Market

XRP Ledger Sees Sharp Decline In Major Metric That Threatens To Send XRP Price To $0.2

Ripple’s Q2 2024 market report recently highlighted a decline in a crucial on-chain metric that could significantly impact the the XRP price. This decline in network activity and several other factors threaten to send the crypto token to new lows soon enough.

XRP Records Decline In On-chain Transactions

According to the report, on-chain transactions on the XRP Ledger (XRPL) declined by 65.6% in the second quarter of 2024. 86.38 million transactions were recorded during this period, compared to 251.39 million in the first quarter of this year. A drop in the network activity is significant as it highlights investors’ sentiment towards the XRP ecosystem.

Related Reading

This decline in network activity can also negatively impact the XRP price, especially if this trend continues in the third quarter of the year. A plausible explanation for the decline in on-chain transactions for the XRPL in the second quarter is XRP’s underperformance in the first quarter of the year.

High expectations for XRP heading into the new year may have prompted investors to increase their exposure to the crypto, which led to the highs in network activity recorded in the first quarter. However, these investors may have had a rethink as XRP failed to reach new highs even when Bitcoin hit a new all-time high (ATH), leading to a decline in network activity in the second quarter.

The silver lining is that XRP investors have regained their bullish sentiment towards XRP, leading to increased network activity. Bitcoinist recently reported a spike in new addresses and the number of addresses interacting on the XRPL, with these metrics reaching their highest levels since March earlier this year.

The revived bullish sentiment among XRP investors is mainly thanks to the belief that the lawsuit between the US Securities and Exchange Commission (SEC) and Ripple could end soon, presenting a bullish outlook for XRP’s price. However, if that doesn’t happen soon enough, XRP is at risk of witnessing a significant price decline as activity on the XRPL drops.

Other Factors That Could Contribute To A Crash For The XRP Price

The bearish sentiment in the broader crypto market is another factor that could contribute to massive price declines for XRP. Bitcoin is currently struggling to hold above $50,000, and the flagship crypto could send altcoins like XRP crashing if it continues to drop to new lows. XRP is also well-placed to be among the altcoins that will be most affected, seeing how the crypto token has so far reacted to Bitcoin’s recent crash below $60,000.

Related Reading

The conclusion of the lawsuit between the SEC and Ripple could also negatively impact XRP’s price if the remedies awarded against the crypto firm align with the Commission’s proposed remedies. The SEC has asked Judge Analisa to award a fine of $102.6 million against Ripple, which is way above the $10 million that the crypto firm proposed.

At the time of writing, XRP is trading at around $0.46, down over 16% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Market

Market Cap Now Approaching $300 Million

SAFE has emerged as the best-performing altcoin of the day, with its price surging 5% in the last 24 hours and its market capitalization now close to $300 million. The coin is showing strong technical indicators despite some mixed signals from momentum oscillators that suggest consolidation may be on the horizon.

Technical analysis of the EMA lines remains bullish, with short-term averages positioned favorably above long-term ones, pointing to continued strength in the immediate term. However, recent RSI and BBTrend readings indicate a potential cooling-off period could be approaching as the asset digests its recent gains.

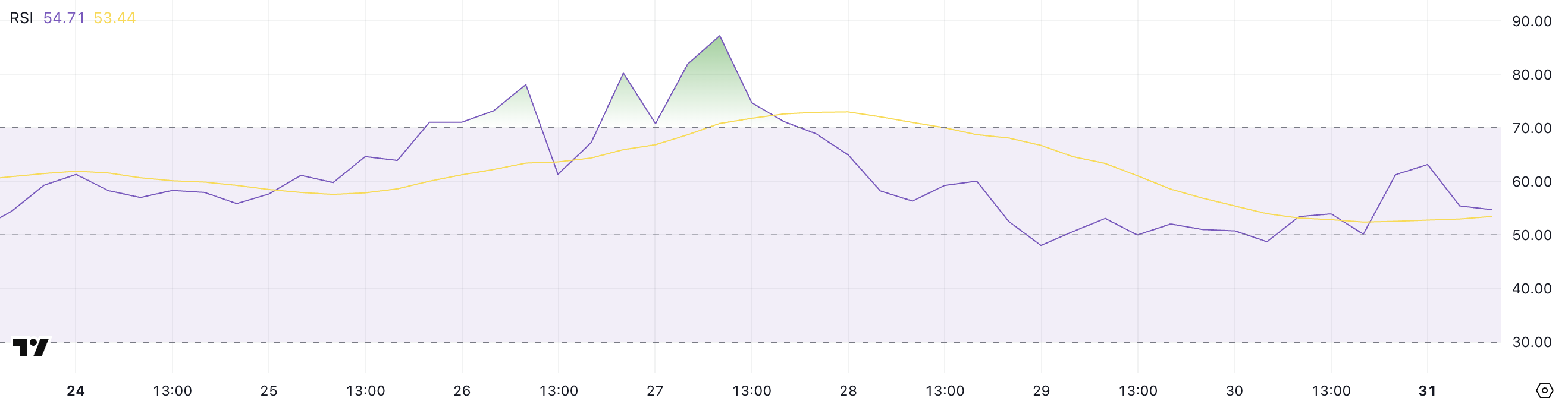

SAFE RSI Is Back To Neutral Levels After Reaching Overbought Levels

The SAFE RSI is currently at 54.71, maintaining a neutral position for the past three days after experiencing significant momentum earlier in the week.

