Market

XRP Price Hints at Weekly High: Are Bears Ready to Take Over?

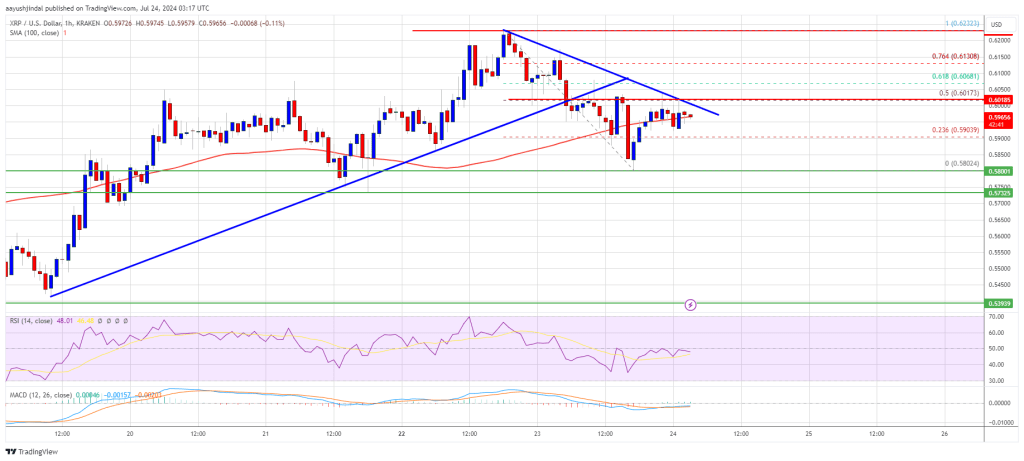

XRP price started a downside correction from the $0.6220 zone. The price declined below $0.600 and now consolidating above the $0.580 support.

- XRP price started a downside correction below the $0.600 zone.

- The price is now trading near $0.5950 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $0.600 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair could continue to rise if it clears the $0.600 resistance zone.

XRP Price Corrects Gains

XRP price extended its increase above the $0.600 resistance. However, it faced sellers near $0.6220 and recently started a downside correction like Ethereum and Bitcoin. There was a move below the $0.600 and $0.5950 levels.

The price even tested $0.580. A low is formed at $0.5802 and the price is now rising. There was a move above the $0.590 level. The price climbed above the 23.6% Fib retracement level of the recent decline from the $0.6232 swing high to the $0.5802 low.

The price is now trading near $0.5950 and the 100-hourly Simple Moving Average. If there is a fresh upward move, the price could face resistance near the $0.600 level. There is also a connecting bearish trend line forming with resistance at $0.600 on the hourly chart of the XRP/USD pair.

The trend line is close to the 50% Fib retracement level of the recent decline from the $0.6232 swing high to the $0.5802 low. The first major resistance is near the $0.6050 level.

The next key resistance could be $0.6220. A clear move above the $0.6220 resistance might send the price toward the $0.6350 resistance. The next major resistance is near the $0.6500 level. Any more gains might send the price toward the $0.680 resistance.

More Losses?

If XRP fails to clear the $0.600 resistance zone, it could start another decline. Initial support on the downside is near the $0.5850 level. The next major support is at $0.580.

If there is a downside break and a close below the $0.580 level, the price might continue to decline toward the $0.550 support in the near term.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.5850 and $0.5800.

Major Resistance Levels – $0.6000 and $0.6050.

