Market

Analyst Predicts Blow-Off Top Ahead

Market analyst and trader Henrik Zerberg predicts a blow-off top in US markets for cryptocurrency and stock sectors. This prediction comes after the market-wide crash on Monday, which saw over $1 billion in crypto positions liquidated.

The crypto industry is recording a shift in sentiment, with Bitcoin up 8%, holding well above $55,000, and dragging altcoins along with it.

Blow Off Top To Come In Crypto and Stock Markets

Zerberg anticipates new all-time highs (ATHs) in the US stock market as well as crypto. He says the current bearish sentiment will transform into a strong bullish sentiment and euphoria, leading to a blow-off top.

“As we in the coming few months reach ATHs in the US stock market and in BTC+ Crypto, the current Bearish sentiment will develop into strong Bullish sentiment and euphoria – and the markets will soar! I will be told that I am wrong about my forecast of a coming top in US markets. But Recession is coming and the largest bear market since 1929 will begin. First, blow-off top (in US markets!),” Zerberg wrote.

In crypto jargon, a blow-off top is a trading term that describes a chart pattern showing a steep and rapid increase in Bitcoin price and trading volume. After that, a steep and rapid drop in price happens, accompanied by high volume. Analysts interpret the rapid changes to mean the market was way overbought.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

Zerberg’s forecast comes after panic selling on Monday turned into impulse buying. Nevertheless, Jack Mallers, a popular market analyst, ascribes the sell-off to the unique availability of open Bitcoin markets as the crisis intensified.

“In crises, markets sell what they can, not what they want. Bitcoin is down because it was the only market open to sell on Sunday night, not because the only fixed supply of money we have is now less valuable. Bitcoin isn’t hedging the broken financial system, it’s replacing it,” Mallers explained.

At the height of the crisis, liquidity was needed, and it could only come from one place on a Sunday night. Accordingly, Bitcoin’s liquidity positioned it for losses, as investors had a gateway to exit the market. This explanation highlights Bitcoin’s role in fixing the financial system.

“Liquid assets always be liquidated first in liquidity crises. Bitcoin is insanely liquid…try and sell $275k of gold at 11:27 pm on a Sunday,” Adam, a Bitcoin mining infrastructure developer, said.

As BeInCrypto reported, markets are already recovery mode after ETF (exchange-traded funds) investors reportedly seized the opportunity to buy the dip.

ETF Investors, Whales Buy The Dip After Marketwide Jitters

On Tuesday, analyst James Seyffart observed, “ETF investors, in aggregate, likely bought the dip on Ethereum today.” Indeed, data shows that ETH ETFs recorded up to $48.73 million in net inflows on Monday, effectively beating Bitcoin ETFs, which saw $168.44 million in net outflows.

Bitwise CIO Matt Hougan reported positive inflows into the firm’s ETF instruments, IBIT for Bitcoin and ETHW, acknowledging that ETF investors bought the dip.

“We had net inflows into both our Bitcoin and Ethereum ETFs today. ETF investors buying the dip,” Hougan wrote.

Read more: How to Invest in Ethereum ETFs?

Notably, Bitcoin ETFs witnessed some of the most substantial trading volumes on August 5 within minutes of the US session opening. BlackRock’s iShares ETF IBIT, in particular, surpassed $1.55 billion in trading volume in Monday’s first hour of trading. ETF analyst Eric Balchunas said this was concerning.

“Bitcoin ETFs have traded about $2.5b so far, a lot for 10:45 am, but not too crazy (full history below). If you are a Bitcoin bull you do not want to see crazy volume today, as ETF volume on bad days is a pretty reliable measure of fear. On the flip, deep liquidity on bad days is part of what traders and institutions love about ETFs. You also want to see volume too, good for the long term,” Balchunas commented.

Alongside ETF investors, whales are also scooping Bitcoin at a discount. According to a press release shared on Monday, healthcare company Semler Scientific acquired 101 BTC tokens. The company recently adopted a Bitcoin treasury, with the latest buy bringing its total holdings to 929 BTC.

The firm started buying Bitcoin in late May, acquiring 581 BTC for around $40 million. It made two more Bitcoin investments in June, effectively emulating the precedent set by Michael Saylor’s MicroStrategy. So far, the company has spent $63 million in Bitcoin purchases, steadily integrating Bitcoin into its treasury operations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

10 Altcoins at Risk of Binance Delisting

On April 3, Binance announced that it would add a new set of tokens to its monitoring list. These tokens are under closer scrutiny and may face delisting following the upcoming review period.

This move follows the exchange’s aims to increase transparency while offering more clarity regarding the risk levels associated with different cryptocurrencies.

10 Altcoins in Danger of Binance Delisting

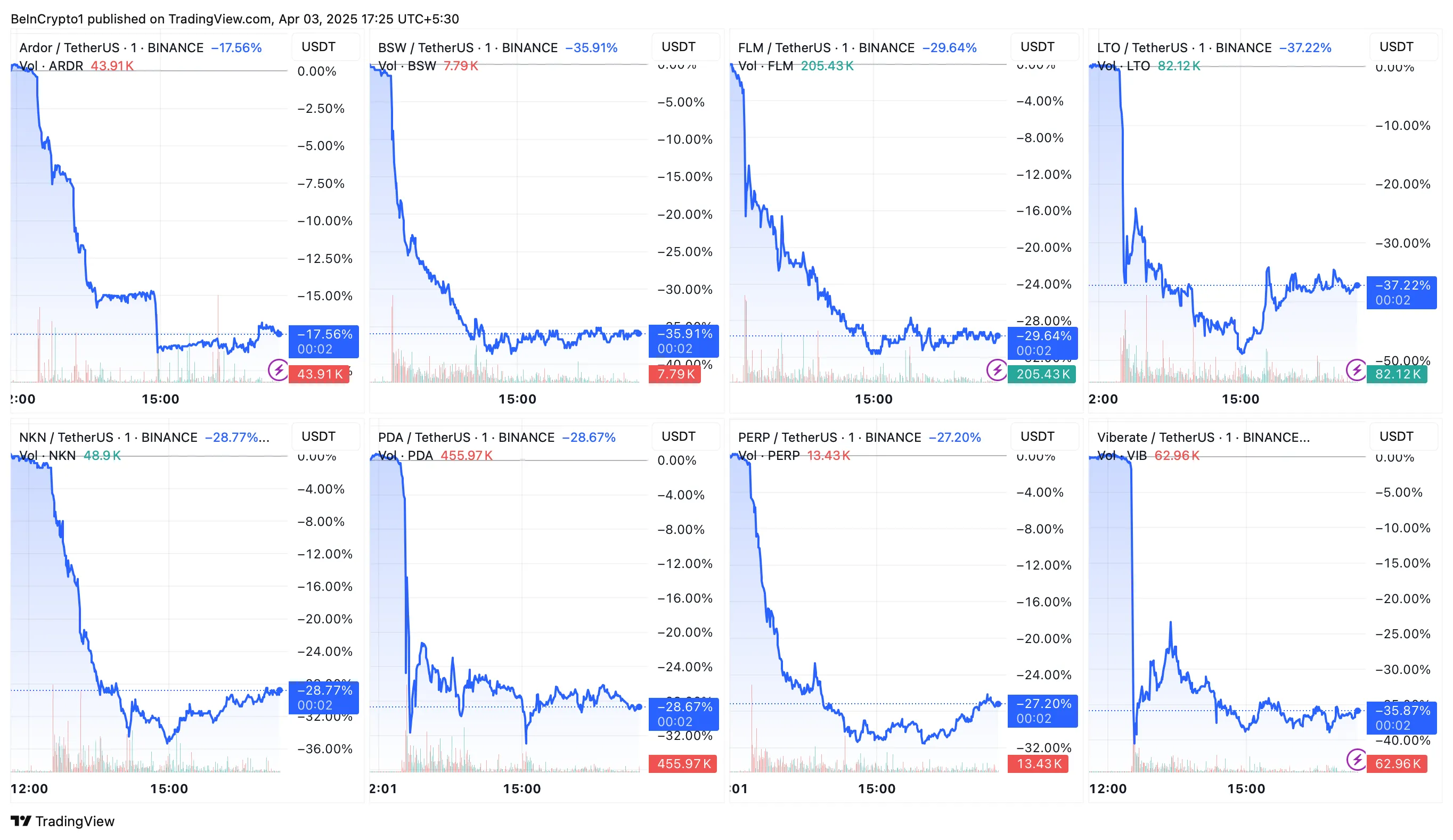

As part of this update, the following tokens will be added to the Monitoring Tag list: Ardor (ARDR), Biswap (BSW), Flamingo (FLM), LTO Network (LTO), NKN (NKN), PlayDapp (PDA), Perpetual Protocol (PERP), Viberate (VIB), Voxies (VOXEL) and Wing Finance (WING).

Tokens added to the Monitoring Tag exhibit notably higher volatility and risk compared to other listed tokens. Binance will closely monitor these tokens, with regular reviews to assess their compliance with the platform’s listing criteria.

“Tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance said.

Following the announcement, the prices of the mentioned altcoins plummeted by double-digits.

In addition to the new Monitoring Tag additions, Binance will also remove the Seed Tag from Jupiter (JUP), Starknet (STRK), and Toncoin (TON).

Tokens marked with the Seed Tag are those that are still in their early stages of development and have not yet met Binance’s full listing criteria. The removal of the Seed Tag indicates a change in the status of these projects. This suggests that they no longer fit the initial criteria for such a label.

Tokens with the Monitoring Tag or Seed Tag come with inherent risks. Binance ensures that users are well-informed before trading them. To access trading for these tokens, users must pass a risk awareness quiz every 90 days.

The quiz makes sure that users understand the potential risks associated with trading higher-risk tokens. Binance will also display a risk warning banner for these tokens on its Spot and Margin platforms.

Binance will continue to conduct periodic reviews of tokens with the Monitoring Tag and Seed Tag. During these reviews, several factors are taken into account. This includes the project team’s commitment, development activity, token liquidity, and community engagement.

The latest development follows a similar announcement from Binance in March. The exchange routinely delists tokens that fail to keep up with its criteria.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Foundation Eyes TikTok, Price Rally To $0.20 Possible

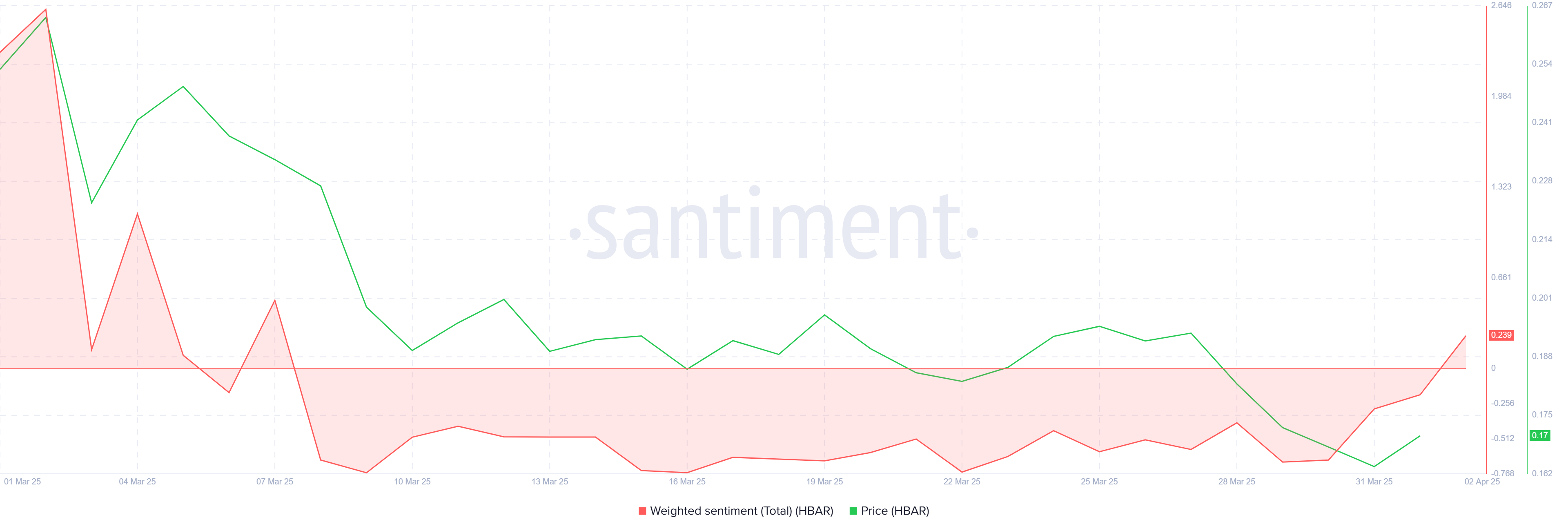

Hedera (HBAR) has faced a downtrend recently, with the crypto asset’s price failing to maintain support at $0.200. This failure to establish a solid base has led to a pullback.

However, key developments within the Hedera ecosystem and shifting investor sentiment could spark a potential price rally in the coming days.

HBAR Foundation Eyes TikTok

After nearly a month of bearish sentiment, investors are beginning to shift their stance towards bullishness. The Hedera Foundation’s recent move to team up with Zoopto for a late-stage bid to acquire TikTok has played a pivotal role in this shift. If the acquisition is approved, the partnership could expose HBAR to a massive audience due to TikTok’s extensive user base, potentially driving up demand and mainstream adoption.

The prospect of this collaboration has reignited interest among investors, sparking optimism about Hedera’s future growth potential. With TikTok’s wide-reaching influence, the strategic partnership could offer Hedera an edge in the competitive crypto market, encouraging further accumulation of HBAR tokens.

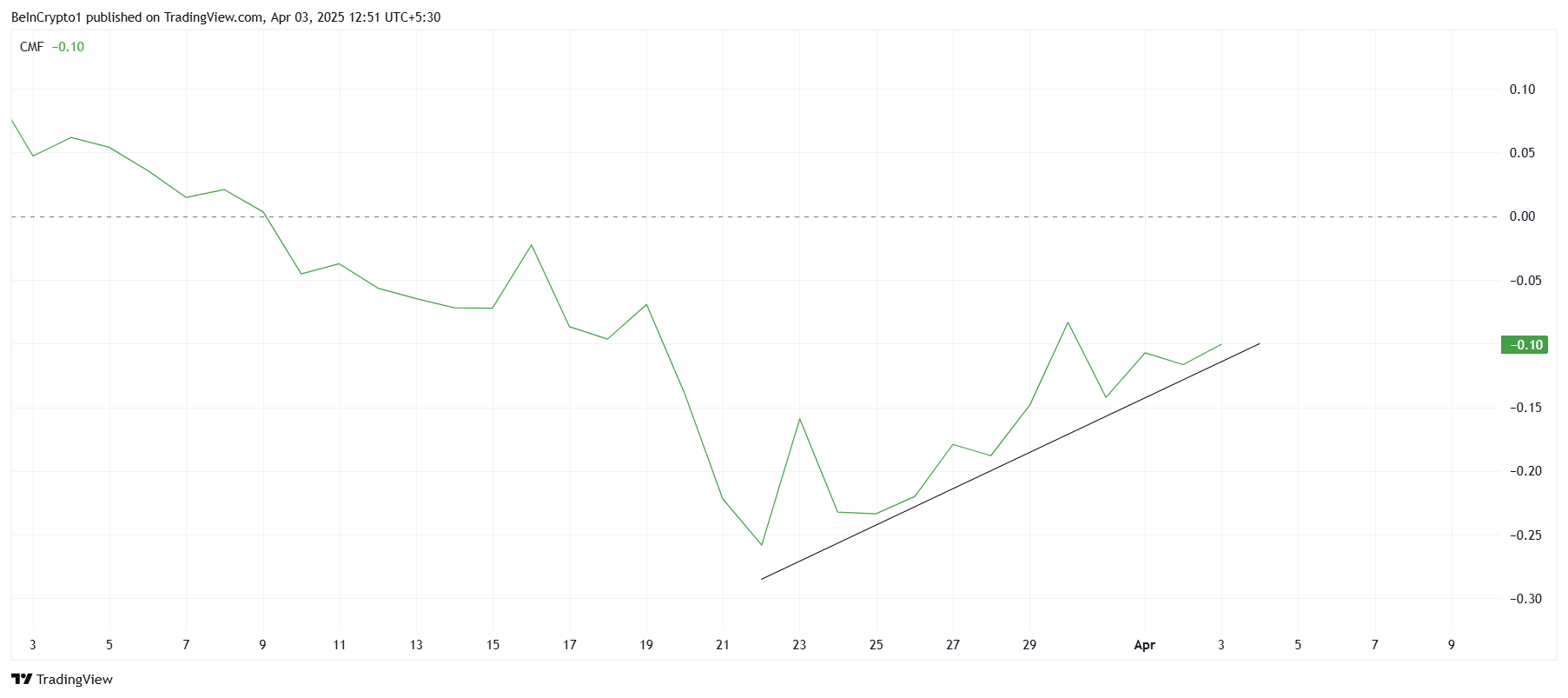

On the technical front, the Chaikin Money Flow (CMF) indicator is showing signs of recovery. The CMF has started to tick upwards, signaling a potential increase in inflows. While it hasn’t yet crossed above the zero line, the growing positive momentum indicates that more capital could be entering the market. Continued inflows could provide the necessary push for HBAR to break through key resistance levels.

The increase in capital flow suggests a strengthening of investor confidence. However, for a sustained rally, more substantial buying pressure will be required to move HBAR above its current price point. If this trend continues, HBAR may see a rise in both investor interest and market value in the near future.

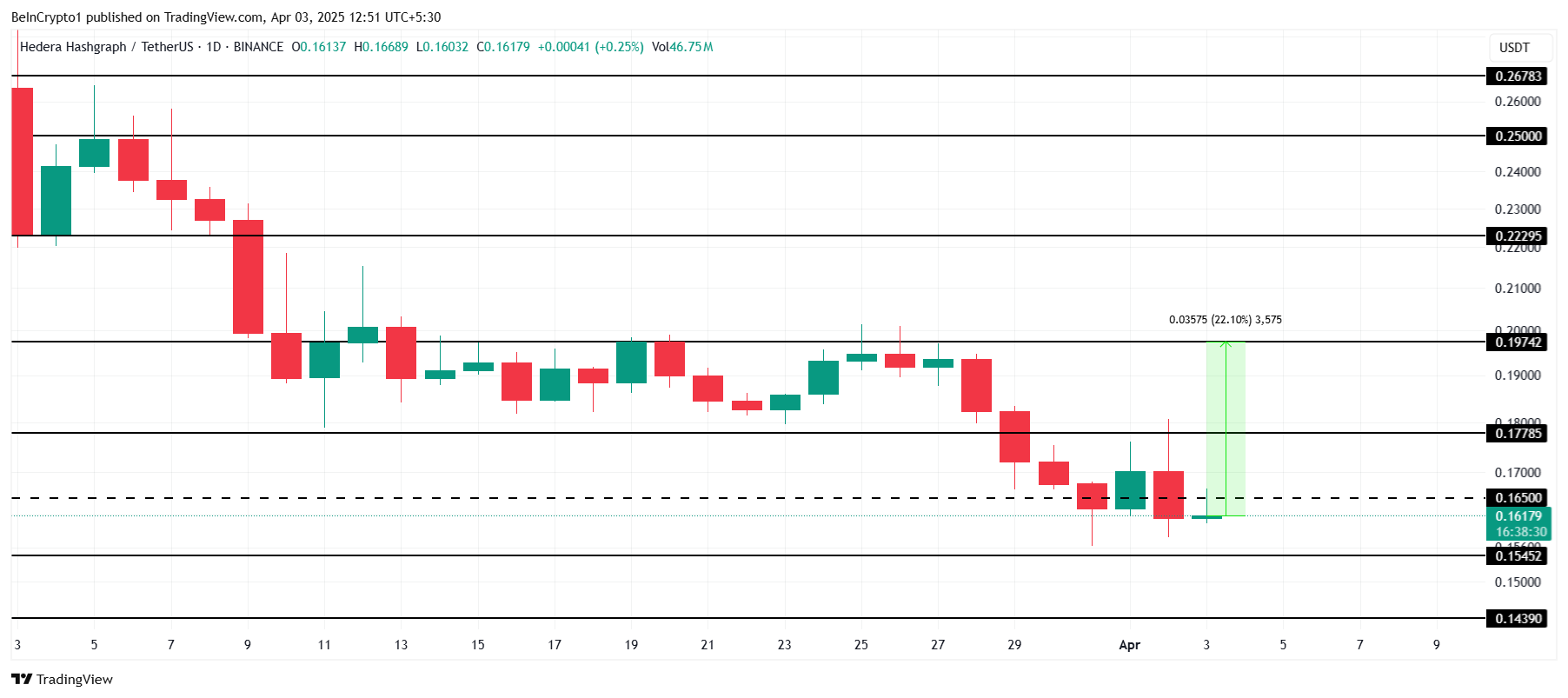

HBAR Price Finds Support

Currently, HBAR is priced at $0.161, just under the key resistance level of $0.165. The next significant resistance lies at $0.197, which has acted as a barrier to HBAR’s price recovery. With a 22% gap between the current price and this resistance, overcoming this hurdle could pave the way for a move toward $0.200.

Given the positive developments surrounding Hedera, it is plausible that HBAR could move toward these resistance levels. If the token can breach $0.165 and then $0.177, the path to $0.197 becomes much clearer. This would mark a critical point for HBAR as it seeks to regain lost ground.

However, if investors decide to take profits and sell before further upward movement, HBAR could fail to breach the $0.177 resistance. Such a scenario could push the price back down towards $0.154 or $0.143, invalidating the bullish outlook and prolonging the consolidation phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

IP Token Price Surges, but Weak Demand Hints at Reversal

Story’s IP is today’s top-performing asset. Its price has surged 5% to trade at $$4.37 at press time, defying the broader market’s lackluster performance.

However, despite the price uptick, the weakening demand for the altcoin raises concerns about its rally’s sustainability.

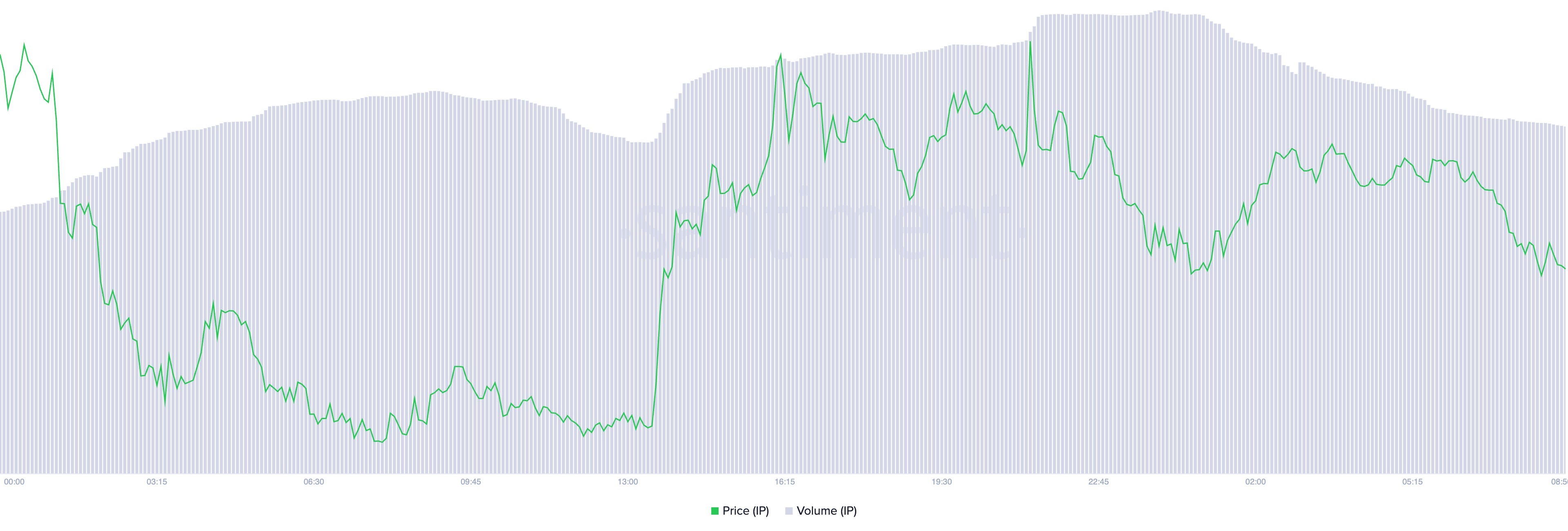

IP Price Rises, But Falling Volume Signals Weak Buying Momentum

IP’s daily trading volume has plummeted by 7% over the past 24 hours despite the token’s price surge. This forms a negative divergence that hints at the likelihood of a price correction.

A negative divergence emerges when an asset’s price rises while trading volume falls. It suggests weak buying momentum and a lack of strong market participation.

This indicates that the IP rally may not be sustainable, as fewer traders are backing its upward move. Without sufficient volume to reinforce the price increase, the altcoin is at risk of a potential reversal or correction.

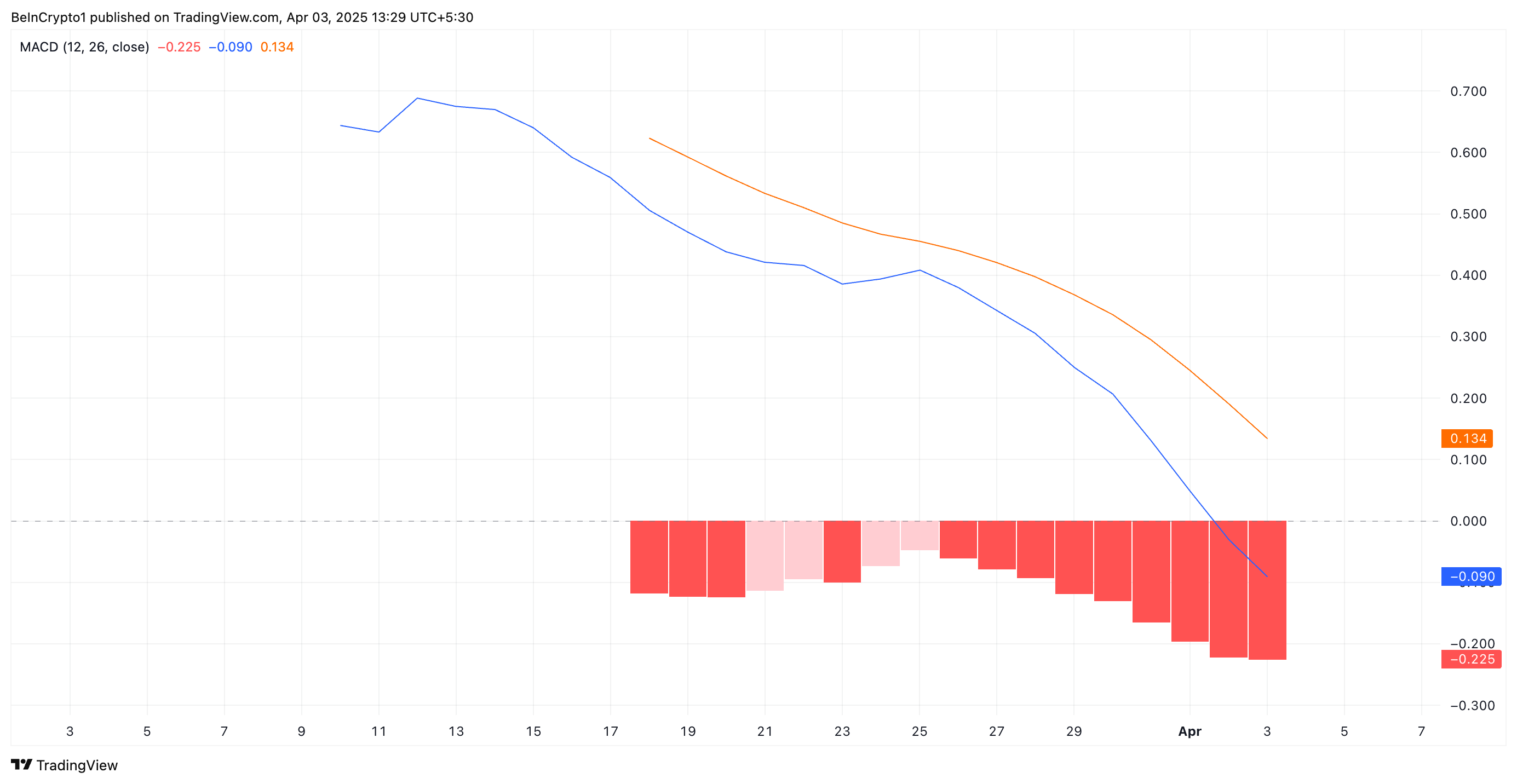

Further, IP’s Moving Average Convergence Divergence (MACD) setup supports this bearish outlook. As of this writing, the token’s MACD line (blue) rests below its signal line (orange), reflecting the selling pressure among IP spot market participants.

The MACD indicator measures an asset’s trend direction and momentum by comparing two moving averages of an asset’s price. When the MACD line is below the signal line, it indicates bearish momentum, suggesting a potential downtrend or continued selling pressure.

If this trend persists, IP’s recent 5% price surge may lose steam, increasing the likelihood of a short-term correction.

IP’s Bearish Structure Remains Intact – How Low Can It Go?

On the daily chart, IP has traded within a descending parallel channel since March 25. This bearish pattern emerges when an asset’s price moves within two downward-sloping parallel trendlines, indicating a consistent pattern of lower highs and lower lows.

This pattern confirm’s IP prevailing downtrend, suggesting continued bearish pressure unless a breakout above resistance occurs.

If the downtrend strengthens, IP’s price could break below the lower trend line of the descending parallel channel and fall to $3.68.

On the other hand, if the altcoin witnesses a spike in new demand, it could break above the bearish channel and rally toward $5.18.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoKraken Obtains Restricted Dealer Registration in Canada

-

Altcoin19 hours ago

Altcoin19 hours agoHere’s Why This Analyst Believes XRP Price Could Surge 44x

-

Ethereum17 hours ago

Ethereum17 hours agoWhy A Massive Drop To $1,400 Could Rock The Underperformer

-

Altcoin15 hours ago

Altcoin15 hours agoFirst Digital Trust Denies Justin Sun’s Allegations, Claims Full Solvency

-

Altcoin18 hours ago

Altcoin18 hours agoHow Will Elon Musk Leaving DOGE Impact Dogecoin Price?

-

Altcoin16 hours ago

Altcoin16 hours agoWill Cardano Price Bounce Back to $0.70 or Crash to $0.60?

-

Market8 hours ago

Market8 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Altcoin8 hours ago

Altcoin8 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds