Altcoin

Crypto Analyst Recommends 10 Safe Altcoins Now

Mystery of Crypto, a popular analyst and cryptocurrency veteran, identifies ten altcoins with strong potential amidst the prevailing uncertain market conditions.

The crypto market is actively recovering from Monday’s shock, leading some to believe this is a good time to buy promising assets.

Altcoin Picks for Optimal Performance Amid Market Jitters

Amidst market fears, the crypto industry recorded over $1 billion of liquidations. It marked the biggest collapse a single day after the FTX scenario in November 2022. Spotting them for stability and growth prospects, the analyst identifies ten altcoins that are safer bets during uncertain market conditions.

Toncoin (TON)

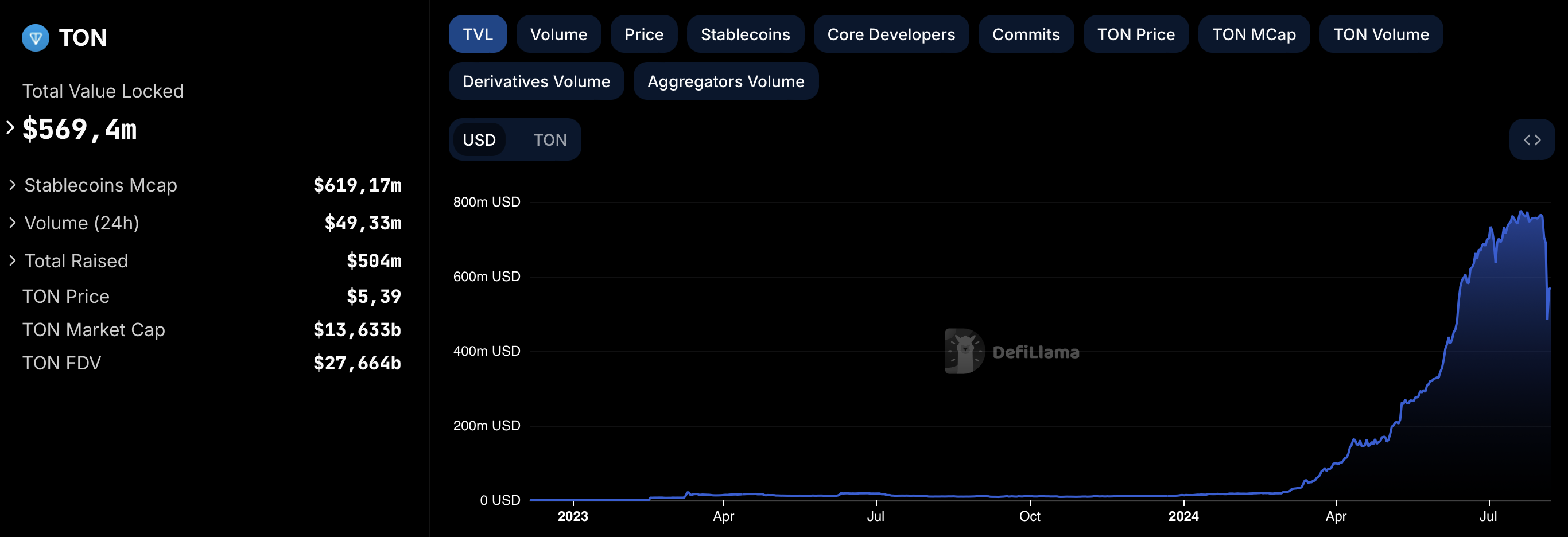

Toncoin is the first choice, given the number of decentralized applications (DApps) built atop the network. These DApps span gaming, social, and DeFi, among others, and have recorded significant user growth over the last six months.

Based on DefiLlama stats, TON blockchain records over four million daily transactions. Latest data shows that it has a total value locked (TVL) above $560 million, a 20% growth since Monday, adding credence to the analyst’s selection.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Solana (SOL)

Solana secures the second place in the list due to its strong performance in 2024. The analyst highlights its key features: high scalability and low transaction fees, making it a compelling choice. Strong interest from developers and institutions also supports SOL’s position as a top-tier altcoin.