Market

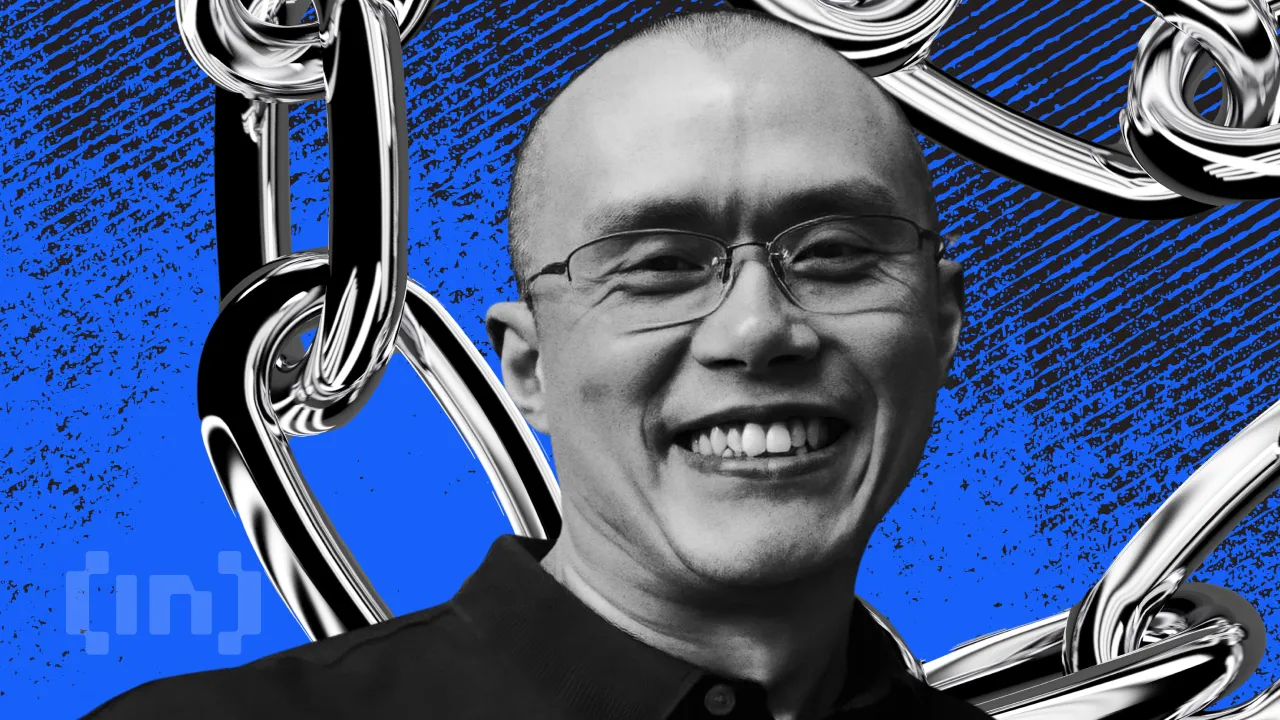

Binance Founder CZ Joins Pakistan Crypto Council as Advisor

Changpeng ‘CZ’ Zhao, the founder of Binance, has reportedly taken on a new role as Strategic Advisor to the Pakistan Crypto Council.

Pakistan’s local media suggests that the appointment was confirmed during a meeting held in Islamabad with top government officials.

CZ Joins Pakistan Crypto Council

The Finance Minister, Senator Muhammad Aurangzeb, reportedly led the session. Other attendees included the heads of Pakistan’s key financial and regulatory bodies—the Securities and Exchange Commission and the State Bank—and senior officials from the law and IT ministries.

According to the reports, Zhao also met separately with Pakistan’s Prime Minister and Deputy Prime Minister to discuss digital asset policy and blockchain adoption.

His involvement with Pakistan follows a recent agreement with the Kyrgyz Republic. There, he is advising on Web3 infrastructure and blockchain education.

Kyrgyzstan has also launched the A7A5 stablecoin, pegged to the Russian ruble. Both Kyrgyzstan and Pakistan are looking to develop their financial ecosystem around crypto to attract industry interest in the regions.

Meanwhile, CZ continues to engage with multiple governments on crypto regulation. He has been focused on building secure frameworks and enabling digital finance ecosystems.

BeInCrypto has contacted Binance about the reports and whether the company is involved in the initiative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low

The value of the leading altcoin, Ethereum, has plunged to its lowest point since March 2023, signaling a steep decline in market confidence. This has happened amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative strength against Ethereum.

ETH/BTC Ratio Hits 5-Year Low as Traders Flee

ETH’s price decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative value compared to BTC. When it rises, it indicates that ETH is outperforming BTC, either because the altcoin’s price is growing faster or the king coin’s price is falling.

Conversely, a decline like this suggests that the leading coin, BTC, is gaining strength relative to the top altcoin, ETH. It suggests that traders are moving capital into BTC, seeing it as a safer or more profitable investment at the moment despite its own price troubles.

