Market

BNB Chain TVL Slumps 24% In Q2, Yet Vital Metrics Surge In Double Digits

The BNB Smart Chain (BSC) experienced a mixed performance in the second quarter (Q2) of the year as the broader cryptocurrency market cooled off after a strong price surge in March. While BNB, the native token of the BSC, remained mostly flat, down 5% quarter-over-quarter (QoQ), the network’s key metrics showed both positive and negative trends.

Binance Smart Chain Revenue Plunges

According to a recent report by market intelligence platform Messari, the chain’s revenue, which measures the total fees collected by the network, fell 28% QoQ to $48.1 million during Q2, although it was only down 8% year-over-year from $52.4 million in Q2 2023.

According to the report, this decline was largely driven by the decrease in BNB’s price, as revenue in the network’s native token terms declined 51% sequentially from 165,100 BNB to 81,300 BNB.

Related Reading

The report also highlighted a decline in network activity, with average daily transactions decreasing 10% QoQ to 3.7 million and average daily active addresses dropping 18% QoQ to 1.1 million. This trend was not isolated to the BSC, as on-chain activity decreased across most smart contract platforms in Q2 following a strong Q1.

Despite the overall decline, the report noted notable shifts in user preferences within the BSC ecosystem as decentralized exchange (DEX) Uniswap experienced a significant increase in daily transactions, up 630% QoQ, while the previously dominant PancakeSwap saw a 46% QoQ decrease.

Staking Surges 30%, TVL Drops

Messari also highlighted that the total BNB staked increased 30% QoQ to 30.4 million BNB, with the total dollar value of staked funds increasing 24% to $17.7 billion. This ranks the Binance Smart Chain as the third-highest Proof-of-Stake (PoS) network by staked value, though it still lags behind the Solana blockchain by a significant $38.4 billion.

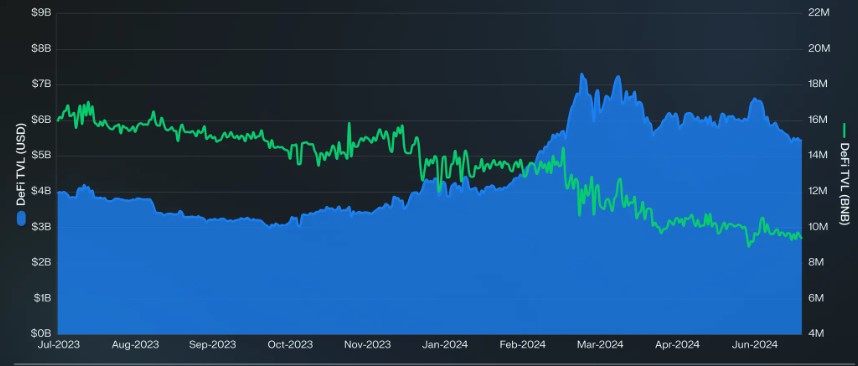

The BSC’s decentralized finance (DeFi) ecosystem, however, saw a decrease in total value locked (TVL), down 24% QoQ to $5.5 billion, primarily driven by a 41% QoQ drop in borrowing on the DeFi protocol, Venus Finance.

The company notes that this indicates that the overall decrease in value locked was partially due to the drop in value of the BNB token, which closed the quarter at a low of $567 after reaching an all-time high of $722 in March.

Despite these fluctuations, Messari reported that the Binance Smart Chain maintained the third-highest decentralized exchange (DEX) trading volume during the second quarter of the year, with $66 billion in total volume, trailing only Ethereum (ETH) and Solana.

BNB Price Analysis

At the time of writing, the BNB token was trading at $586, up over 2% in the last 24 hours. However, trading volume in the last 24 hours was down 3% to $830 million, according to CoinGeko data.

Since Friday, the token has been consolidating between $570 and the current trading price, following the lead of the largest cryptocurrencies on the market, after a failed attempt on Monday to break through its nearest resistance wall at $590, which is the last obstacle preventing a move upwards to the $600 milestone.

Related Reading

Conversely, the key level to watch for BNB bulls is the 200-day exponential moving average (EMA) noted on the daily BNB/USDT chart below, with the yellow line just below the current price, which could act as a key support for the token, potentially preventing further declines.

Featured image from DALL-E, chart from TradingView.com

Market

Exploring Hottest New Coins: FINE, CHILLGUY, and CHILLFAM

New coins such as FINE, launched three days ago, have seen their market cap reach $2.5 million. CHILLGUY, driven by TikTok hype, has amassed 120,000 holders and achieved $129 million in daily trading volume.

CHILLFAM, following in CHILLGUY’s footsteps, has quickly reached a $10 million market cap with a 300% price surge, showing the potential for continued interest in these emerging tokens.

