Market

BingX’s Bold Step in Web3 Entertainment

BingX, one of the world’s leading cryptocurrency exchanges, has launched the first phase of its BingX Launchpool, introducing MATR1X (MAX) — an exciting entertainment platform that blends Web3 game ,and esports with blockchain and AI technologies.

In a recent AMA, Matr1x Co-Founder Madeira and the Chief Product Officer at BingX Vivien Lin talked about what makes Matr1x special and what the future holds.

The Start and Vision

Matr1x was created to show that blockchain technology can be used for more than just finance. Madeira, with a background in finance and crypto, wants Matr1x to be more than just a gaming platform. It’s designed to be a complete system that brings more people into Web3, blending digital entertainment with blockchain.

“Web3 gaming can do things that current games cannot do. It’s a better form of value exchange and a much bigger multiplayer platform. I think Web3 gaming will exist and will take the world of gaming by storm at some point,” Madeira states.

At the center of Matr1x is the Matr1x trilogy game series. This isn’t just about playing games; it’s also about teaching players important ideas like data privacy and the benefits of decentralization.The game’s story unfolds in a future where a powerful company controls everyone’s personal information, prompting players to consider the importance of controlling their own data.

“For those who are new to crypto, we have made it easy to get involved. Players can participate in our games without needing to understand wallets or blockchain. This way, we can attract more users and eventually convert them into the Web3 space,” Madeira says.

Matr1x ecosystem also includes other games like Castile, an RPG card game, and Evermoon, a 5v5 MOBA. These games are part of Matr1x’s broader plan to offer a variety of gaming experiences, appealing to both casual and serious gamers. The platform also includes GEDA, an esports platform for organizing tournaments and events, adding another layer to its gaming ecosystem.

“Many people thought the industry is a scam and doesn’t create any value. But I wanted to build something real and show that blockchain technology has practical applications beyond just finance”, Madeira adds.

How Matr1x Makes Money and Engages Players

Matr1x plans to make money similarly to popular games like Counter-Strike (CS), which earns a lot from skin trading and in-game purchases. This approach has already shown promise, with transactions involving skins and loot boxes reaching 13 million USDT shortly after launch.

To get more people involved, Matr1x will host esports tournaments. These events are a great way to attract a wide audience, from young gamers to experienced players.

“We hosted the Matr1xFile Asian Masters 2024 with the grand final at the Hong Kong Web3 Festival. We got almost 2 million live viewers, showing the immense interest and potential in Web3 gaming and esports,” Madeira shares.

AI is also a key part of Matr1x. The project plans to use AI not only to make the games more fun but also to introduce new ways to play. For example, AI-trained bots could play in games, allowing for both human and AI competitions. This approach could attract a wide range of players, including those interested in AI and learning more about it.

Promising Partnership with BingX

Vivien Lin highlighted the partnership between Matr1x and BingX, showing how this collaboration brings new Web3 and AI-driven content to BingX’s platform. The BingX Launchpool, currently featuring MATR1X (MAX), allows users to earn tokens by staking USDT or BTC, providing a smooth and easy experience.

This launch marks an important milestone for BingX, which has recently partnered with Chelsea FC, showcasing its expansion into the sports world.

“This launch represents our unwavering commitment to delivering innovative and rewarding experiences for our community, allowing them to participate in and explore the future of digital entertainment,” Vivien Lin notes.

The partnership between Matr1x and BingX aims to bring exciting new content to BingX’s platform and attract users interested in the latest digital experiences. This initiative not only encourages participation but also helps users become familiar with the Matr1x ecosystem, potentially turning casual users into active community members.

“Quality assets like Matr1x are very good additions to our community. By partnering with Matr1x, we want to help the project gain more exposure and bring it to our user base. We are glad to bring projects like Matr1x, that can provide long-term value, to our platform,” Lin adds.

Future Plans and Community Involvement

Matr1x has big plans for the future. The project aims to keep developing new games and features, with a strong focus on creating an inclusive and engaging ecosystem.

One unique aspect of Matr1x is its commitment to community involvement. MAX token holders can vote on various aspects of the platform’s future, from game development to ecosystem improvements. This ensures that the project stays aligned with what the community wants.

“We look forward to supporting Matr1x’s growth and exploring further synergies. There’s so much potential, especially with many new games and features coming up,” Vivien Lin comments.

Madeira also talked about potential ways to generate money in the future, such as possibly adding transaction fees. However, the main goal is to build a sustainable ecosystem where the community’s contributions are reinvested into the platform.

Matr1x is a bold new project aiming to change the future of gaming. Combining Web3 technology with AI and esports offers a unique and immersive experience. The project’s focus on educating users about data privacy and decentralization sets it apart, promising not only to entertain but also to inform.

“We think going forward into the future, Matr1x will be much more valuable compared to now. We aim to bring mass adoption to our industry through gaming and social platforms,” Madeira concludes.

