Bitcoin

Crypto Volatility Expected as US Releases Key Economic Data

The crypto market’s correlation with key macroeconomic events has returned after dissipating for most of 2023. With the influence back on, crypto market participants must brace for volatility with key releases lined up this week.

In a sentiment-driven market, getting ahead of market-moving economic data releases is critical for traders and investors looking to revise their trading strategies.

What Could Cause Market Volatility This Week

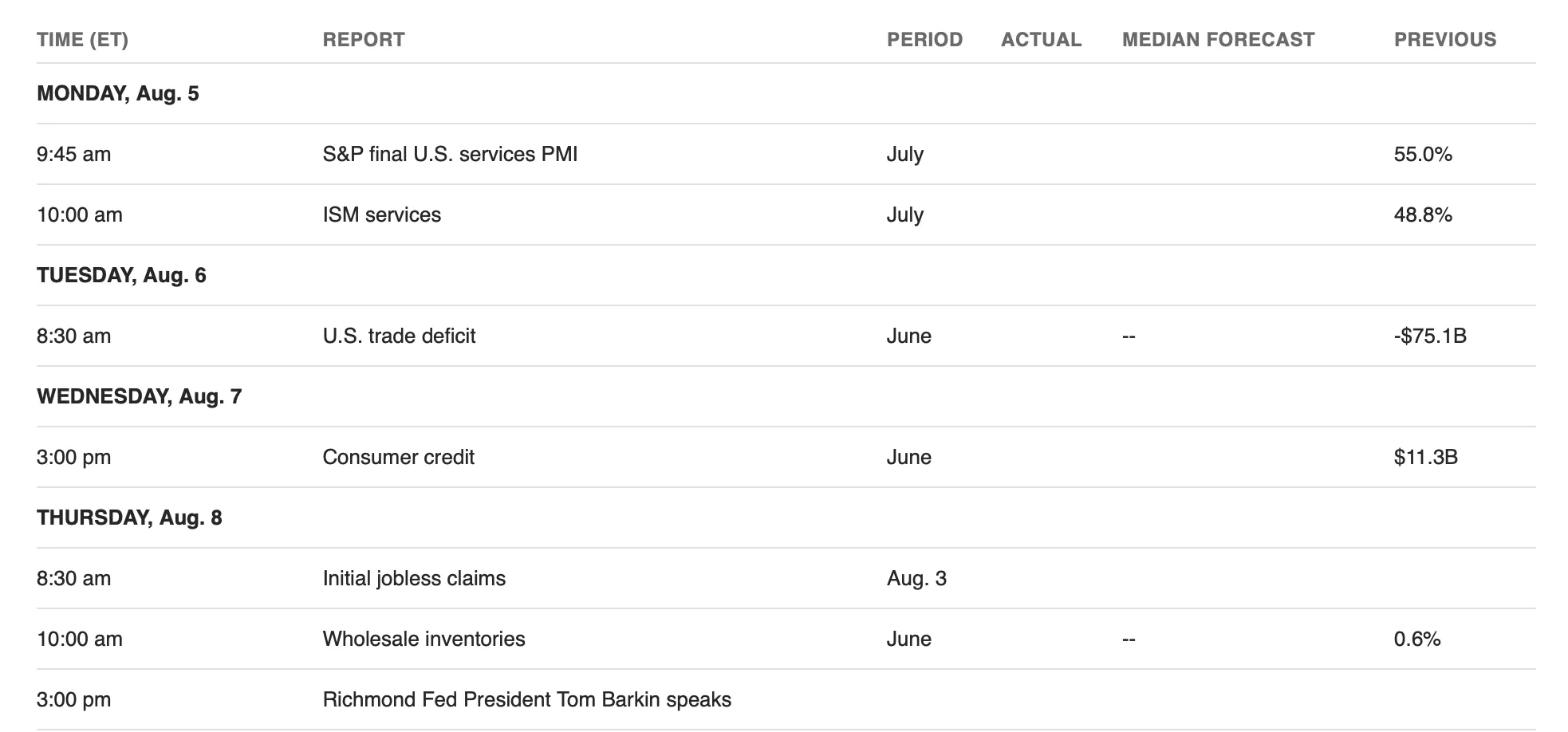

Four events will be of interest to crypto market players this week. They include:

S&P Final US Services PMI

Traders will watch the S&P Global Services PMI on Monday, which is compiled by the S&P Global. Sectors covered include consumer (excluding retail), transport and information, communication, finance, insurance, real estate, and business services.