Recently, Solana outperformed Ethereum in weekly revenue. More closely, it remains the most preferred blockchain for memecoin traders, which positions SOL for performance. There are also prospects for a Solana ETF, which continues to provide tailwinds for SOL.

Arbitrum (ARB)

Arbitrum is a key player among Ethereum’s Layer-2 (L2) scaling solutions, boasting over 408,000 daily active users. Data shows that its TVL is above $2.5 billion, higher than Polygon (MATIC), Optimism (OP), and other L2s.

After its Kwenta launch and Orbit expansion, Arbitrum delivers a top-tier trading interface and is frequently praised for the best perpetuals user experience in DeFi. This, coupled with the backing of Pantera Capital, positions ARB for good performance, according to Mystery of Crypto.

Ondo Finance (ONDO)

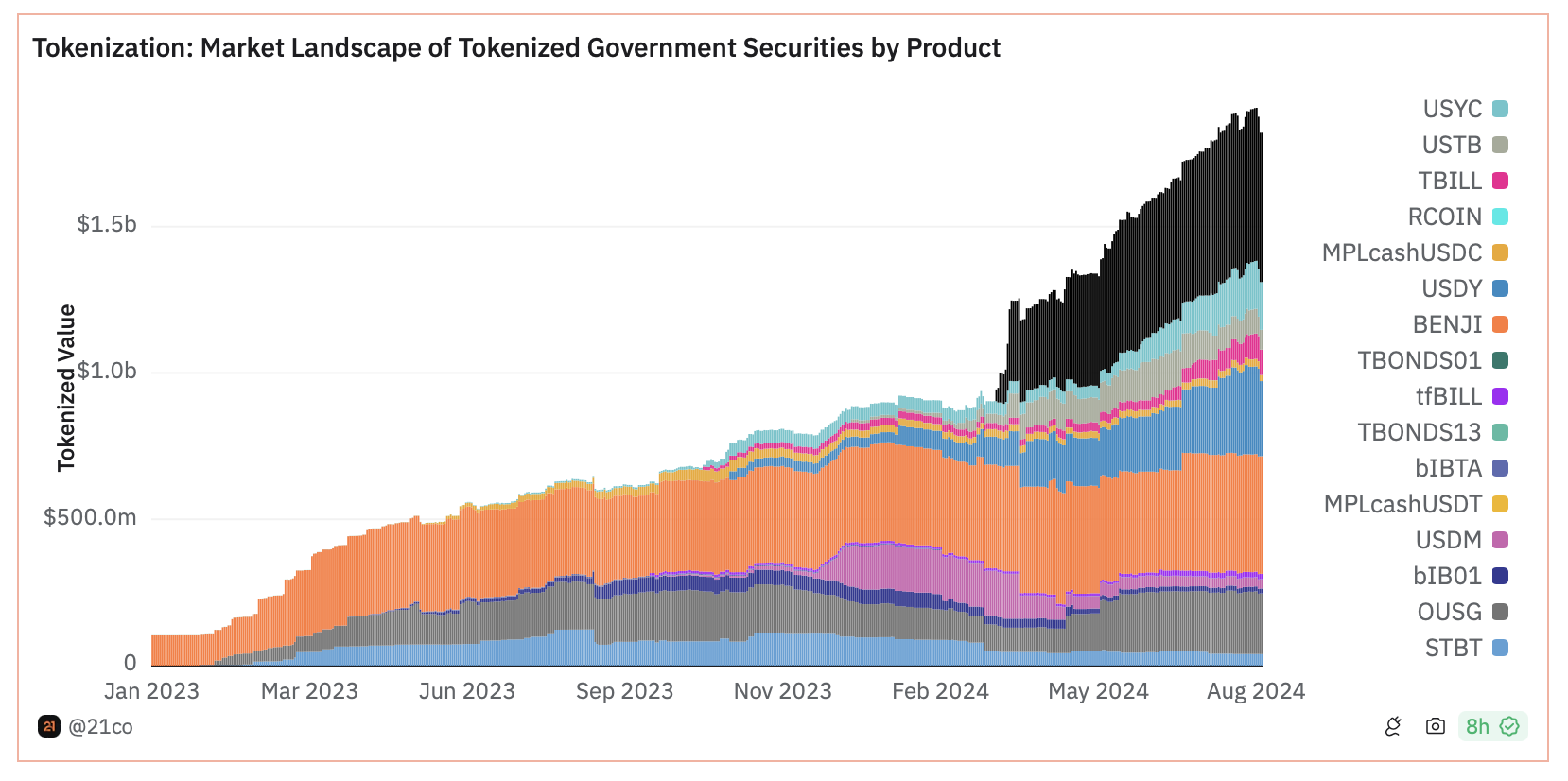

Ondo Finance features on the list of multiple analysts, including AltcoinDaily, with both citing its ability to turn RWAs into digital tokens.

The network’s strong partnerships with BlackRock and Coinbase Ventures also make strong fundamentals for the project. Moreover, the Pyth Network launched a USDY/USD price feed in collaboration with Ondo Finance, which adds to the list of project fundamentals.

Read more: What is Tokenization on Blockchain?

Near Protocol (NEAR)

According to the analyst, the Near Protocol is known for resilience and innovation. Its developer-friendly platform continues to attract more projects, and it has an $800 million ecosystem fund to seed and support new projects.

It boasts the highest daily active users among L1 scaling solutions, only second to Solana, which positions NEAR to do well in uncertain market times.

Mantra (OM)

Mantra meets the analysts’ bar, given its move to enhance Ethereum functionality and promote accessible financial services. Given the growing interest in real-world asset (RWA) tokenization, it is also positioned for good returns.

The project launched Season 2 of 50,000,000 OM GenDrop, whereas the dYdX ecosystem added OM to its chain, bringing new exciting opportunities. Further, with more than $50 million OM tokens staked, the reduced supply increases the chances of further upside for OM tokens.

