Market

Focus on Value, Not Speculation

Ethereum (ETH) core developer Peter Szilagyi is disappointed with the crypto industry, advocating for actual value in a sector that can be so much more.

The crypto industry has come a long way since its inception, from the creation of Bitcoin to the development of various blockchain projects and applications. There are still challenges, but the industry keeps growing and changing, guided by goals of decentralization, transparency, and financial empowerment.

How Crypto Started and How It’s Going

The ethos behind crypto was to provide a decentralized and secure alternative to traditional currency and financial systems. The potential for blockchain technology to disrupt various industries and empower individuals with financial sovereignty was the main goal.

In the early years, the focus was on building the infrastructure for cryptocurrencies and exploring their potential use cases. Bitcoin gained popularity as a digital currency and store of value, while Ethereum introduced smart contracts, enabling developers to build decentralized applications (dApps) on its blockchain.

The industry has seen quick growth, with new projects and tokens entering the market, fueled by the initial coin offering (ICO) boom of 2017. However, the ICO craze also brought about challenges, as many projects turned out to be scams or failed to deliver on their promises.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

This led to concerns about investor protection and regulatory oversight. The industry now faces scrutiny from governments and financial regulators worldwide. As the industry evolved, the focus shifted towards addressing scalability issues, improving security, and user experience.

Projects like decentralized finance (DeFi) emerged, offering a wide range of financial services without the need for traditional intermediaries. Stablecoins provided a stable means of value transfer within the volatile crypto market, while privacy coins enhanced transaction anonymity.

Despite these advancements, Peter Szilagyi is disappointed that the speculative aspects of crypto take precedence over what could be its true value.

“Yes, it takes time to ‘build a new monetary system’. For sure… but how about we make a few useful things along the way? Everyone is so focused on becoming the next V that nobody wants to build useful stuff, everyone’s in it for value extraction,” Szilagyi lamented.

Ethereum’s Peter Szilagyi on Crypto: “A Damn Casino”

“Crypto is a damn casino,” he says, referring to how traders cheer when the price soars and lives wrecked when prices crash. In his opinion, the industry is about so much more. This criticism concerns the speculative nature of the market, characterized by extreme price volatility and a focus on short-term gains.

“Bitcoin at least tries (and fails) to be a safe haven asset, the rest are all selling shovels with no gold rush in sight… My feeling is that the speculative aspects outrank the true values way too heavily and we seem to like it because it makes money. I fail to see any value creation thus far… Mind you, making it big by luck and moving your funds into some non-crypto venture is not a success story for crypto. It at best is a success story for a philanthropic lucky person, but more likely a simple diversification of said person,” Szilagyi added.

With this, he observes that digital assets as a system could collapse if everyone’s focus is on “value extraction” instead of building useful stuff. The Ethereum executive calls for the industry to create something genuinely useful that people want to use.

Nevertheless, Erik Voorhees challenges Szilagyi’s casino outlook, highlighting some of the valuable projects in the industry with actual use cases. Among them are stablecoins, DeFi lending, DEXs, privacy coins, wallet apps, financial intelligence systems like Dune or Messari, and high-throughput blockchains. Voorhees is the founder of Swiss digital asset trading company ShapeShift and Venice, a permissionless alternative to popular AI apps.

But Szilagyi writes off DEXs, privacy coins, and wallets. DeFi data developer Geninsus.sol on X agrees.

“When I talk about crypto to non-crypto people, I always say we have 99% of useless things and 1% of potentially useful things. The most bullish use case for me is the possibility to lend/exchange money from peer-to-peer without any central organization taking a split and all automated,” the developer said.

Szilagyi’s critique of the industry reflects concerns about the prevalence of trading and speculation over genuine value creation. This debate mirrors the ongoing tension between speculation and utility within the crypto space and raises good rhetoric:

“How does the crypto industry impact 99.999% of the world population who doesn’t have money to gamble?”