Matr1x future success will depend on its ability to attract and keep a diverse group of users. Partnership with BingX and a strong focus on community involvement provide a solid foundation for growth. For anyone interested in the future of gaming and blockchain, Matr1x is a project worth watching.

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Bounces Back—Can It Finally Break Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $83,500 zone. BTC is now consolidating and might struggle to settle above the $85,500 zone.

- Bitcoin started a decent recovery wave above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $83,500 zone.

Bitcoin Price Starts Recovery

Bitcoin price managed to stay above the $82,000 support zone. BTC formed a base and recently started a decent recovery wave above the $82,500 resistance zone.

The bulls were able to push the price above the $83,500 and $84,200 resistance levels. The price even climbed above the $85,000 resistance. A high was formed at $85,487 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,550 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,200 level. The first key resistance is near the $85,500 level. The next key resistance could be $85,850. A close above the $85,850 resistance might send the price further higher. In the stated case, the price could rise and test the $86,650 resistance level. Any more gains might send the price toward the $88,000 level or even $88,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $84,500 level and the trend line. The first major support is near the $83,500 level and the 50% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

The next support is now near the $82,850 zone. Any more losses might send the price toward the $82,000 support in the near term. The main support sits at $80,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,500.

Major Resistance Levels – $85,200 and $85,500.

Market

Analyst Reveals ‘Worst Case Scenario’ With Head And Shoulders Formation

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

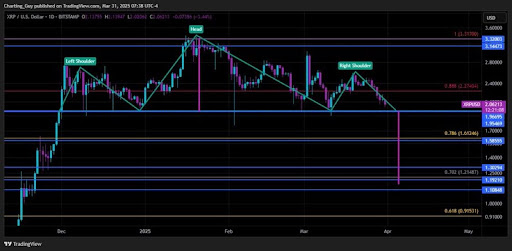

Recent XRP price action has sparked a new prediction from a crypto analyst, as a potential Head and Shoulders pattern emerges on the chart. The analyst warns that this technical formation could trigger a significant price correction for XRP, describing this downturn as the worst-case scenario.

Analyst Predicts XRP Price Crash To $1.15

The ‘Charting Guy,’ a pseudonymous crypto analyst on X (formerly Twitter), has unveiled a potential Head and Shoulder pattern formation on the XRP price chart. The analyst has shared insights into the implications of this technical pattern, projecting a potential crash in the XRP price.

Related Reading

As a well-known bearish reversal pattern, the formation of a Head and Shoulder in the XRP price chart suggests a potential shift from an uptrend to a downtrend. Typically, a Head and Shoulder pattern consists of three peaks: the Left Shoulder, Head, and Right Shoulder. However, the Charting Guy has confirmed that XRP’s current pattern formation consists of two right shoulders and one head. Due to this irregularity, the analyst has expressed doubt about the possibility of the pattern playing out.

If the Head and Shoulder pattern eventually takes shape, it could lead to a significant drop in the XRP price, potentially bringing it down to as low as $1.15. This price level aligns with a key Fibonacci Golden Pocket retracement zone between 0.618 – 0.786.

Notably, the analyst has described this projected price crash as the worst-case scenario for XRP. While he believes a bearish move is possible, the analyst is confident that XRP’s broader market structure is bullish.

Moreover, the Charting Guy argues that if XRP does decline to $1.15, it would likely serve as a healthy retracement in an overall bullish trend. He noted that XRP’s price has been holding the $2 level on daily closes, meaning its price action remains strong above support levels. This also indicates the possibility of an uptrend resumption that could yield higher highs and higher lows for XRP.

Key Support And Resistance Levels To Watch

The Charting Guy’s analysis of XRP’s potential Head and Shoulder pattern formation highlights several critical price levels to watch. Since XRP has consistently closed daily candles above $2, the analyst has determined this level as short-term support.

Related Reading

XRP has also been wicking during recent pullbacks in a crucial range between $1.7 and $1.9. As a result, the crypto analyst has revealed that he will be watching this area closely for a potential price bounce.

The Golden Pocket retracement zone, which represents the worst-case scenario for the XRP price, is between $1.15 and $1.30. If XRP experiences a deeper price correction, lower support levels have been marked from $1.19 to $0.91.

For its resistance levels, the Charting Guy has pinpointed $2.27 as a key price point. Additionally, $3.14 – $3.32 has been identified as an upper resistance range where XRP could rally if bullish momentum resumes.

Featured image from Medium, chart from Tradingview.com

Market

BeInCrypto US Morning Briefing: Standard Chartered and Bitcoin

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Standard Chartered sees early signs of institutional investors turning to Bitcoin as a hedge against equity market volatility, just as traders gear up for a potentially volatile week driven by tariff news. At the same time, Coinbase wraps up its worst quarter since the FTX collapse, and U.S. regulators inch closer to unified stablecoin legislation.

Standard Chartered Sees Signs of Bitcoin Starting to Be Used as Hedge Against Market Volatility

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, sees signs that institutional traders are starting to use Bitcoin as a hedge against equity market volatility.

In a recent exclusive interview with BeInCrypto, Kendrick highlighted that this trend is already underway, with investors seeking alternatives to traditional instruments. “This is happening already,” Kendrick stated. “Investors used to use FX, specifically AUD, for this purpose due to its highly liquid and positive correlation to stocks, but now I think Bitcoin is being used because it is also highly liquid and trades 24/7.”

Additionally, in an investor note from late March, Kendrick expanded on Bitcoin’s evolving role in investment portfolios, suggesting that over time, Bitcoin may serve multiple purposes—both as a hedge against traditional financial market fluctuations and as a proxy for tech stocks.

He pointed out signs that markets could anticipating a less severe tariff announcement from the U.S. on April 2. “Given this has been the worst quarter for the Nasdaq since Q2 2022, there should be a degree of portfolio rebalancing (buying) that needs to take place,” Kendrick added.

As of April 1, 2025, Bitcoin has shown resilience amid broader market uncertainties. The cryptocurrency is up approximately 3.32%, trading at $84,282. This uptick comes alongside an overall increase in the global cryptocurrency market capitalization. In contrast, U.S. stock futures, including Dow Futures, S&P 500 Futures, and Nasdaq Futures, are all trending lower in pre-market trading, reflecting investor caution ahead of the anticipated tariff announcements.

Bitcoin Options Heat Up Before Trump’s “Liberation Day”

FalconXCrypto Global Co-Head of Markets, Joshua Lim, noted that in anticipation of Wednesday’s Trump-tariff “Liberation Day,” crypto funds are actively purchasing Bitcoin options at two key strike prices: $75,000 on the downside to hedge against potential losses and $90,000 on the upside to capitalize on a price surge.

Lim highlighted that the options market is pricing in a potential 4% move in Bitcoin’s price during the event. “The implied event move embedded in Bitcoin options is around 4% for the 2 April event,” he told BeInCrypto.

He also pointed out that traders are likely to keep buying put options in the short term as a protective measure, maintaining a high options cost premium. “We believe the front of the options curve will hold its premium as traders continue to hedge their portfolios or replace spot positions with limited-loss option positions,” Lim added.

Additionally, he noted a 4-point increase in the VIX, signaling that investors expect heightened volatility in the coming days and are turning to options to manage risk or capitalize on price swings. “US equities are also showing a bid in options, with the front-month VIX up 4 points to 22v from last week,” he said.

Crypto Stocks Slide: Coinbase Suffers Worst Quarter Since FTX Collapse

Coinbase is closing out its roughest quarter since the FTX collapse, with its stock tumbling over 30% since January. While it dipped nearly 1% in early U.S. pre-market trading on Monday, the stock managed to claw back losses and is now up around 1%.

Other crypto-linked companies are also feeling the pressure. Galaxy Digital Holdings has dropped over 8% in pre-market trading, while mining firms Riot Platforms and Core Scientific are only barely staying afloat, each gaining less than 0.5%.

Meanwhile, CoreWeave, which pivoted from Bitcoin mining to AI infrastructure, is struggling after a disappointing IPO. Initially aiming for a $2.7 billion raise, the company had to settle for $1.5 billion, slashing its offer price from the $47–55 range to $40 per share. Since going public last Friday, its shares are down 6.8%, with a 7.3% drop recorded in the last 24 hours.

Byte-Sized Alpha

– Today’s JOLTS report, a key gauge of U.S. job openings, could sway Bitcoin—strong data may boost the dollar and hurt crypto, while a sharp decline could fuel rate-cut hopes and lift risk assets.

– Bitcoin is off to its worst quarterly start since 2018, dropping nearly 12% in Q1 2025—but growing whale accumulation, falling exchange supply, and signs of consolidation hint at a potential rebound ahead.

– Crypto scams are on the rise, with fake Gemini bankruptcy emails and a Coinbase employee breach fueling phishing attacks

– OKX has appointed former NYDFS Superintendent Linda Lacewell as Chief Legal Officer, a move aimed at bolstering its regulatory credibility as the exchange accelerates global expansion into regions like Europe and the UAE.

– A unified U.S. stablecoin regulation could soon become reality, as the STABLE and GENIUS Acts differ by only 20% and enjoy strong bipartisan support alongside SEC and CFTC involvement.

– A push for expanded crypto oversight is underway as incoming CFTC Chair Brian Quintenz meets with Senator Chuck Grassley to discuss regulating the crypto spot market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoEthereum Price Faces a Tough Test—Can It Clear the Hurdle?

-

Market21 hours ago

Market21 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Market18 hours ago

Market18 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin17 hours ago

Bitcoin17 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Bitcoin16 hours ago

Bitcoin16 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market22 hours ago

Market22 hours agoSolana (SOL) Holds Steady After Decline—Breakout or More Downside?

-

Ethereum22 hours ago

Ethereum22 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Altcoin14 hours ago

Altcoin14 hours agoWill XRP, SOL, ADA Make the List?