This moderation in the indicator suggests that the previous buying pressure has subsided somewhat, allowing the asset to consolidate following recent price movements.

The current neutral reading indicates a balanced market where neither buyers nor sellers have a decisive advantage.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100. Generally, an RSI reading above 70 is considered overbought, suggesting a potential reversal or pullback, while readings below 30 indicate oversold conditions that might precede a bounce.

With SAFE’s RSI recently peaking at 87 just four days ago, the asset was in strongly overbought territory, signaling excessive buying enthusiasm. The current value of 54.71 represents a significant cooling off from those extreme levels, suggesting that SAFE’s price could be entering a period of stabilization.

This moderation may provide a healthier foundation for sustainable price action moving forward, as the previous overbought conditions have been worked through without dropping into oversold territory. This potentially indicates underlying strength in the asset despite the retreat from recent highs.

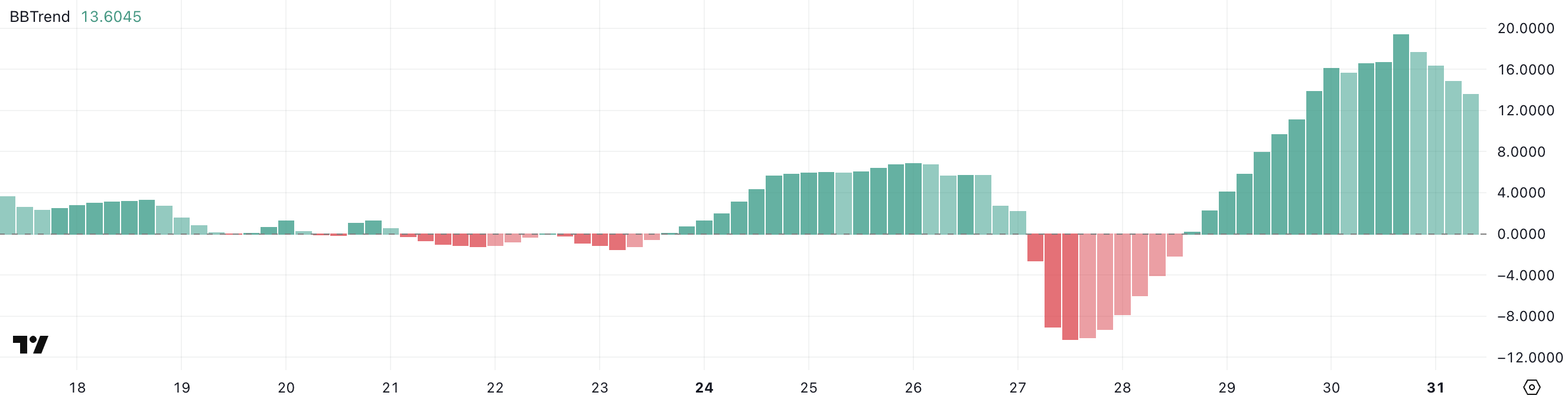

SAFE BBTrend Is Still High, But Down From Yesterday

The SAFE BBTrend is currently at 13.6, maintaining a positive position for the last two days after reaching a peak of 19.39 yesterday.

This recent positive trend suggests that the price movement has been gaining momentum, though there appears to be some moderation from yesterday’s higher reading.

The continued positive BBTrend indicates that the asset is still showing strength, despite the slight pullback from yesterday’s peak value.

BBTrend (Bollinger Bands Trend) is a technical indicator that measures the strength and direction of a trend by analyzing the relationship between price and Bollinger Bands.

The indicator typically ranges from negative to positive values, with readings above 0 indicating a bullish trend and readings below 0 suggesting a bearish trend. With SAFE’s BBTrend at 13.6, this suggests a moderately strong bullish trend that could indicate potential for continued upward price movement in the near term for the altcoin.

However, the decrease from yesterday’s 19.39 peak might signal some slowing in momentum, potentially leading to consolidation before the next significant move higher.

Will SAFE Uptrend Revert Soon?

SAFE EMA lines are still bullish, with short-term lines positioned above long-term ones. This positive alignment of exponential moving averages indicates continued upward momentum in the price action.

If this uptrend momentum maintains its strength, SAFE could potentially climb to test the resistance level at $0.72.

Should this resistance be successfully broken, the next target would be $0.879. The altcoin could exceed $0.90 for the first time since January 19, sustaining its momentum as one of the most trending altcoins.

On the other hand, as indicated by the RSI and BBTrend indicators, the uptrend appears to be losing some momentum. This could signal a potential reversal in the near future.

If the trend does reverse, SAFE might test the nearby support level at $0.54, which sits precariously close to the current price.

