Market

Bitcoin Layer-2 Solutions Face Viability Issues

Bitcoin Layer-2 (L2) solutions have recently garnered significant attention within the crypto community. However, a new report highlights potential challenges regarding their long-term viability.

Layer-2 solutions aim to enhance the Bitcoin blockchain’s scalability and speed by processing transactions off the main chain. Despite their promise, these solutions might encounter issues related to high data posting costs.

High Data Costs Could Hinder Bitcoin Rollups’ Long-Term Viability

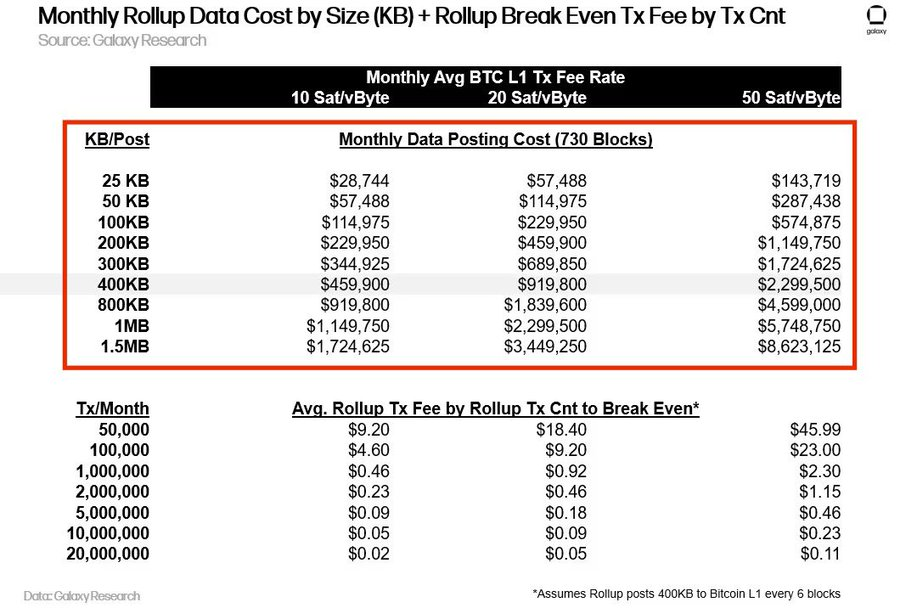

According to Galaxy Research, Bitcoin rollups, which rely on Bitcoin for data availability, may struggle with elevated data posting costs. The limited 4MB blockspace on the Bitcoin network creates a scarcity that could impact these solutions.

Rollups often need to post ZK-Proof outputs and state differences every 6-8 blocks. Each transaction can use up to 400KB (0.4MB) of blockspace, potentially consuming 10% of a full block. This high usage could lead to substantial costs if rollups utilize the entire 4MB.

For context, Galaxy Digital noted that the Taproot Wizards team’s first 4MB Bitcoin transaction (block 774,628) incurred a fee of $147,000. So, for these activities to be sustainable, the L2 solutions must generate significant revenue from transaction fees. However, a higher revenue requirement could increase transaction fees, possibly making them unaffordable for some users.

Alex Thorn, the head of research at Galaxy Research, explained that competition for Bitcoin blockspace might drive up Layer-1 (L1) transaction fees, affecting all users, including rollups. He furthered that a rollup posting its data to Bitcoin directly could be spending an average of $27.6 million annually or more.

“Our research suggests there are 65 such projects currently in development, but both blockspace & fee markets make it impossible for them all to launch. Only the strongest [will] survive,” Thorn stated.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Considering this, Galaxy Digital predicted that Bitcoin rollups might seek partnerships with Bitcoin miners for guaranteed block inclusion or use fee rate derivatives and alternative mining deals to manage volatile fee spikes. Some Bitcoin L2s could explore Layer-3 environments for transaction execution and combine L2s with Bitcoin L1 for data availability.

Meanwhile, Alexei Zamyatin, co-founder of Build on Bob, disagrees with the concerns raised. He argues that rollups might avoid these issues by using Optimistic Rollups, which could offer a more scalable solution with less frequent data posting on the main chain.