In July, the S&P Global Services PMI beat expectations of 55, rising to 56 points, higher than June’s 55.3. This indicates expansion in the services sector, a positive sign for traditional markets, showing higher service demand.

US Trade Deficit

Markets also await the US trade deficit on Tuesday, which could cause TradFi and crypto volatility this week. Like the S&P Services PMI, the country’s trade deficit also pointed to increased services in June and more car exports.

The two positive data points to sharp increases in business inflows, reaching their quickest pace in over a year.

“The US is transitioning to a services economy, less manufacturing,” Lumida Wealth CEO Ram Ahluwalia said over positive services data.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

These lead to increased investment opportunities and improved economic conditions, boosting sentiment in traditional markets like stocks. The impact may not be as direct or significant on crypto compared to traditional markets. However, if the positive trajectory continues, capital could rotate into risk-on assets like crypto.

Positive economic data often influences investor sentiment in the crypto space. As traditional markets strengthen, investors may become more confident in the economy. This could increase risk appetite and lead to greater interest in alternative assets like cryptocurrencies.

Consumer Credit

The US Consumer Credit data for June will be released on Wednesday, July 7. The data reports outstanding credit extended to individuals. The data helps measure conditions in consumer credit markets and analyze the effects of monetary policy. In May’s report, released on July 8, consumer credit increased at a seasonally adjusted annual rate of 2.7%. Revolving credit increased at an annual rate of 6.3%, while non-revolving credit also increased at an annual rate of 1.4%.

The increase in consumer credit indicates that consumers are borrowing and spending more. In traditional finance markets, this is a positive sign for the economy. It suggests consumers are more confident about their financial situation, which explains the willingness to take on debt to make purchases.

If authorities report a similar trend in June, it would stimulate economic activity and drive corporate earnings, leading to higher stock prices. Nevertheless, there is a risk associated with higher consumer credit levels. If consumers become overleveraged and struggle to repay their debts, it could lead to defaults and financial instability.

This could negatively affect traditional finance markets by increasing volatility and investor uncertainty. Crypto, on the other hand, could benefit indirectly from the implied stronger overall economy. Increased economic stability and consumer activity could attract investors to alternative assets like cryptocurrencies.

Richmond Fed President Tom Barkin’s Speech

The Richmond Fed President Tom Barkin will speak on Thursday, August 8, giving insight into policymakers’ thinking and potentially inspiring traditional market and crypto volatility. He will also comment on what recent economic reports mean for future action from the central bank. The Federal Open Market Committee (FOMC) recently decided to keep interest rates unchanged at 5.25%—5.50% for the eighth consecutive meeting.

Jerome Powell, the Federal Reserve (Fed) chair, did not explicitly signal a September rate cut. He demonstrated increasing but cautious optimism about disinflation progress resuming in the second half of 2024.

“He is clearly expecting a correction of some kind or otherwise simply cannot see better investments than Treasury bills. The Fed needs to drop rates. They have been foolish not to have done so already,” X CEO Elon Musk said in a Sunday post.

Musk’s comments came following a lackluster jobs report last week, which raised concerns about an economic slowdown. Meanwhile, Wall Street banks advocate for aggressive interest rate cuts amid evidence that the labor market is cooling. Citigroup economists Veronica Clark and Andrew Hollenhorst, for example, anticipate “half-point rate cuts in September and November and a quarter-point cut in December.”

JPMorgan economist Michael Feroli echoed Clark and Hollenhorst, adding that there’s “a strong case to act” before the next meeting on September 18. According to Feroli, Powell may not “want to add more noise to what has already been an event-filled summer.”

Macro Data Drives Crypto Sell-Off

Meanwhile, crypto volatility has markets bleeding, with the total market capitalization down a stark 12%. Bitcoin is down 12.35%, trading for $53,000 at the time of writing, while Ethereum lost 20%.

Some ascribe the crash to the Japanese stock market suffering its worst losses since 1987. Market analyst Zach Jones associates the crash with Japan defending its Yen currency and dumping all of its Treasury Holdings (US-owned debt).