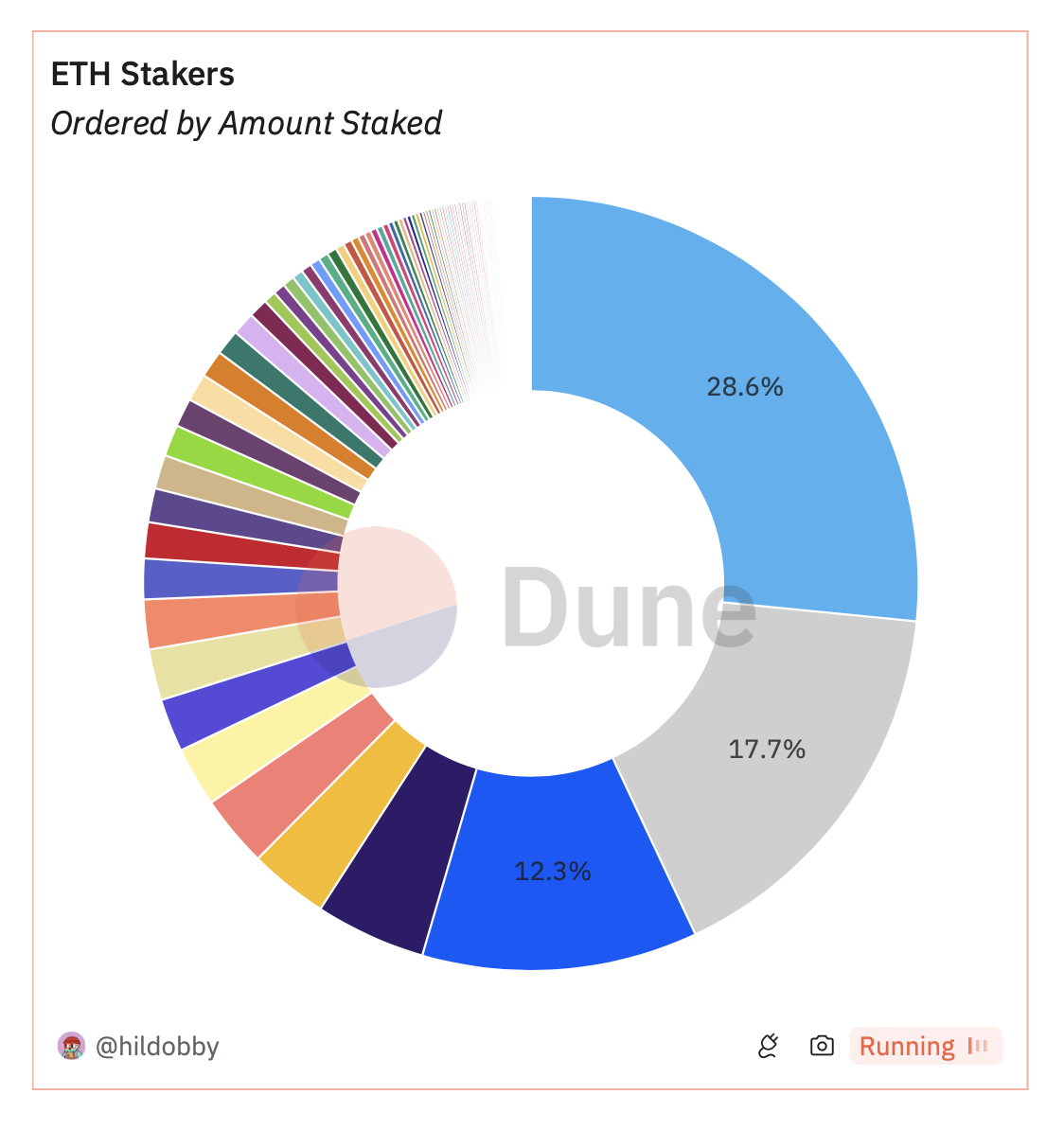

EtherFi (ETHFI)

EtherFi is a leading restaking platform running on Ethereum. The project recently released Season 2 claim checker, distributing more than 53 million ETHFI tokens worth approximately $100 million.

Its participation in the rewards model, which promises even more exciting opportunities for users, could drive more interest in the ETHFI token. Moreover, the project also has Cash, a mobile wallet with Visa credit card integration.

Read more: Ethereum Restaking: What Is It And How Does It Work?

Polygon (MATIC)

The Polygon blockchain collaborates with Axie Infnity’s Ronin Network via its Polygon Chain Development Kit. Given its essence as a scaling solution for Ethereum, more than 17,800 DApps are actively running on Polygon. It is popular among DeFi and NFTs projects, with 35 million MATIC tokens allocated for its ecosystem projects.

Render (RNDR)

Render is one of the AI crypto coins with decentralized GPU network services, which makes it essential for gaming and movies. Recent social dominance, active addresses, and whale transaction metrics have been at a six-month peak amid AI hype, making RNDR a potential big shot.

Arweave (AR)

Arweave has been demonstrating its strength in the blockchain industry. This network provides permanent data storage, with users leveraging it to store data for a one-time payment. Over one petabyte of data is stored on the Arweave network, which connects individuals needing storage with those with hard drive space.

The project announced a 100% fair launch for its new token with no pre-mine or pre-sales. This, coupled with its recent partnership with InQubeta, a blockchain firm that enhances technology, makes AR a coin to watch.

Mystery of Crypto also highlights Chainlink (LINK) as a potential big shot, citing its launch of a digital assets Sandbox for tokenization trials. Its partnerships with technology giants like Google and Oracle make LINK a good choice.

Nevertheless, traders must not rely solely on analyst predictions. Conducting one’s own research is always advisable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Ethereum Bitcoin Ratio Drops to Record Low, What Next for ETH?

The world’s second-largest digital asset, Ethereum (ETH), struggles to keep up with Bitcoin. Market data shows that the ETH/BTC ratio has dropped to its lowest level in five years. Consequently, investors and analysts are now questioning whether Ethereum can recover in the coming quarter, considering Bitcoin may continue its long-standing domination in the digital assets market.

The Ethereum Bitcoin Ratio At New Lows

ETH performed poorly compared to Bitcoin in the first quarter of 2025. According to a recent update from The Kobeissi Letter, the Ethereum to Bitcoin ratio has dropped to 0.02, its lowest level since December 2020.

