Altcoin

Mantle (MNT) Price Hit Hard After TVL Drops from All-Time High

Mantle (MNT), an Ethereum layer-2 (L2) project, has recently gained widespread attention.

MNT, its native cryptocurrency, has also outperformed tokens from other blockchains in the same category. However, this analysis focuses on a recent change.

Fall in Mantle TVL Drives Ripple Effects on the Network

According to DeFiLlama, Mantle’s Total Value Locked (TVL) reached an all-time high of $636.50 million on July 24. TVL, as it is commonly called, measures the value of assets locked or staked in a protocol.

The higher the TVL, the more trustworthy a network is perceived to yield gains. However, if the TVL decreases, it implies that market participants are withdrawing previously-locked tokens.

Seven days after reaching the peak, Mantle’s TVL has decreased to 589.13 million. The decrease highlights the growing prevalence of lower benefits and proceeds on the lending, staking, and cross-chain protocols developed under Mantle.

Read more: What Is Mantle Network? A Guide to Ethereum’s Layer 2 Solution

The decrease also seems to have affected MNT’s price. Some days ago, the cryptocurrency’s price climbed by double digits. But afterward, profit-taking tanked the upswing. Since then, MNT has struggled to rebound, as it trades at $0.75 at press time.

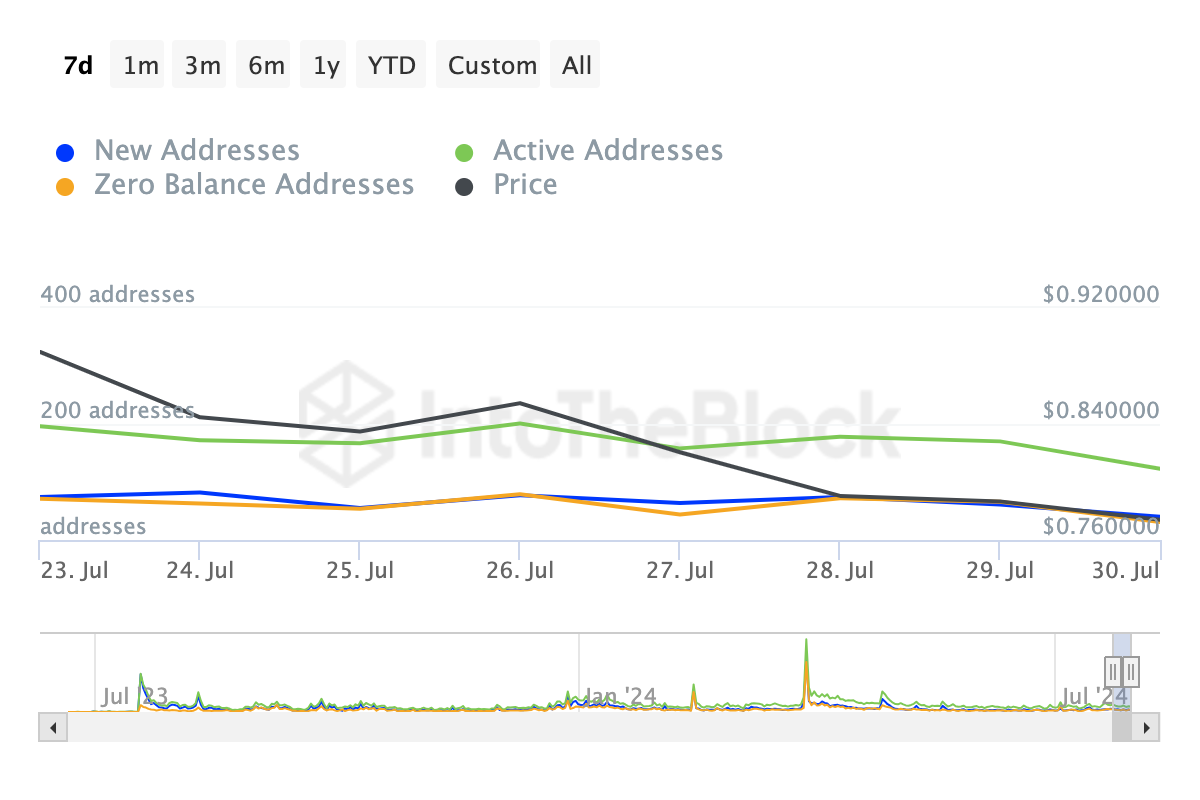

Additionally, data from IntoTheBlock indicates that Mantle network activity has faced challenges in recovering. To gain a clearer understanding of the network’s activity, BeInCrypto examines the condition of active and new addresses.

In simple terms, active addresses estimate the number of users on a blockchain. If the number increases, it implies that there is a lot of interaction with the native token, and this could be bullish for the price. A decline in the metric implies otherwise.

New addresses, on the other hand, track the number of first-time transactions on the blockchain. As a measure of traction, an uptick in the number suggests increased adoption, while a downturn implies decreased demand.

As shown above, active, new, and zero-balance addresses on Mantle have all declined in the last seven days, reflecting a drop in interaction with the MNT token. Should this continue, MNT’s price may find it challenging to rebound from its recent lows.

MNT Price Prediction: Downward Pressure Lingers

Based on the daily chart, the Moving Average Convergence Divergence (MACD) has dropped into negative territory. The MACD is a technical indicator that uses correspondence between two Exponential Moving Averages (EMAs) to determine momentum and price trends.