“Japan created an everything bubble in the 80’s/90’s. The bubble got so big that in the 30-40 years since their stock market has never gotten close to the highs of the bubble. The US economy has a 122% debt to GDP ratio which is insane. Japan has doubled that. They were between a rock and a hard place, either letting their currency collapse and experience a Great Depression-esque collapse or printing money and hyperinflating their currency. They chose to print hundreds of billions of dollars per day to defend their currency. This has been an inevitability to anyone who pays attention to markets,” Jones wrote.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Elsewhere, Republic ticket nominee for the November elections, Donald Trump, blames the recent financial markets crash on Kamala Harris, Joe Biden, and “inept US leadership.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Tokenized Gold Market Cap Tops $1.2 Billion as Gold Prices Surge

The market cap of tokenized gold has surpassed $1.2 billion, driven by soaring gold prices and a growing appetite for blockchain-based assets.

Rising interest in tokenized gold is part of a broader movement to modernize storage, trading, and utilization in financial markets.

Gold Meets Blockchain Amid Tokenization Revolution

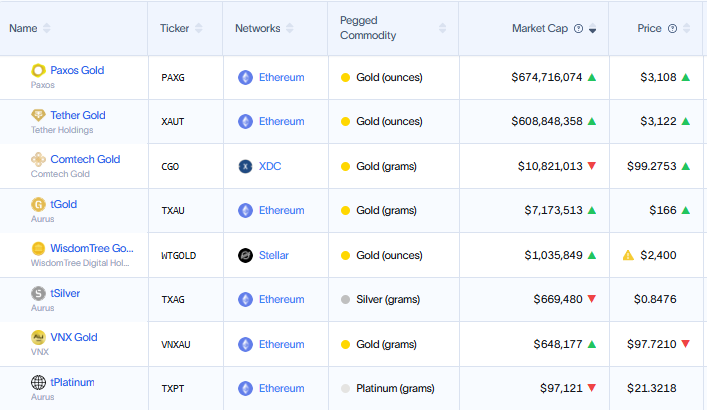

Gold price has reached historic highs above $3,000 per ounce. With this surge, digital representations of precious metals, such as Tether Gold (XAUT) and Paxos Gold (PAXG), capture investor interest.

Don Tapscott, co-founder of Blockchain Research Institute, argues that tokenized gold could transform the $13 trillion gold market by bringing transparency, liquidity, and new financial models.

Based on this assumption, he questioned why gold is still stored in vaults as it was in the 1800s. Meanwhile, assets like Bitcoin (BTC) and stablecoins have gone digital. He believes blockchain technology can revolutionize gold’s role in finance.

“The US government could even tokenize its gold reserves, track them immutably, and use them in innovative ways,” Tapscott explained.

He stated that such an outcome would enable fractional ownership, on-chain verification, and increased accessibility to investors worldwide.

Meanwhile, companies such as Paxos and Tether lead the charge in tokenized gold offerings. Paxos holds a 51.74% market share, while Tether’s holdings follow closely behind at 46.69%.

Publicly listed Matador Technologies is taking a unique approach by tokenizing gold on the Bitcoin blockchain. This offers investors a digital claim on both physical gold and limited-edition digital art.

“We believe that the next generation of financial powerhouses will likely emerge from the tokenization revolution. It’s still early, and the playing field is wide open. Matador and others have the bull by the horns,” Tapscott noted in a recent article.

Gold Tokenization in the US: A Bold Policy Shift?

The momentum behind tokenized gold has also reached the US government. Following President Trump’s March 5 executive order to establish a Strategic Bitcoin Reserve (SBR), policymakers are exploring ways to modernize gold holdings.

Treasury Secretary Scott Bessent has indicated that the US will move to “monetize its assets,” leading some to speculate that Fort Knox gold could be tokenized.

“US Treasury Secretary Scott Bessent says, all the GOLD is there, as he has no plans to visit Fort Knox or to revalue GOLD reserves in a sovereign wealth fund. He speaks on “Bloomberg Surveillance,” Erik Yeung noted.

Senator Cynthia Lummis has also proposed swapping some of the US government’s gold reserves for Bitcoin. US gold reserves are held at a book value of $42 per ounce—unchanged since 1973—despite the market price exceeding $3,000 per ounce.

While the US explores tokenization, geopolitical rivals China and Russia may take an even bolder step—launching a gold-backed stablecoin. Bitcoin maximalist Max Keiser recently highlighted BRICS’ plans to introduce a gold-backed stablecoin.

“The BRICS, principally Russia, China & India, will counter any attempt by the US to introduce a hegemonic, USD-backed stablecoin — with a Gold-backed stablecoin. The majority of the global market will favor a Gold-backed coin since it’s inflation-proof (unlike the USD) and doesn’t boost unwelcome US hegemony. India already runs on a defacto Gold standard and Sharia law in Muslim countries would dictate Gold over a USD riba-coin as well. To be clear, a BTC-backed stablecoin is not fit for purpose due to volatility,” Keiser stated.

Further, Keiser suggested that a stablecoin backed by gold would outcompete USD-backed stablecoins in global markets. He argues that gold is more trusted than the US dollar, tracks inflation effectively, and remains minimally volatile compared to Bitcoin’s price swings.

Russia’s recent rejection of Bitcoin for its National Wealth Fund in favor of gold and the Chinese yuan adds weight to this theory.

With an estimated 50,000 tonnes of combined gold reserves, China and Russia could leverage blockchain technology to introduce a new gold-backed digital asset. Such an action would challenge the US dollar’s dominance in global trade.

Gold vs. Bitcoin: The Safe Haven Debate Intensifies

Gold’s record-breaking rally has reignited debates over its role as a safe-haven asset compared to Bitcoin. Some analysts speculate that Bitcoin could soon follow gold’s trajectory, setting new all-time highs.

However, in economic uncertainty and President Trump’s 2025 tariff policies, gold remains the preferred safe-haven asset. Historically, gold has been the go-to store of value during trade wars and inflationary periods. Meanwhile, Bitcoin’s volatility raises concerns for risk-averse investors.

Despite these differences, the rise of tokenized gold highlights a convergence between traditional and digital finance. As financial markets advance and investors rebalance their portfolios, gold and Bitcoin will likely coexist in a contemporary monetary system.

Whether through tokenization, gold-backed stablecoins, or government-led blockchain initiatives, the financial playing field is shifting.

As traditional institutions increasingly adopt blockchain, the stage is set for transforming how the world perceives, trades, and stores gold relative to Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Institutional Risk Aversion Drives $218 Million Bitcoin ETF Outflows

Bitcoin ETFs (exchange-traded funds) continue to record negative flows this week as President Trump’s Liberation Day countdown continues.

Sentiment is cautious across crypto markets, with traders and investors adopting a wait-and-see approach.

Bitcoin ETF See Outflows Amid Investor Caution

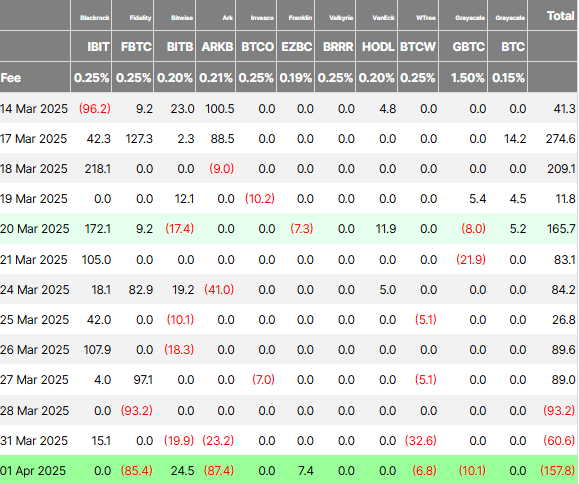

Data on Farside Investors shows two consecutive days of net outflows for Bitcoin ETFs since Monday. Financial instruments from Bitwise (BITB), Ark Invest (ARKB), and WisdomTree (BTCW) were in the frontline for Monday’s $60.6 million outflows, with only BlackRock’s IBIT seeing positive flows.

Meanwhile, Tuesday saw even more outflows, approaching $158 million, with Bitwise and Ark Invest leading the charge. Then, on April 1, BlackRock’s IBIT recorded zero flows. Meanwhile, Ethereum ETFs recorded net outflows of $3.6 million, data on Farside shows. This suggests a cautious sentiment among institutional investors.

“The Spot Bitcoin ETFs saw $157.8 million outflow yesterday. The Spot Ethereum ETFs saw a $3.6 million outflow. Institutions are reducing risk ahead of today’s tariff announcement,” analyst Crypto Rover noted.

Indeed, sentiment suggests traders are exercising caution, choosing to remain in “wait-and-see” mode. The caution comes ahead of Trump’s Liberation Day announcement, which is due later in the day on April 2.

With POTUS poised to unveil sweeping new tariffs, traders and investors across financial playing fields wait to see the scope of an onslaught that could spark a global trade war. Specifically, there is generally very little information about the tariffs’ specifics, which creates uncertainty regarding their impact on the broader economy and the crypto market.

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people close to the matter.

Despite the lack of clarity, it is understandable why investors would be cautious considering the impact of previous tariff announcements on Bitcoin price. Meanwhile, analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen,” economic analyst Alex Krüger predicted.

While sentiment is cautious in the crypto market, some investors are channeling toward gold as a safe haven. A Bank of America survey showed that 58% of fund managers prefer gold as a trade war safe haven, while only 3% back Bitcoin.

These findings came as institutional investors cite Bitcoin’s volatility and limited crisis-time liquidity as key barriers to its safe-haven adoption. Trade tensions have historically driven capital into safe-haven assets.

With Trump’s Liberation Day announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

Nevertheless, despite Bitcoin’s struggle to capture institutional safe-haven flows, its long-term narrative remains intact. This is seen with Bitcoin supply on exchanges dropping to just 7.53%, the lowest since February 2018.

When an asset’s supply on exchanges reduces, investors are unwilling to sell, suggesting strong long-term holder confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Could Serve as Inflation Hedge or Tech Stock, Say Experts

Bitcoin may be a useful hedge against inflation in the near future as market uncertainty is growing. In the long run, it may also be useful to envision Bitcoin differently, treating it as a barometer for the tech industry.

Standard Chartered’s Head of Digital Assets Research and WeFi’s Head of Growth both shared exclusive comments with BeInCrypto regarding this topic.

Bitcoin: Inflation Hedge or Magnificent 7 Candidate?

Since the early days of the crypto space, investors have been using it as a hedge against inflation. However, it’s only recently that institutional investors are beginning to treat it the same way. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, the trend of Bitcoin as an inflation hedge is increasing.

Still, this view may be too narrow in a few ways. Since the Bitcoin ETFs were first approved, BTC has been increasingly well-integrated with traditional finance. Kendrick noted this, saying that it is highly correlated with the NASDAQ in the short term. He claimed that Bitcoin might represent more than an inflation hedge, instead serving as an ersatz tech stock:

“BTC may be better viewed as a tech stock than as a hedge against TradFi issues. If we create a hypothetical index where we add BTC to the ‘Magnificent 7’ tech stocks, and remove Tesla, We find that our index, ‘Mag 7B’, has both higher returns and lower volatility than Mag 7,” Kendrick said in an exclusive interview with BeInCrypto.

This comparison is particularly apt for a few reasons. Tesla’s stock price is heavily entangled with Bitcoin, but it’s also been dropping due to political controversies. If Bitcoin were to replace Tesla’s position in the Magnificent 7, it may be a welcome addition. Of course, there is currently no mechanism to cleanly treat Bitcoin as a similar type of product. That could change.

However, Bitcoin’s role as an inflation hedge might be more immediately relevant. As Trump’s Liberation Day approaches, the crypto markets are becoming increasingly nervous about new US tariffs. As Agne Linge, Head of Growth at WeFi, said in an exclusive interview, these fears are impacting all risk-on assets, Bitcoin included.

“Crypto markets are closely tracking investor sentiment ahead of Trump’s…tariff announcement, with growing concerns over the potential economic impact. Bitcoin’s increasing correlation with traditional markets has amplified its exposure to broader macroeconomic trends, making it more sensitive to the risk-off sentiment that has affected equity markets,” Linge claimed.

She went on to state that US economic uncertainty was at record levels, surpassing both the 2008 financial crisis and the pandemic in April 2020. In these circumstances, recent inflation indicators are showing expected rates above expectations.

In such an environment, the crypto market is sure to take a hit, but traditional finance and the dollar is also in great jeopardy. All that is to say, Bitcoin is likely to be a solid inflation hedge in the near future. Even if it falls dramatically, it has worldwide appeal and the ability to rebound.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin21 hours ago

Bitcoin21 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market21 hours ago

Market21 hours agoCoinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

-

Altcoin19 hours ago

Altcoin19 hours agoWill XRP, SOL, ADA Make the List?

-

Bitcoin22 hours ago

Bitcoin22 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Market14 hours ago

Market14 hours agoEthereum Struggles to Break Out as Bear Trend Fades

-

Market20 hours ago

Market20 hours agoEthereum Reclaims Top DeFi Spot As Solana DEX Volume Drops

-

Market13 hours ago

Market13 hours agoHow Did UPCX Lose $70 Million in a UPC Hack?