This Is Fine (FINE)

FINE, launched on Pumpfun just three days ago and now graduated into Raydium, is attempting to capitalize on the growing trend of coins paired with animated video.

As of this writing, the coin boasts over 26,000 holders and a market cap of $2.5 million. However, it has experienced a steep decline, dropping more than 50%. If FINE can stabilize after this sharp drop, it may present an attractive entry point for traders eyeing a potential recovery.

FINE’s RSI is 35, indicating that it is approaching the oversold zone. This suggests that selling pressure may be reaching an extreme, potentially setting the stage for a reversal or bounce if buying interest returns. However, the current bearish momentum highlights the need for caution before expecting a recovery.

Just a chill guy (CHILLGUY)

CHILLGUY, a Solana-based meme coin that gained popularity through TikTok, has quickly risen to prominence in less than a week. The coin’s rapid adoption is evident in its impressive metrics, boasting over 120,000 holders and amassing 112,000 transactions per day.

The coin’s daily trading volume has surpassed $129 million, showcasing substantial market activity and strong interest from traders. This level of engagement highlights CHILLGUY’s potential to sustain its momentum if the hype continues to drive liquidity and participation.

CHILLGUY’s RSI sits at 52.3, indicating a neutral zone where neither buyers nor sellers have a dominant edge. This balanced sentiment suggests the market is stabilizing after initial volatility, leaving room for the token to move in either direction depending on future market activity and demand.

Chill Family (CHILLFAM)

CHILLFAM, inspired by the success of CHILLGUY, was launched just two days ago. With nearly 58,000 holders and a daily trading volume of $55 million, the token is gaining traction among meme coins enthusiasts on Solana.

Currently boasting a $10 million market cap, CHILLFAM has surged almost 300% in 24 hours, highlighting strong early interest. If it can maintain this momentum and sustain its $10 million market cap, the coin could potentially aim for $15 million or even $20 million.

CHILLFAM’s RSI is at 43, suggesting that the token is in a slightly bearish to neutral zone. This level indicates that the recent rally may be cooling off, providing a period of consolidation. If buying interest returns, it could reignite bullish momentum and push CHILLFAM toward higher valuations.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP To Hit $40 In 3 Months But On This Condition – Analyst

XRP remains one of the crypto market’s current trailblazers rising by 23.21% in the past 24 hours. Over the last two weeks, the prominent altcoin has recorded a 154% price gain establishing itself as the sixth-largest cryptocurrency with a market cap of $89.82 billion. With this current momentum and the crypto bull season still in its early stages, analysts remain highly bullish on XRP’s potential to reach lofty price levels.

Can XRP Repeat 2017 Historical Price Movement?

In an X post on November 22, an analyst with the username CryptoBull stated that XRP could trade at $40 over the next three months if the token mirrors its first prominent price surge from 2017.

Data from CoinMarketCap shows that XRP rose $0.006 to a market peak of $0.33 in early 2017, representing a 5,400% gain. Considering its recent price rally, the altcoin may be gathering momentum to reproduce such price movement in a highly anticipated crypto bull run, especially considering recent happenings.

Most notably, popular anti-crypto Securities and Exchange Commission Chairman Gary Gensler recently announced his intentions to resign on January 20, a move largely behind the current bullish sentiment among XRP investors considering the Commission’s long-lasting regulatory battle with Ripple. In fact, Gensler’s decision to leave the SEC has been described as the “best thing” for Ripple, which holds significant weight for XRP’s future.

Gensler’s resignation coincides with the inauguration of pro-crypto incoming US President-Elect Donald Trump who has promised to introduce a more friendly approach to digital asset regulation in the US. Aside from XRP finally being free from the regulatory scrutiny of the SEC, the potential introduction of a spot ETF under Trump’s pro-crypto regime also contributes to bullish sentiments on the altcoin’s profitability.

According to CryptoBull, if XRP follows its price explosion from early 2017, the token is expected to hit a price target of $1.96 in November, $6.30 in December, and $40 in January.

Price Resistance Levels In XRP’s Dream Surge

While XRP presents much potential for a high price target, CryptoBull predicts the token to face significant resistance at the $1.96 price region. If buying pressure proves sufficient to move past this level, the analyst expects XRP to confront another resistance at $3.84 which represents the token’s current all-time high price.

Considering the current robust bullish sentiments in the market, the altcoin is likely to move past these highlighted resistance levels. However, the token’s Relative Strength Index remains far in the overbought zone (91.73) indicating significant potential for a price pullback.

At the time of writing, XRP continues to trade at $1.78 reflecting a 79.57% gain in the past week. Meanwhile, the token’s daily trading volume is up by 103.57% and valued at $20.29 billion.

Featured image from Trackinsight, chart from Tradingview

Market

Kraken Eyes Token Expansion as Trump Promises Crypto Support

Kraken, one of the leading cryptocurrency exchanges, has announced plans to list 19 new tokens, including a range of popular meme coins, and to integrate three additional blockchains.

This development has sparked optimism across the crypto industry, with many anticipating a more favorable environment for token listings under the incoming Trump administration.

Kraken Plans to List 19 Tokens and Integrate 3 Blockchains

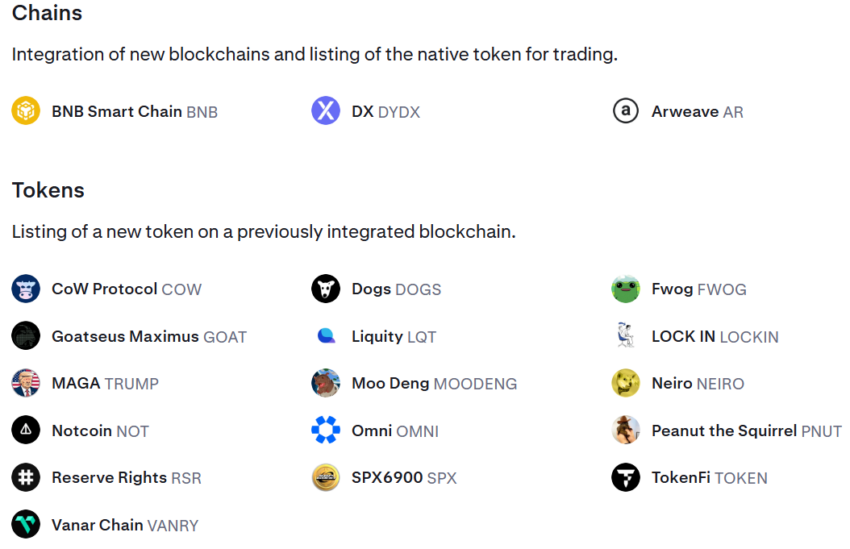

According to its recently published tradeable asset roadmap, Kraken will add the Binance Smart Chain, dYdX, and Arweave blockchains to its platform. Each integration will include support for the native tokens of these networks.

“Kraken lists BNB,” Binance founder Changpeng Zhao stated.

In addition to these three, Kraken plans to list 16 other tokens, primarily meme coins. Some of the notable additions include FWOG, TRUMP, NEIRO, DOGS, GOAT, PNUT, MOODENG, and COW, alongside eight others. These tokens belong to blockchains already integrated into Kraken’s ecosystem.

However, the exchange clarified that listing plans are not guaranteed. Funding and trading for these tokens will only begin after an official announcement through Kraken Pro’s account on X. The company warned that Depositing tokens prematurely could result in losses.

Kraken’s planned token expansion comes at a time when the exchange is navigating legal challenges. The US Securities and Exchange Commission (SEC) has accused Kraken of operating an unregistered securities exchange and offering staking services in violation of federal laws. The exchange has been actively defending itself against these allegations.

Despite regulatory hurdles, crypto industry stakeholders are optimistic that the incoming administration will ease restrictions on token listings. Many believe President-elect Trump’s pro-crypto stance could pave the way for a more supportive regulatory environment. Expectations include a clear regulatory framework, the potential establishment of a Bitcoin reserve, and a departure from the SEC’s regulation-by-enforcement approach.

Already, major US exchanges are capitalizing on the growing market optimism to expand their token listings. Coinbase recently listed PEPE and FLOKI, leveraging the ongoing meme coin trend.

Similarly, Robinhood expanded its offerings by adding tokens that the SEC previously described as securities — XRP, Cardano, and Solana. These moves reflect a broader effort by exchanges to capture market momentum and cater to diverse investor interests.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoADA Sights More Growth After Breaking $0.8119

-

Altcoin22 hours ago

Altcoin22 hours agoBTC at $98K, HBAR Surges 25% and XLM rises 55%

-

Altcoin14 hours ago

Altcoin14 hours agoAlameda Research Dumping Polygon (POL) Amid Price Spike, What’s Next?

-

Altcoin19 hours ago

Altcoin19 hours agoRipple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

-

Altcoin16 hours ago

Altcoin16 hours agoArthur Hayes Shills Another Solana Meme Coin, Price Rallies

-

Market15 hours ago

Market15 hours agoTrump Taps Pro-Crypto Scott Bessent for Treasury Secretary Role

-

Altcoin15 hours ago

Altcoin15 hours agoTerra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

-

Market14 hours ago

Market14 hours agoArtificial Intelligence Coins on the Rise: TFUEL, ZIG, and AKT