Altcoin

Arthur Hayes Issues Dire Warning On Second Wave Of Market Crash

Crypto billionaire Arthur Hayes surprises the crypto market with his yet another bold prediction that a second wave will follow soon after the recent crypto market crash. He believes the current respite is only temporary and market volatility will continue to persist in stocks and crypto markets.

BitMEX Co-Founder Arthur Hayes Predicts Another Market Crash

Global equity and crypto markets show signs of recovery today. Japan’s Nikkei rebounds 10% after losing 12% in previous sessions. The global crypto market and US stock market index futures are also rising higher.

However, BitMEX co-founder Arthur Hayes said “That was the first wave,” warning about a cautious outlook despite signs of recovery.

He asserts that the first wave of impact on the markets has passed, and now the problem of over-leveraged investors in the traditional markets will surface. It will lead to a second wave of correction in broader markets.

However, if the US Federal Reserve decides to bailout, the market may need to go through more pain by Friday. Moreover, Arthur Hayes adds that the current respite is only temporary, and market volatility will continue amid tensions in the Middle East.

Also Read: MicroStrategy’s Michael Saylor Says HODL Bitcoin Despite Sub $50K Crash

Cathie Wood Reflects on Market Situation

ARK Invest CEO Cathie Wood shared that the VIX (Equity Volatility Index) increased to 65, the fourth-highest level in the past 40 years. She compares it to Black Monday in October 1987, Lehman shock in 2008, and COVID market crash in 2020. Investors relying on the carry trade with Japan cash out at the same time.

“The US statistics like employment and the PMI have disappointed expectations and, at the same time, the Bank of Japan has raised interest rates more than expected, investors and speculators have faced margin calls forcing them to unwind the yen carry trade,” said Wood.

She said the 10-year Treasury bond yield should be around 2% today, not where it is at 3.8% or last October’s 5%, as per metals to gold ratio. The US dollar index (DXY) has dropped below 103, which actually promotes buying Bitcoin. However, uncertainty still exists in the markets turning investors cautious.

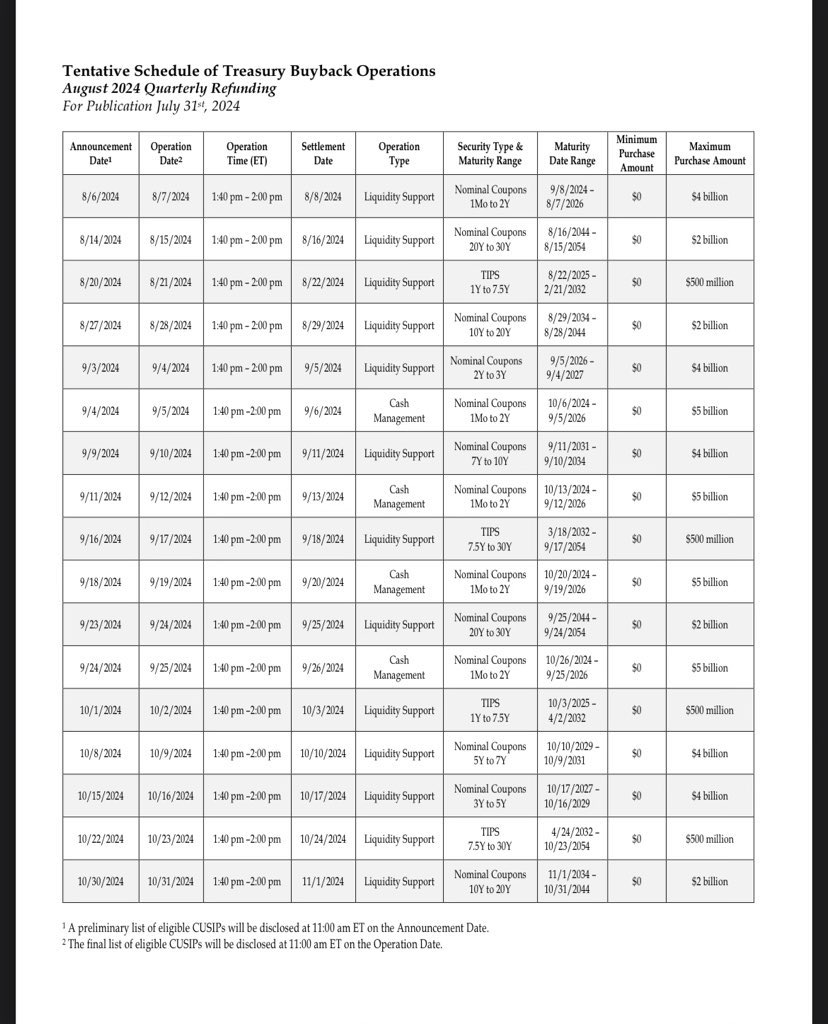

Meanwhile, the U.S. Treasury Dept. is to start Treasury buyback again with $30 billion a month. It could also help the crypto market to rebound further.