Read more: 4 Best Crypto Learn and Earn Platforms in 2024

The future of the crypto industry will likely be shaped by efforts to balance innovation, regulation, and user adoption. Building sustainable projects with tangible benefits for users will be crucial for long-term success.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BTC Futures Show Bullish Sentiment, Options Traders Cautious

After a surge in Bitcoin spot ETF inflows on April 2, yesterday’s market action painted a different picture as institutional investors began offloading BTC holdings.

Despite this retreat, futures traders remain confident, with open interest climbing and funding rates staying positive. However, the options market tells a different story, with traders showing less conviction in sustained upward momentum. As a key batch of BTC options nears expiration, all eyes are on how the market will respond to this divergence.

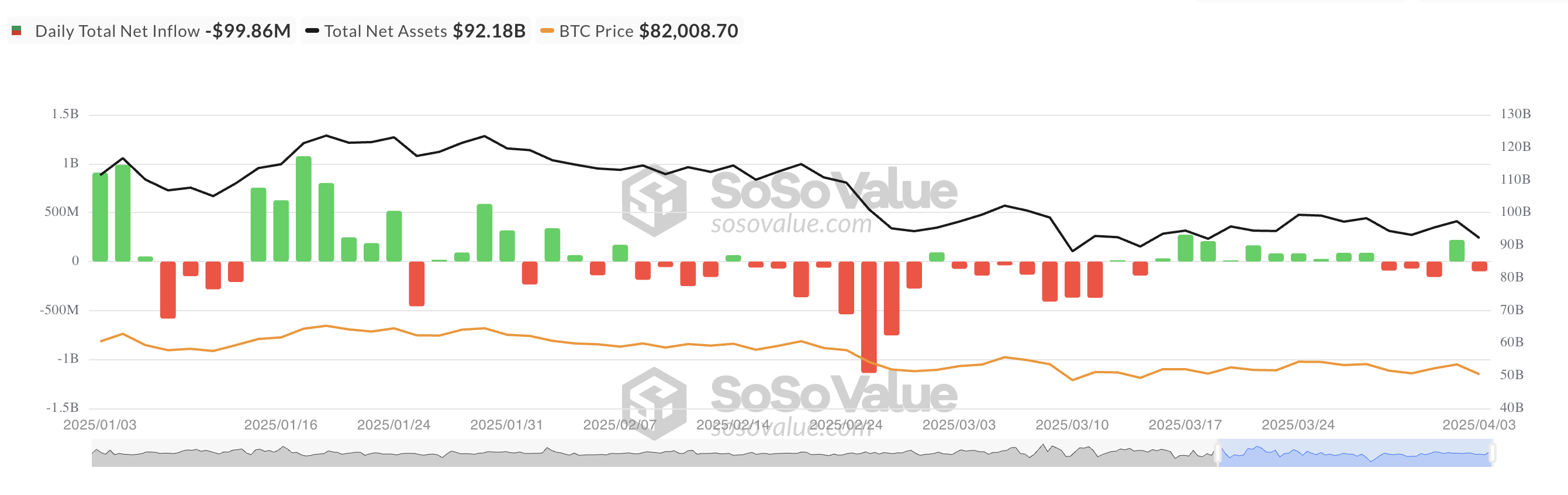

BTC Spot ETFs See $99.86 Million Outflow as Institutional Confidence Wavers

Institutional investors withdrew liquidity from BTC spot ETFs yesterday, resulting in a net outflow of $99.86 million.

This abrupt shift followed April 2’s $767 million net inflow, which ended a three-day streak of outflows. It signaled a brief return of institutional confidence before momentum quickly reversed.

Grayscale’s ETF GBTC saw the highest amount of fund exits, with a daily net outflow of $60.20 million, bringing its net assets under management to $22.60 billion.

However, BlackRock’s ETF IBIT stood out, witnessing a daily net inflow of $65.25 million. At press time, Bitcoin Spot ETFs have a total net asset value of $92.18 billion, plummeting 5% over the past 24 hours.