Historically, Ethereum has gained strength after Bitcoin halvings, but the trend has reversed. While Bitcoin price is going upward, Ethereum has struggled to gain traction.

Several factors have contributed to this decline. Bitcoin’s narrative as digital gold has strengthened, drawing more institutional investment. In addition, the coin has faced challenges, including relatively higher gas fees and competition from other blockchain networks.

Unfortunately, the Ethereum Pectra upgrade, which experts believe could drive a price increase for the coin, faced some challenges. As reported by CoinGape, multiple testnet attempts failed before the Hoodi testnet that launched recently.

Some experts believe Ethereum’s transition to proof-of-stake has not delivered the expected market boost.

Q1 Performance and ETF Downturn

The ETH price performance in the first quarter of 2025 has been disappointing. For context, data shows that the coin has dropped 46% this year, nearly 4 times more than Bitcoin’s decline of 12%.

Many investors expected a strong bull run, but Ethereum has remained weak. The adoption of spot Bitcoin ETFs earlier in the year attracted billions of dollars, but Ethereum has not seen the same level of interest for its potential ETF.

Market analysts suggest that institutional investors are still hesitant about Ethereum’s long-term value compared to Bitcoin. Bitcoin’s fixed supply and reputation as a hedge against inflation have made it a safer choice for institutional investors.

Where is ETH Price Heading?

Some analysts believe ETH price could hit $10,000 if broader market conditions improve and the Ethereum Pectra upgrade launches on the mainnet.

Others warn that if the coin continues to lose value against Bitcoin, investors may start shifting funds to other networks like Solana or Avalanche.

Even though short-term price predictions remain speculative, some traders expect Ethereum to rebound as Bitcoin stabilizes. Others believe the ETH/BTC ratio could drop even further.

As of this publication, CoinMarketCap data shows that Ethereum’s price was $1,842.29, up 1.34% in the last 24 hours. Many experts believe that the coming days will determine whether Ethereum can regain strength or whether Bitcoin’s dominance will continue to grow.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Elon Musk Rules Out The Use Of Dogecoin By The US Government

Elon Musk has doused optimism for the US government to adopt Dogecoin at the America PAC town hall event. The head of the Department of Government Efficiency (DOGE) noted that the government agency only bears a nominal resemblance to the memecoin.

Elon Musk Dispels Rumors Of Dogecoin Adoption By The US Government

At a recent event, Tesla CEO Elon Musk cleared the air on the potential adoption of Dogecoin by the US government. In his keynote speech, Musk noted that the US government will not be adopting Dogecoin, contrary to swirling speculation.

Musk noted that the speculation gained traction following the launch of the Department of Government Efficiency (DOGE). Following the launch of DOGE and Musk tapped to lead the agency, enthusiasm for Dogecoin government utility reached new highs.

However, Musk clarified that the agency bears only a nominal resemblance to the memecoin, stemming from an internet trend. The Tesla CEO disclosed that the original intended name was the Government Efficiency Commission, opting for DOGE “because the internet is right.”

“The name is similar but they are two different things,” said Musk. “But there are no plans for the government to use Dogecoin as far as I know.”

Musk has a long and storied history with Dogecoin, famously shilling the memecoin and integrating DOGE payments for Tesla. Musk teased an anime-themed DOGE on X, setting the stage for a $2 rally for the memecoin.

DOGE Reacts Negatively To The News

Dogecoin price slumped by nearly 2% in the wake of the grim report. Currently, the memecoin is trading at 0.1660 as it eyes a push toward the $1 mark.

The negative fundamental adds pressure to reports of DOGE forming a falling wedge pattern, signaling a potential downward breakout. However, optimists are rippling with confidence that DOGE can shake off the negative sentiments to post new all-time highs.

One analysis claims that if the Dogecoin price breaks a 3-month trendline, an $8 valuation for the memecoin is in play. Others claim that the House of Doge Reserve launch will be a tailwind for Dogecoin price, sending the dog-themed coin on a strong rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

$33 Million Inflows Signal Market Bounce

Crypto inflows hit $226 million last week, signaling a cautiously optimistic investor sentiment amid ongoing market volatility.