From the chart below, the 26-day EMA (orange) is above the 12-day (EMA), suggesting sellers’ dominance and a bearish momentum. If the shorter EMA is above the longer one, then the trend would have been bullish.

If the trend continues, MNT may not escape another drop and the Fibonacci retracement series gives an idea of the levels the token may reach. Should selling pressure increase, MNT’s price may decrease to $0.70 — where the 23.6% Fib level lies.

Read more: Layer-2 Crypto Projects for 2024: The Top Picks

However, a surge in buying pressure, combined with increased network activity, may invalidate the thesis. If this happens, MNT may bounce to $0.83 or as high as $0.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Altcoin

Dogecoin Code Appears In CyberTruck And Model 3 Website, Will Tesla Accept DOGE Payments For Cars Soon?

Dogecoin enthusiasts recently reignited discussions on the meme coin’s future after an observation shared on the social media platform X. KrissPax, a Dogecoin enthusiast, highlighted a curious detail that showed that DOGE is the only cryptocurrency currently embedded in the payment code for Tesla’s Cybertruck and Model 3 vehicles. Interestingly, this plays into the current bullish sentiment surrounding DOGE and rumors about Tesla’s plans to officially accept DOGE as a payment method.

Dogecoin Code In Tesla’s Payment: A Long-Standing Detail Revisited

The inclusion of Dogecoin in Tesla’s payment infrastructure has been known for some time, but the timing of its renewed focus has drawn attention. Notably, it comes during a notable price correction for the meme cryptocurrency.

Back in October 2023, reports surfaced about mentions of DOGE in the source code of Tesla’s Cybertruck checkout page. Particularly, crypto influencer MartyParty identified over 50 references to Dogecoin within the code.

However, the renewed interest stems from a recent post by Dogecoin enthusiast KrissPax on the social media platform X. He highlighted the presence of a DOGE code in Tesla’s payment systems, stating:

“Just remember, there is Dogecoin in the Cybertruck and Model 3 Tesla payment codes. Not any other crypto – just Dogecoin. Just waiting for Tesla to turn this option on!”

Although Tesla’s Cybertruck has since been launched, this year, the DOGE payment feature has not yet been activated. Nonetheless, its presence in the code suggests that Tesla is keeping the door open to allow DOGE transactions in the future.

What Does This Mean For DOGE?

Tesla CEO Elon Musk has long been a vocal supporter of Dogecoin, often relaying its use for everyday transactions. His enthusiasm for DOGE has been evident through numerous public endorsements, including Tesla’s decision in January 2022 to start accepting DOGE as payment for select merchandise. This endeavor created some sort of utility for DOGE, which is known for its meme status.

However, a final integration of DOGE as a payment method for Tesla cars would be the final straw in the electric vehicle maker’s creation of utility for the meme coin. A move of such magnitude would not only improve Dogecoin’s adoption but also open it up to another path of inflows, which would in turn benefit its price growth. Furthermore, other companies could follow in the footsteps of Tesla and make DOGE a payment method.

Interestingly, such a move would not be the first time Tesla accepted crypto payments for its vehicles. Back in 2021, Tesla started allowing customers to use Bitcoin as a form of payment. However, the initiative was short-lived, as Tesla discontinued Bitcoin payments just months later due to environmental concerns over the growing energy consumption of Bitcoin mining and transactions.

At the time of writing, the Dogecoin price is trading at $0.3842, down by 0.92 and 1.69% in the past 24 hours and seven days, respectively.

Featured image created with Dall.E, chart from Tradingview.com

Altcoin

5 Key Indicators To Watch For Ethereum Price Rally To $10K

The Ethereum price has surged more than 7% recently, with recent indicators hinting towards a potential ETH rally to $10K ahead. Notably, the recent surge also indicates a bullish momentum for the crypto ahead. So, here we explore some of the top indicators that could propel an ETH price surge ahead.

5 Indicators To Watch For Ethereum Price Rally Ahead

A recent X post from top on-chain analytics platform IntoTheBlock highlighted that Ethereum often follows Bitcoin’s rallies. While mixed signals exist, certain metrics suggest optimism. The platform noted that whales continue accumulating ETH, indicating confidence in the asset’s long-term growth. Increased transaction volumes and minimal selling pressure from holders are also contributing to Ethereum’s positive outlook.

In addition, one critical indicator is daily transactions, which recently rose to 1.22 million from 1.1 million three months ago. This slight uptick reflects growing network activity and rising demand for Ethereum.

Another key metric is large holder netflow, which tracks the buying activity of whales. When whales accumulate, it reduces sell-side pressure and supports price appreciation. Short-term holder behavior also warrants attention.

Meanwhile, increased activity among short-term investors often aligns with heightened retail interest. The holding time of transacted coins is another bullish sign. A steady hold time suggests that long-term investors are retaining their assets, keeping supply constrained as demand grows.

Lastly, exchange flows reveal sentiment trends. Significant outflows from exchanges typically indicate accumulation, signaling confidence among investors.

ETH Rally To $10K Imminent?

ETH price today was up nearly 8% and exchanged hands at $3,343, while its one-day trading volume rocketed 61% to $45.19 billion. In addition, Ethereum Futures Open Interest also rose more than 13%, indicating a strong market confidence towards the crypto.

Amid this, a top crypto market expert predicts ETH price to hit $10K in the coming days, sparking market speculations. However, despite that, a recent Ethereum price analysis hints that the top altcoin should soar past the $4K mark, before its further rally.

Having said that, a flurry of crypto market experts anticipates the crypto to continue its rally in the coming days. In addition, as BTC hits a new ATH recently, the market pundits expect the altcoins to follow suit, especially amid soaring optimism towards a clear regulatory path after Donald Trump’s election win.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Agency Reiterates “Digital Assets Securities” As XRP Eyes $2

Ripple SEC Lawsuit: The US Securities and Exchange Commission (SEC) hinted at “digital asset securities” claims amid the appeal in the Second Circuit Court. The move comes as XRP price surpassed $1 and expected a rally to $2 on Gary Gensler’s resignation and the end of XRP lawsuit during Donald Trump’s presidency.

US SEC Hints At Digital Asset Securities Claims In Ripple Lawsuit

In a PLI’s 56th Annual Institute speech last week, SEC Chair Gary Gensler reiterated “Bitcoin is not a security.” He also cleared the intention to continue considering XRP as security as he didn’t mention it along with “Bitcoin, ether, and stablecoins.”

“Our focus, rather, has been on some of the 10,000 or so other digital assets, many of which courts have ruled were offered or sold as securities. Putting this in context, aside from bitcoin, ether, and stablecoins, the rest of this market approximates $600 billion.”

Crypto lawyer James Murphy, also known as MetaLawMan slammed the US SEC for using the term “digital asset securities” again in an X post on Wednesday. Gensler and the SEC disregarded the court’s order on XRP security status in the Ripple SEC Lawsuit. This indicates that the agency failed to comply with its recent apology for using the term “crypto asset securities” in lawsuits.

Here we go again “digital asset securities.”

Unbelievable. https://t.co/vqCbEJ9PNh— MetaLawMan (@MetaLawMan) November 20, 2024

The regulator appealed the summary judgment on XRP sales by Ripple, XRP distribution to employees and others by the company, and XRP sales on exchanges by CEO Brad Garlinghouse and Executive Chairman Chris Larsen. However, the recent crypto narratives amid President-elect Trump has sparked speculation of the end of SEC v Ripple lawsuit.

Will XRP Lawsuit Get Dismissed?

The crypto community called for the dismissal of the long-running Ripple SEC lawsuit and resignation of SEC Chair Gary Gensler. Also, Ripple CEO Brad Garlinghouse said he is expecting a resolution or end of the SEC lawsuit after Trump’s win.

Ripple CTO David Schwartz cleared that the company is legally obligated to Ripple shareholders and not XRP holders. While Ripple can work around legal clarity around XRP and digital assets, the prices of digital assets don’t depend on the efforts of the company. Schwartz and lawyers assert XRP lawsuit will likely get dismissed or settled with $125 million.

Meanwhile, lawyer Bill Morgan asserted that the price of XRP is not influenced by Ripple’s efforts as seen by long-term investors. Notably, Gensler’s hint at resignation and the potential end of Ripple SEC lawsuit triggered an XRP price rally to $1.

XRP Price Rally to $2

XRP price is currently holding at 0.702 Fib retracement level. Any strong upside momentum can trigger the next move to the $1.6–$2. The strong sentiment in the XRP community and Trump’s crypto policies will maintain bullishness in the crypto market.

Popular analyst CredibleCrypto suggests XRP will probably going to make new ATH “a lot quicker than most are expecting.” XRP/ETH just reclaimed and retested a 4-year long-range in the monthly chart, which signals a 250% higher target. He predicted a target of $2.

XRP price jumped over 1% in the past 24 hours and 60% in a week, with the price currently trading at $1.13. The 24-hour low and high are $1.07 and $1.15, respectively. Furthermore, the trading volume has increased by 7% in the last 24 hours, indicating a rise in interest among traders.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market20 hours ago

Market20 hours agoThis is Why MoonPay Shattered Solana Transaction Records

-

Ethereum17 hours ago

Ethereum17 hours agoFundraising platform JustGiving accepts over 60 cryptocurrencies including Bitcoin, Ethereum

-

Regulation24 hours ago

Regulation24 hours agoBitClave Investors Get $4.6M Back In US SEC Settlement Distribution

-

Market23 hours ago

Market23 hours agoNvidia Q3 Revenue Soars 95% to $35.1B, Beats Estimates

-

Market22 hours ago

Market22 hours agoDogecoin (DOGE) Price Momentum Weakens Despite Rally

-

Altcoin22 hours ago

Altcoin22 hours agoCrypto Analyst Says Dogecoin Price Has Entered Parabolic Surge To $23.36. Here Are The Reasons Why

-

Market21 hours ago

Market21 hours agoSteady Climb Toward New Highs

-

Altcoin20 hours ago

Altcoin20 hours agoBTC Reaches $97K, Altcoins Gains

✓ Share: