Market

IMF and El Salvador Discuss Bitcoin Risk Strategies

The International Monetary Fund (IMF) is in discussions with El Salvador to address the macroeconomic and financial risks associated with Bitcoin. (BTC)

These talks aim to devise a comprehensive risk management strategy that will ensure the stability and growth of El Salvador’s economy while integrating Bitcoin as a legal tender.

Fiscal Stability Focus: IMF’s Plan with El Salvador

On August 6, the IMF released a statement highlighting the progress made in the ongoing negotiations. An IMF mission, led by Raphael Espinoza, engaged in both in-person and virtual discussions with Salvadoran authorities.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

The talks emphasized strengthening public finances, improving bank reserve buffers, enhancing governance, and increasing transparency. The IMF highlighted the need for El Salvador to strengthen its primary balance by approximately 3.5% of GDP over three years. This fiscal consolidation would involve rationalizing the public wage bill while allowing for essential social and infrastructure spending.

“Progress was also made on developing a plan to gradually strengthen financial system reserve buffers in a manner consistent with continued private sector credit and growth. This is also being supported by efforts to reduce the government’s reliance on domestic financing through the planned consolidation and potential support from the Fund and other multilateral development banks,” the IMF added.

The IMF and El Salvador acknowledged the potential fiscal and financial stability risks from the Bitcoin project. While many risks have not yet materialized, both parties agree that further efforts are necessary to enhance transparency and mitigate potential issues. These efforts include preparing legislative proposals to address corruption, money laundering vulnerabilities, and procurement weaknesses.

El Salvador adopted Bitcoin as its legal tender in September 2021 under President Nayib Bukele’s leadership. The IMF had previously warned that this move could raise significant macroeconomic, financial, and legal issues. Despite these concerns, the Salvadoran government has remained committed to its Bitcoin strategy.

Earlier this year, President Bukele announced a plan to implement the Dollar Cost Averaging (DCA) strategy, buying one Bitcoin daily. This approach aims to accumulate Bitcoin steadily, regardless of market conditions.

Read more: Who Owns the Most Bitcoin in 2024?

Despite market volatility, El Salvador continues its Bitcoin purchases. The Bitcoin Office Mempool shows that the country maintains a significant Bitcoin reserve. As of August 8, El Salvador holds approximately 5,835 BTC, valued at around $334.04 million at current market prices.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

BlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

Larry Fink, CEO of BlackRock, claimed in a recent letter that Bitcoin and crypto could damage the dollar’s international standing. If investors treat Bitcoin as an inflation hedge to the dollar, it could precipitate serious trouble.

However, he was also adamant that the industry offers a lot of advantages, particularly through tokenization.

Larry Fink Sees Opportunity in Crypto

BlackRock is the leading Bitcoin ETF issuer in the US, and its CEO Larry Fink has long been bullish on Bitcoin. However, as Fink described in his most recent Annual Chairman’s Letter to investors, crypto’s best interest doesn’t always align with TradFi or the dollar.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the US doesn’t get its debt under control… America risks losing that position to digital assets like Bitcoin,” he said.

To be clear, Fink insisted that he supports crypto and listed some practical problems that he believes it can solve. He expressed a particular interest in asset tokenization, claiming that a digital-native infrastructure would improve and democratize the TradFi ecosystem.

Despite these advantages, Fink recognizes the danger that crypto can present to the US economy if not properly managed. He addressed the longstanding practice of using crypto to hedge against inflation, a wise practice for many assets.

However, if a wide swath of investors think Bitcoin is more stable than the dollar, it would threaten USD’s status as the world reserve currency. A scenario like that would be very dangerous to all of TradFi, and Fink has a particular interest in protecting BlackRock. Such an event would doubtlessly impact crypto as well.

“Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” Fink added.

He didn’t offer too many specific solutions to this growing problem, but Fink isn’t the only person concerned with the issue. President Trump recently suggested that stablecoins could promote dollar dominance worldwide. Even if the dollar is seen as unstable, its adoption within a rapidly growing global industry like stablecoins could help reinforce its strength and relevance.