“Bitcoin rollups will likely have to use optimistic verification. Posting data to L1 is great but it’s a vanity metric if this explodes costs,” Zamyatin asserted.

Read more: Layer-2 Crypto Projects for 2024: The Top Picks

Despite these concerns, the popularity of Bitcoin L2s continues to rise. In the second quarter of 2024 alone, Bitcoin L2s collectively raised $94.6 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Surprise Move Sends ETH Up 15%

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,600 zone. ETH is now up nearly 15% and might attempt a move above the $1,680 zone.

- Ethereum started a decent increase above the $1,550 and $1,600 levels.

- The price is trading above $1,550 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1,470 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair tested the $1,680 resistance zone and might correct some gains.

Ethereum Price Jumps Over 12%

Ethereum price formed a base above $1,380 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,450 and $1,500 resistance levels.

The bulls even pumped the price above the $1,550 zone. There was a break above a key bearish trend line with resistance at $1,470 on the hourly chart of ETH/USD. The pair even cleared the $1,620 resistance zone. A high was formed at $1,687 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $1,384 swing low to the $1,687 high.

Ethereum price is now trading above $1,550 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,650 level.

The next key resistance is near the $1,680 level. The first major resistance is near the $1,720 level. A clear move above the $1,720 resistance might send the price toward the $1,750 resistance. An upside break above the $1,750 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,850 resistance zone or even $1,880 in the near term.

Are Dips Limited In ETH?

If Ethereum fails to clear the $1,650 resistance, it could start a downside correction. Initial support on the downside is near the $1,615 level. The first major support sits near the $1,580 zone.

A clear move below the $1,580 support might push the price toward the $1,535 support and the 50% Fib retracement level of the upward move from the $1,384 swing low to the $1,687 high. Any more losses might send the price toward the $1,480 support level in the near term. The next key support sits at $1,420.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,535

Major Resistance Level – $1,650

Market

Solana Price Attempts Recovery, Nears $120, But Needs A Push

Solana (SOL) has experienced significant volatility recently, with a marked decline following its failure to breach the $150 mark.

Over the last few days, Solana has struggled to break through certain resistance levels that have been affected by broader market trends. However, investor optimism appears to be driving recent price movements as SOL nears $120.

