Market

Why Render (RENDER) Holders Need To Excercise Caution

The price of the leading artificial intelligence-based token, Render (RENDER), has plummeted 25% over the past week.

While a key on-chain metric suggests this may be a good time to buy the altcoin, its price remains at risk of falling further.

Render Buyers Should Take Caution

As of this writing, RENDER trades at $4.62. During Monday’s market downturn, the altcoin plummeted to a seven-month low of $4.14.

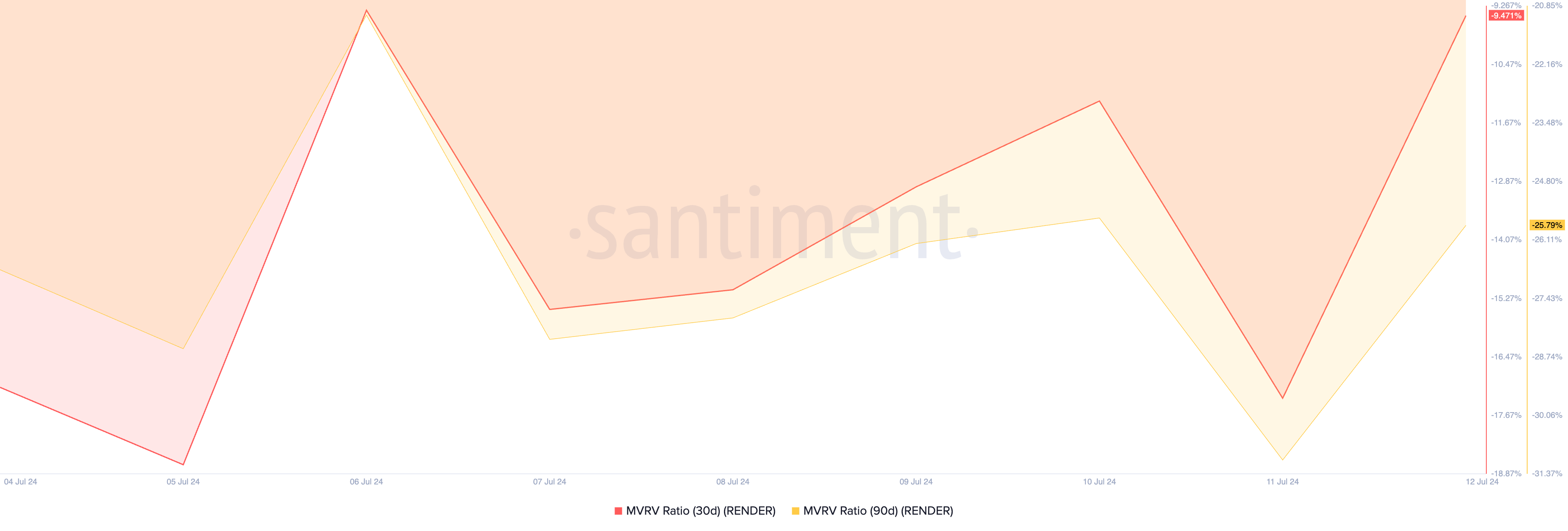

According to RENDER’s market value to realized value (MVRV) ratio, now may be a good time to buy the altcoin as it is currently undervalued. The negative values of this ratio, when assessed over different moving averages, confirm this. Per Santiment, RENDER’s 30-day and 90-day MVRV ratios are -9.47 and -25.79, respectively.

This metric measures the ratio between an asset’s current price and the average price at which all its coins or tokens were acquired. When its value is positive, the asset’s market value is higher than the cost basis for most investors. Here, the token is overvalued, and coin holders can sell for profit.

Conversely, an MVRV ratio below zero indicates that the asset’s market value is less than the average purchase price of all its circulating tokens, signaling that it is undervalued.

A negative MVRV ratio presents a good buying opportunity, as it connotes that the asset trades at a lower price. This allows traders to accumulate it, hoping to sell it at a higher price later.

