Market

Bitcoin volatility climbs, geopolitical tension rises

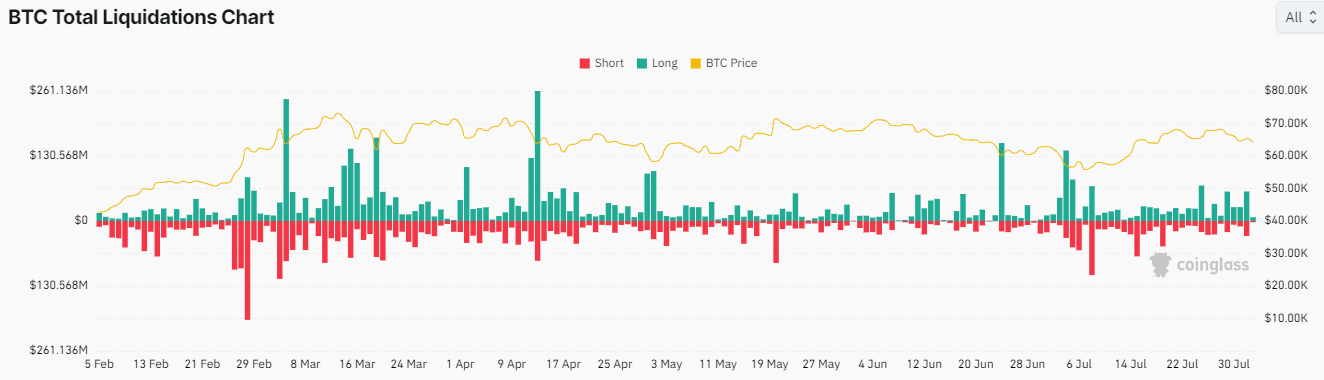

Bitcoin (BTC) volatility is at multi-month highs, with the price action whiplashing futures traders on both sides, long and short alike. It comes amid geopolitical tension, which inspires an increase in safe-haven demand.

TradFi and crypto market participants should brace for impact as the world watches developments in the geopolitical space.