According to CoinShares data, altcoins broke a five-week streak of negative flows, recording their first inflows in over a month.

Crypto Inflows Hit $226 Million Last Week

This turnout marks a significant slowdown from the previous week when crypto inflows hit $644 million, ending a five-week outflow streak. Before that, inflows peaked at $1.3 billion, with Ethereum outpacing Bitcoin in investor demand.

“Digital asset investment products saw $226 million of inflows last week suggesting a positive but cautious investor,” read an excerpt in the report.

The pullback to $226 million last week suggests a more measured approach by investors as they assess macroeconomic conditions and regulatory uncertainties.

Specifically, CoinShares’ researcher James Butterfill ascribes Friday’s minor outflows of $74 million to core personal consumption expenditure (PCE) in the US, which came in above expectations.

“The Fed’s preferred measure of inflation (Core PCE) moved up to 2.8% in February & remains well above their 2% target that has yet to be achieved. The market is expecting the Fed to hold rates steady again at their next meeting on May 7 (at 4.25-4.50%),” investor Charlie Bilello noted.

Nevertheless, this turnaround comes after nine consecutive trading days of inflows into crypto ETPs (exchange-traded products).

Despite the slowdown, Bitcoin continued to attract strong inflows of $195 million. Meanwhile, short-Bitcoin products registered outflows of $2.5 million for the fourth consecutive week. This suggests that investors are leaning bullish on Bitcoin, even as altcoins begin to recover.

The CoinShares report shows that altcoins saw $33 million in inflows last week after suffering $1.7 billion in outflows over the past month.

Altcoins Rebound After $1.7 Billion in Outflows

Ethereum (ETH) led the recovery, attracting $14.5 million, then Solana (SOL) at $7.8 million, while XRP and Sui recorded $4.8 million and $4.0 million, respectively. Market analysts believe altcoins may be bottoming out, creating potential buying opportunities.

“Altcoins are oversold. The bottom is close. We’re ready for a bounce,” renowned analyst Crypto Rover highlighted.

Other analysts echoed the sentiment, suggesting growing attention toward altcoins. Among them was trader Thomas Kralow, who said, “altcoins are setting up for a comeback.”

Adding credence to this bullish outlook for altcoins, project researcher BitcoinHabebe, known for insightful mid-low cap sniper entries, pointed to technical indicators suggesting a market reversal.

“While bears are trying to spread fear & make you sell your altcoins, the TOTAL3 [Altcoins market cap chart excluding Bitcoin and Ethereum] just bounced off an HTF [higher timeframe] retest,” the analyst stated.

This means most coins have bottomed out and are expected to start reversing soon. Cole Garner noted a key buy signal in market liquidity metrics, further supporting this view.

“Tether Ratio Channel already flashed a double buy signal this month. Now my lower timeframe version is popping off. Fresh capital incoming,” he indicated.

The Tether Ratio Channel is an on-chain analytical tool that helps traders identify potential buy signals. It tracks the ratio of Bitcoin’s market capitalization to that of stablecoins, acting as a leading indicator for short- to medium-term trends.

When the ratio hits certain levels, it can signal shifts in market sentiment, often indicating whether fresh capital is entering or exiting the market.

While overall crypto inflows have slowed compared to previous weeks, the return of capital into altcoins suggests renewed investor confidence. Analysts see signs of an impending altcoin rally, with market metrics indicating that most coins have bottomed out.

As investors weigh macroeconomic uncertainties, the coming weeks could be critical in determining whether the altcoin recovery sustains momentum or if caution prevails.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market18 hours ago

Market18 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market17 hours ago

Market17 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Bitcoin8 hours ago

Bitcoin8 hours agoBTC Price Rebound Likely as Long-Term Holders Reenter Market

-

Market14 hours ago

Market14 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market8 hours ago

Market8 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Ethereum13 hours ago

Ethereum13 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund

-

Market13 hours ago

Market13 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

✓ Share: