Bitcoin

Polymarket Traders Bet Big Amid Market Volatility

Polymarket is recording heightened activity as traders display increasing interest in prevailing market conditions. Participants are betting thousands of dollars in a bold attempt to predict the market.

While the platform’s impartiality has been questioned, especially regarding showing market sentiment, its role in driving crypto adoption cannot be ignored.

Polymarket Traders Bet Big

According to Dune Analytics, Polymarket has seen a significant increase in daily volume and active traders as participants try to predict market outcomes. These metrics have been steadily rising since May.

Narratives such as US elections continue to drive this interest. However, the latest crypto market crash has also contributed to the surges in activity. Different dashboards on Polymarket show participants betting on multiple questions.

Among them, the odds of Bitcoin (BTC) price dipping below $45,000 before September and Ethereum (ETH) reclaiming above $3,000 on August 9. BeInCrypto data shows that at press time, BTC is trading at $53,625, while ETH remains below $2,400.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

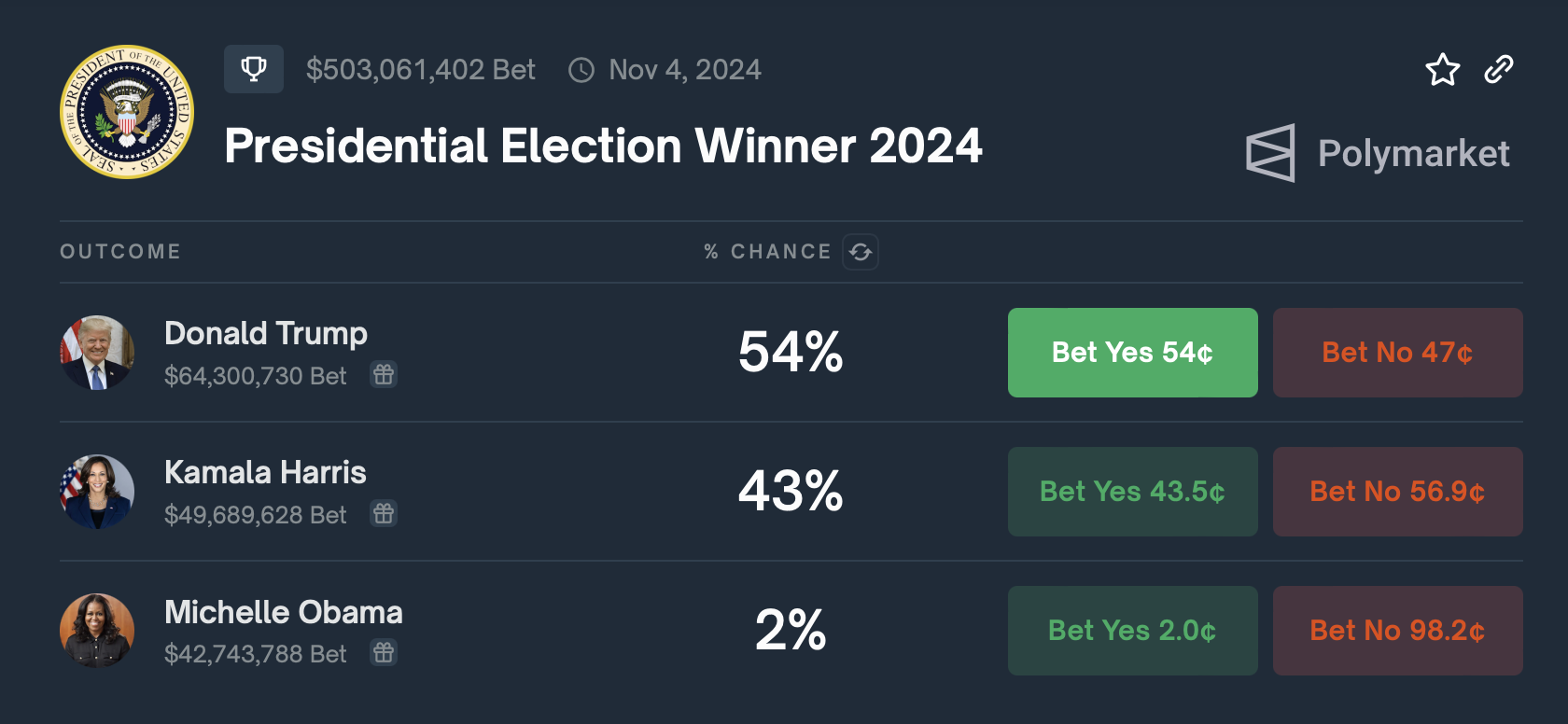

The US presidential race remains one of the favorite topics among Polymarket users. The crypto community is increasingly engaging in predictions, wagering on potential outcomes.

Republican ticket nominee Donald Trump is leading with 54% success odds. In contrast, Kamala Harris stands at 43%, while former US First Lady Michelle Obama has 2% odds.

Read more: How Can Blockchain Be Used for Voting in 2024?

Polymarket bets also show traders’ interest in whether there will be an “emergency rate cut in 2024.” This gamble comes as markets decry the latest industry slump.

“Jerome Powell needs to call a meeting now and announce an emergency rate cut,” Bitcoin veteran Kyle Chassé remarked.

In a recent meeting, Federal Reserve chair Jerome Powell hinted at potential policy easing in late 2024. He acknowledged that a rate cut could be on the table in September. Whether an emergency rate cut will come amid remains unknown.

Besides emergency rate cuts, Polymarket participants speculate about a possible recession in 2024. However, this bet could roll over soon as US economic activity challenges recession warning.

As BeInCrypto reported, markets watched Monday’s S&P Final US Services PMI data. The latest data release shows that economic activity in the services sector expanded in July, with the Services PMI registering 51.4%, showing sector expansion for the 47th time in 50 months.