Bitcoin Bends To Geopolitical Tension

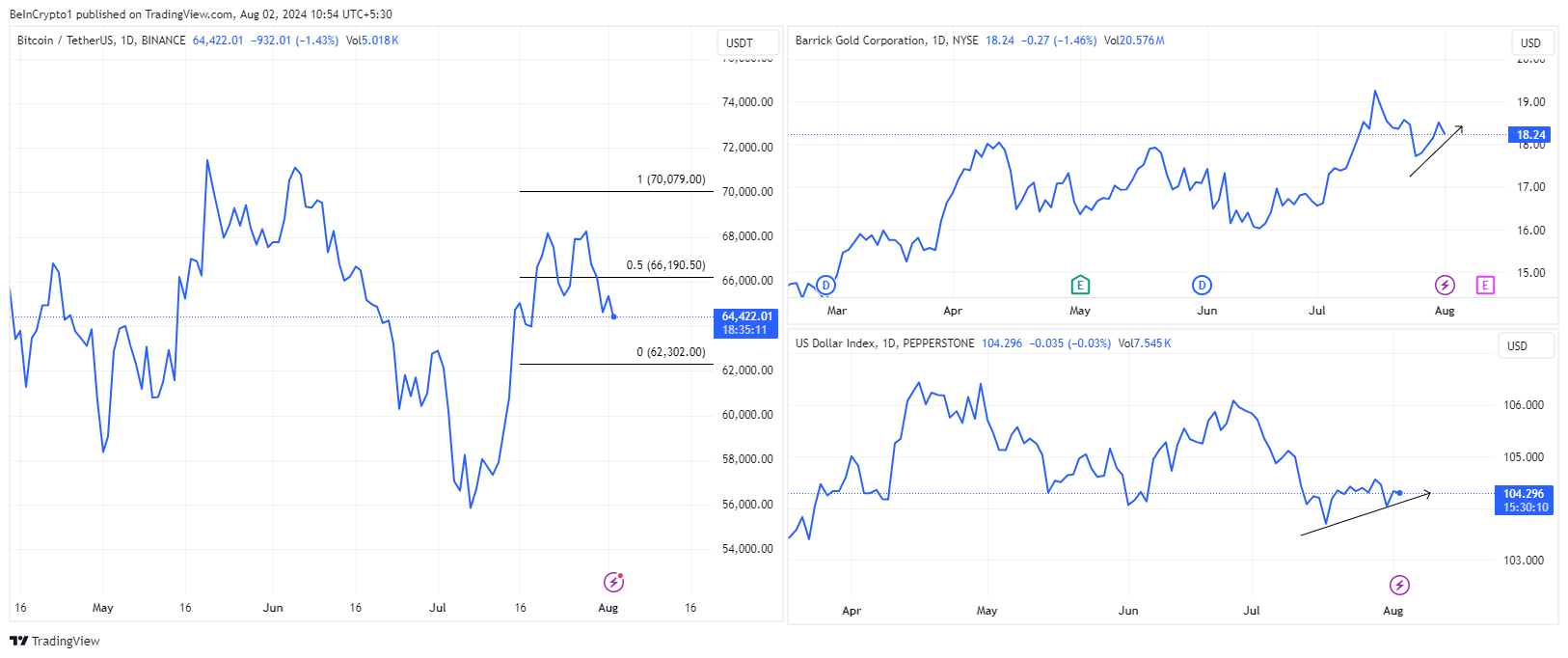

Bitcoin price volatility has been increasing, maintaining a steady climb since June 24. Data dashboard BiTBO shows that the last time volatility levels were this high was in early May. This metric indicates how rapidly the BTC price fluctuates within a certain period.

Coinglass data shows that volatility has led to the liquidation of over 90,000 traders, with total crypto market liquidations reaching $267.95 million. In the Bitcoin market, nearly $60 million in long positions were liquidated, compared to about $30 million in short positions.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

This comes amid ongoing turmoil between Israel and Hezbollah, creating a risk-off scenario. Recent reports indicate that Hezbollah fired a barrage of rockets into Israel’s Western Galilee late Thursday.

With major escalation and fears of a larger war, markets are experiencing growing uncertainty and soaring apprehension levels. A similar outlook occurred during the Russia-Ukraine conflict and the Iran-Israel saga. This demonstrates that financial markets, including crypto, are influenced by geopolitical tensions and conflicts that inspire fear and risk aversion.

“The magnitude of Iran’s attack on Israel will tell us how far the fall will go in Bitcoin and markets,” one analyst said.

Meanwhile, the US Dollar Index and precious metals like gold are rising. The US Dollar Index, which measures the USD’s value against six foreign currencies, rose 0.54% in the last week. This caused Bitcoin to crash by 5% due to its inverse relationship with the USD. The general atmosphere of fear and risk aversion is affecting Bitcoin as investors seek to reduce risk and move towards traditional safe-haven assets like gold.

In the next few days, therefore, it would be critical to monitor the conflict’s severity. Global response, market sentiment, and investor behavior will also influence price action.

Nevertheless, geopolitical uncertainty or conflict may also favor alternative assets like Bitcoin. It could drive adoption, similar to what happened during the early months of the Russia-Ukraine conflict.

Read more: Top 9 Crypto-Friendly Countries For Digital Assets Investors

nvestors may turn to alternative assets like Bitcoin as a haven to protect their wealth from traditional market volatility. This could drive up the demand for Bitcoin and crypto in general, effectively increasing their value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can the SAND Token Price Touch $1?

The Sandbox (SAND) continued its bullish trend, hitting a new yearly high of $0.86 during Monday’s early Asian session. However, it has since pulled back by 14%, trading at $0.76 at press time.

Despite the recent surge, on-chain and technical indicators suggest that the much-anticipated $1 price target remains unlikely for now. Here’s why.

