Market

Online casinos will add $7.10B a year to the British economy by 2029, according to market data

- UK online casino sector to grow from $6.47B to $7.10B annually by 2029

- UK leads globally in online casino revenue, surpassing the US in 2024

- Cryptocurrency adoption boosts UK online casino growth and user engagement.

The online casino industry in the United Kingdom is set to experience significant growth over the next five years. Currently generating an impressive $6.47 billion annually, market projections indicate that this figure will rise to $7.10 billion a year by 2029.

This growth underscores the dynamic and evolving nature of the UK’s online gambling sector, which remains a global leader in terms of revenue.

Current online casino market performance

The UK’s online casino market is not only thriving but also outpacing other nations. With a projected revenue of $6.47 billion in 2024, the country has the highest-earning online casino sector globally.

It surpasses the United States, which, despite its larger population, is expected to generate slightly less revenue at $6.29 billion in the same year.

The key to this success lies in the UK’s higher user penetration rate of 17.4%, compared to the US’s 9.4%, and a significantly higher average revenue per user (ARPU). UK players spend approximately $0.63k annually, more than double the US ARPU of $380.50.

Factors driving the growth of online casinos in Britain

Several factors contribute to the robust performance and future growth of the British online casino industry. A significant driver is the growing adoption of cryptocurrencies by crypto casino sites.

A crypto casino site with cryptocurrencies incorporated into the platform’s payment and withdrawals system offers enhanced security, anonymity, and faster transaction times, which appeal to many casino users. This technological adoption is making online gambling more accessible and attractive to a broader audience.

Additionally, the convenience and tax-free nature of online gambling in the UK are compelling factors. The shift towards online platforms, accelerated by the COVID-19 pandemic, has remained strong even as traditional gambling venues reopened.

The ease of access from home, coupled with a wide array of gaming options, continues to draw more users to online casinos.

Cultural and regulatory influence

The cultural acceptance of gambling in the UK, supported by a long history of betting on events like horse races and the national lottery, also plays a crucial role.

According to YouGov’s Global Gambling Profiles data, nearly half of UK online gamblers spend more than £5 monthly on fantasy sports and sports bets. The diversity in gambling preferences, spanning slot machines, casino games, and bingo, reflects a deeply ingrained gambling culture.

Regulatory frameworks established by the United Kingdom Gambling Commission (UKGC) have provided a secure environment for online gambling. These regulations ensure fair play, consumer protection, and the integrity of the gambling industry.

Despite these stringent measures, challenges such as addiction, bankruptcy, and fraud persist. The UK government has introduced measures like levies on individual stakes for online slot machines and increased funding for treatment systems to address these issues.

Advocacy for further measures, including slower spin speeds and affordability checks, continues.

The rise of non-GamStop casinos

Another emerging trend is the rise of non-GamStop casinos. These platforms operate outside the jurisdiction of the UKGC, providing an alternative for players seeking to bypass the restrictions of GamStop, the UK’s national online self-exclusion scheme.

While these casinos offer greater flexibility, they also pose significant regulatory and safety risks. Players must exercise caution, ensuring they engage with reputable platforms that prioritize security and fairness.

Future outlook

The future of the UK’s online casino market looks promising. With an expected annual growth rate (CAGR) of 1.88% from 2024 to 2029, the market is projected to reach $7.10 billion by 2029.

The number of users is also expected to grow, reaching 12.4 million by 2029, with a slight increase in user penetration to 17.9%.

This growth trajectory highlights the UK’s position as a global leader in the online gambling industry. The combination of cultural acceptance, advanced regulatory frameworks, and technological adoption, including cryptocurrencies, positions the UK’s online casino market for continued success.

As the industry evolves, it will be crucial to balance growth with responsible gambling practices, ensuring a sustainable and secure environment for all players.

Market

3 altcoins that could go ballistic if Bitcoin (BTC) crosses $120,000 mark

Some altcoins are setting themselves up to profit from the positive wave as the crypto market prepares for Bitcoin’s possible breakout above the $120,000 mark. Rexas Finance (RXS), SUI, and Solana (SOL) are being hailed by some industry insiders as particularly outstanding performers and ready to go ballistic during the anticipated Bitcoin rally.

Rexas Finance (RXS): The future of real-world asset tokenization

Rexas Finance provides creative ideas for real-world asset (RWA) tokenization. By letting users tokenize real estate, artwork, and other highly valuable assets, Rexas Finance is changing the crypto scene. The initiative has enormous market potential since the real estate sector alone is valued at around $379.7 trillion.