Bitcoin Derivatives Split as Traders Bet on Both Sides of the Market

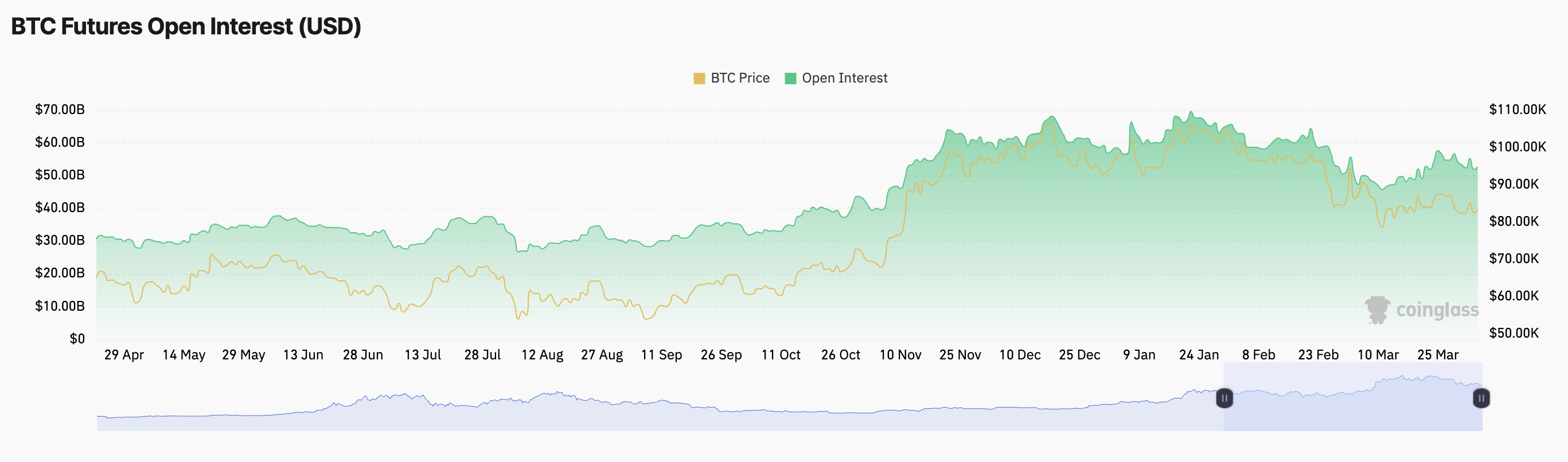

Meanwhile, the derivatives market remains split—Bitcoin futures traders are leaning bullish, backed by rising open interest and positive funding rates. In contrast, options traders appear more hesitant, signaling uncertainty in the market’s next move.

At press time, Bitcoin futures open is $52.63 billion, up 2% over the past day. The coin’s funding rate remains positive and currently stands at 0.0084%.

Notably, amid the broader market dip, BTC’s price has noted a minor 0.34% decline during the review period.

When BTC’s price declines while its futures open interest rises and funding rates remain positive, it suggests that traders are increasing leveraged positions despite the price drop. The positive funding rate indicates that long positions remain dominant, meaning traders expect a rebound.

However, caution is advised. If BTC’s price continues to fall, it could trigger long liquidations as overleveraged positions get squeezed.

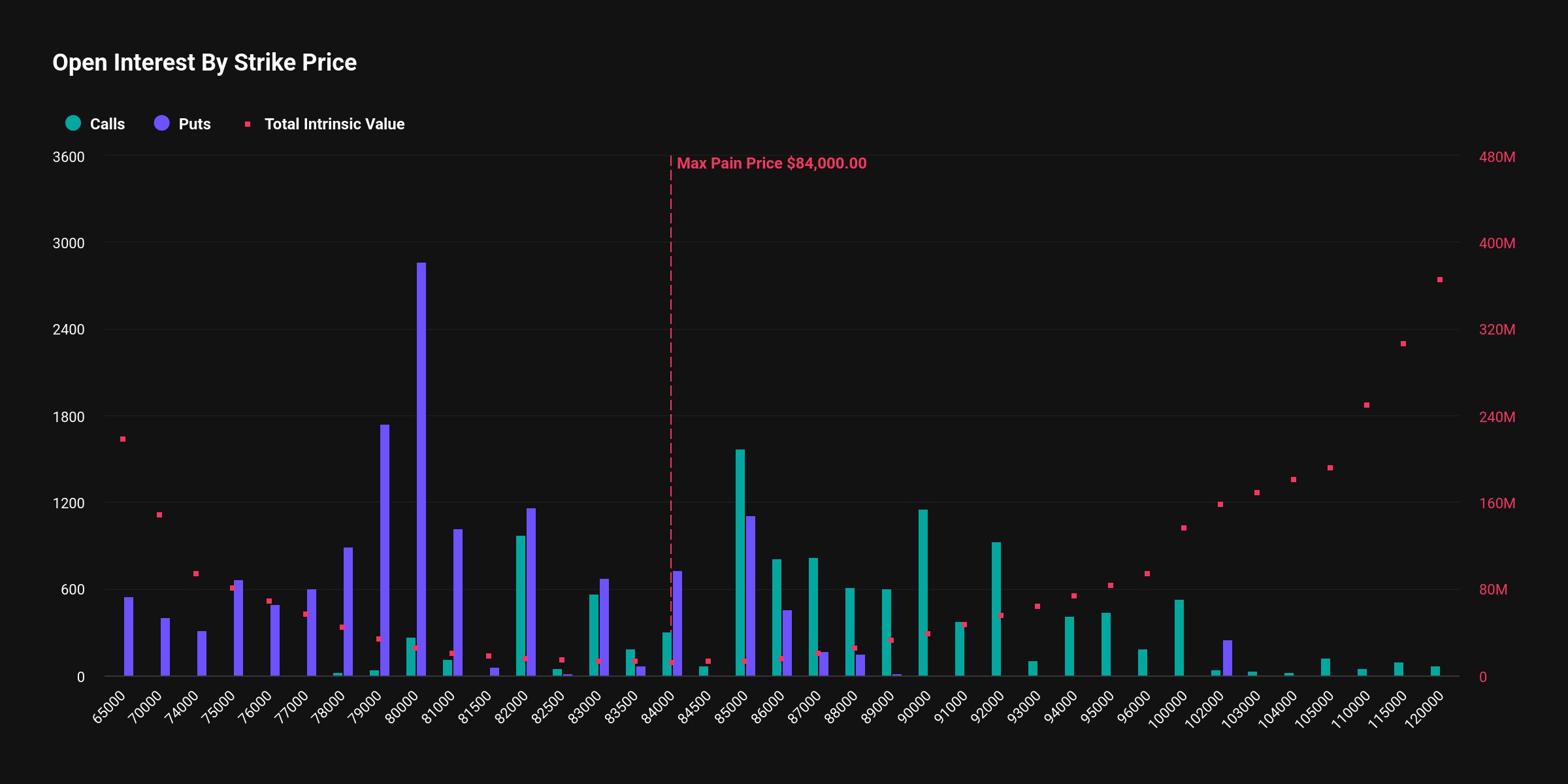

In contrast, the options market tells a different story, with traders showing less conviction in sustained upward momentum. This is evident from the high demand for put options.

According to Deribit, the notional value of BTC options expiring today is $2.17 billion, with a put-to-call ratio of 1.24. This confirms the prevalence of sales options among market participants.

This divide between futures and options traders suggests a tug-of-war between bullish speculation and cautious hedging, potentially leading to heightened volatility in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What to Expect on May 7

The highly anticipated Pectra upgrade will launch on the Ethereum (ETH) mainnet on May 7, 2025, after overcoming a series of technical challenges and delays in the testnet phase.

Ethereum developers announced the date during the All Core Developers Consensus (ACDC) meeting on April 3, 2025.

Pectra Upgrade Countdown Begins

The upgrade was initially slated for a tentative mainnet launch on April 30. However, Ethereum developers have postponed the launch by one week.

“We’ll go ahead and lock in May 7 for Pectra on mainnet,” Ethereum Foundation researcher Alex Stokes said.

In preparation for this, Stokes confirmed that client releases will be made available by April 21, ensuring that all users have the necessary updates and tools ahead of the mainnet launch. On April 23, a detailed blog post outlining the Pectra mainnet will be published.

The Pectra upgrade will introduce 11 Ethereum Improvement Proposals (EIPs) to enhance various aspects of the network. Notably, three EIPs are dedicated to improving the validator experience.

The first is EIP-7251. This will increase the staking limit for validators from 32 ETH to 2,048 ETH per validator. This change aims to enhance capital efficiency for large stakers and staking pools.

“This simplifies the staking experience, allowing users to manage multiple validators under one node instead of several,” an analyst remarked.

Moreover, EIP-7002 introduces execution-layer triggerable withdrawals, giving validators more control. Meanwhile, EIP-6110 reduces the deposit processing delay from about 9 hours to just 13 minutes.

The upgrade will also include EIP-7702, a major step toward account abstraction. It allows Externally Owned Accounts (EOAs) to gain smart contract functionality while maintaining simplicity. This enables features like transaction batching, gas sponsorship (where third parties pay fees), passkey-based authentication, spending controls, and asset recovery mechanisms.

Finally, the upgrade increases blob capacity through EIP-7691. In addition, EIP-7623 helps manage the increased bandwidth requirements. These updates aim to make Ethereum more scalable, efficient, and user-friendly.

It is worth noting that the road to the mainnet launch has not been without hurdles. Two previous tests on the Holesky and Sepolia test networks failed to finalize properly. However, Pectra achieved full finalization on the Hoodi testnet on March 26, marking a significant milestone toward the successful deployment of the upgrade.

Despite the technical progress, ETH continues to face market challenges.

Data from BeInCrypto shows that ETH dropped 4.8% over the past week, with weekly losses extending to 17.1%. At the time of writing, the altcoin was trading at $1,822, reflecting a small daily gain of 0.8%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Futures and Illinois Lawsuit Relief

Coinbase filed with the US Commodity Futures Trading Commission (CFTC) to launch futures contracts for Ripple’s XRP token.

The move comes after a positive development for the crypto derivatives market in the US, reflecting shifting regulatory ties in the country.

Coinbase Files for XRP Futures Trading With CFTC

Coinbase Derivatives has submitted a filing to self-certify XRP futures. It will provide a regulated, capital-efficient means for market participants to gain exposure to XRP. The new contract could go live as soon as April 21.

“We’re excited to announce that Coinbase Derivatives has filed with the CFTC to self-certify XRP futures – bringing a regulated, capital-efficient way to gain exposure to one of the most liquid digital assets. We anticipate the contract going live on April 21, 2025,” read the announcement.

Meanwhile, the official filing indicates that the XRP futures contract will be a monthly cash-settled and margined contract trading under the symbol XRL.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two subsequent months. As a protective measure, trading will be temporarily halted if the spot XRP price moves more than 10% within an hour.

The Coinbase Exchange also confirmed that it has engaged with Futures Commission Merchants (FCMs) and other market participants. Both references reportedly expressed support for the launch.

However, Coinbase is not the first US-based exchange to introduce regulated XRP futures. In March, Chicago-based Bitnomial launched what it advertised as the country’s first CFTC-regulated XRP futures contract.

For Coinbase, however, the boldness comes after the CFTC eased key regulatory hurdles for crypto derivatives trading. As BeInCrypto reported, this signaled a more accommodating stance towards the sector.

“Pursuant to Commodity Futures Trading Commission (“CFTC” or “Commission”) Regulation 40.2(a), Coinbase Derivatives, LLC (the “Exchange” or “COIN”) hereby submits for self-certification its initial listing of the XRP Futures contract to be offered for trading on the Exchange…,” an excerpt in the filing indicated.

This suggests that the commodities regulator’s shift, revoking previous crypto-related guidelines, may boost institutional confidence. For XRP, this development bolsters confidence in the asset’s previously contentious status following Ripple’s recent regulatory breakthrough.

“Coinbase Derivatives’ filing with the CFTC to self-certify XRP futures aims to legitimize XRP trading by offering a regulated, capital-efficient product for investors,” one user remarked.

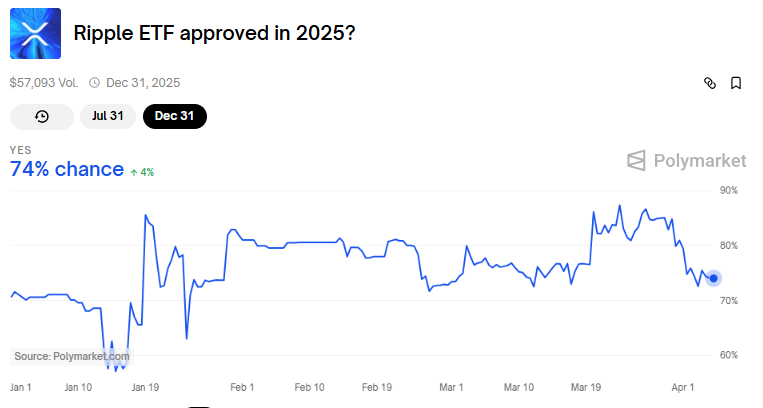

The futures contract might also help the odds of XRP ETF approval. Recently, the SEC delayed several applications to create one, and its status is in limbo.

Data on Polymarket shows bettors see a 74% chance for XRP ETF approval in 2025 and a more modest 34% by July 31.

Regulatory and Legal Developments Favor Coinbase

Elsewhere, the timing of this filing aligns with recent favorable regulatory developments for Coinbase. Reports suggest Illinois intends to drop its lawsuit against the exchange over its staking services.

Up to 10 states filed a lawsuit against Coinbase in June 2023 alleging that its staking program constituted unregistered securities offerings.

This recent development makes Illinois the fourth state to withdraw legal action against Coinbase. Vermont, South Carolina, and Kentucky also dismissed their cases on March 13, 27, and 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey, Washington and Wisconsin.

These legal retreats coincide with the US SEC’s (Securities and Exchange Commission) February decision to abandon its federal lawsuit against Coinbase. BeInCrypto reported that this development marked a broader shift in the regulatory approach under the current administration.

“Regulators are losing steam, and Coinbase is stacking quiet courtroom wins. Staking’s future in the US might just be back on track,” a user commented.

Illinois’ decision to drop its lawsuit comes as the state advances a Bitcoin strategic reserve bill. Specifically, Illinois State Representative John M. Cabello introduced House Bill 1844 (HB1844), highlighting Bitcoin’s potential as a decentralized, finite digital asset.

“A strategic bitcoin reserve aligns with Illinois’ commitment to fostering innovation in digital assets and providing Illinoisans with enhanced financial security,” the bill read.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

-

Market20 hours ago

Market20 hours agoBitcoin’s Future After Trump Tariffs

-

Bitcoin24 hours ago

Bitcoin24 hours agoBlackRock Approved by FCA to Operate as UK Crypto Asset Firm

-

Market24 hours ago

Market24 hours agoHBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

-

Altcoin23 hours ago

Altcoin23 hours agoJohn Squire Says XRP Could Spark A Wave of Early Retirements

-

Market22 hours ago

Market22 hours ago10 Altcoins at Risk of Binance Delisting

-

Market21 hours ago

Market21 hours agoEDGE Goes Live, RSR Added to Roadmap

-

Regulation19 hours ago

Regulation19 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role