The Sandbox’s Long-Term Holders Book Profit

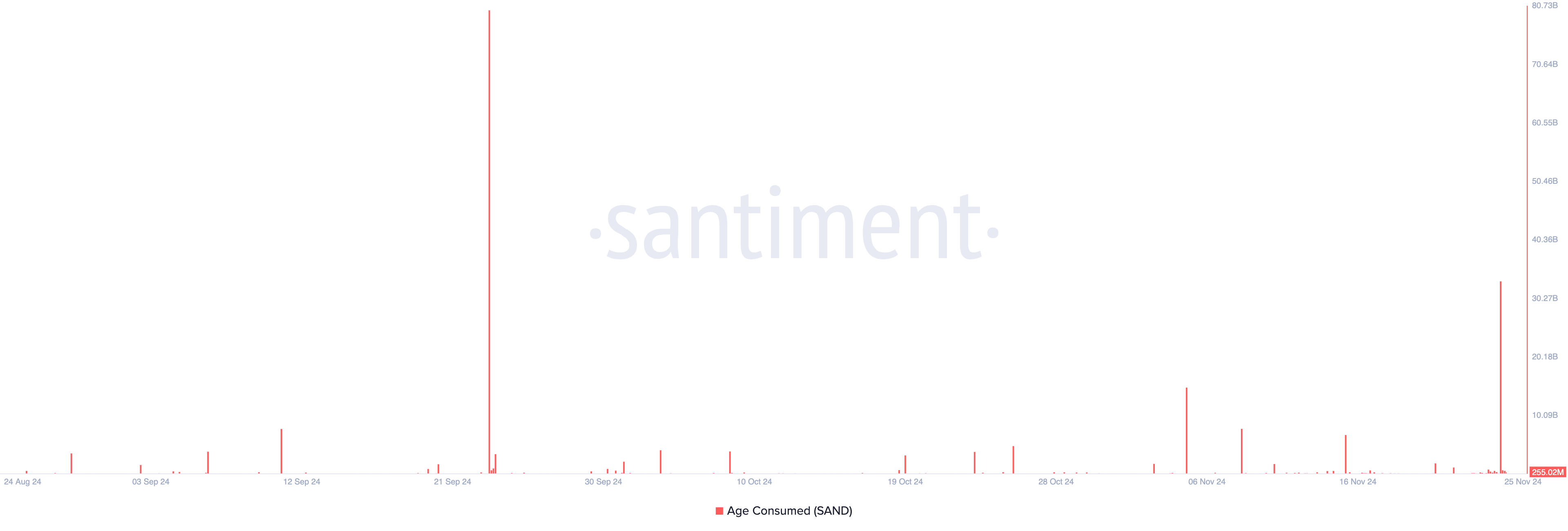

SAND’s price hike over the past week has prompted its long-term holders to move their previously dormant tokens around. This is reflected in the surge in the token’s age-consumed metric, which measures the movement of long-held coins. According to Santiment, this skyrocketed to a two-month high of 33.19 billion on Sunday.

This metric’s rally is notable because long-term holders are not in the habit of moving their coins around. Therefore, when they do, especially during periods of price uptick, it hints at a shift in market trends. Significant spikes in age-consumed during a rally like this suggest that long-term holders are offloading, possibly leading to increased selling pressure.

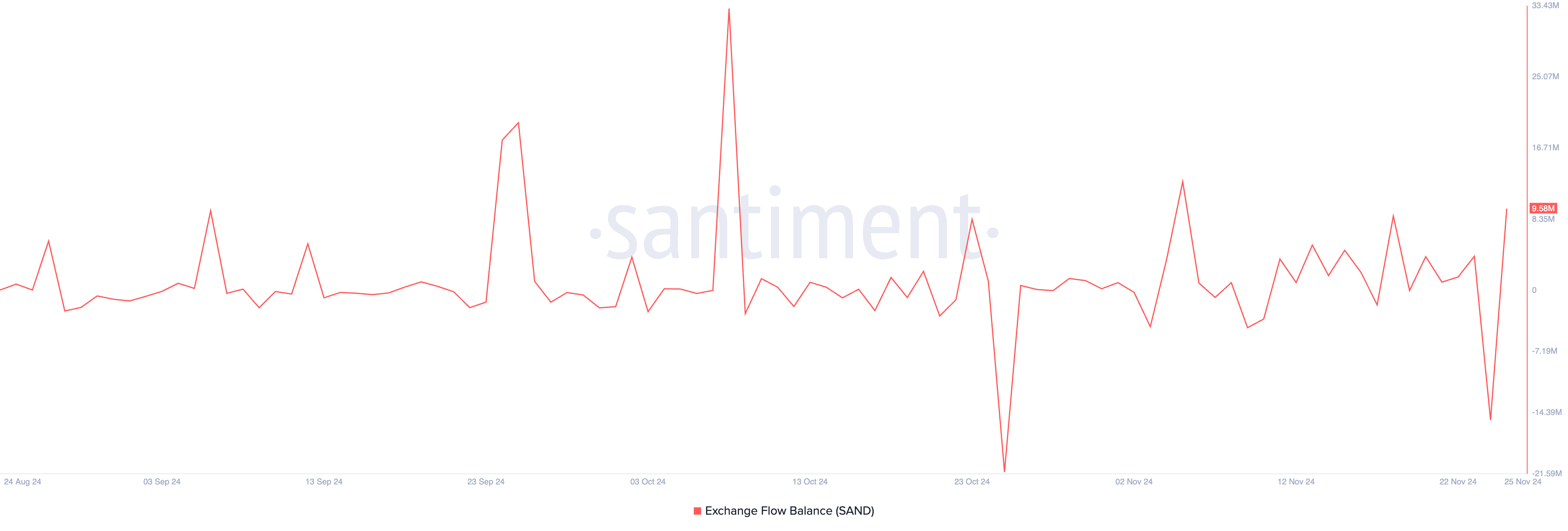

Notably, the rise in SAND’s Exchange Flow Balance over the past 24 hours confirms the selling activity. According to Santiment, this metric, which measures the net difference between the amount of an asset sent to exchanges and the amount of an asset withdrawn from exchanges over a specific period, has climbed by 162%.

This reflects an increase in the amount of SAND tokens being deposited to exchanges. It signals that holders are preparing to sell, possibly leading to downward price pressure.

On the daily chart, SAND’s Relative Strength Index (RSI) stands at 87.18, indicating overbought conditions. The RSI measures whether an asset is oversold or overbought, ranging from 0 to 100. Values above 70 signal that the asset is overbought and could face a decline, while values below 30 suggest it is oversold and might rebound.

With an RSI of 87.18, SAND is signaling overbought conditions, putting it at risk of a near-term pullback. If a decline occurs, its price could drop to $0.72. Increased selling pressure at this level may push SAND further down to $0.61, distancing it even more from the sought-after $1 target.

On the other hand, the SAND token price may reclaim its year-to-date high of $0.86 if the selling pressure wanes. This will invalidate the bearish thesis above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Traders Show Confidence in Solana Recovery After Sub-$260 Dip

On November 23, Solana’s (SOL) price hit a new all-time high, sparking speculation that the altcoin could rally as high as $300. While that did not happen, recent data shows that Solana traders are betting on a rebound.

Why are traders confident? This on-chain analysis explores whether these positions could deliver gains or if many are at risk of liquidation.

Solana Longs Keep Shorts Out of the Way

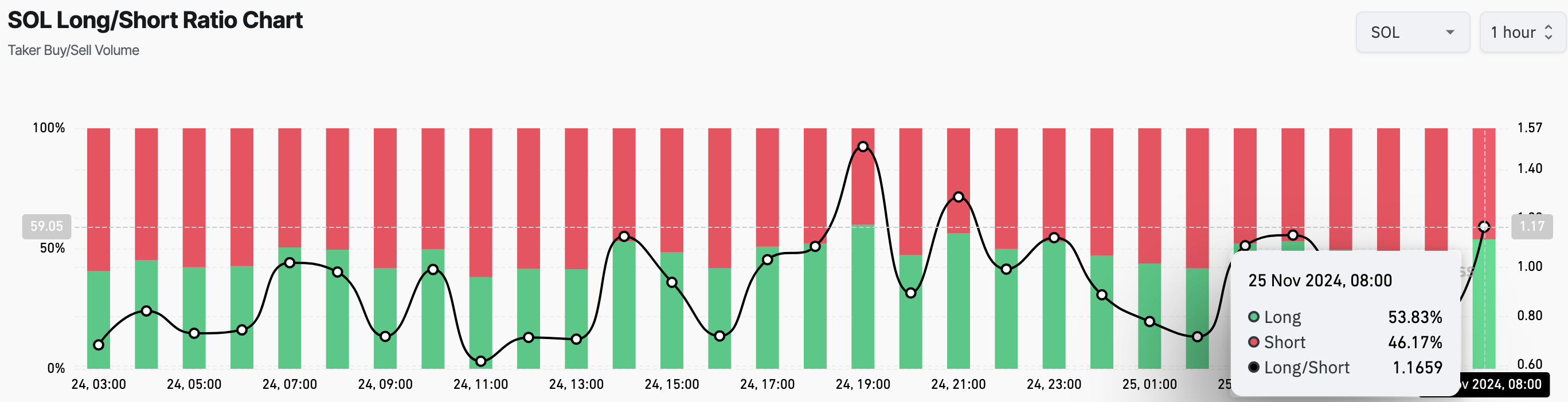

Data from Coinglass reveals that Solana’s Long/Short ratio on the 1-hour timeframe has climbed to 1.17. This ratio gauges market expectations, indicating whether most traders hold bearish or bullish positions.

When the ratio falls below 1, it indicates more shorts (sellers) than longs (buyers). Conversely, a ratio above 1 suggests a higher number of traders betting on a price increase compared to those anticipating a decline.

Currently, 54% of Solana traders hold long positions, while 46.17% expect a drop below $255. This indicates a bullish leaning among traders, with more optimism about the token’s price rising than falling.

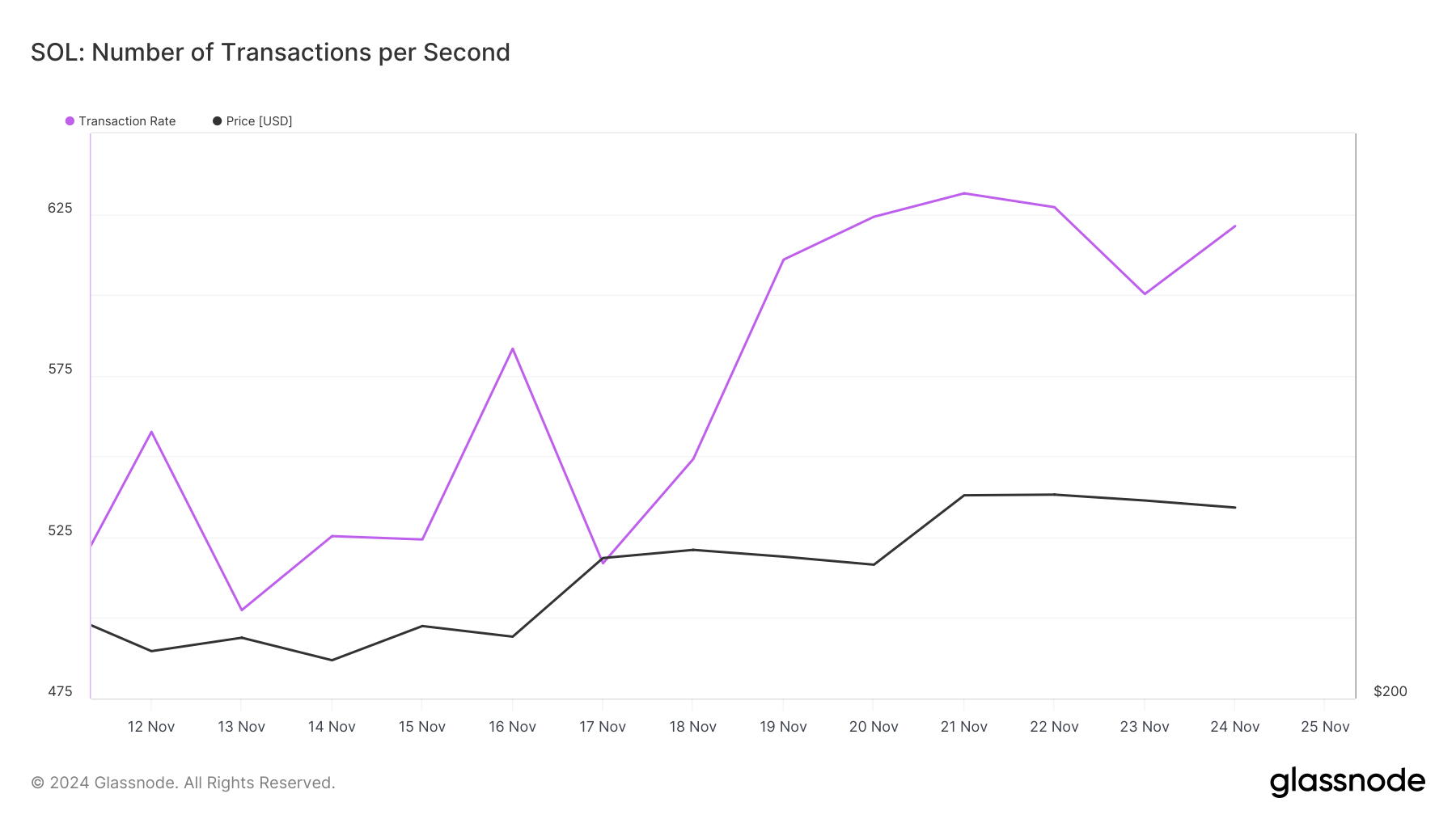

Additionally, it appears that these traders’ positions could prove profitable, thanks to an uptick in Solana’s Transaction Rate, which is the number of successful transactions processed per second on its blockchain.

An increasing Transaction Rate signals heightened user activity and engagement with the cryptocurrency, while a decline indicates reduced interest. According to Glassnode, Solana’s Transaction Rate has been climbing. If this trend continues, it could propel SOL’s price past its all-time high.

SOL Price Prediction: Upside Potential Remains

On the weekly chart, Solana’s price has surged above the 20 and 50 Exponential Moving Averages (EMAs), key indicators that measure trends. When the price sits above the EMAs, it signals a bullish trend, while a drop below them typically signals bearish momentum.

With SOL currently priced at $255, above both EMAs, the altcoin seems poised to continue its upward direction. The formation of a bull flag further supports this bullish outlook.

A bull flag is a continuation pattern, indicating that once the price breaks out, it’s likely to maintain the prior upward momentum. As seen below, SOL has already broken out of the consolidation pattern and is heading higher.

As long as the price remains above the upper trendline of the consolidation phase, it could rise toward $325. However, if selling pressure takes hold, this bullish scenario could shift. In that case, SOL might fall below $200.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Are Shiba Inu Holders Selling Their Coins?

The meme coin mania of the past few weeks pushed Shiba Inu’s (SHIB) price to an eight-month high of $0.000030 on November 12. Due to this hike, a significant portion of SHIB’s supply is now profitable.

However, as market sentiment shifts, many Shiba Inu holders are now opting to secure their gains by selling their SHIB coins.

