Market

Crypto Industry Losses Top $1 Billion Due to Major CeFi Hacks

According to a recent Immunefi report, the crypto industry has faced significant financial setbacks since the beginning of 2024. Losses due to hacks and fraud have exceeded $1.19 billion.

The losses recorded in the first seven months of this year showed a notable 16.3% increase compared to the same period in 2023, when losses amounted to $1.02 billion. These numbers highlight the persistent and growing threat cybercriminals pose to the crypto industry.

CeFi Suffers Most as Crypto Losses Skyrocket in July

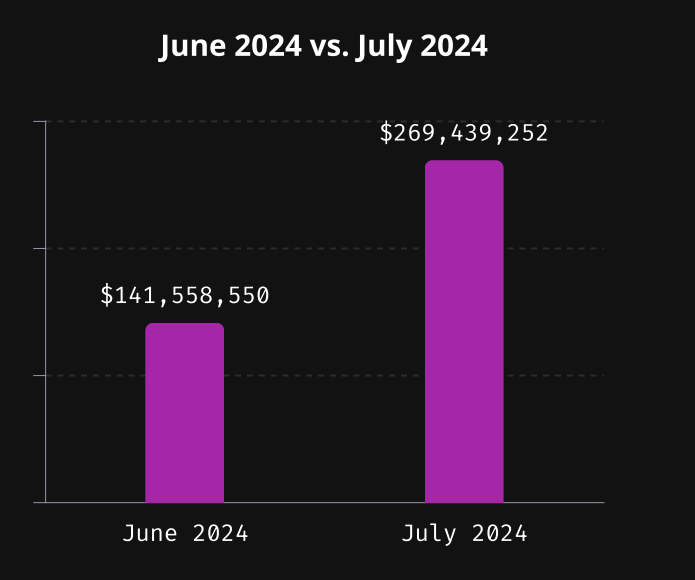

In July, Immunefi reported that the crypto sector suffered losses of $269.4 million in 14 separate incidents. This reflects a 90% increase from June, making July the second most damaging month of 2024. The most significant losses were in May, reaching $358 million.

Despite the monthly rise, the year-over-year comparison shows a 15.9% decrease in July losses. The bulk of these recent losses can be attributed to a major hack on the Indian centralized exchange WazirX, which suffered a devastating $235 million loss.

Read more: 15 Most Common Crypto Scams To Look Out For

Centralized finance (CeFi) has borne the brunt of these attacks, surpassing decentralized finance (DeFi) in terms of the total volume of funds lost. In July, CeFi accounted for 87% of the total losses, while DeFi platforms saw $34.4 million in losses spread across 13 incidents.

Furthermore, the report pointed out that hacks remain the predominant cause of these losses, with $266.5 million lost to such incidents in July alone. In comparison, fraud and scams only accounted for 1.1% of the total losses for the month.

Immunefi’s report also sheds light on the involvement of North Korean hacker groups, particularly the notorious Lazarus Group, in some of the most significant attacks. The WazirX hack, for instance, is suspected to be orchestrated by North Korean hackers.

The report reveals that Ethereum and BNB Chain were the most targeted blockchain networks in July. These blockchains collectively accounted for 71.4% of the total losses. Ethereum alone suffered seven attacks, representing half of the total incidents, while BNB Chain experienced three significant breaches.

ChainSwap’s founder and CEO, Fitzy, shared his perspective with BeInCrypto regarding this situation. He acknowledges that while Web3 technology drives innovation, it also opens avenues for financial crimes and fraud. He clarifies that Web3 tools aren’t inherently criminogenic but rather are exploited as new mediums by scammers.

“Web3 tools do not cause crime, it is just used as a new medium to commit some scams. The common thing across all these mediums is that the best way someone can protect themselves from scams and fraud is to proceed with caution. Victims of scams and fraud are usually the ones who do not know any better,” Fitzy explained.

Additionally, Slava Demchuk, CEO of AMLBot, pointed out that the significant losses due to hacker attacks and fraud in this industry show the urgent need for strong security measures. He suggested that beyond implementing general software security and encryption, conducting frequent audits and penetration tests is crucial.

“Personal training in handling sensitive data and stricter employee hiring processes are crucial as well. For instance, the Fractal ID hack exposed vulnerabilities in KYC data handling, leading to leaked information on the dark web. Similarly, the Coinspad hack illustrated the risks associated with inadequate employee vetting when a new, well-paid employee exploited the system from within,” Demchuk said.

Read more: Top 5 Flaws in Crypto Security and How To Avoid Them

Echoing Demchuk, Fitzy also cautioned individual investors to protect themselves from scams and fraud, particularly in decentralized applications.

“For centralized companies and systems, governments need to find new ways to monitor activities for this new asset class and companies around it. For decentralized applications, the best way for people to stay safe is to have caution and knowledge for themselves. Indicators like volume, number of people in the community, credible founders or partners – are all good indicators for an application that is likely safe to use,” he added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Winklevoss Urges Scrutiny of FTX and SBF Political Donations

Gemini co-founder Cameron Winklevoss has called for a renewed investigation into the dropped campaign finance charges against Sam Bankman-Fried, the convicted founder of the now-defunct FTX exchange.

Winklevoss emphasized the need for the incoming US Attorney General to address unresolved concerns about how these charges, tied to election interference involving stolen customer funds, were handled.

Winklevoss Demands Probe Into FTX-Linked Election Interference Accusations

In a November 23 post on X, Winklevoss expressed the belief that the campaign finance allegations remain a critical issue. He pointed to the Department of Justice under Merrick Garland, which declined to pursue these charges due to extradition technicalities with the Bahamian government.

According to Winklevoss, the DOJ chose not to work through the required legal processes to include the campaign finance violations in the indictment, leaving the matter unaddressed.

“Merrick Garland’s DOJ refused to pursue campaign finance charges against SBF because they were not included in his extradition…Since when has paperwork stood in between a prosecutor and adding more charges? Especially when it involves election interference with $100m of stolen customer funds,” Winklevoss stated.

Federal prosecutors initially dropped the campaign finance charge last year, attributing their decision to objections from Bahamian authorities. This charge involved over $100 million allegedly funneled from Alameda Research to fund more than 300 political contributions.

According to the indictment, these contributions, often made through straw donors or corporate funds, aimed to enhance Bankman-Fried’s influence in Washington, D.C.

The indictment also noted that Bankman-Fried became a top political donor in the 2022 midterm elections. He allegedly used the funds to gain favor with candidates across party lines, potentially shaping legislation favorable to FTX and the broader crypto industry.

Winklevoss’ remarks come as other key figures in the FTX collapse face their consequences. While Caroline Ellison and Ryan Salame received sentences of two years and 7.5 years, respectively, Gary Wang and Nishad Singh avoided prison by cooperating with prosecutors. Bankman-Fried is currently serving a 25-year prison sentence for fraud and other crimes.

Meanwhile, FTX has announced plans to implement its approved reorganization strategy starting in January. The exchange’s bankruptcy managers have recovered billions of dollars for creditors and are intensifying efforts to reclaim assets held by other entities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why a New Solana All-Time High May Be Near

Solana’s (SOL) price clinched a new all-time high of $264.39 during the trading session on November 23. Its price has since witnessed a 3% correction, causing the popular altcoin to exchange hands at $255.12 as of this writing.

Despite this pullback, the bullish bias toward the altcoin strengthens. An assessment of its daily chart highlights two reasons why a new Solana all-time high may be on the horizon.

Solana Bulls Relegates Its Bears

On the SOL/USD one-day chart, its price is positioned above the green line of its Super Trend indicator. This indicator measures the overall direction and strength of a price trend. It appears as a line on the chart, changing color based on the prevailing trend: green signifies an uptrend, while red indicates a downtrend.

When the Super Trend line is above an asset’s price, it signals a downtrend, suggesting continued bearish momentum. In Solana’s case, when the Super Trend line turns green and moves below the price, buyers are in control.

This green line often acts as a support level, where increased buying pressure can drive a rebound following price dips. For Solana, this support is currently set at $213.53.

Further, the coin’s price rests significantly above its Ichimoku Cloud, confirming this bullish outlook. This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price rests above the Ichimoku Cloud, it signals a bullish trend. It indicates that the asset is on an upward trend with the potential for further gains. In this case, the Cloud is a dynamic support zone below the price, reinforcing bullish sentiment.

SOL Price Prediction: New High on the Horizon

At press time, SOL trades at $255.12, below the new resistance at its all-time high of $264.39. If buying pressure strengthens further, the coin’s price will flip this level into a support floor and attempt to touch a new peak.

On the other hand, if profit-taking activity resurges, SOL’s price will shed some of its current gains to trade at $231.35. Should this level fail to hand, SOL’s price will fall toward the support formed by its Super Trend indicator at $213.53. This will invalidate the possibility of a new Solana all-time high in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WIF Shakes Off Setbacks As Bullish Resurgence Targets More Gains

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

-

Altcoin7 hours ago

Altcoin7 hours agoBTC Continues To Soar, Ripple’s XRP Bullish

-

Market20 hours ago

Market20 hours agoWhy the Altcoin Season May Be Underway

-

Altcoin23 hours ago

Altcoin23 hours agoSHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

-

Market22 hours ago

Market22 hours agoSEC Secures Record $8.2 Billion in 2024 Financial Remedies

-

Altcoin22 hours ago

Altcoin22 hours agoDogecoin Price Forms Extremely Rare And Bullish High Tight Flag Pattern, What To Expect Next

-

Altcoin21 hours ago

Altcoin21 hours agoCrypto Trader Records $2.5M Profit With This Token, Here’s All

-

Ethereum19 hours ago

Ethereum19 hours agoDeribit Moves $783M in Ethereum To Cold Storage: A Bullish Signal for ETH?

-

Market19 hours ago

Market19 hours agoSolana Sees Surge in Meme Coin Activity and Rising Fees