Of course, there are also drawbacks to Trump’s plan. Larry Fink acknowledged a possible threat from crypto, but continues to espouse its utility. Its benefits are too good to ignore.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bears Lead, But Bulls Protect Key Price Zone

XRP has experienced a significant downturn in recent price action, with its value dropping nearly 15% over the past seven days as bears maintain control of the market. The coin’s technical indicators are showing mixed signals, with the RSI rebounding from oversold territory while Ichimoku Cloud patterns continue to paint a predominantly bearish picture.

Despite yesterday’s test of the critical $2.06 support level resulting in a temporary bounce, the momentum remains negative, with short-term EMAs positioned below long-term averages. The move from extreme oversold conditions suggests XRP might be entering a consolidation phase before its next significant price movement.

XRP RSI Is Up From Oversold Levels

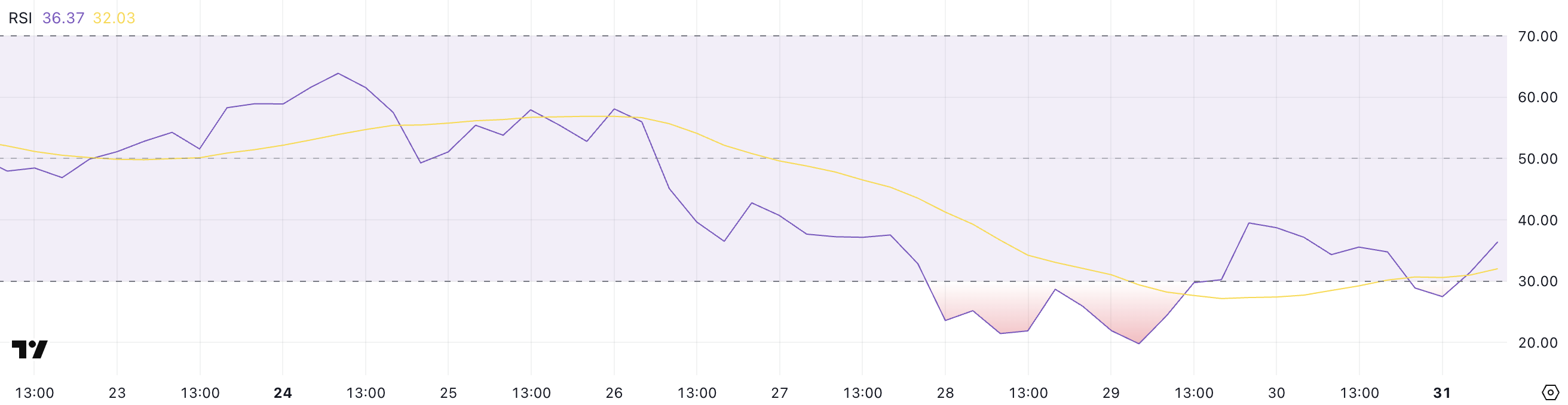

XRP’s Relative Strength Index (RSI) is currently at 36.37, showing a notable rebound from a low of 27.49 just a few hours ago. This upward shift indicates a shift in momentum, as buying interest has started to pick up after a period of heavy selling pressure.

Although still in the lower range, this recovery suggests that traders may be stepping back in. That could mean they are potentially viewing the recent dip as an opportunity.

RSI is a widely used momentum indicator that measures the speed and change of price movements on a scale from 0 to 100. Readings below 30 typically indicate that an asset is oversold and may be undervalued, while readings above 70 suggest it is overbought and could be due for a correction.

XRP’s bounce from 27.49 to 36.37 signals that it may have just exited oversold conditions. This could mean that the recent selling phase is easing. If the buying momentum continues to build, XRP might be entering the early stages of a potential recovery.