“In July, the Services PMI registered 51.4%, 2.6 percentage points higher than June’s figure of 48.8%. The reading in July marked the fifth time the composite index has been in expansion territory in 2024,” the report read.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The bullish development is helping Bitcoin rebound. It points to higher demand for services and, therefore, increases in inflows to businesses. Positive economic data often influences investor sentiment in the crypto space.

As traditional markets strengthen, investors may become more confident in the economy. This could increase risk appetite and increase interest in alternative assets like cryptocurrencies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Lummis Confirms Treasury Probes Direct Buys

In an interview with Bitcoin commentator Natalie Brunell, Senator Cynthia Lummis (R-WY) reaffirmed her commitment to establishing a US Strategic Bitcoin Reserve (SBR), disclosing that the Treasury Department is probing its legal authority to purchase and custody BTC on behalf of the federal government. The senator believes such a move could significantly reduce the national debt over the long term.

Senator Lummis Pushes Bitcoin Reserve

Lummis pointed to roughly 200,000 BTC in the US Marshals Service’s asset forfeiture program as a possible starting point: “Working with Treasury, and the Treasury Secretary, we’re trying to find out which assets among those could become the basis of the first year’s investment in a strategic Bitcoin reserve.”

Further clarifying her stance, the senator noted she is determining whether a new law is required or if the administration already has the authority: “What I’m trying to figure out right now is whether it needs to be done legislatively or whether the Treasury Secretary has the authority to do it right now.”

Lummis proposes converting the seized BTC into an official “base investment,” which she says would be the foundation of a larger BTC reserve. If successful, this would mark the first time the US government deliberately and openly accumulated Bitcoin as a strategic asset.

One of Lummis’ main arguments for a SBR is its capacity to trim the federal debt, which she deems “irresponsibly high.” Under her Bitcoin Act, the US could also revalue its gold certificates—currently listed at a decades-old official price of $42 per ounce, far below market value—and deploy the difference toward purchasing BTC in a budget neutral way:

“My legislation would provide that we could take our gold certificates… bring them up to current fair market value for gold and then use that to buy Bitcoin, thereby creating a 1 million Bitcoin reserve over five years.”

She contends that holding this million BTC over a 20-year horizon could “cut the current national debt in half.” Citing extensive modeling—some from advocates like Michael Saylor—she believes the price appreciation of BTC has the potential to deliver significant gains to taxpayers.

New Episode Out Now! 🇺🇸

U.S. Senator Cynthia Lummis is leading the Bitcoin Revolution in Washington.

Her bold plans for America through Bitcoin & digital asset policy promise to reshape the financial system—reduce U.S. debt, protect Bitcoin self-custody, and reinforce dollar… pic.twitter.com/G1Rvl1ORDb

— Natalie Brunell ⚡️ (@natbrunell) April 1, 2025

The senator lauded President Trump’s recent executive orders that aim to make the United States “the digital asset capital of the world” by fostering a favorable environment for BTC mining, regulatory clarity, and a strategic reserve. According to Lummis, those moves stand in stark contrast to prior administrations, where “people neither knew nor wanted to talk about digital assets.”

However, Lummis also underscored the need for bipartisan collaboration, suggesting that while Bitcoin has now garnered interest in Republican circles, it should not become a strictly partisan endeavor: “We want to keep that momentum… We worked extremely hard to keep it bipartisan, so I can’t flip my brain and start to think of it as a partisan issue.”

At press time, BTC traded at $84,202.

Featured image from YouTube, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

Tokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

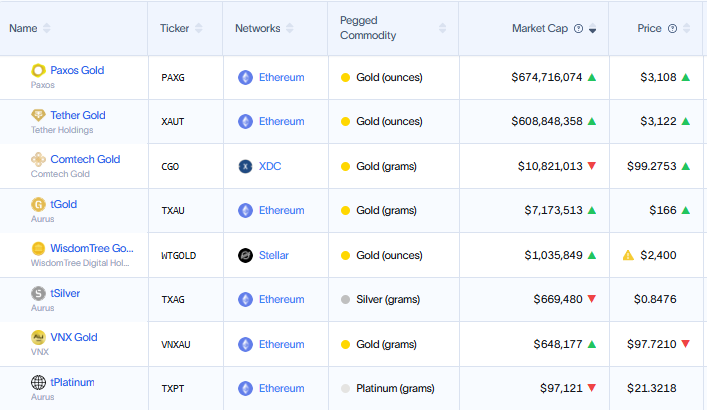

The market cap of tokenized gold has surpassed $1.2 billion, driven by soaring gold prices and a growing appetite for blockchain-based assets.

Rising interest in tokenized gold is part of a broader movement to modernize storage, trading, and utilization in financial markets.

Gold Meets Blockchain Amid Tokenization Revolution

Gold price has reached historic highs above $3,000 per ounce. With this surge, digital representations of precious metals, such as Tether Gold (XAUT) and Paxos Gold (PAXG), capture investor interest.

Don Tapscott, co-founder of Blockchain Research Institute, argues that tokenized gold could transform the $13 trillion gold market by bringing transparency, liquidity, and new financial models.

Based on this assumption, he questioned why gold is still stored in vaults as it was in the 1800s. Meanwhile, assets like Bitcoin (BTC) and stablecoins have gone digital. He believes blockchain technology can revolutionize gold’s role in finance.

“The US government could even tokenize its gold reserves, track them immutably, and use them in innovative ways,” Tapscott explained.

He stated that such an outcome would enable fractional ownership, on-chain verification, and increased accessibility to investors worldwide.

Meanwhile, companies such as Paxos and Tether lead the charge in tokenized gold offerings. Paxos holds a 51.74% market share, while Tether’s holdings follow closely behind at 46.69%.

Publicly listed Matador Technologies is taking a unique approach by tokenizing gold on the Bitcoin blockchain. This offers investors a digital claim on both physical gold and limited-edition digital art.

“We believe that the next generation of financial powerhouses will likely emerge from the tokenization revolution. It’s still early, and the playing field is wide open. Matador and others have the bull by the horns,” Tapscott noted in a recent article.

Gold Tokenization in the US: A Bold Policy Shift?

The momentum behind tokenized gold has also reached the US government. Following President Trump’s March 5 executive order to establish a Strategic Bitcoin Reserve (SBR), policymakers are exploring ways to modernize gold holdings.

Treasury Secretary Scott Bessent has indicated that the US will move to “monetize its assets,” leading some to speculate that Fort Knox gold could be tokenized.

“US Treasury Secretary Scott Bessent says, all the GOLD is there, as he has no plans to visit Fort Knox or to revalue GOLD reserves in a sovereign wealth fund. He speaks on “Bloomberg Surveillance,” Erik Yeung noted.

Senator Cynthia Lummis has also proposed swapping some of the US government’s gold reserves for Bitcoin. US gold reserves are held at a book value of $42 per ounce—unchanged since 1973—despite the market price exceeding $3,000 per ounce.

While the US explores tokenization, geopolitical rivals China and Russia may take an even bolder step—launching a gold-backed stablecoin. Bitcoin maximalist Max Keiser recently highlighted BRICS’ plans to introduce a gold-backed stablecoin.

“The BRICS, principally Russia, China & India, will counter any attempt by the US to introduce a hegemonic, USD-backed stablecoin — with a Gold-backed stablecoin. The majority of the global market will favor a Gold-backed coin since it’s inflation-proof (unlike the USD) and doesn’t boost unwelcome US hegemony. India already runs on a defacto Gold standard and Sharia law in Muslim countries would dictate Gold over a USD riba-coin as well. To be clear, a BTC-backed stablecoin is not fit for purpose due to volatility,” Keiser stated.

Further, Keiser suggested that a stablecoin backed by gold would outcompete USD-backed stablecoins in global markets. He argues that gold is more trusted than the US dollar, tracks inflation effectively, and remains minimally volatile compared to Bitcoin’s price swings.

Russia’s recent rejection of Bitcoin for its National Wealth Fund in favor of gold and the Chinese yuan adds weight to this theory.

With an estimated 50,000 tonnes of combined gold reserves, China and Russia could leverage blockchain technology to introduce a new gold-backed digital asset. Such an action would challenge the US dollar’s dominance in global trade.

Gold vs. Bitcoin: The Safe Haven Debate Intensifies

Gold’s record-breaking rally has reignited debates over its role as a safe-haven asset compared to Bitcoin. Some analysts speculate that Bitcoin could soon follow gold’s trajectory, setting new all-time highs.

However, in economic uncertainty and President Trump’s 2025 tariff policies, gold remains the preferred safe-haven asset. Historically, gold has been the go-to store of value during trade wars and inflationary periods. Meanwhile, Bitcoin’s volatility raises concerns for risk-averse investors.

Despite these differences, the rise of tokenized gold highlights a convergence between traditional and digital finance. As financial markets advance and investors rebalance their portfolios, gold and Bitcoin will likely coexist in a contemporary monetary system.

Whether through tokenization, gold-backed stablecoins, or government-led blockchain initiatives, the financial playing field is shifting.

As traditional institutions increasingly adopt blockchain, the stage is set for transforming how the world perceives, trades, and stores gold relative to Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Institutional Risk Aversion Drives $218 Million Bitcoin ETF Outflows

Bitcoin ETFs (exchange-traded funds) continue to record negative flows this week as President Trump’s Liberation Day countdown continues.

Sentiment is cautious across crypto markets, with traders and investors adopting a wait-and-see approach.

Bitcoin ETF See Outflows Amid Investor Caution

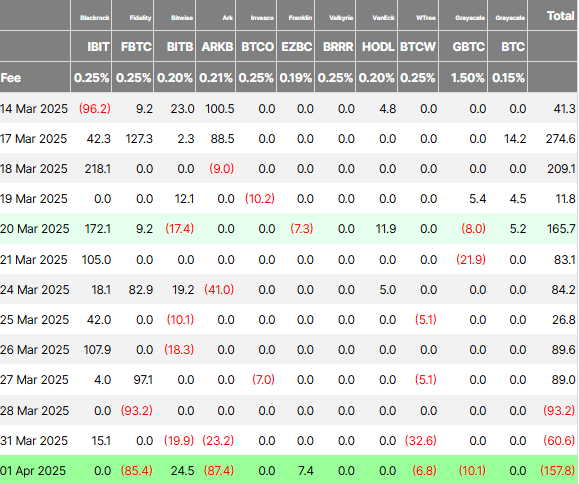

Data on Farside Investors shows two consecutive days of net outflows for Bitcoin ETFs since Monday. Financial instruments from Bitwise (BITB), Ark Invest (ARKB), and WisdomTree (BTCW) were in the frontline for Monday’s $60.6 million outflows, with only BlackRock’s IBIT seeing positive flows.

Meanwhile, Tuesday saw even more outflows, approaching $158 million, with Bitwise and Ark Invest leading the charge. Then, on April 1, BlackRock’s IBIT recorded zero flows. Meanwhile, Ethereum ETFs recorded net outflows of $3.6 million, data on Farside shows. This suggests a cautious sentiment among institutional investors.

“The Spot Bitcoin ETFs saw $157.8 million outflow yesterday. The Spot Ethereum ETFs saw a $3.6 million outflow. Institutions are reducing risk ahead of today’s tariff announcement,” analyst Crypto Rover noted.

Indeed, sentiment suggests traders are exercising caution, choosing to remain in “wait-and-see” mode. The caution comes ahead of Trump’s Liberation Day announcement, which is due later in the day on April 2.

With POTUS poised to unveil sweeping new tariffs, traders and investors across financial playing fields wait to see the scope of an onslaught that could spark a global trade war. Specifically, there is generally very little information about the tariffs’ specifics, which creates uncertainty regarding their impact on the broader economy and the crypto market.

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people close to the matter.

Despite the lack of clarity, it is understandable why investors would be cautious considering the impact of previous tariff announcements on Bitcoin price. Meanwhile, analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen,” economic analyst Alex Krüger predicted.

While sentiment is cautious in the crypto market, some investors are channeling toward gold as a safe haven. A Bank of America survey showed that 58% of fund managers prefer gold as a trade war safe haven, while only 3% back Bitcoin.

These findings came as institutional investors cite Bitcoin’s volatility and limited crisis-time liquidity as key barriers to its safe-haven adoption. Trade tensions have historically driven capital into safe-haven assets.

With Trump’s Liberation Day announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

Nevertheless, despite Bitcoin’s struggle to capture institutional safe-haven flows, its long-term narrative remains intact. This is seen with Bitcoin supply on exchanges dropping to just 7.53%, the lowest since February 2018.

When an asset’s supply on exchanges reduces, investors are unwilling to sell, suggesting strong long-term holder confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoSolana Faces Resistance While ETH Sees DEX Volume Boost

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

-

Market22 hours ago

Market22 hours agoSUI Price Stalls After Major $147 Million Token Unlock

-

Market21 hours ago

Market21 hours agoBeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

-

Market20 hours ago

Market20 hours agoAnalyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

-

Market18 hours ago

Market18 hours agoBitcoin Price Bounces Back—Can It Finally Break Resistance?

-

Altcoin17 hours ago

Altcoin17 hours agoWill BNB Price Rally to ATH After VanEck BNB ETF Filing?

-

Regulation7 hours ago

Regulation7 hours agoKraken Obtains Restricted Dealer Registration in Canada