Price Below 20-Day EMA and 50-Day SMA, Downtrend to Continue?

However, RENDER’s price action on a daily chart hints at the continuation of its downtrend in the short term. At its current price, RENDER trades below its 20-day exponential moving average (EMA (blue line) and its 50-day small moving average (SMA) (yellow line).

An asset’s 20-day EMA is a short-term moving average that reacts quickly to price changes. It reflects the average closing price of an asset over the past 20 days.

The 50-day SMA, on the other hand, is a longer-term moving average that reflects an asset’s average closing price over the past 50 days.

When an asset trades below these moving averages, it indicates its price has declined over both short—and medium-term periods. This bearish trend is seen by traders as a signal to sell or avoid buying until the asset shows signs of recovery above these moving averages.

Read More: How To Buy Render Token (RENDER) and Everything You Need To Know

Additionally, RENDER’s Relative Strength Index (RSI) is in a downtrend at 31.36 at press time. This indicator measures an asset’s oversold and overbought market conditions. At 31.36, RENDER’s RSI confirms a decline in buying activity.

RENDER Price Prediction: Token May Revisit 7-Month Low

The further the demand for RENDER dries up, the more it is at risk of devaluation. Once it sheds its gains of the past 24 hours, the altcoin will revisit its seven-month low of $4.14 and may even fall below it to trade at $3.41.

Read More: Render Token (RENDER) Price Prediction 2024/2025/2030

However, if more traders begin to “buy the dip” and RENDER accumulation steadies, its price may climb to $5.87.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

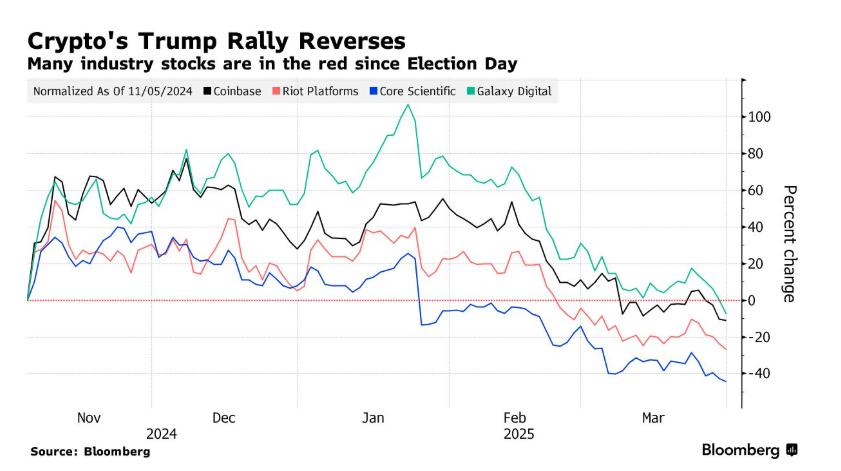

Coinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

Coinbase, the largest US crypto exchange, has recorded its worst quarter since the dramatic collapse of FTX in late 2022.

Coinbase’s stock (COIN) plummeted by 30% in Q1 2025, mirroring the steep losses seen across the broader crypto market.

Crypto Stocks and Assets Bleed Red in Q1

According to Bloomberg, the sharp decline has hit several other major crypto-related stocks as well. This includes Galaxy Digital, Riot Blockchain, and Core Scientific, all of which have experienced significant downturns.

Furthermore, the broader crypto market is facing tough times. Bitcoin, which has long been considered the bellwether of digital assets, has dropped by 10% this quarter. More dramatically, Ethereum (ETH) has seen a staggering 45% decline. These losses reflect a broader downturn in the crypto market, fueled by several macroeconomic factors.

Analysts point to the global uncertainty surrounding the US economy, including concerns over Trump’s tariffs and recession fears. This has resulted in a general “risk-off” mood among investors.

“In a risk-off mood, no asset is safe stocks, crypto, all get hit. It’s more about sentiment than fundamentals in those moments,” an investor commented on X.

While some point to these macroeconomic pressures as the primary cause, others argue that the market’s underperformance is more due to lingering fears of trade wars and broader geopolitical instability.

“Trump’s trade wars are driving markets into a panic. As much as he is doing for crypto, the macro market conditions are speaking louder – as bullish as the news is from the white house – His trash trade war is squelching any price surge,” another X user remarked.

Coinbase has been hit especially hard in this downturn. Coinbase’s revenue model is heavily reliant on altcoins and transaction volumes beyond Bitcoin. Hence, the overall market drop could have made a mark on the exchange’s stock prices. Moreover, the news comes as Coinbase users have collectively lost more than $46 million to scams in March.

While crypto has been in a freefall, other assets have fared much better. Gold, for example, has surged, posting its best quarter since 1986 as investors flock to safer assets amid the market turmoil. The shift toward traditional assets is particularly noticeable as the post-election crypto hype, which briefly boosted Bitcoin’s value to $109,000, begins to fade.

Despite the overall market challenges, some crypto-related firms have shown resilience. MicroStrategy, led by CEO Michael Saylor, remains in the green year-to-date, bolstered by its substantial Bitcoin holdings.

For now, the crypto market is left to weather the storm, with analysts continuing to scrutinize the interplay of macroeconomic factors and its impact on digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Fake Gemini Bankruptcy Emails Target Users

Crypto scams are surging as more people flock to digital currencies, with fraudsters exploiting the industry’s rapid growth to deceive investors.

Recently, numerous crypto users reported receiving fraudulent emails claiming that the Gemini exchange had filed for bankruptcy. Meanwhile, Coinbase Exchange has admitted that an employee illegally accessed user account information.

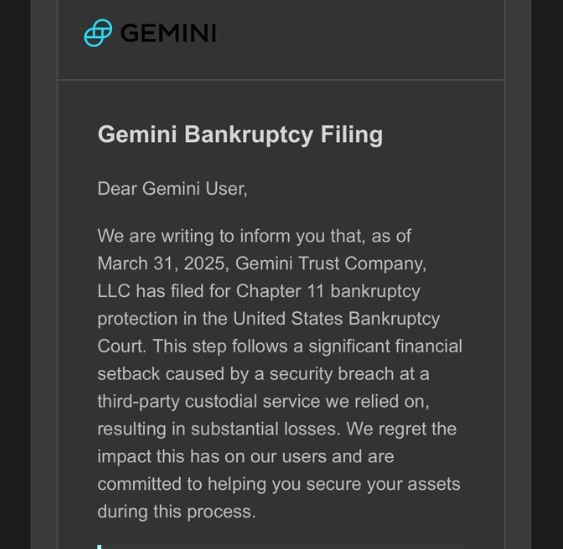

Gemini Exchange Addresses Bankruptcy Allegations

Multiple accounts highlighted the scam on social media, indicating that an email circulating falsely claims that Gemini has filed for bankruptcy. The email instructed users to withdraw to an Exodus wallet and provided a seed phrase.

These phishing emails, shared on April 1, urged recipients to withdraw their funds into a specified crypto wallet to protect their assets. This was an attempt to deceive users into transferring their cryptocurrencies to wallets controlled by scammers.

“Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email,” wrote Jason Williams, a contributor to Fox Business.

The deceptive emails alleged a substantial loss of $1.2 billion by Gemini Exchange. Understandably, some novice investors would heed this email and even move their assets to the address. After all, some victims of FTX Exchange contagion continue to pursue their funds even years after the incident.

“I got one also. It is better than your typical ‘Coin Base’ one, but still not quite there. Might fool a boomer though,” one X user remarked.

However, security experts advise users to always verify information through official channels, avoid clicking on unsolicited links, and refrain from sharing personal data. Gemini issued an official warning in response to the scam, acknowledging the threat against its users.

“We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets,” the exchange articulated.

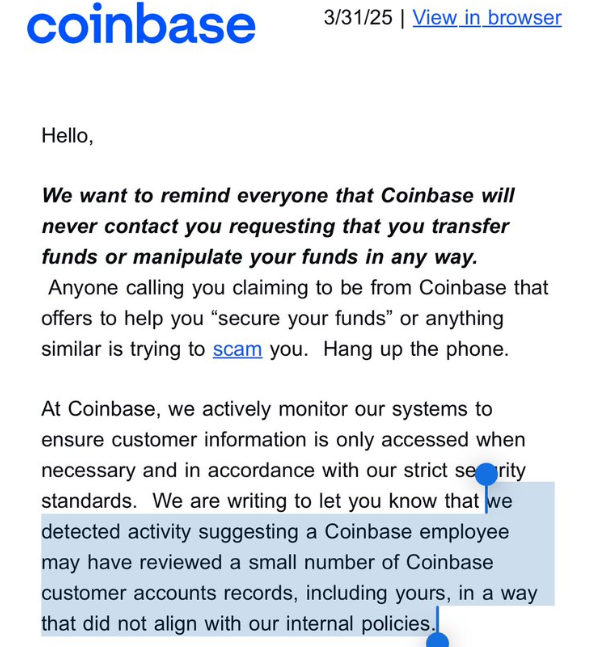

Coinbase Admits Employee Illegally Accessed User Account Data

Coinbase exchange acknowledged a privacy violation by one of its staff in a somewhat related development. Specifically, a customer service employee accessed user account information without authorization.

This breach has raised concerns about potential scams targeting Coinbase users. Mike Dudas, a crypto investor and co-founder at The Block, shared an email from Coinbase acknowledging the incident.

“That explains the fake Coinbase phishing emails and phone calls today,” he stated.

This breach coincides with reports of phishing attempts, as users have received fake emails and calls purporting to be from Coinbase. These incidents reflect a broader wave of crypto-related fraud.

Blockchain investigator ZachXBT reported that Coinbase users lost over $65 million to social engineering scams between December 2024 and January 2025.

“Coinbase did not detect it; I sent them the intel,” the blockchain investigated noted.

Additionally, crypto analyst Cobie suggested Kraken might be experiencing a similar issue. Per his post, a new attack may be budding, where attackers infiltrate customer service roles to exfiltrate data.

“Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data),” the analyst remarked.

Amidst these events, ZachXBT recently explained how to avoid crypto scams. He emphasizes the importance of conducting thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains.

Additionally, he advises caution when dealing with projects with few credible followers, as these may indicate potential scams.

Therefore, it is imperative that users remain vigilant against sophisticated phishing scams and unauthorized data breaches.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Struggles as Whale Selling Rises To $2.3 Billion

XRP has been on a consistent downtrend in recent days, with its price falling sharply and approaching the $2 mark. This has resulted in extended losses for the cryptocurrency, with a notable rise in selling pressure.

Despite the bearish momentum, key investors are trying to offset the negative impact.

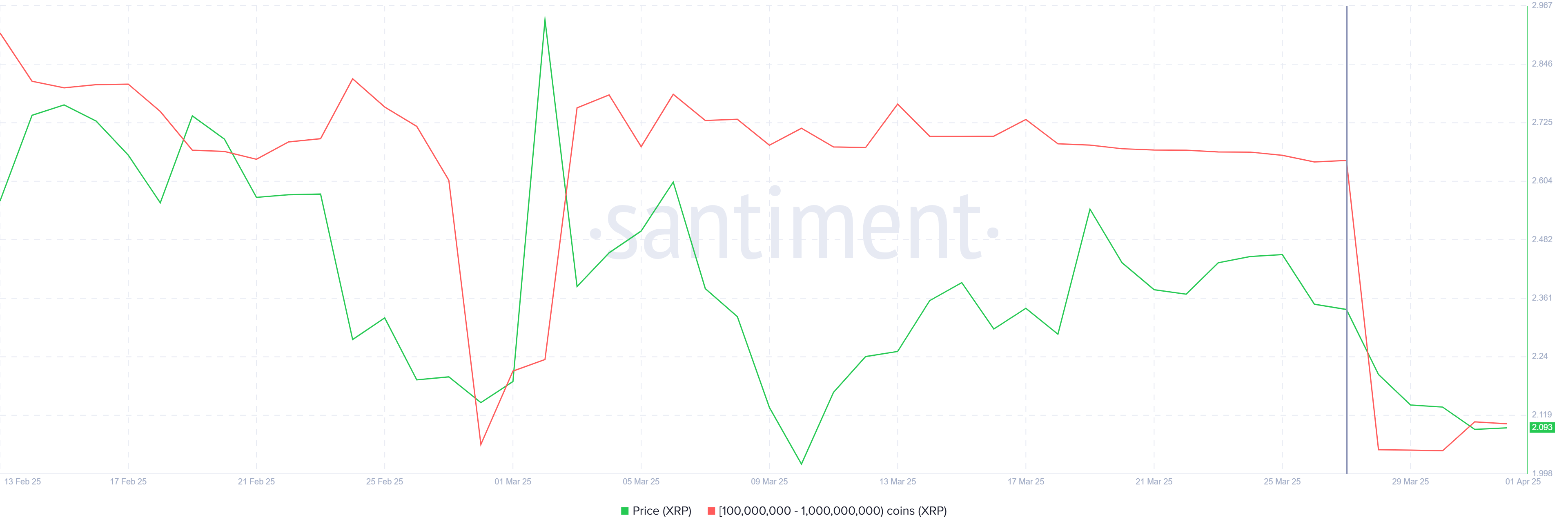

XRP Whales Are Uncertain

Whale activity has been a major factor contributing to the recent decline in XRP’s price. Addresses holding between 100 million and 1 billion XRP have sold over 1.12 billion XRP, worth $2.34 billion, in the past seven days. This has brought their total holdings down to 8.98 billion XRP.

The selling activity from these whale addresses reflects a cautious outlook for XRP. While whale selling often indicates uncertainty in the market, it’s important to note that their behavior can also have significant short-term price movements. The recent heavy selling could signal that market participants are unsure about the short-term price action, and further bearish trends could follow if this continues.