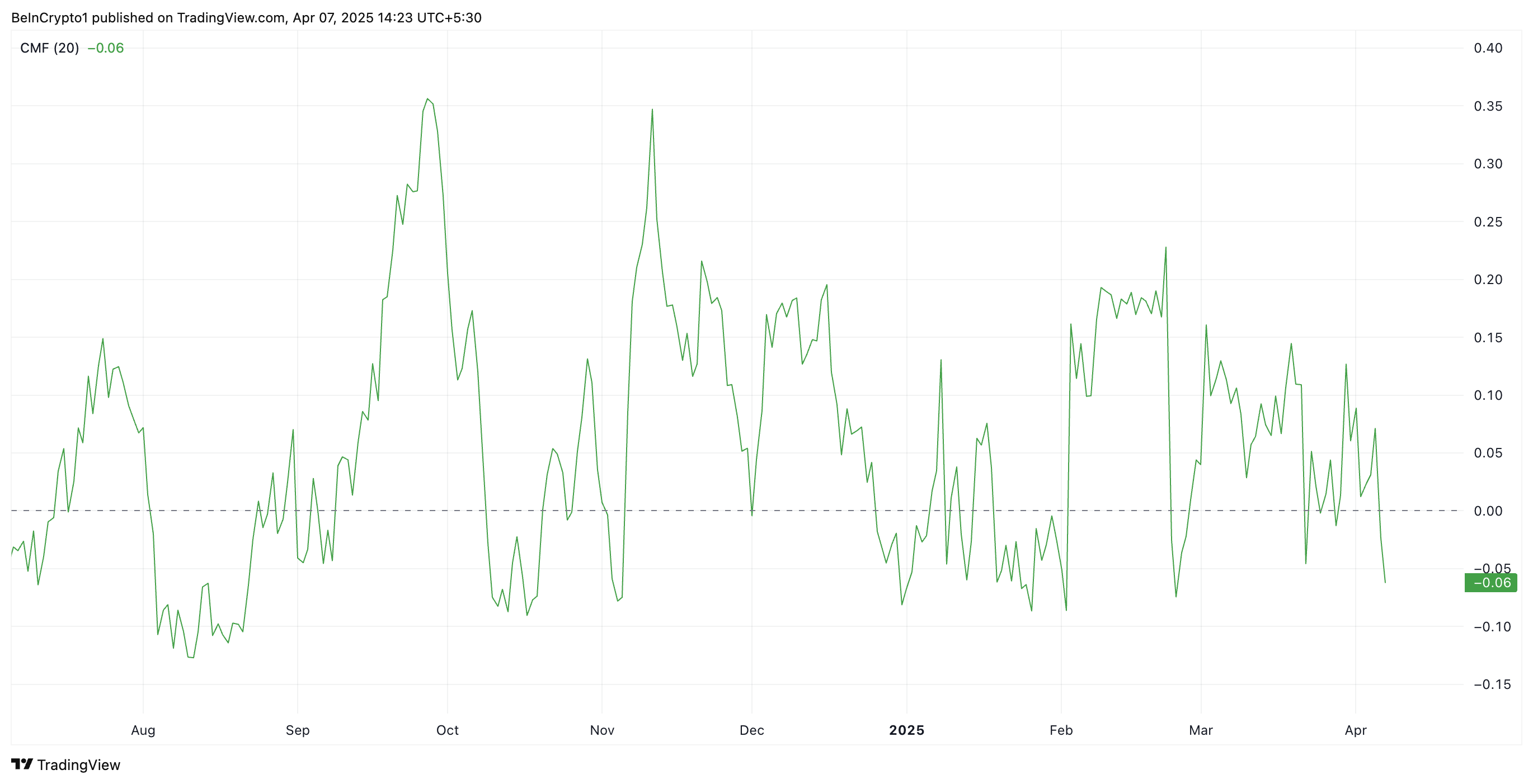

Further, on the daily chart, ETH’s negative Chaikin Money Flow (CMF) confirms the coin’s plummeting demand. At press time, it is at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set period, helping gauge buying and selling pressure. When its value falls below zero like this, it indicates that selling pressure is dominating.

ETH’s CMF readings suggest that more traders are distributing (selling) the coin than accumulating it. This reflects weakening demand and is a bearish signal for the asset’s price momentum.

ETH Flashes Oversold Signal: Is a Bounce Back on the Horizon?

ETH’s Relative Strength Index (RSI), observed on a one-day chart, shows that the altcoin is currently oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 25.62, ETH’s RSI signals that the coin is deeply oversold. This presents a buying opportunity, as such lows are usually followed by a price rebound.

If this happens, ETH’s price could regain and climb back above $1,589. If this support level strengthens, it could propel ETH’s value to $1,904.

However, this rebound is not guaranteed. If ETH bears maintain dominance and selloffs continue, the coin could extend its decline and fall toward $1,197.

The post Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low appeared first on BeInCrypto.