Solana Gains Support

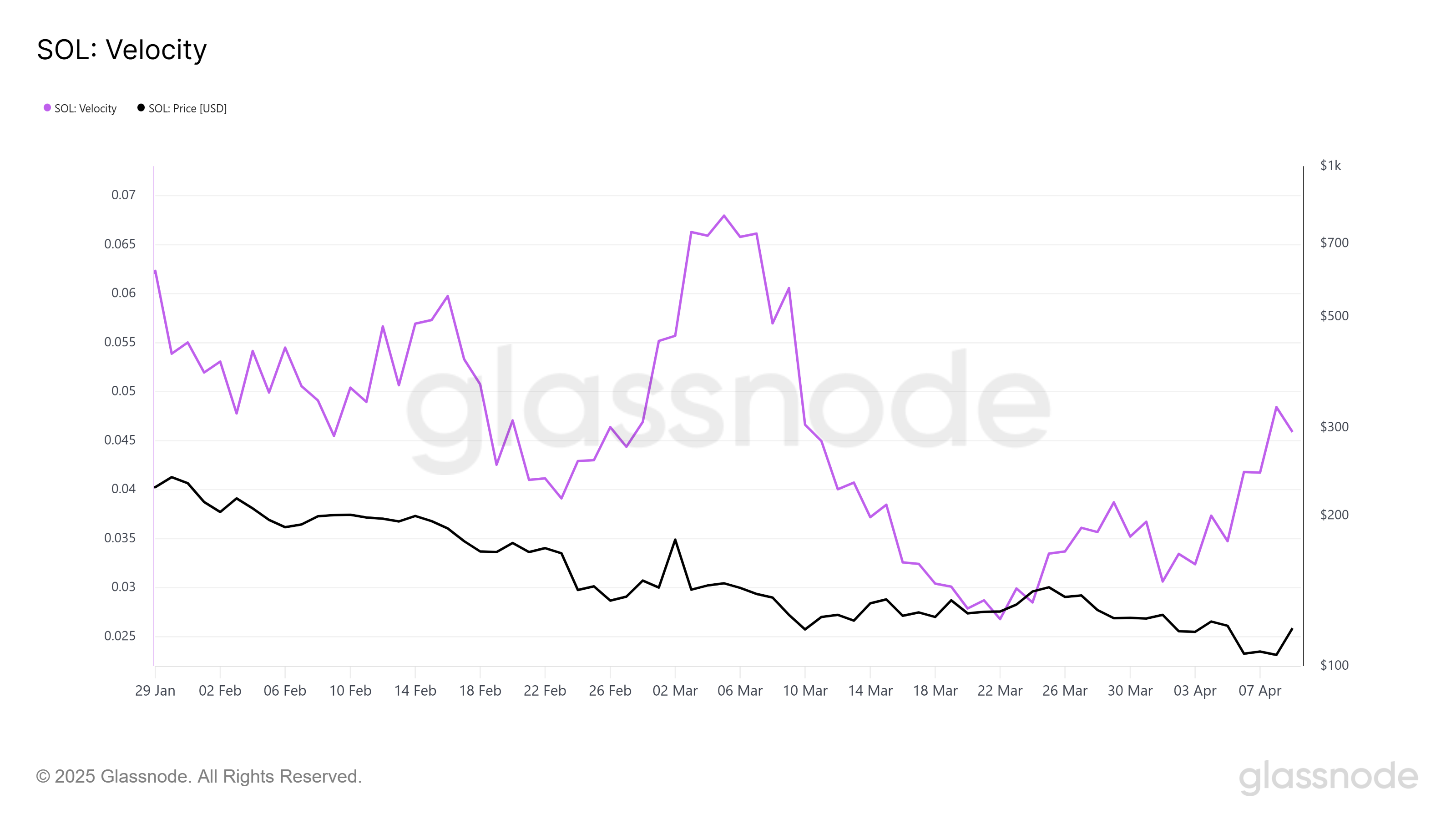

One of the indicators showing promise for Solana’s recovery is its velocity, which measures the pace at which tokens are being circulated. The velocity has reached a monthly high, signaling that the transaction of supply is accelerating.

Amidst recovering price, there’s a noticeable increase in the velocity at which tokens are being transacted, highlighting greater demand. Velocity and price tend to move in tandem. Typically, when both price and velocity rise together, it’s considered a bullish signal — a trend currently seen with Solana.