Rexas Finance attracts retail and institutional investors by lowering transaction costs, improving liquidity, and raising transparency. Rexas Finance, in Stage 6 of its presale, has raised $9.5 million with 166 million tokens sold as of writing, indicating 81.74% completion. In this stage, the token price is $0.080; from its initial $0.03 price two months ago, this shows an impressive 166% increase.

It will list on three tier-1 exchanges at $0.20 post-presale, providing a wider global reach and more potential for gains. Rexas Finance recently received a Certik audit, which is a sign of security and trustworthiness in blockchain initiatives, improving investor confidence. Furthermore, its inclusion on CoinGecko and CoinMarketCap improves visibility and accessibility.

The ongoing $1 million giveaway, which offers 20 winners $50,000 in RXS apiece, has piqued investor interest. Based on projections for RXS, price appreciation seems to be strong as adoption rises. Some analysts believe Rexas Finance, with features such as AI integration, DeFi utilities, and yield optimization, could be poised to go ballistic if Bitcoin rallies above $120,000.

SUI: Consistently Hitting new all-time highs

Rising 105% in the past two weeks, SUI is among the top-performing altcoins in the current bull run. As of writing, SUI trades at $3.72, just below its all-time high of $3.94, which it attained last weekend.

Reflecting increased investor demand and confidence, its Open Interest (OI) has lately topped $826 million. The Chaikin Money Flow (CMF) indicator of the token indicates significant inflows, highlighting its positive trend. With a constant tendency to new all-time highs, SUI’s upward trajectory exactly matches market expectations of a possible surge. Driven by its excellent foundations and growing market visibility, SUI is expected to rise sharply if Bitcoin crosses $120,000.

Solana (SOL): Poised for a new all-time high?

Riding a surge of positive momentum, Solana broke past the $240 barrier twice in the current bull run. SOL trading at $246.89 as of writing has increased 59.9% over the past month. With analysts predicting a surge to $600 or more, its market capitalization of $115 billion ranks it among the top four leading cryptocurrencies, recently flipping Binance Coin.

Technical indicators supporting this optimistic view include a declining triangle breakout and a cup-and-handle pattern. Solana-based decentralized exchanges (DEXs), which account for 33.59% of DEX trade activity as of November, support its bullishness even more. So, Solana might see significant inflows if Bitcoin crosses the $120,000 mark, increasing its price to new highs.

Conclusion

Rexas Finance, SUI, and Solana could be ready to go ballistic if Bitcoin surges past $120,000. Each altcoin has unique qualities and solid foundations that guarantee a place of strength in the next positive market phase. Although SUI and Solana present interesting development chances, Rexas Finance distinguishes itself with its innovative RWA tokenizing, unparalleled presale expansion, and rich possibilities.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Market

Cardano Whales Accumulation Hits $55 Million: $1 Target Soon?

On November 20, crypto whales offloaded significant amounts of Cardano (ADA), disrupting its bullish momentum. However, the narrative shifted today as the Cardano whales’ accumulation has taken center stage.

This renewed buying activity suggests that ADA’s price might regain its bullish momentum toward $1. But does the data support this bullish outlook?

Cardano Key Investors Change Their Stance

According to IntoTheBlock, Cardano’s large holders’ netflow has surged to 67.51 million ADA, signaling a significant shift in sentiment among crypto whales. The netflow represents the difference between the amount of ADA purchased and sold by large holders over a specific period.

When netflow increases, it indicates that whales are buying more than they are selling. Typically, this is a bullish signal. Conversely, a drop in netflow suggests more selling by whales, which is generally regarded as bearish.

In this case, the recent netflow increase, valued at approximately $55 million, aligns with ADA’s 11% price surge over the last 24 hours. Thus, this Cardano whales accumulation suggests that ADA may be poised for further gains, with the recent uptick serving as a potential foundation for a higher value.

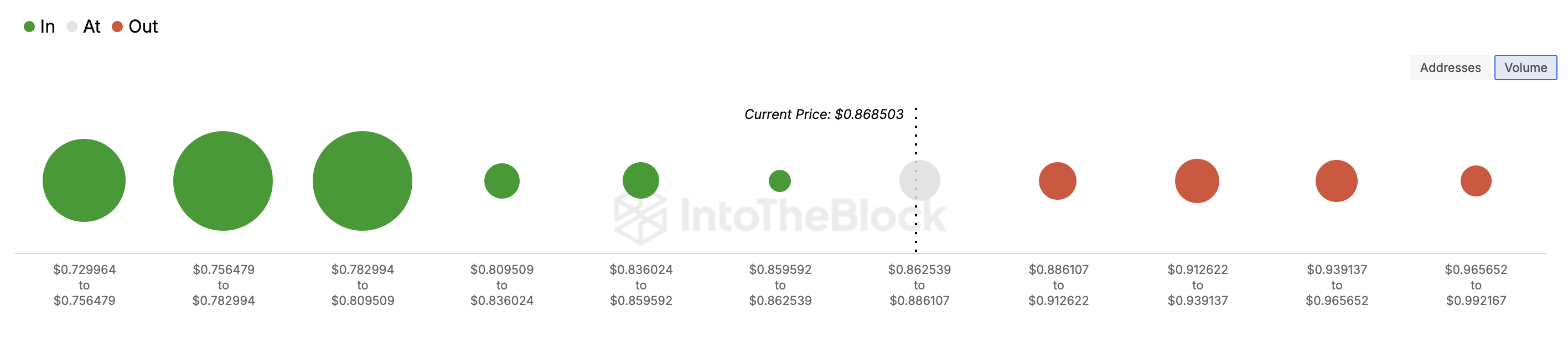

Furthermore, the In/Out of Money Around Price (IOMAP) indicator provides further support for this bullish outlook. For context, the IOMAP analyzes token clusters based on three groups: holders who purchased below the current price (in the money), above the current price (out of the money), and those at breakeven.

This metric is essential for identifying potential support and resistance zones. Specifically, if there is a higher number of tokens “in the money, ” it signifies solid support, as many holders are at a profit and less likely to sell, potentially driving the price higher.

On the other hand, a higher “out of the money,” volume points to resistance, as holders might sell to recover losses, putting downward pressure on the price.

Currently, ADA’s IOMAP shows strong support levels outweighing resistance zones, reinforcing the potential for its price to climb further.

ADA Price Prediction: Move Toward $1 Almost Valid

On the daily chart, ADA’s price has risen above the key Exponential Moving Averages (EMAs). Specifically, the 20-day EMA (blue) and 50 EMA (yellow) are below Cardano’s price. When the price is above the indicator, the trend is bullish.

On the other hand, if the price is below the indicator, the trend is bearish. Therefore, it appears that, with the current trend, ADA could rise higher than $0.87. If this happens, the altcoin might rally toward the $1 mark.

However, if Cardano whales decide to sell and book profits, this prediction might not come to pass. Instead, the price could drop to $0.68.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Approaches $100K: The Countdown Is On

Bitcoin price is rising steadily above the $95,000 zone. BTC is showing positive signs and might soon hit the $100,000 milestone level.

- Bitcoin started a fresh increase above the $95,000 zone.

- The price is trading above $95,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $100,000 resistance zone.

Bitcoin Price Sets Another ATH

Bitcoin price remained supported above the $92,000 level. BTC formed a base and started a fresh increase above the $95,000 level. It cleared the $96,500 level and traded to a new high at $98,999 before there was a pullback.

There was a move below the $98,000 level. However, the price remained stable above the 23.6% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. There is also a key bullish trend line forming with support at $95,200 on the hourly chart of the BTC/USD pair.

The trend line is close to the 50% Fib retracement level of the upward move from the $91,500 swing low to the $98,990 high. Bitcoin price is now trading above $96,000 and the 100 hourly Simple moving average.

On the upside, the price could face resistance near the $98,880 level. The first key resistance is near the $99,000 level. A clear move above the $99,000 resistance might send the price higher. The next key resistance could be $100,000.

A close above the $100,000 resistance might initiate more gains. In the stated case, the price could rise and test the $102,000 resistance level. Any more gains might send the price toward the $104,500 resistance level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $100,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $98,000 level.

The first major support is near the $96,800 level. The next support is now near the $95,500 zone and the trend line. Any more losses might send the price toward the $92,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $96,800, followed by $95,500.

Major Resistance Levels – $99,000, and $100,000.

-

Bitcoin21 hours ago

Bitcoin21 hours agoMarathon Digital Raises $1B to Expand Bitcoin Holdings

-

Regulation15 hours ago

Regulation15 hours agoUK to unveil crypto and stablecoin regulatory framework early next year

-

Market20 hours ago

Market20 hours agoETH/BTC Ratio Plummets to 42-Month Low Amid Bitcoin Surge

-

Altcoin23 hours ago

Altcoin23 hours agoSui Network Back Online After 2-Hour Outage, Price Slips

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Whale Accumulation Sparks Optimism, DOGE To Rally 9000% Ahead?

-

Market14 hours ago

Market14 hours agoTrump Media Files Trademark for Crypto Platform TruthFi

-

Altcoin20 hours ago

Altcoin20 hours ago5 Key Indicators To Watch For Ethereum Price Rally To $10K

-

Market19 hours ago

Market19 hours agoSEC Moves Toward Solana ETF Approval Amid Pro-Crypto Shift