Market

CoinGecko Refreshes Brand During Crypto Black Monday Chaos

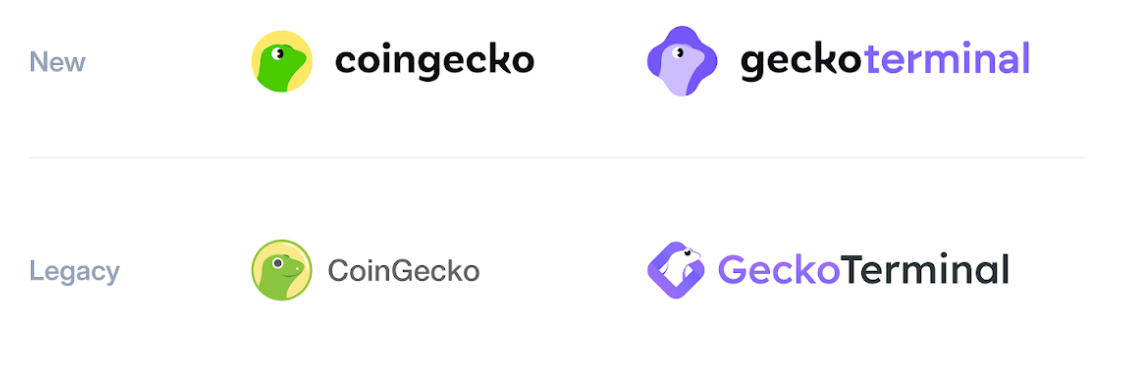

CoinGecko unveiled a refreshed brand identity and two new mascots, marking the 11th anniversary of the crypto data aggregator.

The changes come amid a bruising “Crypto Black Monday,” with CoinGecko’s brand revitalization presenting as a show of optimism despite sour sentiment.

CoinGecko Resets Its Brand on 11th Anniversary

CoinGecko leaned into Monday’s turbulence with the message that growth is still on the table despite sour crypto market sentiment. Marking its 11th anniversary, the crypto data aggregator introduced a new visual identity.

The change features a modernized logo, a more interactive and user-friendly design system, and a cohesive brand refresh. These changes extend to GeckoTerminal, its DEX aggregator that tracks real-time trading data from over 1,500 decentralized exchanges.

CoinGecko users will henceforth encounter Gekko and Rex as two new mascots. In a statement shared with BeInCrypto, CoinGecko said these mascots embody the duality of the crypto experience.

On the one hand, Gekko is a playful and geeky friend offering insights. On the other hand, Rex is sharp, analytical, and always on the hunt for alpha.

“This brand refresh marks a new chapter for CoinGecko, as we continue building for the decentralized future,” an excerpt in the statement read, citing TM Lee, CEO and co-founder of CoinGecko.

Lee explained that this refresh was for the crypto community, which has continuously leveraged CoinGecko’s crypto data aggregator across market cycles. The changes are intended to make CoinGecko more relatable and forward-looking, emulating the industry’s spirit of resilience and innovation.

Refresh in the Face of Crypto Black Monday

This show of optimism comes in time to boost user sentiment after a weekend bloodbath that set the pace for crypto’s black Monday narrative. Liquidations swept the crypto market over the weekend, triggering millions of losses.

The company acknowledged the market stress in a post teasing the launch just hours before the unveiling.

“We know it’s not the easiest day for crypto. Still, something new is on the way,” wrote CoinGecko on X (Twitter).

CoinGecko was founded in April 2014. It has grown from a price-tracking site into a comprehensive crypto data platform serving millions worldwide. The aggregator reportedly monitors over 17,000 cryptocurrencies and NFTs (non-fungible tokens) across over 1,200 exchanges.

Its on-chain analytics platform, GeckoTerminal, launched in 2022, has since become an expansive DEX aggregator. According to the report, GeckoTerminal tracks over 6 million tokens across more than 200 blockchain networks.

Meanwhile, CoinGecko’s brand update is more than cosmetic. It reflects the platform’s consistent effort to stay relatable to its user base.

Recently, it has been a go-to source for key market insights. Among them was a 2025 sentiment survey, which revealed mixed investor moods and highlighted a strong belief in the rise of crypto-AI.

CoinGecko has also been instrumental in reflecting changing user behavior in the industry. Recently, the platform shared a 2024 analysis showing crypto perpetuals trading volumes reaching all-time highs. Similarly, the data aggregator shared a report pointing out that publicly listed crypto companies account for just 5.8% of the market cap.

By launching a branding overhaul during one of the year’s harshest market downturns, CoinGecko sends a clear message that beyond surviving, crypto is also preparing for what is next.

As the dust settles from the weekend sell-off and key US economic indicators are in the pipeline, CoinGecko’s refreshed look suggests the next chapter is always around the corner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market19 hours ago

Market19 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market23 hours ago

Market23 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise

-

Market22 hours ago

Market22 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Market10 hours ago

Market10 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?