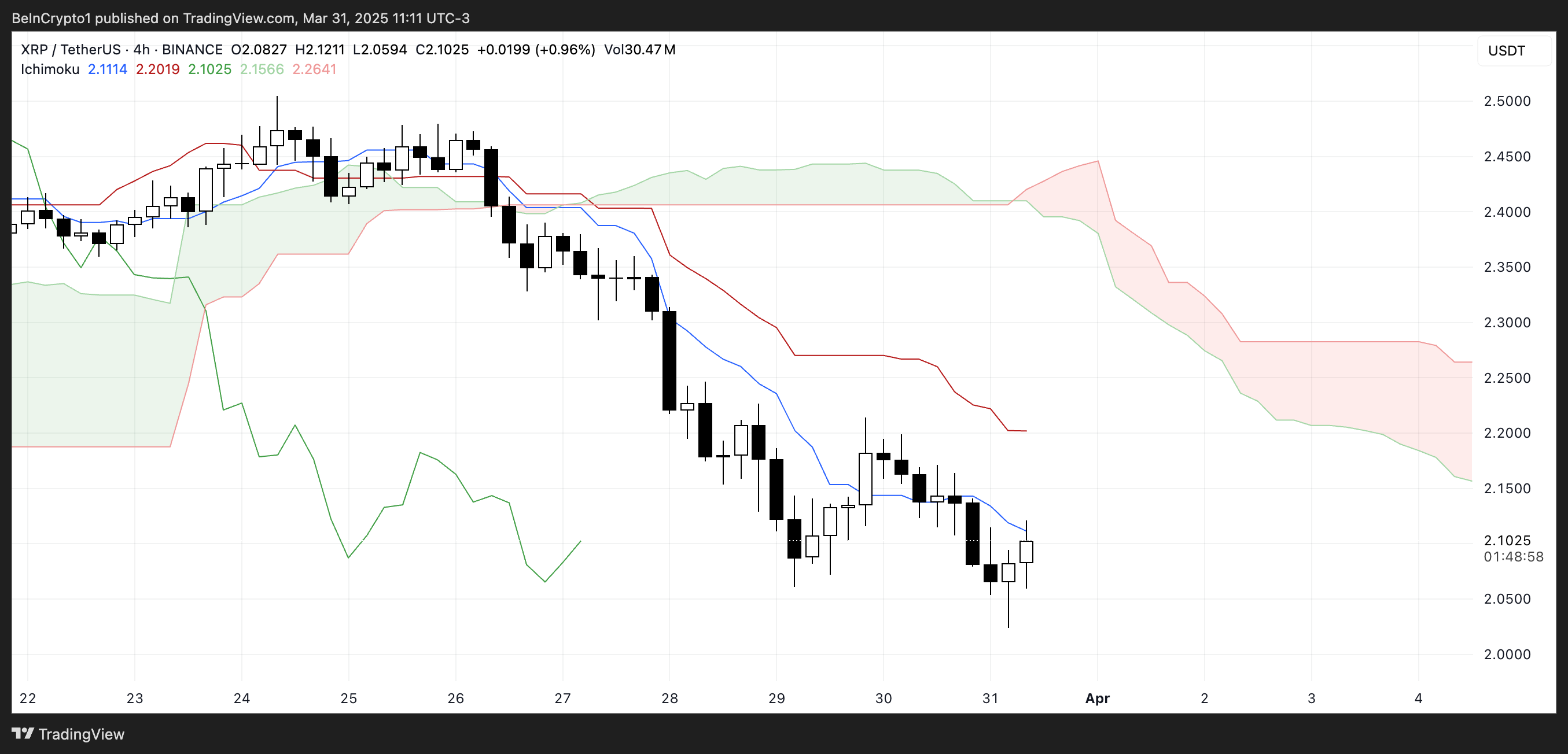

XRP Ichimoku Cloud Shows A Bearish Scenario

XRP’s Ichimoku Cloud chart shows that the price action remains below both the red baseline (Kijun-sen) and the blue conversion line (Tenkan-sen). That indicates the prevailing momentum is still bearish.

The candles are also forming well beneath the cloud, which reflects a broader downtrend.

When the price is under all major Ichimoku components like this, it typically signals continued downward pressure unless a strong reversal breaks those resistance levels.

Additionally, the cloud ahead is red and spans horizontally with a downward slope, reinforcing the bearish outlook in the near term. The thickness of the cloud suggests moderate resistance if the price attempts to move upward.

However, some consolidation is evident in the recent candles, showing that sellers may be losing some control.

For any potential trend reversal, XRP would need to break above the Tenkan-sen and Kijun-sen, and eventually challenge the cloud itself — a move that would require a clear uptick in momentum.

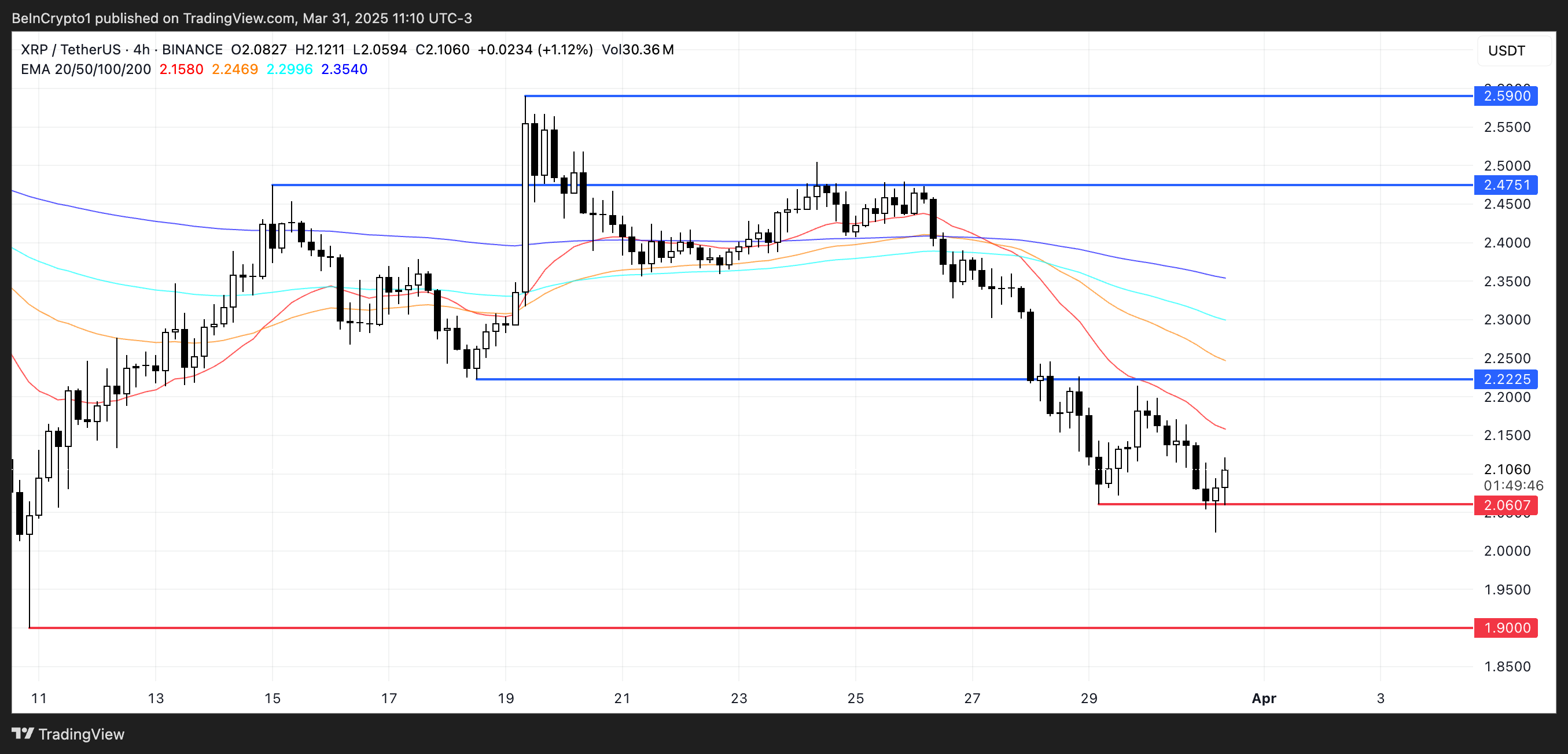

XRP Could Rise After Testing An Important Support Yesterday

XRP’s EMA lines are clearly aligned in a bearish formation, with the short-term averages sitting well below the long-term ones and a noticeable gap between them—highlighting strong downward momentum.

Yesterday, XRP price tested the support level at $2.06 and rebounded, showing that buyers are still active at that zone. However, this support remains critical. If it is tested again and fails to hold, XRP could fall further. Its next major support sitting around $1.90.

If the trend begins to shift and XRP breaks above the short-term EMAs, the first key resistance to watch is at $2.22. A successful move above this level could trigger a stronger recovery, potentially pushing the price toward $2.47.

If bullish momentum continues, the next upside target would be $2.59. For now, though, the EMA structure still leans bearish. XRP would need sustained buying pressure to flip the trend and aim for those higher resistance levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Market Cap Now Approaching $300 Million

SAFE has emerged as the best-performing altcoin of the day, with its price surging 5% in the last 24 hours and its market capitalization now close to $300 million. The coin is showing strong technical indicators despite some mixed signals from momentum oscillators that suggest consolidation may be on the horizon.

Technical analysis of the EMA lines remains bullish, with short-term averages positioned favorably above long-term ones, pointing to continued strength in the immediate term. However, recent RSI and BBTrend readings indicate a potential cooling-off period could be approaching as the asset digests its recent gains.

SAFE RSI Is Back To Neutral Levels After Reaching Overbought Levels

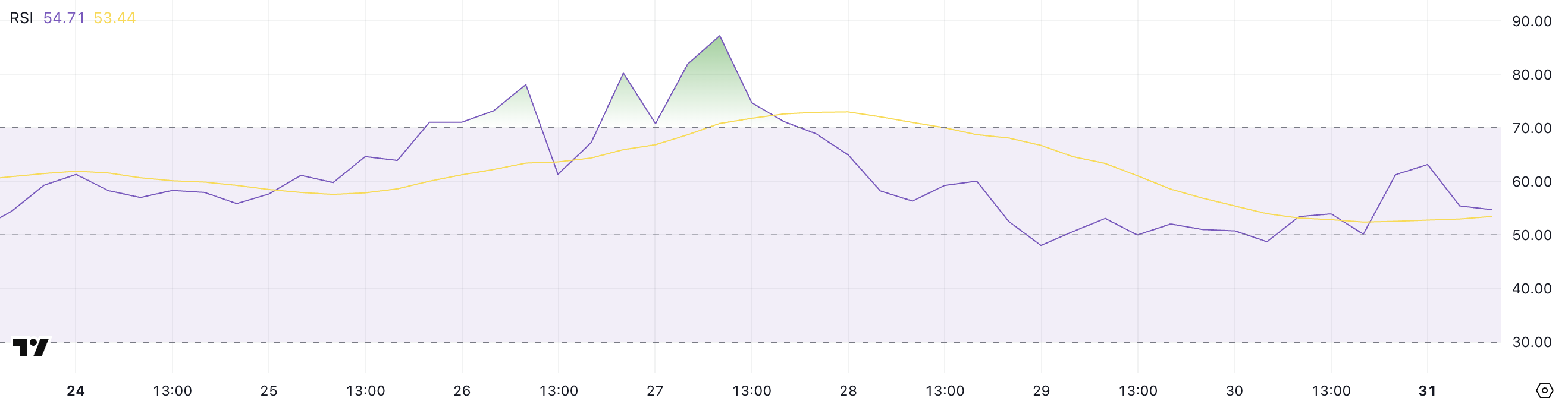

The SAFE RSI is currently at 54.71, maintaining a neutral position for the past three days after experiencing significant momentum earlier in the week.

This moderation in the indicator suggests that the previous buying pressure has subsided somewhat, allowing the asset to consolidate following recent price movements.

The current neutral reading indicates a balanced market where neither buyers nor sellers have a decisive advantage.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Generally, an RSI reading above 70 is considered overbought, suggesting a potential reversal or pullback, while readings below 30 indicate oversold conditions that might precede a bounce.

With SAFE’s RSI recently peaking at 87 just four days ago, the asset was in strongly overbought territory, signaling excessive buying enthusiasm. The current value of 54.71 represents a significant cooling off from those extreme levels, suggesting that SAFE’s price could be entering a period of stabilization.

This moderation may provide a healthier foundation for sustainable price action moving forward, as the previous overbought conditions have been worked through without dropping into oversold territory. This potentially indicates underlying strength in the asset despite the retreat from recent highs.

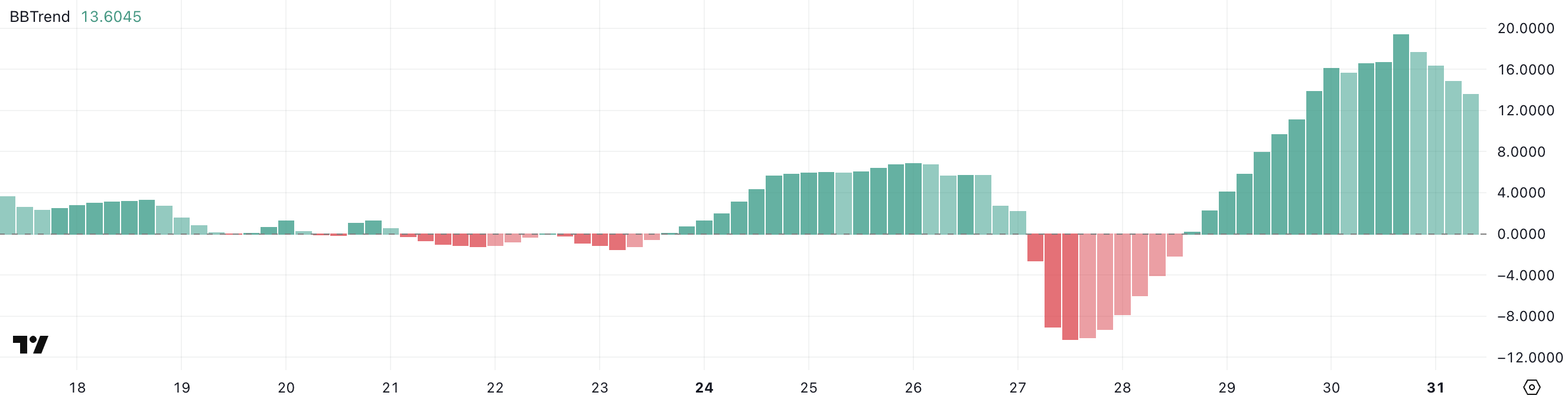

SAFE BBTrend Is Still High, But Down From Yesterday

The SAFE BBTrend is currently at 13.6, maintaining a positive position for the last two days after reaching a peak of 19.39 yesterday.

This recent positive trend suggests that the price movement has been gaining momentum, though there appears to be some moderation from yesterday’s higher reading.

The continued positive BBTrend indicates that the asset is still showing strength, despite the slight pullback from yesterday’s peak value.

BBTrend (Bollinger Bands Trend) is a technical indicator that measures the strength and direction of a trend by analyzing the relationship between price and Bollinger Bands.

The indicator typically ranges from negative to positive values, with readings above 0 indicating a bullish trend and readings below 0 suggesting a bearish trend. With SAFE’s BBTrend at 13.6, this suggests a moderately strong bullish trend that could indicate potential for continued upward price movement in the near term for the altcoin.

However, the decrease from yesterday’s 19.39 peak might signal some slowing in momentum, potentially leading to consolidation before the next significant move higher.

Will SAFE Uptrend Revert Soon?

SAFE EMA lines are still bullish, with short-term lines positioned above long-term ones. This positive alignment of exponential moving averages indicates continued upward momentum in the price action.

If this uptrend momentum maintains its strength, SAFE could potentially climb to test the resistance level at $0.72.

Should this resistance be successfully broken, the next target would be $0.879. The altcoin could exceed $0.90 for the first time since January 19, sustaining its momentum as one of the most trending altcoins.

On the other hand, as indicated by the RSI and BBTrend indicators, the uptrend appears to be losing some momentum. This could signal a potential reversal in the near future.

If the trend does reverse, SAFE might test the nearby support level at $0.54, which sits precariously close to the current price.

Should this support level fail to hold, further downside could see SAFE decline to test subsequent support levels at $0.48 and $0.40. In a worst-case scenario, a drop all the way to $0.35 could potentially occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market18 hours ago

Market18 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market17 hours ago

Market17 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market14 hours ago

Market14 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market8 hours ago

Market8 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund

-

Market13 hours ago

Market13 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

-

Bitcoin12 hours ago

Bitcoin12 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More