Should this support level fail to hold, further downside could see SAFE decline to test subsequent support levels at $0.48 and $0.40. In a worst-case scenario, a drop all the way to $0.35 could potentially occur.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Family Gets Most WLFI Revenue, Causing Corruption Fears

A new report claims that President Trump and his immediate family receive most of WLFI’s revenues. The Trumps are entitled to 75% of token sale revenues, about $400 million, and 60% of other incomes.

If these numbers are even partially accurate, they raise significant concerns about potential conflicts of interest. They also raise questions about the broader implications for transparency and accountability regarding Trump’s crypto policies.

Does the Trump Family Receive WLFI Proceeds?

World Liberty Financial (WLFI), a project affiliated with President Trump, has made a lot of waves in the crypto space since the end of last year. After persistent rumors of a Binance partnership, WLFI officially launched a new stablecoin, USD1. There is no clear evidence of Binance’s involvement in this launch. However, a new report from Reuters has disclosed some disturbing details.

Essentially, it claims that it has found evidence of how much of WLFI’s revenues go directly to Trump’s family. Trump will get 75% of revenues from token sales and 60% from subsequent operations. WLFI completed its major token sale, which would, therefore, entitle the Trumps to about $400 million.

Reuters calculates that 5% of proceeds from this token sale would actually fund WLFI’s platform, with the rest going to other co-founders. Further, its buyers are not able to actually resell their tokens, and it’s unclear what governance actions they could influence. There’s not an apparent reason for the average retail trader to actually buy these assets.

If these numbers are true, they could represent a serious conflict of interest and a dire threat to the US economy. First, community leaders like Vitalik Buterin warned of corruption from political meme coins like TRUMP. If Trump gets a cut of WLFI’s token sales, that’s already a huge avenue for misuse.

Additionally, since Trump is making huge changes to US financial regulators, there may not be anyone to investigate WLFI corruption allegations. For example, TRON founder Justin Sun invested $30 million into WLFI, and the SEC settled a fraud case against him months later. The SEC has been settling all its crypto enforcement actions, but this investment still looks relevant.

“You’ve got the guy in charge who is responsible for his own regulation. WLFI tokens would be the perfect vehicle for governments or oligarchs overseas to funnel money to the president,” former regulator Ross Delston claimed.

The biggest danger might not even come from political corruption or fears of centralization in crypto. Trump recently outlined a plan to use stablecoins to promote dollar dominance, and WLFI now has its own stablecoin. It also has around $111 million in unrealized losses due to its crypto investments and claims it will use “other cash equivalents” in USD1’s reserves.

It’s hard to overstate the potential risks involved. Given Trump’s financial stake in WLFI, there’s a clear incentive to promote the firm’s stablecoin as part of his “dollar dominance” agenda. If this leads to widespread investment in USD1 and the peg doesn’t hold, the consequences could ripple across the entire crypto market.

Simply put, this sort of business arrangement is totally unprecedented for a sitting US President. A few Senators are already investigating Trump’s connections with WLFI. However, their lack of political power and defanged federal regulators may hamper their ability to change anything.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

The crypto market just got a shock as BNB plunged below the crucial $605 support level, sending ripples of concern across trading circles. This sudden breakdown comes after weeks of bullish dominance, leaving investors scrambling to answer one critical question: Is this a temporary dip or the start of a major trend reversal?

With weakening momentum and key technical indicators flashing red, BNB charts are telling a worrisome story. The once-steady uptrend now faces its toughest test as the token struggles to maintain its footing in a suddenly bearish market.

Bearish Pressure Builds: Are BNB Sellers Gaining Control?

BNB’s price is facing growing bearish pressure after slipping below the crucial $605 level, signaling a potential shift in market momentum. The failed attempt to hold this key support has allowed sellers to take control, pushing BNB lower and raising concerns about a prolonged decline.

Technical indicators further confirm the increasing strength of sellers. The MACD has turned negative, indicating a loss of upward momentum, while the RSI is trending downward, suggesting that buying pressure is weakening. Additionally, trading volume remains low on attempted rebounds, highlighting a lack of conviction from bulls.

If sellers maintain their grip, BNB could extend its decline toward the next major support zone around $531, which previously served as a short-term bounce level during past corrections. A break below this zone would solidify bearish dominance and cause a deeper decline to $500.

Below $500, the next key level to watch is $454, representing a technical support area. Pushing below this level may trigger an extended sell-off, driving BNB toward other key support levels where traders may look for signs of reversal.

What Needs To Happen For A Rebound

For BNB to stage a meaningful recovery after breaking below $605, the bulls must reclaim key levels and generate strong buying momentum. Its first crucial step is stabilizing above $530, a short-term support zone that could provide the foundation for a reversal. Holding this level would signal that buyers are stepping in, preventing more declines.

A sustained move back above $605 would be the next major confirmation of a recovery. Reclaiming this level as support might shift market sentiment in favor of the bulls and trigger renewed buying interest. Additionally, the Relative Strength Index (RSI) needs to rebound from oversold conditions, while the MACD crossover into bullish territory would reinforce an upside move.

For a stronger bullish outlook, BNB would need to push past $680, a level that previously acted as resistance. Breaking above this zone with increasing volume could confirm a trend reversal toward $724 and $795, marking a full recovery from recent losses.