BTC price have rebounded above $55,800, but a BTC price analysis suggests the Bitcoin crash to continue. If the $50,000 psychological level is breached again, chances of revisiting the $45,156 key weekly support level are high.

Also Read: JPMorgan Cites Buy-the-Dip Opportunity, Crypto Market Recovery Ahead?

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Will BNB Price Rally to ATH After VanEck BNB ETF Filing?

Asset manager VanEck has registered for a proposed BNB exchange-traded fund (ETF), the latest among the list of its new crypto ETF filings. As a result, the trading volume for BNB Coin has shot up by 42% to more than $2.12 billion, as analysts are now closely watching for a BNB price rally to all-time highs.

In BNB Price Ready for A Mega Rally?

BNB Coin has performed relatively well over the past month compared to Bitcoin and other altcoins. While BTC and top altcoins like ETH, SOL, XRP saw double-digit losses in March, BNB Coin is down just 1% on the monthly chart. After a strong consolidation of around $610 levels, the BNB price could be eyeing a strong breakout to new all-time highs.

BNB Burn and Pascal Hardfork Offer Support

BNB Coin features a real-time burn mechanism that permanently removes a portion of gas fees from circulation. Over the past seven days, 951.85 BNB worth $571,747.74 was burned, contributing to a total burn value of nearly $160 million, as per data from BNBBurn.

BNB’s price recently gained momentum following the implementation of the Pascal hard fork, which enhanced its compatibility with Ethereum. The network is preparing for additional hard forks this month and in June, aimed at further improving transaction speeds.

Additionally, BNB Chain is gaining a lot of popularity among meme coins, adding support for Mubarak meme coin, CZ’s Dog BROCOLLI meme coin, and others.

Looking at the technical setup, the BNB price chart shows that the altcoin is forming a cup-and-handle pattern, along with an ascending channel pattern formation, as shown in the image below.

On the other hand, BNB price is trading above the 50-day moving average, which is a positive indicator. But for the altcoin to kickstart a rally to its all-time high of $790, it must first complete the handle formation at $662, and give a breakout above that level.

As of press time, BNB Coin is trading at $603 levels with its daily trading volume up by 42%, surging past $2.12 billion. Furthermore, the Coinglass data shows that the BNB options trading volume is also up by 46%.

VanEck Files for Spot BNB ETF

$115 billion asset manager VanEck filed for the spot BNB ETF in Delaware on Tuesday, April 1, which could serve as a major catalyst for the BNB Coin rally ahead. The proposed BNB ETF would follow the price of BNB, the fifth-largest cryptocurrency by market capitalization.

Apart from BNB, VanEck has already submitted crypto ETF applications for Bitcoin, Ether, Solana, and Avalanche. VanEck filed for SEC approval last month to launch the first AVAX ETF, building on its success with spot Bitcoin and Ethereum ETFs.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Tether Expands Bitcoin Reserves with 8,888 BTC Buy—What’s the Plan?

Tether, the developer of USDT, has added 8,888 Bitcoins to its holdings valued at around $735 million at the time of the transaction. This latest market move by the popular stablecoin issuer was reported by Arkham.

In a snapshot offered by Arkham on its official website, it revealed that the stablecoin company withdrew 8,888 Bitcoins from Bitfinex, a leading exchange and Tether’s sister company, on Monday.

Source: Arkham

Tether’s latest transaction pushes its Bitcoin holdings to 92,647, valued at $7.7 billion at current market prices. With this latest boost to its crypto holdings, Tether remains one of the biggest Bitcoin holders in the industry.

Tether Slowly Builds Its Bitcoin Reserve

In the last few weeks, Bitcoin was the among the main agenda of US President Donald Trump for a Strategic Bitcoin Reserve (SBR). But last Monday, Tether made its presence felt by adding more Bitcoins to its already huge crypto reserve.

Tether’s crypto reserve is one of the biggest in the business as it’s used to back up its stablecoin, the USDT. Currently, Tether controls over5 60% of the total stablecoins market, with a market cap of $144 billion, compared to a total of $234 billion valuation for the whole stablecoin industry.

Tether’s latest transaction puts it in the big league, making it the sixth biggest holder of Bitcoin. According to Bitcoin Treasuries, Tether is the second-largest private holder of the asset, below Block.one. But if we zoom out and consider other entities and publicly-traded companies, Strategy (formerly MicroStrategy), and the top spot Bitcoin ETFs issuers beat Tether’s holdings.

Commitment To Invest In Bitcoin

Tether’s latest Bitcoin acquisition reflects the company’s commitment to Bitcoin. Interestingly, the company pledged to use a part of its net profit to buy additional Bitcoins. The company committed last May 2023, and stated that it will use 14% of its net profits to buy additional Bitcoins.

Tether’s most recent Bitcoin purchase was 8,404, which was made last December, which pushed its holdings to 83,759.

$1B USDT Into Reserves

Tether’s latest Bitcoin purchase coincided with the minting of fresh tokens. According to on-chain data, the stablecoin company minted $1 billion in tokens on Tron. Tether CEO Paolo Ardoino has confirmed the minting of a new USDT.

According to Ardoino, the minting of new USDT was authorized, but he insisted that this batch is not yet included in the circulation. They added that the newly minted USDT is now part of their inventory and will be used for future issuance requests. Tether has already minted $8 billion tokens on Tron since the start of the year, and recorded $22 billion worth of USDT minted last year.

Featured image from Pixabay, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

XRP Price to $27? Expert Predicts Exact Timeline for the Next Massive Surge

Crypto expert Egrag Crypto has again predicted that the XRP price could rally to as high as $27. The analyst has also revealed the exact timeline for when the altcoin could record this massive price surge.

Expert Reveals Time For XRP Price To Hit $27

In an X post, Egrag Crypto asserted that the XRP price can hit $27 in 60 days. The expert remarked that historical patterns indicate that the altcoin can reach this target within this timeframe.

Based on this price prediction, XRP could reach this $27 target by June, marking a 1,250% gain for Ripple’s native crypto. The expert’s accompanying chart showed that he was alluding to the 2017 bull run as to why the altcoin could record such a parabolic rally.

In 2017, XRP recorded a historic gain of over 60,000% as it rallied to its current all-time high (ATH) of $3.8 the following year. As such, based on history, a 1,250% increase is nothing for the altcoin.

In the meantime, the XRP price still boasts a bearish outlook thanks to the sentiment in the broader crypto market. As CoinGape reported, Ripple’s coin could drop to the next major support levels at $1.79 and $1.56 if it fails to hold above $2.03.

Decision Time For The Altcoin

In an X post, crypto analyst CasiTrades stated that it is decision time for the XRP price. She noted that the altcoin is showing strength with a bounce right back to the first key test at $2.17. She added that this is the resistance level she wants to see flip into support, as it might be the “most important price of the week.”

The analyst stated that XRP must reclaim this level to build momentum. She added that the $2 level remains a valid target if the $2.17 level rejects. Meanwhile, CasiTrades revealed that $2.70, $3.05, and $3.80 are the major resistance zones once the upward trend is confirmed.

The analyst also mentioned that the XRP price is now fully inside the Fibonacci Time Zone 3, which spans most of April. She affirmed that this is the breakout window market participants have been preparing for and that all signs point to a macro wave.

CasiTrades affirmed that the structure is clean. The RSI divergence has confirmed the bottom, while the subwaves are aligning well with the larger targets. If the next leg pushes XRP back above $2.17 with momentum, she claimed that market participants may finally see obvious signs of Wave 3. Interestingly, the analyst added that if the altcoin clears $2.70 this week, it may break the $1,000 price extension.

For now, investors may remain cautious, especially seeing how XRP fell after the PMI and JOLTS data release earlier today. Donald Trump is also set to announce reciprocal tariffs tomorrow, which could spark a massive price crash.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum24 hours ago

Ethereum24 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Market21 hours ago

Market21 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin18 hours ago

Bitcoin18 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market24 hours ago

Market24 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Altcoin23 hours ago

Altcoin23 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market22 hours ago

Market22 hours agoIs CZ’s April Fool’s Joke a Crypto Reality or Just Fun?

-

Bitcoin19 hours ago

Bitcoin19 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Altcoin16 hours ago

Altcoin16 hours agoWill XRP, SOL, ADA Make the List?

✓ Share: