Bitcoin

Bitcoin Leads $528M Outflows: Market Insights

Bitcoin (BTC) topped the list in negative flows last week as digital asset investment products saw outflows totaling $528 million. The turnout preceded the ongoing crypto market crash, with BTC still on the frontline.

Crypto markets continue to bleed, starting the week off badly. Nevertheless, the crash may provide an opportunity for willing investors to buy the dip.

Bitcoin Saw $400 Million Outflows Last Week

With total crypto investments outflows reaching $528 million, Bitcoin led the negative flows with $400 million. Ethereum followed with $146 million in outflows, bringing the net outflows since the ETH ETFs (exchange-traded funds) launch in the US to $430 million. Solana recorded $2.8 million in negative flows.

For Bitcoin, it marked the first outflow after five weeks of positive flows. CoinShares researchers ascribe it to market fears, citing concerns of a recession in the US, geopolitical turmoil, and “consequent broader market liquidations across most asset classes.”

Markus Thielen, Founder and CEO at 10x Research, seems to agree with the recession argument in a statement to BeInCrypto.

“Bitcoin and Ethereum tend to underperform during periods that resemble or approach a recession in the United States. Additionally, investors are reducing their positions as prices have fallen below the average entry point for ETF investors, which is approximately $60,000,” Thielen said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

The US session’s opening will be interesting to watch, given this market closed on Friday with Bitcoin at $61,498. Between then and Monday, BTC has lost over $10,000 worth of value, which will likely trigger a response from ETF investors once the market opens on Monday.

Specifically, investors should expect price adjustment, potentially leading to a sharp drop in the Bitcoin ETFs’ trading price. Subsequently, investors’ reactions could cause increased volatility in the ETF market, with some selling their holdings to avoid further losses. Others may yet see it as a buying opportunity, with both perspectives driving trading volume as investors adjust their positions.

“While institutions might incur losses of 20% or 40%, they won’t hold positions until they become worthless. Every trader, institutional or retail, must take responsibility for risk management and establish an acceptable threshold for remaining long in their positions,” Thielen stated.

Bitcoin Drop to $42,000 Would Send Ethereum to $2,000

The research highlights that ETF investors bought the dip when Bitcoin dropped below $60,000 in July. This accumulation came despite the average ETF holder experiencing losses, rendering $60,000 the level where BTC mining becomes unprofitable for the industry. It fuels significant price declines amid miners’ high beta.

Accordingly, the researchers anticipate Bitcoin’s price dropping to $42,000 after the $55,000 support level capitulated. This could draw Ethereum down to $2,000, with the researchers citing economic weakness, ongoing weak market structure, on-chain data, and cycle analysis, which suggest further stress ahead. Notably, the researchers have gained prominence after multiple nearly spot-on predictions.

Among them, in October 2022, the experts predicted a 2024 halving price target of $63,160 for Bitcoin, but BTC topped out at around $63,491 on April 20. They also called a $45,000 year-end target in 2023, which ended at $43,613. In February, researchers at 10X set a 2024 Bitcoin target at between $60,000 and $70,000.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Nevertheless, crypto markets, like other financial markets, are dynamic, with new information changing previous outlooks. Even as sleuths continually reevaluate and analyze the markets, traders must conduct their own research and appreciate the volatility of crypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin’s aSOPR Resets To 1.01 — Here’s Why It Could Spark A Rally?

Following a brief ascent above $99,000 on Friday, the Bitcoin market experienced a negative end to the past trading week as prices crashed below $96,000 in a sharp descent. Based on these happenings, the premier cryptocurrency remains in consolidation with little indication of its long-term price movement. Notably, blockchain analytics firm Glassnode has shared a recent network development hinting at a possible price rally.

Bitcoin At A Crossroads: Key Metric Set Could Decide Next Move

In an X post on Friday, Glassnode reports that Bitcoin’s aSOPR is at 1.01, a critical metric level that places the crypto asset in a delicate market position. Generally, an adjusted Spent Output Profit Ratio (aSOPR) is an on-chain metric that measures the profitability of Bitcoin transactions by comparing the selling price of coins to their acquisition price.

When the aSOPR is above 1, it indicates that the average Bitcoin holder is selling at a profit. Conversely, a value below one indicates that BTC is being sold at a loss. Therefore, Bitcoin’s aSOPR at 1.01 suggests that market participants are barely making profits on their transactions.

According to Glassnode, the BTC market is historically a breakeven point where further movement of the aSOPR in either direction could significantly impact price trajectory. In 2021, Bitcoin’s aSOPR reset to around 1.01 preceded a strong bull run that eventually resulted in the then new-all time of $64,800. A similar reset was also seen in late 2023 resulting in a price surge to around $69,000.

Going by these past events, if Bitcoin’s aSOPR holds above 1.01, it would suggest buyer absorption indicating a renewed market confidence in anticipation of an incoming price rally. On the other hand, if the aSOPR decline continues a break below 1.0, this development would mean sellers are offloading BTC at a loss which can signal further downward pressure.

BTC Price Outlook

At the time of writing, Bitcoin trades at $96,300 following a significant 1.98% loss in the past day. Meanwhile, its daily trading volume has gained by 51.28% indicating an increased market interest. This increased market interest amidst price decline could be indicative of either a panic selling by concerned investors or strong accumulation by market bulls.

Based on the BTCUSDT daily chart, breaking and holding above $99,000 could mark an end to the current consolidation phase leading to a sustained price uptrend. However, a price fall below $95,000 could pave the way for all bearish possibilities with certain analysts hinting at a potential return to $76,000.

Featured image from iStock, chart from Tradingview

Bitcoin

VanEck Tool Shows Strategic Bitcoin Reserve Can Trim US Debt

Asset manager VanEck has stated that a Strategic Bitcoin Reserve could help mitigate the US’ growing debt, which currently stands at $36 trillion.

To explore the potential effects of this idea, the firm has developed an interactive tool inspired by the BITCOIN Act.

How Will a Strategic Bitcoin Reserve Reduce US Debt?

The BITCOIN Act, introduced by Senator Cynthia Lummis, outlines a plan for the US government to acquire up to 1 million Bitcoins (BTC) over five years, purchasing no more than 200,000 BTC per year.

These assets would be held in a dedicated reserve for at least 20 years. Lummis believes such a reserve could substantially reduce the nation’s debt.

Notably, VanEck’s new calculator lets users know the impact of such a reserve. The tool allows the simulation of a variety of hypothetical scenarios by adjusting different variables.

These include the debt and BTC’s growth rates, the average purchase price of Bitcoin, and the total quantity of Bitcoin held in reserve. Meanwhile, VanEck has also included their own “optimistic projection.”

“If the US government follows the BITCOIN Act’s proposed path – accumulating 1 million BTC by 2029 – our analysis suggests this reserve could offset around $21 trillion of national debt by 2049. That would amount to 18% of total US debt at that time,” VanEck noted.

The analysis is based on assumptions regarding the future growth rates of both US debt and Bitcoin. VanEck has supposed a 5% annual growth rate for the national debt. This would see it rise from $36 trillion in 2025 to around $116 trillion by 2049.

Similarly, Bitcoin is presumed to appreciate at a compounded rate of 25% per year. Its acquisition price is predicted to start at $100,000 per Bitcoin in 2025. Thus, by 2049, the price could potentially be $21 million per Bitcoin.

While the federal government considers the potential of a Strategic Bitcoin Reserve, interest is also rising at the state level. At least 20 US states have introduced bills to create digital asset reserves.

According to Matthew Sigel, Head of Digital Assets Research at VanEck, state-level bills could collectively drive as much as $23 billion in Bitcoin purchases.

President Trump’s Crypto Promise

VanEck’s move comes as Bitcoin is receiving increasing political support. US President Donald Trump has reiterated his commitment to positioning the US as a global leader in cryptocurrency.

Speaking at the Future Investment Initiative Institute summit in Miami, Trump emphasized the economic growth driven by crypto-friendly policies.

“Bitcoin has set multiple all-time record highs because everyone knows that I’m committed to making America the crypto capital,” Trump said.

Since returning to office, Trump has signed an executive order to establish a national “digital asset stockpile.” He has also nominated pro-crypto leaders to head major regulatory bodies. However, whether a Bitcoin reserve will actually be established remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

$2 Billion Bitcoin, Ethereum Options Expiry Signals Market Volatility

Today, approximately $2.04 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating significant anticipation in the crypto market.

Expiring crypto options often leads to notable price volatility. Therefore, traders and investors closely monitor the developments of today’s expiration.

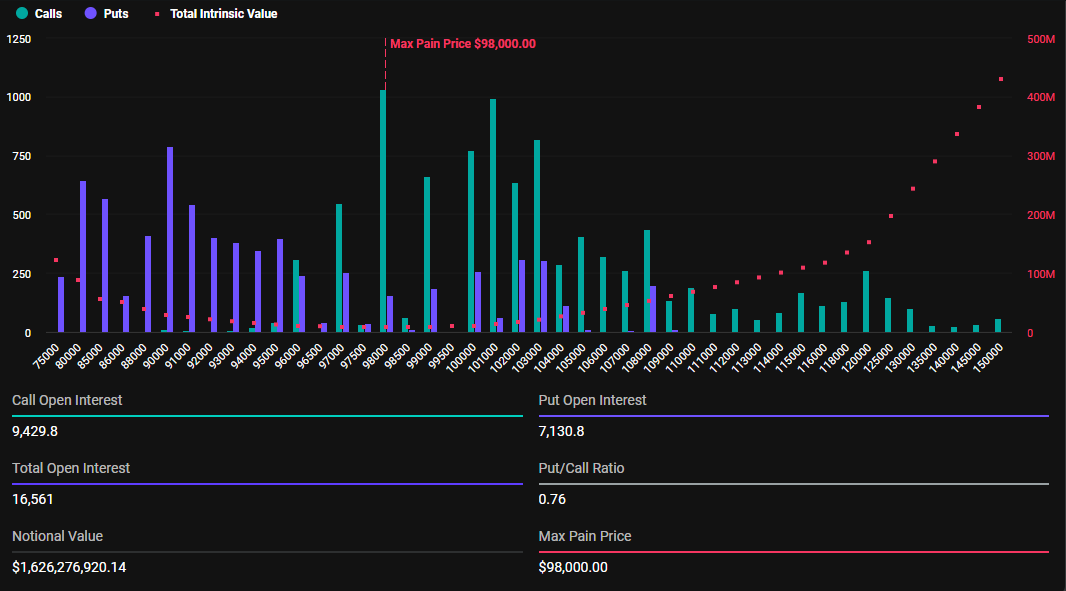

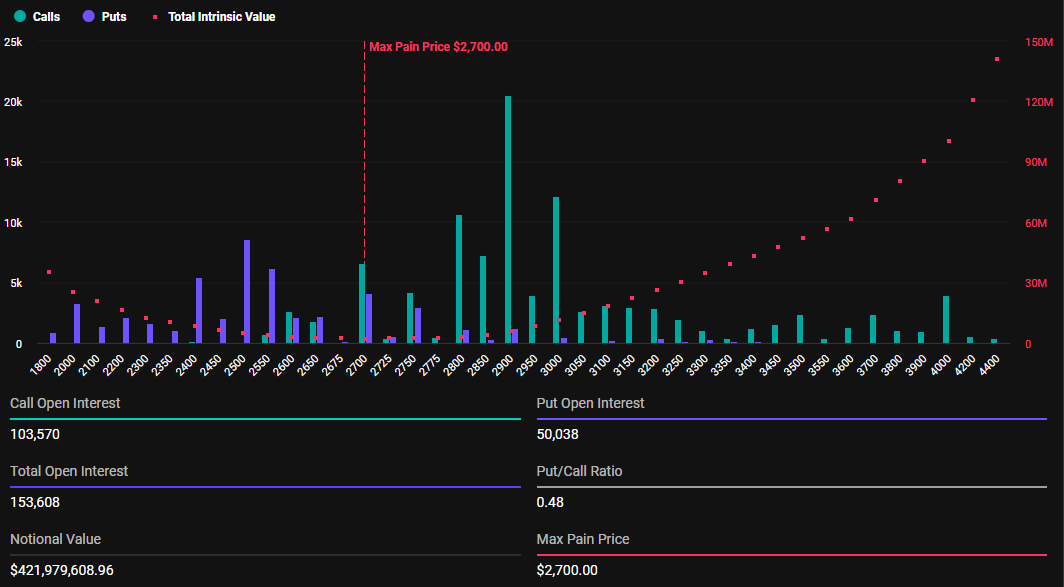

Options Expiry: $2.04 Billion BTC and ETH Contracts Expire

Today’s expiring Bitcoin options have a notional value of $1.62 billion. These 16,561 expiring contracts have a put-to-call ratio of 0.76 and a maximum pain point of $98,000.

On the other hand, Ethereum has 153,608 contracts with a notional value of $421.97 million. These expiring contracts have a put-to-call ratio of 0.48 and a max pain point of $2,700.

At the time of writing, Bitcoin trades at $98,215, a 1.12% increase since Friday’s session opened. Ethereum trades at $2,746, marking a 0.20% decrease. In the context of options trading, the put-to-call ratio below 1 for BTC and ETH suggests a prevalence of purchase options (calls) over sales options (puts).

However, according to the max pain theory, Bitcoin and Ethereum prices could gravitate toward their respective strike prices as the expiration time nears. Doing so would cause most of the options to expire worthless and thus inflict “max pain”. This means that BTC and ETH prices could register a minor correction as the options near expiration at 8:00 AM UTC on Deribit.

It explains why analysts at Greeks.live noted a cautiously bearish sentiment in the market, with low volatility frustrating traders. They suggest ongoing concern among traders and investors, particularly around Bitcoin, with traders closely monitoring key price points.

“The group sentiment is cautiously bearish with low volatility frustrating traders. Participants are watching $96,500 level with skepticism about upward momentum, while discussing possibilities of volatility clustering at low levels around 40%,” the analysts wrote.

Elsewhere, Deribit warns that while low volatility feels safe, this sense of safety is only momentary, as markets tend not to wait long.

Bitcoin Price Outlook: Key Levels and Market Outlook

Bitcoin trades around $98,243, hovering above a critical demand zone between $93,700 and $91,000. This area has previously acted as strong support, indicating buyers may step in to defend these levels.

On the other hand, a key supply zone is positioned at around $103,991, where selling pressure has historically been significant. BTC has struggled to break past this level, making it a major resistance to watch.

From a price action perspective, BTC has been forming lower highs and lower lows, suggesting a short-term bearish trend. However, the recent price movement hints at a possible reversal, as BTC is attempting to bounce off its demand zone.

The volume profile also shows significant trading activity near $103,991, reinforcing the resistance level. Meanwhile, a noticeable low volume area near $91,000 suggests that if BTC breaks below this level, a sharp drop could follow due to the lack of strong support.

Meanwhile, the Relative Strength Index (RSI) is currently at 50.84, indicating neutral momentum. While BTC is not overbought or oversold, the RSI’s slight upward trend could signal growing buying interest.

If Bitcoin holds above the $93,700 support zone, it may attempt a push towards the $100,000 milestone. However, a breakdown below $91,000 could trigger a move lower, potentially testing the $88,000 to $85,000 range.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoGrayscale’s Ethereum ETF On The Brink Of Major Change With NYSE’s Staking Proposal

-

Ethereum19 hours ago

Ethereum19 hours agoBitcoin Pepe set to reap big from its virality, fundamentals, and timing

-

Altcoin20 hours ago

Altcoin20 hours agoWill Pi Coin Surpass XRP Price After Binance Listing?

-

Market19 hours ago

Market19 hours agoBybit Assures Stability Amid $5.2 Billion Asset Outflow After Hack

-

Market18 hours ago

Market18 hours agoMantle (MNT) Falls 10% as Bybit Hack Rattles Investors

-

Altcoin18 hours ago

Altcoin18 hours agoLawyer Estimates Maximum Timeframe for Ripple vs SEC Case Dismissal

-

Altcoin17 hours ago

Altcoin17 hours agoLitecoin Whales On Buying Spree Sack 930K Coins Amid LTC ETF Buzz, What’s Next?

-

Market16 hours ago

Market16 hours agoKanye West is Launching His Token Despite Past Criticism