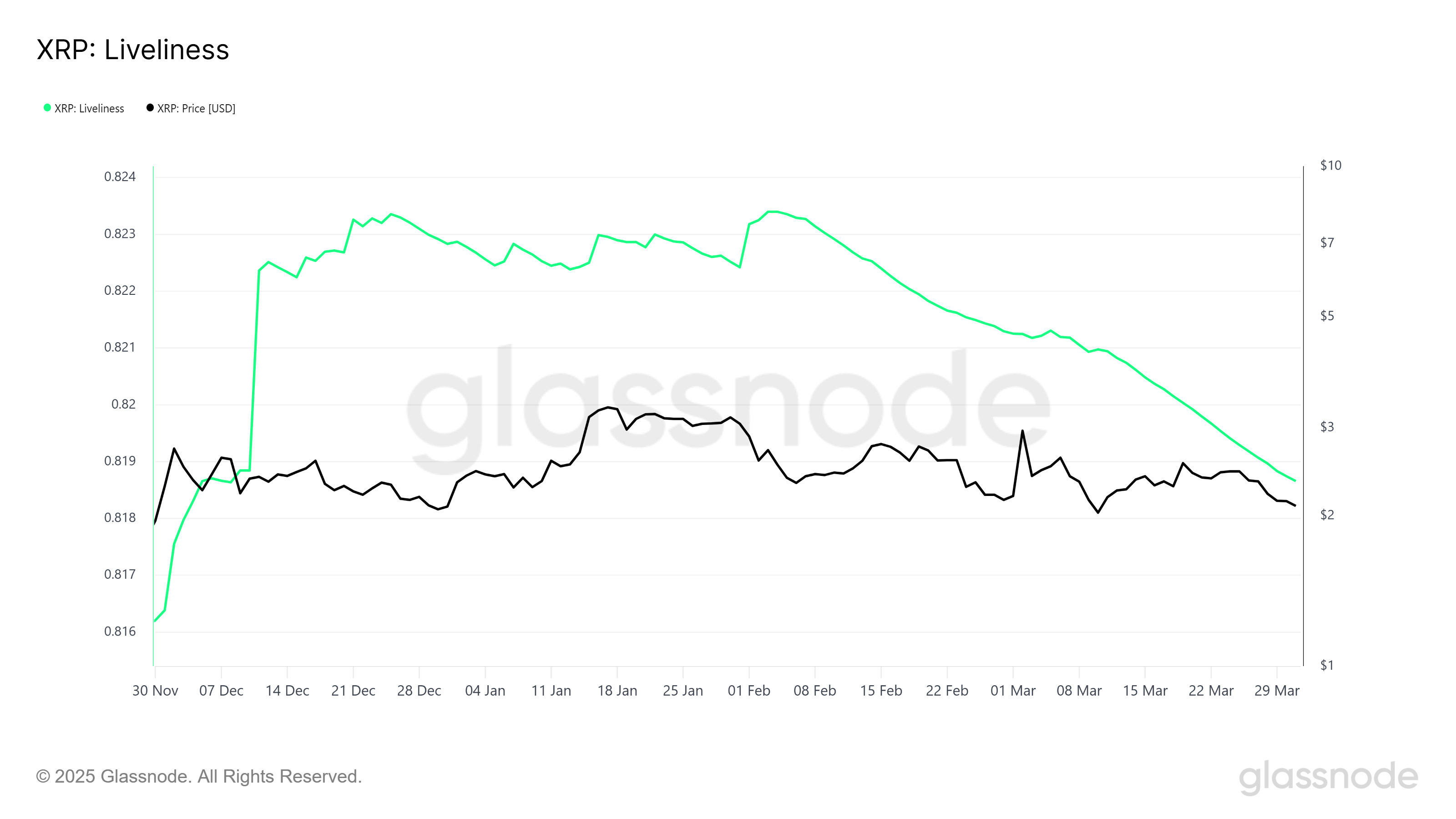

On the broader market level, XRP’s macro momentum shows signs of divergence from the whale selling. The Liveliness metric, which tracks the behavior of long-term holders (LTHs), is currently declining.

A falling Liveliness typically signals that LTHs are accumulating more of the asset at lower prices rather than selling. This drop to a three-month low suggests that long-term holders are sticking to their conviction and accumulating XRP, even as whale selling intensifies.

The steady accumulation of LTHs might help cushion the bearish effects created by the whales. This behavior can counteract the selling pressure, potentially offering stability to XRP’s price and supporting a recovery if market conditions improve.

XRP Price Needs To Find Direction

XRP’s price has fallen by 14.5% this week, bringing it to $2.09, which is dangerously close to losing the critical $2.02 support level. The ongoing bearish momentum has created mixed signals in the market, which are likely to keep the price stuck in a narrow range for the time being.

If XRP can bounce back from the $2.02 support, it could recover some of the recent losses. However, the altcoin may remain consolidated below the $2.27 resistance level unless more positive news or market conditions arise to push it higher.

If XRP breaks through the $2.27 barrier or falls below $2.02, it could invalidate the current consolidation outlook. A successful breach of $2.27 could pave the way for a price recovery, with $2.56 being the next significant target.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoTop Crypto Airdrops to Watch in the First Week of April

-

Market19 hours ago

Market19 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Bitcoin20 hours ago

Bitcoin20 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market20 hours ago

Market20 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Altcoin24 hours ago

Altcoin24 hours ago$33 Million Inflows Signal Market Bounce

-

Market23 hours ago

Market23 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Market22 hours ago

Market22 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH