tokenization process transforms traditional bonds or securities into digital assets that are tradable securely on blockchain networks.

Read more: How to Use Aave inside Aave V4’s Safer, Faster Lending Solutions

Aave DAO supports this fixed yield, maintaining returns across the loan term using revenues generated by the Aave lending protocol. When the term is over, the smart contract unlocks. This enables lenders to withdraw their initial ETH deposit and the accrued interest, opening up new possibilities for creating and trading tokenized financial instruments in a decentralized and inclusive manner.

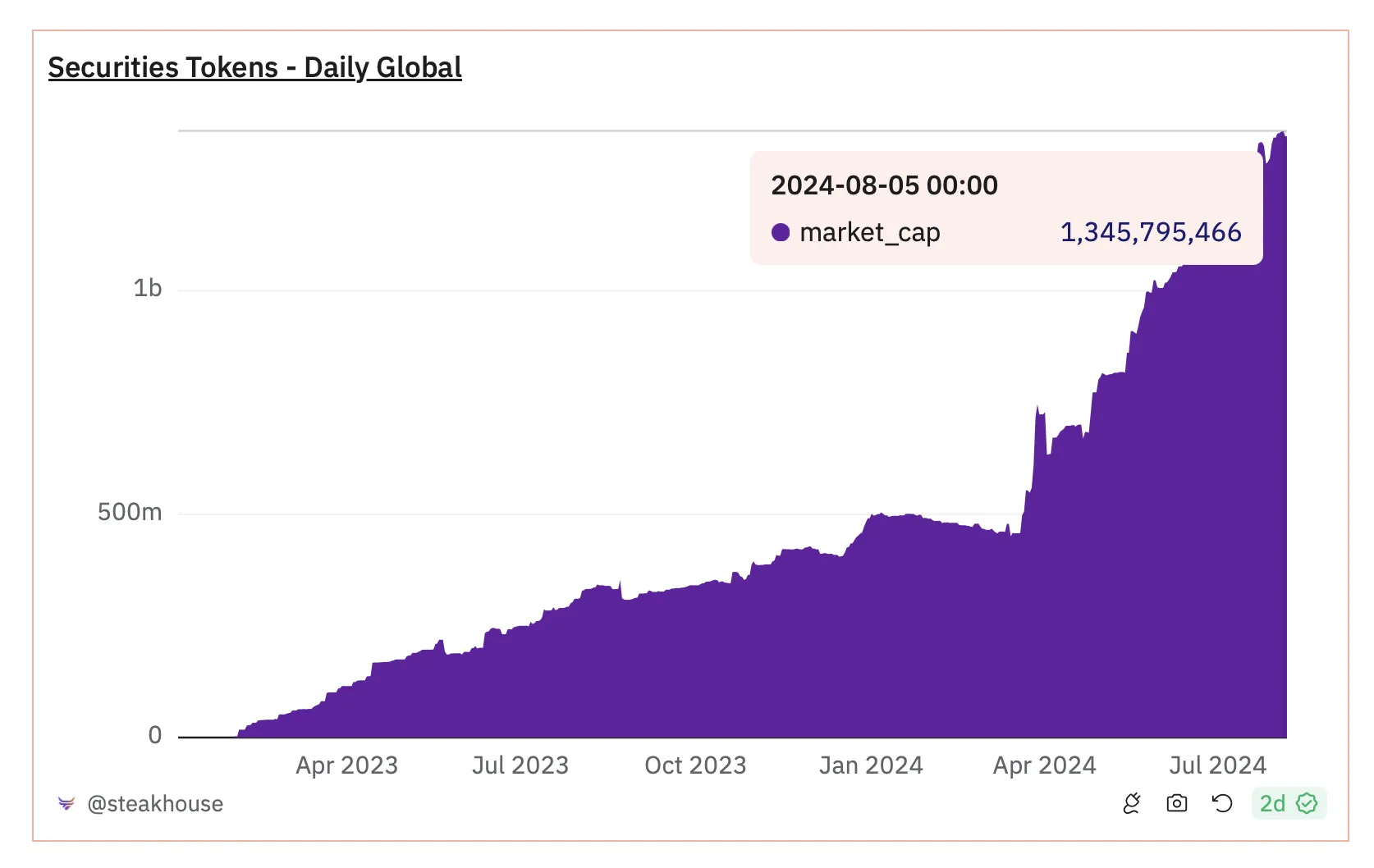

The trend is gaining traction in 2024, attracting industry giants like BlackRock, which paid out $2.1 million in dividends in July. Other notable players in the securities tokenization sector include Ondo Finance and Franklin Templeton. Together, they boast a market capitalization exceeding $1.3 billion.

The launch marks a big step for the Aave DAO, implementing a model of Aave v3 to support ETH-correlated assets. It aligns with the broader initiative to promote Liquid Restaking Tokens (LRTs) on Mellow Finance’s Symbiotic restaking protocol alongside Lido DAO.

Restaking Solution for Traditional Challenges in On-Chain Bonds

Traditional challenges regarding term debt access affect the industry’s progress. Due to their volatility and illiquidity, efforts to use governance tokens as collateral in establishing on-chain “bonds” remain obstructed. The structures disproportionately favored borrowers, exposing lenders to serious risks without commensurate rewards.

Against this backdrop, restaking has become one of the most interesting crypto narratives in 2024. Data on Dune shows that 27.86% of ETH supply is staked. It also shows a steady increase in staked ETH (stETH), reaching over 34 million, and validators going above one million.

A recent report from CoinGecko noted that EigenLayer’s restaking contributed to the Ethereum ecosystem’s achievement in Q1 2024.

Read more: Ethereum Restaking: What Is It And How Does It Work?

BeInCrypto also covered Symbiotic’s debut in mid-June, which aims to offer flexible, permissionless restaking options. The launch followed a $5.8 million funding round from Paradigm and Cyber Fund. The new project poses a significant challenge to EigenLayer, a major player in the Ethereum restaking sector.

These developments signal a new era of possibilities in the digital asset industry, demonstrating continued innovation. It also sets a new standard for secure, balanced, mutually beneficial financial products in decentralized finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Harmful Livestreams Prompt Ban Calls

Since its launch earlier this year, the meme coin platform Pump.fun has become a notable name in the crypto industry. This platform allows users, regardless of their technical know-how, to create and launch meme coins swiftly.

However, the live-streaming feature has led to serious controversies and calls for a ban due to inappropriate content and financial malfeasance.

Originally, Pump.fun’s livestream was intended to let developers promote their meme coins. Regrettably, some users have misused it to broadcast extreme and harmful activities. A notable incident involved a developer promoting self-harm if his cryptocurrency reached a $25 million market cap.

Additionally, some users threaten to harm pets or even humans if their coins do not achieve certain market capitalization goals.

The situation reached a critical point when Beau, a safety project manager at Pudgy Penguins, reported an alarming livestream. In it, an individual threatened to hang themselves if their coin did not reach a specific market cap.

“Shut down the livestream feature. This is out of control,” Beau stated.

The platform has also been a hotbed for financial scams, prominently featuring “rug pulls.” A recent case involved a school-aged individual who created a meme coin named QUANT, quickly amassing $30,000 and then exiting the project, leaving investors with worthless digital tokens. This led to the kid’s doxxing, with his personal information and that of his family maliciously shared online.

In response to these incidents, some community members have called for the complete shutdown of the platform. Conversely, others suggest that simply disabling the livestream function might suffice.

Eddie, a legal intern, strongly criticized the platform’s governance. He believes that turning off the livestreams or moderating them is crucial.

“There is an art to shock value on stream. Simply sharing nudity or other shocking and even horrific content is not innately interesting. People seek stories and novel concepts that engage them. The content shared on pump livestreams at the moment are not only uninteresting, but conceptually lazy,” Eddie said.

Yet Alon, a Pump.fun executive, claims that the platform’s content has been moderated since day one.

“We have a large team of moderators working around the clock and an internal team of engineers that’s working on helping us deal with increased scale of coins, streams, and comments. I admit that our moderation isn’t perfect, so if you’re aware of a coin where moderation isn’t enforced, please report it in our support channels immediately,” Alon said.

The ongoing debate reflects the platform’s dilemma. While it offers users significant creative freedom, it also poses serious risks without stringent moderation.

Now, the community and stakeholders await decisive action. The call for stronger moderation is loud and clear, aiming to protect both the platform’s integrity and its users from further harm.

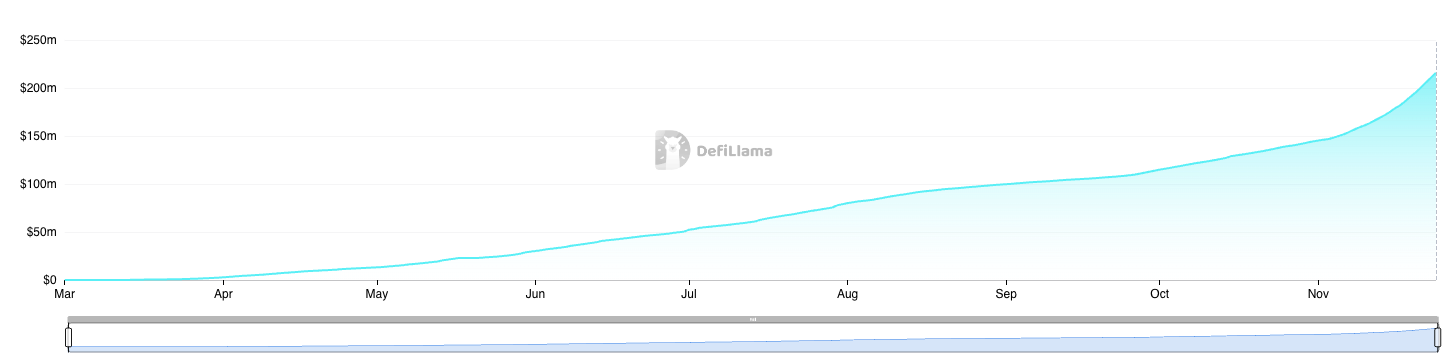

Despite these controversies, Pump.fun has continued to perform well financially. Data from DefiLlama shows that the platform has amassed over $215 million in revenue since March 2024.

Furthermore, the platform has facilitated the deployment of more than 3.8 million meme coins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Builds a Base: Can Bulls Ignite a New Rally?

XRP price surged further above the $1.45 and $1.50 resistance levels. The price is now consolidating gains near $1.40 and might aim for more upsides.

- XRP price started a fresh surge above the $1.40 resistance level.

- The price is now trading above $1.350 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1.450 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair is showing positive signs and might extend its rally above the $1.450 resistance.

XRP Price Holds Gains

XRP price formed a base above $1.250 and started a fresh increase. There was a move above the $1.350 and $1.40 resistance levels. It even pumped above the $1.50 level, beating Ethereum and Bitcoin in the past two days.

A high was formed at $1.6339 before there was a pullback. The price dipped below the $1.50 support level. A low was formed at $1.3007 and the price is now rising. There was a move above the 23.6% Fib retracement level of the downward move from the $1.6339 swing high to the $1.3007 low.

The price is now trading above $1.40 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1.420 level. The first major resistance is near the $1.450 level.

There is also a new connecting bearish trend line forming with resistance at $1.450 on the hourly chart of the XRP/USD pair. It is close to the 50% Fib retracement level of the downward move from the $1.6339 swing high to the $1.3007 low.

The next key resistance could be $1.500. A clear move above the $1.50 resistance might send the price toward the $1.5550 resistance. Any more gains might send the price toward the $1.620 resistance or even $1.650 in the near term. The next major hurdle for the bulls might be $1.750 or $1.80.

Are Dips Limited?

If XRP fails to clear the $1.450 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.3450 level. The next major support is near the $1.320 level.

If there is a downside break and a close below the $1.320 level, the price might continue to decline toward the $1.300 support. The next major support sits near the $1.240 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.4200 and $1.4000.

Major Resistance Levels – $1.4500 and $1.5000.

Market

Solana (SOL) Bulls Stay in Control: Rally Far From Over?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Price Is Decoupling From Gold Again — What’s Happening?

-

Market23 hours ago

Market23 hours agoWhy a New Solana All-Time High May Be Near

-

Market20 hours ago

Market20 hours agoWinklevoss Urges Scrutiny of FTX and SBF Political Donations

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin18 hours ago

Bitcoin18 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market18 hours ago

Market18 hours agoIs the XRP Price Decline Going To Continue?

-

Market17 hours ago

Market17 hours agoToken Unlocks to Watch Next Week: AVAX, ADA and More

-

Bitcoin16 hours ago

Bitcoin16 hours agoSenator’s Bold Proposal To Replenish US Reserves