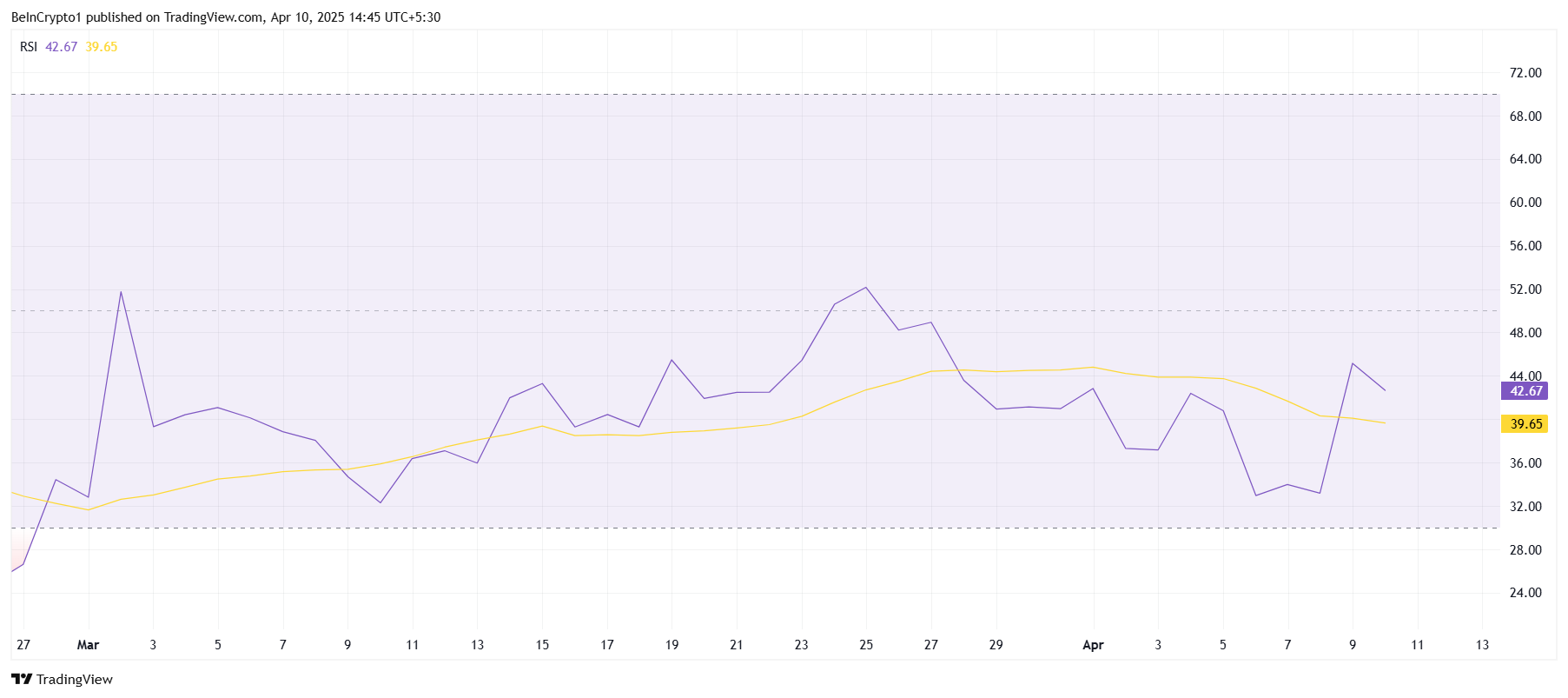

However, despite the favorable signs from the velocity, Solana’s macro momentum remains relatively weak. The Relative Strength Index (RSI) is still stuck in the bearish zone, under the neutral 50.0 mark.

While the broader market has seen some rallies, Solana’s RSI indicates a lack of significant buying momentum. This suggests that while some positive movement is occurring, broader macroeconomic factors may still be playing a limiting role.

The persistent bearish sentiment reflected in the RSI implies that Solana’s recovery may face continued challenges. Despite occasional price bounces, the altcoin has not yet experienced enough momentum to break free from the bearish pressure.

SOL Price Attempts Recovery

Solana’s price has risen by 8.2% in the past 24 hours, trading at $114. While it is showing signs of recovery, the altcoin remains under the key psychological price of $120. Beyond it lies a crucial resistance of $123, which has proven challenging in recent days.

If the bullish momentum continues, Solana could rise past $120 and aim for $123. Securing it as support would likely lead to further gains, pushing Solana toward the $135 mark. Investor confidence and continued supply distribution could support this upward movement.

However, if Solana fails to breach the $123 resistance, the price may retreat toward $105 or even lower. A drop below $105 could signal a deeper decline, with the altcoin potentially heading toward the $100 mark. This would invalidate the recent bullish outlook, extending the correction phase for Solana.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes $2.0 Breakout—Can It Hold and Ignite a Bullish Surge?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin17 hours ago

Bitcoin17 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market17 hours ago

Market17 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin21 hours ago

Altcoin21 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Altcoin20 hours ago

Altcoin20 hours agoIs Dogecoin Price Levels About To Bounce Back?

-

Market18 hours ago

Market18 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Altcoin22 hours ago

Altcoin22 hours agoEthereum Price Signals Strong Recovery After Forming Historical Pattern From 2020

-

Regulation17 hours ago

Regulation17 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market19 hours ago

Market19 hours agoFBI Ran Dark Web Money Laundering to Track Crypto Criminals