Shiba Inu Holders Sell For Profit

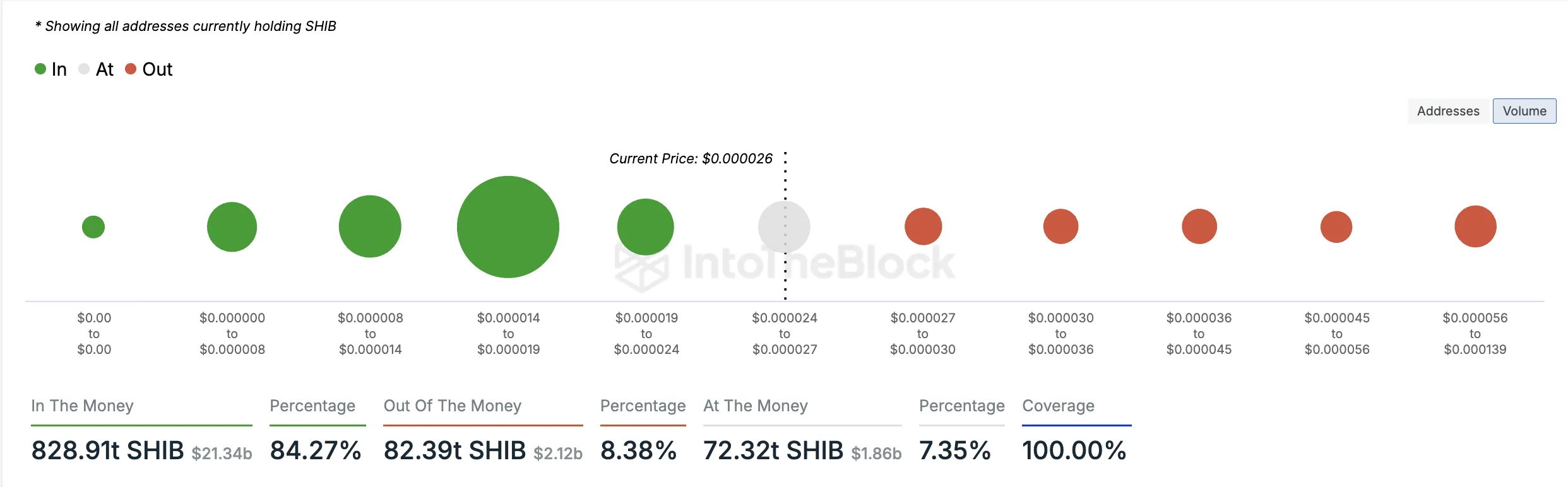

According to IntoTheBlock’s Global In/Out of the Money indicator, 829 trillion SHIB coins held by 851,000 addresses, which comprise 62% of all the meme coins holders, are “in the money.”

An address is considered “in the money” when the current market price of the asset it holds is higher than the average acquisition cost of the tokens in that address. This indicates that the holder would realize a profit by selling their holdings at the prevailing market price.

On the other hand, 82.39 trillion SHIB coins held by 398,000 addresses are “out of the money.” These are addresses that currently hold their coins at a loss.

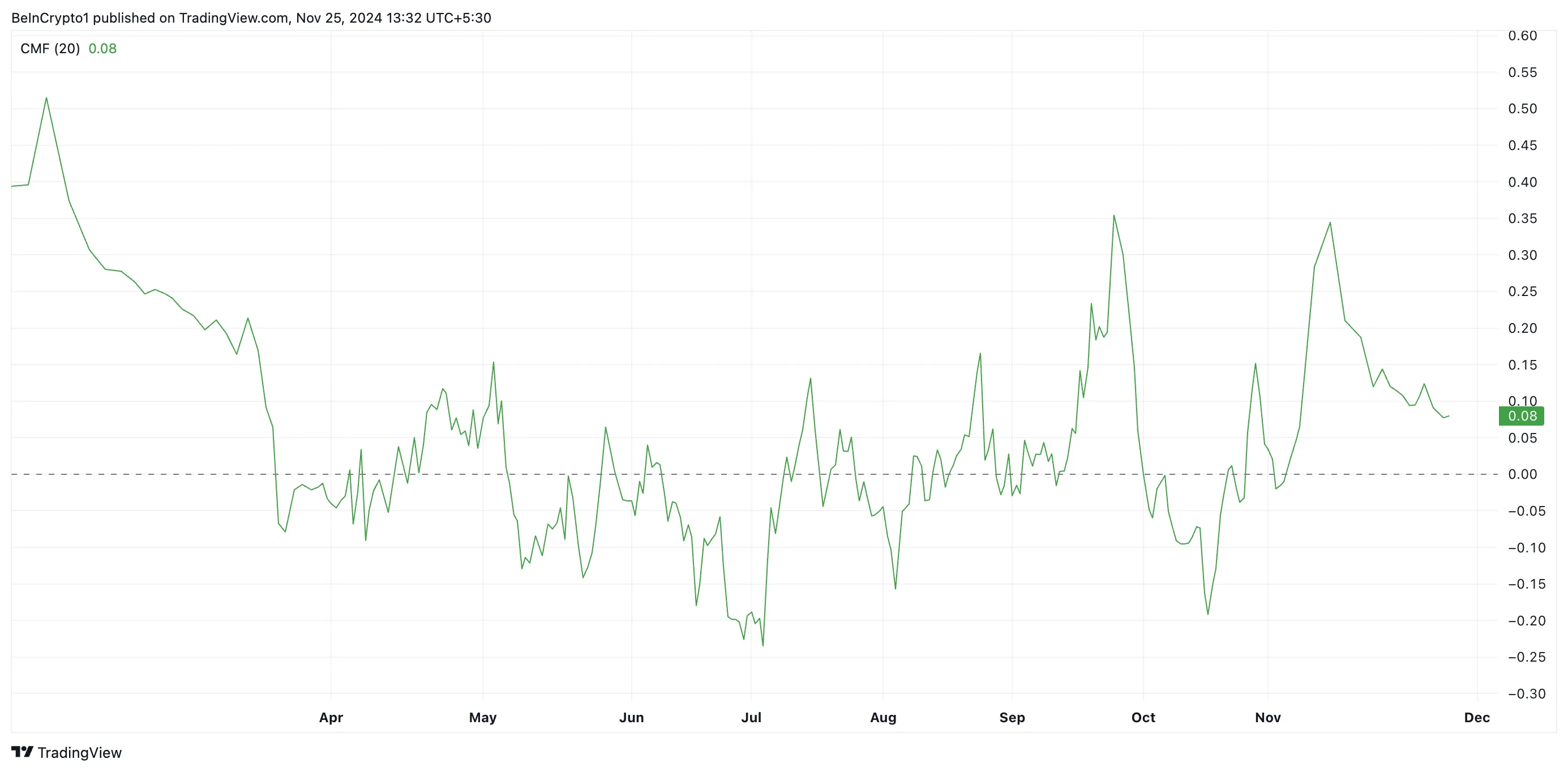

With 62% of all its holders now in profit, there has been a resurgence in profit-taking activity. This is reflected in SHIB’s declining Chaikin Money Flow (CMF). As of this writing, this indicator is at 0.08, trending downward toward the center zero line.

The CMF measures the market’s buying and selling pressure. When it falls toward the zero line, it signals weakening buying momentum, indicating that market participants are losing conviction in the uptrend.

Additionally, the setup of SHIB’s moving average convergence divergence (MACD) indicator confirms this bearish outlook. At press time, the coin’s MACD line (blue) rests below its signal line (orange).

This indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. When the MACD line falls below the signal line, it indicates a bearish trend and confirms the reversal of an uptrend. It suggests that selling pressure is increasing, and the asset’s price could decline further.

SHIB Price Prediction: A Decline To $0.000020?

SHIB is trading at $0.000025, marking a 4% decline in the last 24 hours. It remains above key support at $0.000022. If SHIB falls below this support, its price could drop further to $0.000020.

On the other hand, if profit-taking activity relaxes and the meme coin witnesses a resurgence in new demand, it will break above resistance at $0.000026 to reclaim its eight-month peak of $0.000030.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin21 hours ago

Bitcoin21 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market20 hours ago

Market20 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Altcoin6 hours ago

Altcoin6 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market19 hours ago

Market19 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

-

Market5 hours ago

Market5 hours agoHarmful Livestreams Prompt Ban Calls

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Correction Looms As Analyst Predicts Fall To $85,600

-

Bitcoin23 hours ago

Bitcoin23 hours agoAI Company Invests $10 Million In BTC Treasury